Hanwha Ocean Secures $258M Order for Two VLCCs

South Korean shipbuilder Hanwha Ocean has received an order to construct two very large crude carriers (VLCCs) for a shipping company in Oceania.The order for VLCCs, worth $257.8 million (342 billion won), is the first such order for Hanwha Ocean in the last three years. This is also the highest price for the vessels in 16 years, since the 2008 global financial crisis, the company said.The ships will be built at the Geoje plant and delivered to the shipowner in the first and second half of 2026…

Four Japanese Companies Form Consortium for Eco-Friendly VLCCs Concepts

Idemitsu Tanker, IINO Kaiun Kaisha (IINO Lines), Nippon Yusen Kabushiki Kaisha (NYK), and Nihon Shipyard have established a consortium to conduct joint research and development of design concepts for Malacca Max-type very large crude oil carriers (VLCCs).The design concepts, including machinery and environment equipment, will be developed with a view of reducing greenhouse gas (GHG) emissions, the consortium that was initiated by Idemitsu Tanker said.Aiming to reduce emissions by 40% or more compared to previous levels…

Why the Indian Ocean Could be China's Achilles' Heel in a Taiwan War

Every day, nearly 60 fully loaded very large crude-oil carriers sail between the Persian Gulf and Chinese ports, carrying about half of the oil that powers the world's second-largest economy.As the vessels enter the South China Sea, they ply waters increasingly controlled by China's growing military, from the missile batteries and airfields at its bases on disputed islands to its stealthy Type 055 destroyers.But when crossing the Indian Ocean, joined by others headed to China from Africa and Brazil…

LPG: Dual-Fuel Engines Prove Their Worth

BW LPG has demonstrated the value of dual-fuel LPG operations beyond the company’s initial aim of meeting IMO 2020 Sulphur Cap regulations.In October 2020, the LPG carrier BW Gemini became the first very large gas carrier (VLGC) to have its low-speed main engine converted to an LPG dual-fuel engine. The project started several years earlier, sparked by Oslo-listed BW LPG’s preparations for the IMO’s 2020 Sulphur Cap regulations.Compared to heavy fuel oil, LPG reduces Sox emissions by approximately 97%…

Secondhand Prices Put a Damper on Tanker Demolitions -BIMCO

The year 2021 has been tough on crude oil tanker freight rates across the board so far. Consequently, the industry buzz has been all about largescale scrapping of tankers, but so far, it has been all talk and very little walk, as the secondhand market has proved a much-preferred alternative, says industry group BIMCO.Although demolitions are up from the start of last year, only two shuttle tankers and two Aframax crude oil carriers (450,000 DWT) have been confirmed demolished in the first two months of 2021, according to data from Clarksons.

Second Wave of Floating Storage Triggered by Ailing Oil Market

A stalled global economic recovery from the coronavirus pandemic is leading to a fresh build-up of global oil supplies, pushing traders including Trafigura to book tankers to store millions of barrels of crude oil and refined fuels at sea again.The use of so-called floating storage onboard tankers comes as traditional onshore storage remains close to capacity as supplies outpace demand.Trading house Trafigura has chartered at least five of the largest tankers each capable of storing 2 million barrels of oil…

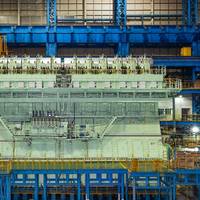

WinGD’s Dual-fuel 12X92DF Engine Gains BV Type Approval

The biggest and most powerful liquefied natural gas (LNG)-fueled engine ever built has received type approval from classification society Bureau Veritas (BV), Switzerland-based engine manufacturer Winterthur Gas & Diesel (WinGD) said on Wednesday.BV awarded the approval for WinGD’s dual-fueled 12X92DF engines, the first series of which is currently being built by China State Shipbuilding Corp (CSSC) and will power nine ultra-large container ships (ULCS) -- the largest ever powered…

Hyundai Heavy Sheds More Light on Tanker Order

South Korean shipbuilder Hyundai Heavy Industries has shared more details on its newly secured contract to build two crude oil carriers.The company had on Thursday issued a brief statement on the Korea Exchange sharing it had won contracts to build two tankers for a European client. The order value is 149,8 billion South Korean Won, or $122,2 million.In a subsequent release issued on Friday on its website, Hyundai Heavy said the orders were secured for two 158,000-ton crude carriers."This contract includes two option contracts…

Hyundai Heavy Bags $122M Order for Two Oil Carriers

South Korean shipbuilder Hyundai Heavy Industries has said it has won an order to build two crude oil carriers.In a brief statement on the Korea Exchange, Hyundai said the order was worth 149,8 billion South Korean Won, or $122,2 million.Hyundai Heavy Industries said it would build the two crude oil carriers for a European client. It did not provide further details on the client.The deliveries are to be made by mid-February 2022.

