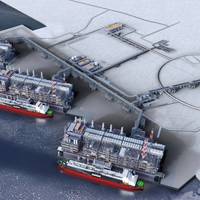

Russia's Arctic LNG 2 Last Line is on Hold

The third and the last train of the Arctic LNG 2 project in Russia has been put on hold but the second train is likely to be installed, the head of stakeholder TotalEnergies' said.The liquefied natural gas (LNG) project in the Russian Arctic has faced challenges from U.S. sanctions imposed on the project last November over the conflict in Ukraine, and subsequent force majeures by shareholders.At the end of 2023 Arctic LNG 2 started tentative production at its first train, which is yet to deliver a first cargo.

Foreign Shareholders Suspend Participation in Russia's Arctic LNG 2 Project

Foreign shareholders suspended participation in the Arctic LNG 2 project due to sanctions, renouncing their responsibilities for financing and for offtake contracts for the new Russian liquefied natural gas (LNG) plant, the daily Kommersant reported on Monday.The project, seen as a key element in Russia's drive to boost its LNG global market share to 20% by 2030 from 8%, was already facing difficulties due to U.S. sanctions over the conflict in Ukraine and a lack of gas carriers.China's state oil majors CNOOC and China National Petroleum Corp (CNPC) each have a 10% stake in the project…

Chinese Defense Firm Takes Over Lifting Venezuelan Oil for Debt Offset

China has entrusted a defense-focussed state firm to ship millions of barrels of Venezuelan oil despite U.S. sanctions, part of a deal to offset Caracas' billions of dollars of debt to Beijing, according to three sources and tanker tracking data. China National Petroleum Corp (CNPC) stopped carrying Venezuelan oil in August 2019 after Washington tightened sanctions on the South American exporter. But it continued to find its way to China via traders who rebranded the fuel as Malaysian, Reuters has reported.

China Ramps Up LSFO Production 30%, backing Bunker Fuel Hub Ambitions

China more than halved the volume of export quotas for refined fuel, predominantly gasoline, diesel and aviation fuel, under the first allotment for 2022, while raising the allowances for low-sulphur fuel oil by 30%, industry sources said on Tuesday.The deep cuts to refined fuel, largely expected by the market, was in line with the Chinese government's recent policy to curb excessive domestic refinery production amid a broad plan to reduce carbon emissions, the sources said.Quotas for refined fuel exports totalled 13 million tonnes under the batch…

China Issues Additional LSFO Quotas for 2021

China has issued new export quotas for the export of low-sulphur fuel oil (LSFO) used to power ships and for other refined fuels such as gasoline and diesel for the rest of 2021, according to a trading source and document reviewed by Reuters on Thursday.Under the new quotas, 1 million tonnes of LSFO can be exported while 1.579 million tonnes of refined fuels can be shipped, according to the source and the document issued by the Ministry of Commerce.The new issue brings this year’s total permits for refined fuel exports to about 38.6 million tonnes…

Report: Venezuela Resumes Oil Shipments to China Despite U.S. Sanctions

Venezuela has resumed direct shipments of oil to China after U.S. sanctions sent the trade underground for more than a year, according to Refinitiv Eikon vessel-tracking data and internal documents from state company Petroleos de Venezuela (PDVSA).Chinese state companies China National Petroleum Corp (CNPC) and PetroChina - long among PDVSA's top customers - stopped loading crude and fuel at Venezuelan ports in August 2019 after Washington extended its sanctions on PDVSA to include any companies trading with the Venezuelan state firm.The imposition of the sanctions was part of a push by the Trump administration to oust Venezuelan President Nicolas Maduro…

Mitsui OSK Inks 30-year LNG Carrier Charter for Russia's Arctic LNG 2 Project

Japan's Mitsui OSK Lines Ltd (MOL) said on Monday it has signed a 30-year charter contract with the operator of the Arctic liquefied natural gas (LNG) 2 project, led by Novatek, for three ice-breaking carriers for the Russian project.The three vessels will be built by South Korea's Daewoo Shipbuilding & Marine Engineering Co Ltd, costing about 90 billion yen ($859 million) in total, and are scheduled for delivery in 2023, MOL said.The carriers will mainly transport LNG from a…

COSCO Orders Three LNG Carriers at Hudong-Zhonghua

Hudong-Zhonghua Shipbuilding Co, a unit of China State Shipbuilding Corp, has signed contract to construct three liquefied natural gas (LNG) carriers worth 3.9 billion yuan ($551.62 million), reported the state-backed Jiefang Daily on Tuesday.The LNG carriers, each with a capacity of 174,000 cubic metres, will be operated by China COSCO Shipping and be deployed for LNG shipping services for PetroChina International Co, an affiliate of China National Petroleum Corp."The construction of the new LNG carriers is to response government calls to expand domestic demand," Jiefang Daily reported, citin

