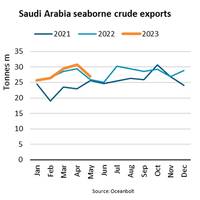

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

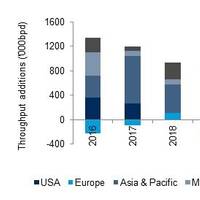

US Oil Exports to Europe Hit Record in March

U.S. crude exports to Europe have hit a record 2.1 million barrels per day on average so far this month, spurred by wide discounts to the global benchmark and weaker oil demand by U.S. refineries.Record exports to Europe and China this month reflect the rise of United States in crude oil trade and solidifies its role supplying Europe following Russia's invasion of Ukraine.A holiday freeze knocked out operations at a dozen U.S. refineries, increasing scheduled plant maintenance and reducing crude oil demand that widened U.S.

China's Commodity Imports Remain Robust

The new coronavirus caused barely a blip in China's imports of major commodities, but this likely underscores the ways China differs from the rest of the world, rather than providing a template for the globe's recovery from the pandemic.China's crude oil imports in March, the month when much of the world's second-largest economy was in lockdown, were equivalent to 9.68 million barrels per day (bpd), according to official customs data released on Tuesday.That's 4.5% higher than…

Frontline Sees Opportunity in Tanker Market

So far in 2019, 41 VLCCs have been added to the global fleet compared to three vessel demolitions, said the world's largest oil tanker shipping company Frontline Ltd.An additional 33 VLCCs are scheduled to be delivered in 2019 with 43 more to follow in 2020 before the order-book declines sharply.It is important to note that both the VLCC and Suezmax tanker order book as a percentage of the total fleet are at the lowest levels seen in over 20 years.The order book has been the biggest challenge for the tanker markets over the last 24 months. The removal of this overhang is positive, but a surge in new orders can of course quickly change this.Despite continued deliveries of newbuilding vessels in the short term…

OPEC Output to Remain Flat: Rystad

OPEC and its allies, including Russia, can maintain their current cuts and not reduce outputs any more because there will be a crude oil demand surge later this year from changing shipping fuel standards worldwide.The OPEC+ countries will not be able to increase their collective oil production levels in the second half of 2019 without having a detrimental effect on oil prices. However, the production cuts required by OPEC+ in order to support prices need not be as much as 1.5 million barrels per day (bpd), according to Rystad Energy.That is contrary to what traditional supply-demand balances suggest, owing to a tight market for medium and heavy barrels and the fast-approaching shipping fuel changes known as IMO 2020…

VLCC Market Remains Strong in Q1: Hunter

The very large crude carriers (VLCC) market market was relatively strong in Q1, with VLCC earnings averaging USD 29,000/day an increase of close to USD 20,000/day versus Q1’18, said Norway's Hunter Group ASA.High USG activity was the main contributor to the rate increase, said the company focusing on shipping and oil services investments.However, rates have dropped significantly towards the end of Q1 due to amongst other things; continued OPEC+ production cuts, heavy refinery maintenance ahead of IMO 2020, and a high number of newbuildings being delivered."We believe this trend will continue through H1. Although we expect the market to remain weak for the above-mentioned reasons until the end of H1…

Tanker Rates Firming Up: Frontline

The middle of the first quarter in 2019 saw tanker rates firming significantly, driven mainly by an increase in US exports, said Frontline Ltd. is the world's largest oil tanker shipping company.The tanker market pulled back in January due to OPEC production cuts and a high level of newbuilding deliveries after a strong end to 2018, it said.The market then came off primarily due to extended refinery maintenance in preparations for IMO 2020 and both new and persistent supply disruptions.Atlantic refinery maintenance is currently coming to an end and East of Suez refinery maintenance is coming off of peak levels.Crude oil demand forecasts remain healthy and largely unchanged since the start of the year.

BIMCO: China Breaks New Ground… Again

Chinese seaborne imports of iron ore, coal and crude oil have all grown strongly throughout 2017. Both seaborne imports of crude oil and iron ore have reached the highest levels ever recorded, while coal reached the highest level in three years. Imports of crude oil and coal have benefitted the shipping industry to the greatest extent as both volumes and distances have increased. China continues to ramp up its imports of iron ore with seaborne imports growing 4.7% in 2017 compared to 2016. This amounts to a total seaborne import of 1,054 million tonnes of iron ore breaking the record of 1,006 million tonnes from the year before. China also reported the highest imported amount of iron ore for one month…

Euronav: VLCC Order Book Expands

The challenging freight market during the third quarter came despite some encouraging signs with active scrapping of vessels returning (nine VLCCs scrapped plus one removed from fleet for FPSO project; six Suezmax scrapped during the third quarter) incentivized by a steel price at near three-year highs, says Euronav NV. This was supported by continued upgrades to crude oil demand with the IEA raising its forecast for 2017 from 1.2 mbpd to 1.6 mbpd over the course of the third quarter and U.S. crude exports again making further progress to record on average 933k bpd for the third quarter. However, the VLCC order book continued to expand with 13 new orders placed during the third quarter largely outpacing this re-emergence of sector discipline in scrapping.