Oil Tanker Rates Double

Supertanker freight rates are on the rise for a second time this month as producers, refiners and traders scramble to secure ships to transport crude or store a fast-growing global glut of oil, industry sources said.Freight rates for very large crude-oil carriers (VLCC) along the Middle East Gulf to China route were assessed at about $180,000 a day on Monday, up from some $125,000 on Friday and a weekly low of about $90,000 a day on Wednesday, according to several ship broking sources.Its difficult to say whether or not the rates will be sustained…

BIMCO Revises 2020 Forecast

The coronavirus pandemic is impacting global shipping demand for 2020 negatively. The speed of the virus spread makes it difficult to assess the full consequences. Nevertheless, we see a need to update our 2020 forecast to make some of this massive uncertainty tangible.What is going on in addition to the coronavirus pandemic?Geopolitical tensions that made the OPEC+ alliance break down, has subsequently made the crude oil tanker spot freight market erupt. The events that followed the breakdown - and those that are likely to follow…

DSME Targets $6.8Bn in Deals for 2020

South Korean shipbuilder Daewoo Shipbuilding & Marine Engineering Co (DSME) is targeting deals worth more than $6.88 billion in 2020, said a report by Yonhap.DSME received an additional order of six container vessels worth 891.8 billion won (US$768 million) from an African client on Dec. 27. DSME will deliver the vessels to their owner by the end of October 2022.The world's second-largest shipbuilder by order backlog won orders worth $6.88 billion to build 39 vessels, achieving 82 percent of its annual order target of $8.37 billion in 2019.The 39 ships includes 10 LNG carriers, 10 super-large crude oil carriers, 11 container ships, two LPG carriers…

DSME Wins $771M Order for 6 Box Ships

South Korean shipbuilding and offshore contractor Daewoo Shipbuilding & Marine Engineering Co., Ltd. (DSME) has secured a 891.8 billion-won (US$771 million) order to build six container ships.According to Yonhap, the world’s second-largest shipbuilder by order backlog will deliver the ships to an unidentified client in Africa by October 2022 under the deal.With the latest deal, Daewoo Shipbuilding has won orders worth $6.88 billion for 39 vessels so far this year, achieving 82 percent of its annual order target of $8.37 billion.The 39 vessels include 10 LNG carriers, 10 super crude oil carriers, 11 container ships, 2 super LPG carriers, 5 submarines, and 1 offshore plant.

SFL Acquires Three VLCC Newbuildings

The international ship owning and chartering company Ship Finance International (SFL) announced that it has agreed to acquire three 300,000 dwt crude oil carriers, or VLCCs, currently under construction at Daewoo Shipbuilding & Marine Engineering (DSME) in Korea.The Bermuda-headquartered company said that the net purchase price will be $180 million, or $60 million per vessel and they are expected to be delivered to SFL within the next two months.The vessels were ordered in 2018 by affiliates of the Norwegian listed company Hunter Group, and have all the latest eco-design features, including exhaust gas cleaning systems. After delivery…

HHI Bags $390mln Order for 2 LNG Carriers

South Korean shipbuilding giant Hyundai Heavy Industries (HHI) said it received an order to build two liquefied natural gas (LNG) carriers for an unidentified European shipping company.Yonhap news agency quoted the shipbuilder saying that the order is valued at 463 billion South Korean won ($390 million), bringing its total number of orders to five so far this year.The 180,000 cbm vessels, ordered by an undisclosed European owner, are scheduled for delivery by the end of June 2022.According to the report, the vessels will be equipped with Mark III Flex Plus technology that has a vaporization rate of 0.07 percent, reducing the daily evaporation of fuels.

MOL Installs AR Navigation on 21 VLCCs

Japanese shipping giant Mitsui O.S.K. Lines (MOL) announced its intention to install a navigation system using augmented reality (AR) technology jointly developed by Furuno Electric and MOL Techno-Trade on 21 MOL Group-operated very large crude oil carriers (VLCCs).The system displays information on other vessels sailing on a vessel's planned route and surrounding sea areas and other ocean conditions, such as shallow waters, on tablets and screens. It integrates information from the Automatic Identification System (AIS) and radar with real-time video images from the bridge camera in collaboration with Furuno Electric's cutting-edge Electric…