How China Got Venezuelan Oil Despite US Sanctions

Last year, China replaced the United States as the No. 1 importer of oil from Venezuela, yet another front in the heated rivalry between Washington and Beijing.The United States had imposed sanctions on Venezuela’s state-owned oil company as part of a bid to topple that country’s socialist president, Nicolas Maduro. U.S. refineries stopped buying Venezuelan crude. Caracas’ ally China, long a major customer, suddenly found itself the top purchaser. Through the first six months of 2019, it imported an average of 350,000 barrels per day of crude from Venezuela.But in August, Washington tightened its sanctions on Venezuela, warning that any foreign entity that continued to do business with the South American country’s government could find itself subject to sanctions.

Yamal LNG on Fast Boat to China as Northern Route Melts Early

The first vessel to deliver a liquefied natural gas (LNG) cargo from Russia's Yamal plant via the Northern Sea Route this year is on its way to China, ship-tracking data showed and analysts said.The direct route to Asia, shorter than the westward journey via Europe, is frozen for much of the year, but is being used increasingly as climate change means it is free of ice for longer.This year's opening is more than a month earlier compared to 2019, when first vessel to go via the route left Yamal LNG on June 29.The Christophe de Margerie vessel, an Arc7-classed LNG tanker, left the Sabbeta port in Russia's Arctic on May 18 and is expected at China National Petroleum Corp' (CNPC) Tangshan LNG terminal on June 11…

China's Crude Imports from Saudi Slip, Russia Up 31%

China's March crude oil imports from top supplier Saudi Arabia fell 1.6% from a year earlier, while purchases from No.2 supplier Russia rose 31%, Reuters' calculations based on customs data showed on Sunday.China's March crude oil imports rose 4.5% year on year to 9.68 million barrels per day (bpd) as refiners stocked up on cheaper cargoes despite falling domestic fuel demand and cuts in refining rates due to the impact the COVID-19 pandemic.Shipments from Saudi Arabia were 7.21 million tonnes…

China's Bunker Fuel Demand Plummets

China's marine fuels sales fell by as much as 50% in February as the rapidly spreading coronavirus and prolonged Lunar New Year break strangled freight movement in and out of the global manufacturing powerhouse, trade sources said.The epidemic, which has killed almost 3,000 people and infected about 80,000 in China alone, triggered the sharpest contraction on record for Chinese factory activity in February and caused massive port congestion because of labor shortages.The resulting plunge in freight demand has knocked 40% off Asian prices for very low-sulphur fuel oil (VLSFO) since early Januar

Vitol Builds Refinery for New Ship's Fuel

Vitol, the world's largest independent oil trader, has started building a small oil refinery at its storage terminal in Malaysia that will provide low-sulfur fuel for ships, a senior company official said on Monday.The project consists of a crude distillation unit that can process 30,000 barrels per day of crude and is located on the same site as Vitol's oil storage terminal at Tanjung Bin in the southern Malaysian state of Johor, Vitol Asia's President and Chief Executive Officer Kho Hui Meng said.A construction unit under China National Petroleum Corp (CNPC) is handling the project which will involve moving a second-hand CDU from China to the site…

US warns Hong Kong about Iranian Oil Tanker

The United States has warned Hong Kong to be on alert for a vessel carrying Iranian petroleum that may seek to stop in the Asia financial hub, and said that any entity providing services to the vessel will be violating U.S. sanctions.The news comes two weeks after U.S. President Donald Trump’s administration stepped up moves to choke off Iran’s oil exports by scrapping waivers it had granted to big buyers of Iranian crude oil, including China.The fully laden Pacific Bravo abruptly changed course on Monday to head towards Sri Lanka, according to shipping data on Refinitiv Eikon. Its destination was originally set for Indonesia, according to ship-tracking data, but industry sources said it was most likely going to China.

Iranian Tanker Offloads Oil for Bonded Storage in China

A vessel carrying 2 million barrels of Iranian oil discharged the crude into a bonded storage tank at the port of Dalian in northeast China on Monday, according to Refinitiv Eikon data and a shipping agent with knowledge of the matter.Iran, the third-largest producer in the Organization of Petroleum Exporting Countries (OPEC), is finding fewer takers for its crude ahead of U.S. sanctions on its oil exports that will go into effect on Nov. 4. The country previously held oil in storage at Dalian during the last round of sanctions in 2014 that was later sold to buyers in South Korea and India.The very large crude carrier Dune, operated by National Iranian Tanker Co…

