Drewry Downgrades Forecast for Container Demand

A gloomier world economic outlook and rising trade tensions have forced Drewry to downgrade its forecast for container demand over the next five years, according to the global shipping consultancy’s latest edition of the Container Forecaster.Drewry’s long-term supply and demand prognosis for carriers has deteriorated since the last report. Previously, the company’s global supply-demand index was expected to take incremental steps upwards through 2022, by which time the industry would at long last be close to equilibrium.However, the new forecasts suggest that the industry now faces being stuck with the current over-supplied situation for several more years.“The anticipated re-balancing of the container market looks to have been postponed.

Drewry Predicts Modest Growth for Container Shipping

The outlook for the container shipping market in 2018 and 2019 is a combination of healthy demand growth that will outpace the fleet; resulting in a better supply-demand balance and slightly higher freight rates and profits for carriers, according to the latest edition of the Container Forecaster published by global shipping consultancy Drewry. “The bad news for carriers is that they are unlikely to see the very strong demand growth rates of early 2017 for the foreseeable future. The good news is that while port handling growth may have peaked, they can still expect more than adequate volumes for at least the next two years,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster.

Containership Consortia Set for Further Expansion: Analyst

The formation of 2M is only the conclusion of the latest round of mega-alliance negotiations. Ocean carriers are clearly not yet done with mega-alliance expansion following China’s rejection of P3. Maersk and MSC’s subsequent 2M agreement is only the latest. Evergreen and the CKYH alliance are still talking to the US’ Federal Maritime Commission (FMC) about extending the scope of their operating agreement between Asia and Europe to include the US, and CMA CGM has yet to clarify who its new partners will be. New partnerships are required as no one has yet come up with a better alternative to reduce costs and improve service frequency at the same time, short of take-overs and mergers.

Cargo Sits Waiting a Fortnight in Asia: Analysts Seek Reasons

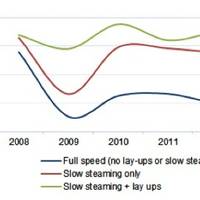

Jochen Gutschmidt, head of global transport procurement at Nestle, asked the Global Liner Shipping Conference in Hamburg last week: “Why is cargo waiting in Asia for two weeks?” Using data from Drewry’s latest 'Container Forecaster', just published, this week’s 'Container Insight Weekly' attempts to answer that question and quantify how much capacity has been taken out of the system by slow steaming and lay-ups. There was a time when vessel optimisation was achieved by simply deploying the biggest ships at full speed so to minimise the number of vessels required.

Profitability Rests in Carriers’ Hands

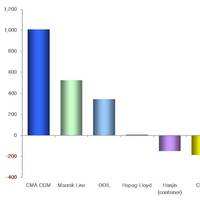

As expected the industry just about scraped over the break-even line in 2012, albeit only because of the results of a handful of leading lights. There is every chance that lines will make decent money in 2013, but only if they refrain from old habits and stick to pricing and capacity discipline. Drewy’s latest Container Forecaster report gives our headline industry operating profit estimate for 2012 of $280 million. Clearly, this is a very poor return for moving nearly 170 million teu of loaded containers…

Does the Container Sector Need to go back to School?

Drewry’s quarterly Container Forecaster focuses on early 2011 and how the scene is being set for what looks like another boisterous year for the sector. What, if any, lessons have been learnt? London, UK, 13th April 2011 -The basic education of school-children used to revolve around the Three R’s of reading, writing and arithmetic. It seems that the container syllabus is currently following a similar mantra. The 3 R’s of Containerisation = rates, reductions, recklessness. Having last year successfully overturned the heavy losses of 2009…

Which way will container freight rates go? Carriers at crossroads, says Drewry

New Drewry special report examines drivers of container freight rates, provides five year forecasts of major east-west trades and offers suggestions for carriers and shippers on how to smooth pricing volatility. London, UK, 14th March 2011 – Container freight rates go up and then they go down - that’s just the way things are. This almost pathological acceptance that things cannot and will not change is a symptom of a deficiency within container shipping’s DNA that prevents it from being able to break the boom and bust.

Drewry’s Forecast Warns Carriers

Drewry believes that the industry has emerged from the global recession with both carrier profitability and demand figures bearing this out, but still ask whether or not the industry has learnt anything? The fact that no major companies went to the wall still seems to have insulated the industry from the despair of 2009 and there is now the feeling that perhaps the dark days did not happen. In essence, Drewry observes that it is back to normal operating conditions. A number of carriers have come back into the newbuild market, believing it is the right time to buy again despite the fact that bank financing is now much more circumspect.

Report Says Trade Slows for Container Shipping Businesses

Maritime consultants Drewry Shipping Consultants has launched its ‘Annual Container Market Review and Forecast 2008/09.’ Now in its ninth year, Drewry’s Review is the liner industry’s leading commentary and forecasting tool for both global and individual trade lane supply, demand and pricing analysis. What is clear from Drewry’s Report it that the strong growth in the container shipping sector is now going into reverse as the credit crunch impacts all the major economies. Using Stock Market Indices as a barometer of economic performance and sentiment, it can be seen that every country/region of critical importance to growth rates of container traffic volumes has suffered a major loss of confidence since the beginning of the year.

The Profits Black Hole: Container Shippers Still Unable To Turn Growth Into Profit

A new report from Drewry Shipping Consultants Ltd., titled "Container Market Outlook," estimates that in 1998 carriers lifted 14.7 percent more cargo than in 1996 (more than 7.2 million teu), but somehow contrived to earn 1.2 percent less revenue. Industry profitability has also declined, with the Asian crisis making 1998 a particularly bad year, and on the main east-west trades Drewry estimates aggregate carrier losses at almost $2.4 billion - a negative margin of more than eight percent. In 1999, carriers, driven perhaps by desperation, have addressed the revenue gap with more aggression than ever before. Massive rises on Asian export…