Making the Case for LPG as a Marine Fuel

The sulfur emission control areas (SECAs) in place in North-America and Northern Europe, in combination with the upcoming global 0.5% limit on sulfur in 2020 (or 2025) and similar EU limits in 2020, call for alternative fuels as a means for compliance. Several alternative fuels are available and, at the same time, new fuel oil products with very low sulfur content have been introduced.In this respect, the ability of the new MAN ME-LGIP engine to run on LPG, which is a sulfur-free fuel…

Guangzhou Shipyard Bags Order for Seven Tankers from Cosco Shipping

Cosco Shipping Energy Transportation (CSET) has placed an order for seven more ships at compatriot Guangzhou Shipyard International Company Limited (GSI), owned by CSSC Offshore & Marine Engineering Company Limited. The order will include two 64,900 dwt crude oil tankers, two 109,900 dwt LR2 vessels and three 114,000 dwt crude tankers, totaling in an investment worth approximately USD 323 million (RMB 2.14 billion.). Expected delivery dates for the two 64,900 dwt panamax crude tankers are on or before 29 February 2020 and 31 May 2020, respectively. The two 109,900 dwt LR2/Aframax clean products/crude oil carriers of 109,900 dead have expected delivery dates of on or before 31 October 2020 and 31 January 2021, respectively.

HMM Orders New Carriers

South Korea’s largest ocean carrier Hyundai Merchant Marine (HMM) will invest USD 417.61 million in five new very large crude oil carriers (VLCCs), Reuters reported quoting company sources. "HMM will invest 470 billion South Korean won (U.S. $418 million) in new facilities for the construction of five, 300,000 deadweight ton (DWT) VLCCs with Daewoo Shipbuilding & Marine Engineering (DSME), with an option for five more," said company sources. HMM will acquire two 11,000-TEU containerships from Hanjin Heavy Industries & Construction’s Subic Shipyard. The contract price is approximately $162 million for the two vessels. HMM also confirmed expansion of its container fleet with two ships of 11,000 teu each to be built at a Hanjin yard in the Philippines.

Tsakos Orders Tankers at Sungdong

South Korean shipyard Sungdong Shipbuilding & Marine Engineering Co. (Sungdong) has won an order from Greece’s Tsakos Energy Navigation (TEN) for two 74,000 deadweight tonnage (DWT) crude-oil carriers with an option for two more. TEN has already ordered three tankers from Sungdong. The total value of the contract for the four LR1 tankers could reach up to USD 170 million. Delivery of the firm ship is due in the first half of 2018. Tsakos’s commitment is a massive boost for Sungdong after a tough period of instability and restructuring where the yard skirted with closure. Tsakos Energy Navigation Limited is a provider of international seaborne crude oil and petroleum product transportation services.

Tanker Shipping: Signs of Weakness are Appearing, But Still Money to be Made

Supported by slow fleet growth and ongoing positive refinery margins, VLCC earnings in Q1-2016 were up from a year ago, but down from Q4-2015 as we expected at $58,367 per day for VLCC (+5.7% year on year). For the minor crude oil carriers, rates were down from Q1-2015 and Q4-2015. Rates in Q1-2016 were $37,914 per day for suezmax (-25% year on year), $30,197 per day for aframax (-24% year on year). For the oil product tankers, Q3-2015 stands out as the peak quarter of the current cycle. Earnings in Q1-2016 were the lowest since Q3-2014 when the markets started to rise. The same patterns of slightly falling freight rates reappears in the time charter market. BIMCO recommended back in January putting some capacity away on time charter. Time charter rates have dropped somewhat since then.

SFL Sells 1995-built Suezmax Tanker

Ship Finance International Limited (SFL), has agreed to sell the 1995-built Suezmax Front Glory to an unrelated third party. The company has simultaneously agreed to terminate the corresponding charter party for the 20-year old crude oil carrier with a subsidiary of Frontline Ltd. The vessel is expected to be delivered to its new owner at the end of the third quarter, 2015. Net sales price is agreed to approximately $16 million, and Ship Finance will receive a net amount of approximately $13.8 million, after compensation of approximately $2.2 million to Frontline for the termination of the current charter. The vessel is currently debt free.

BIMCO: Tanker Market is Full of Surprises

Some time ago, BIMCO expected the first signs of a solid recovery in the oil tanker industry to appear in the product tanker market. However, like other soon-to-arrive recoveries, the waiting time tends to increase as we approach the expected tipping point. This time around, global refinery throughput started the year strongly but entered a still running soft patch in May, high volumes but shorter hauls out of the U.S. Gulf, and the steady inflow of new ships were part of the cocktail that prevented freight rates from taking off big time.