Novatek Ships First LNG Cargo to China via Arctic

Russian natural gas producer Novatek delivered on Thursday the first ever liquefied natural gas (LNG) cargo to China via the Northern Sea Route (NSR) alongside the Arctic coast, which drastically cuts delivery time to Asian consumers.The shipments of LNG from Yamal LNG project via the NSR to China cuts transportation time and costs in comparison to other routes such as Suez Canal.Novatek said a ceremony was held to commemorate the arrival of LNG tankers Vladimir Rusanov and Eduard Toll with cargo capacity over 170…

CNPC ships first larger-sized diesel cargo to Brazil

China National Petroleum Corp (CNPC) shipped a 60,000-tonne cargo of diesel in late May destined for Brazil, the Chinese major's first move of the refined fuel in a shipment of this size to the Americas, an inhouse newspaper reported on Monday.Chinaoil, CNPC's trading unit, has shipped nearly one million tonnes of diesel to Latin America since 2015, but mostly with medium-ranged tankers able to carry about 40,000 tonnes, the report said.The shipment to Brazil was loaded with production from Liaoyang Petrochemical Corp, a subsidiary refinery of CNPC, at Bayuquan port in Liaoning province in northeast China, according to the newspaper.CNPC aims to further explore the arbitrage opportunities and expand market share in South America, the report said, adding that larger shipments would help cut

Cheniere Mulls Third Liquefaction Train at Corpus Christi

U.S. liquefied natural gas (LNG) company Cheniere Energy Inc said it planned to make a final investment decision to build the third liquefaction train at its Corpus Christi LNG export facility in Texas in the first half of 2018:Cheniere said on Friday its Cheniere Corpus Christi Holdings LLC subsidiary engaged financial institutions to arrange up to $6.4 billion of credit facilities. The unit already has about $4.6 billion of existing credit facilities.Cheniere said it will use the credit facilities to fund a portion of the costs of developing…

Novatek to Launch Second Yamal LNG Line in September

Russia's largest non-state natural gas producer Novatek will launch a second line at its Yamal LNG plant in September, the RIA news agency cited the company as saying on Wednesday. Novatek owns a 50.1 percent stake in Yamal LNG. France's Total and China National Petroleum Corp each control 20 percent, while China's Silk Road Fund owns 9.9 percent. Yamal LNG started producing liquefied natural gas in December. (Reporting by Vladimir Soldatkin; Writing by Polina Ivanova; Editing by Jack Stubbs)

Novatek Aims to Launch Yamal LNG on Dec 8

Russia's Novatek has provisionally set Dec. 8 as the official launch date for its Yamal LNG plant, two sources with direct knowledge of the event planning told Reuters. Novatek's partners on the project are France's Total, the China National Petroleum Corp (CNPC) and China's Silk Road Fund. The project, on the Yamal Peninsula above the Arctic Circle, will be Russia's second LNG plant after Sakhalin-2 on the Pacific island of Sakhalin. At full capacity, the Yamal facility will be able to produce 16.5 million tonnes of liquefied natural gas a year, which it will ship to Europe and Asia.

Russia Ramping Up Arctic LNG Production

Russia may produce more than 70 million tonnes of liquefied natural gas (LNG) per year in its remote Arctic regions, the head of gas producer Novatek said on Wednesday. "The Gydan and Yamal peninsulas have a vast resource base that allows the production of over 70 million tonnes (of LNG); it is comparable to LNG production in Qatar", Leonid Mikhelson, the head and co-owner of Novatek told a conference. Novatek, which was put on the list of Russian companies sanctioned by the West over Moscow's role in the Ukraine crisis…

Yamal LNG Project Received €780 Mln in Chinese Loans in July

The Novatek-led Yamal LNG project in Russia received financing in July worth about 780 million euros from China Development Bank and Export-Import Bank of China, according to Yamal's accounting report published on Tuesday. The 15-year loan deals, of 9.3 billion euros and 9.8 billion yuan ($1.48 billion), were signed by the two Chinese financial institutions in late April. The latest disbursement follows the first chunk of 450 million euros Yamal received in late July. Before receiving the financing from the Chinese banks…

VEB Guarantees $3 Bln of Yamal LNG Debt

Russian development bank VEB said on Friday it had provided a guarantee for $3 billion of debt to the Yamal liquefied natural gas (LNG) project, led by Russian gas firm Novatek. VEB said in a statement that the guarantee would help encourage overseas financing for the Yamal project, which it called strategically important for Russia. In April, the Yamal project said it had signed loan agreements with Chinese banks worth over $12 billion. Novatek holds 50.1 percent of Yamal LNG. France's Total and China National Petroleum Corp control 20 percent each, while China's Silk Road Fund owns 9.9 percent. (Reporting by Alexander Winning; Editing by Susan Fenton)