Frontline Q1 Profit Disappoints

Q1 net result $27.0 million; operating profit $40.8 million. * Following the implementation of OPEC and non-OPEC production caps, which have largely been complied with, we have seen trade routes evolve. In particular, there have been increased long-haul voyages from the Atlantic Basin to Asia driven in part by increasing U.S. production and a shift in U.S. * Crude oil demand, particularly from China and India, continues to grow, and crude oil is being imported from nontraditional sources due to OPEC production cuts and the desire to diversify supply. * All factors considered, the company maintains a cautious near-term view on the tanker market and believes the market will begin to balance as vessels are absorbed into the global fleet and older vessels retire from trading.

Asia Tankers-VLCC Rates to Hold Steady

Unipec charters 20 VLCCs for West Africa, MidEast cargoes; China's oil demand to climb 3.4 pct this year - CNPC. Freight rates for very large crude carriers (VLCCs) are expected to remain stable next week as buoyant chartering activity from the Middle East is offset by the large number of supertankers available for charter, ship brokers said. "We're going to see rates holding at current levels," a European supertanker broker said on Friday. "Saudi Arabian cargoes for February loading should be out on Monday. Charterers might be a bit nervous, trying to fix as soon as they see the cargoes in case rates climb. But it looks like there's enough ships to keep the market in check," the supertanker broker said.

Tanker Outlook Dented by Middle East Refineries

A steep rise in refinery capacity in the Middle East, the world’s crude oil production hub, will diminish oil trade growth and with it prospects for tanker shipping, according to the latest edition of the Tanker Forecaster, published by global shipping consultancy Drewry. The global crude oil trade, which surged last year on the back of strong growth in oil demand and stocking activity, is expected to continue to expand strongly over the next 18 months supported by an anticipated rise in U.S. imports. But once U.S.

Asia Tankers-VLCCs Rates Ease as Tanker Jams Fade

Port congestion eases at Basra and Chinese ports; tanker demand set to expand on lower oil prices. Freight rates for very large crude carriers (VLCCs), hurt by slower-than-usual release of cargo, could slip further next week as more tonnage becomes available with the easing of recent tanker traffic jams in China, ship brokers said on Friday. Charter rates from the Middle East to Japan slipped to a six-month low on Thursday, falling by 12 Worldscale points or almost $14,000 since April 21. There are talks of a VLCC from Basra to Asia being fixed for a rate of W45, a Singapore-based supertanker broker said. This could not be confirmed, but if true, the rate would be the lowest since Sept. 2, according to data on the Thomson Reuters Eikon terminal.

Not All Contangos are Created Equal

After the collapse of the global financial system in 2008, crude oil forward curves moved into steep contango. Fortunes were made in storage asset plays in 2009-2010, which is likely the reason that so much attention is being devoted to the topic today; however, the contango is inherently different today than it was after The Great Recession. As the U.S. energy revolution continues to develop, global crude oil supply and demand dynamics have begun to evolve. Improvements to hydraulic fracturing processes have helped the U.S. become the world’s largest crude oil producer.

Iran's Oil Exports Fall in April

Iran's oil exports fell in April for a second month, according to sources who track tanker movements, moving closer to levels allowed by November's interim deal on curbing Tehran's nuclear program. The decline may reflect seasonally lower crude oil demand and U.S. pressure on some customers take less. Signs of higher Iranian sales since late 2013 have led to concern in Washington that a softening of sanctions has given Tehran's economy a boost. "It looks like India has imported less in April - that could be due to a combination of more pressure from the United States and also lower crude demand at this time of year by Indian buyers," a tanker-tracking source said.

Crude Carriers Corp. Q4 Report & Divident

· Reported fourth quarter net profit of $2.4 million or $0.15 per share (‘EPS’). · Earned average Time Charter Equivalent (‘TCE’) of $26,575 per day for the two Very Large Crude Carriers (‘VLCCs’) and $23,826 per day for the three Suezmaxes in the Company’s fleet. Crude Carriers Corp. (NYSE: CRU) reported its financial results and declared a cash dividend of $0.30 per share for the fourth quarter of 2010 payable on March 2, 2011 to shareholders of record on February 23, 2011. The Company’s net profit for the quarter was $2.4 million or $0.15 per share, principally as a result of the commercial operations of our vessels that earned above the TD 3 and TD 5 indices that prevailed in the crude tanker market during the fourth quarter of 2010…

China Oil Demand Expected To Rise

Chinese crude oil demand is expected to average 5.03 million barrels per day (bpd) in 2001, or five percent higher than in 2000, the International Energy Agency (IEA) said. The IEA said in its monthly Oil Market Report that demand was likely to rise by 240,000 bpd over last year's average of 4.79 million bpd but warned that the Chinese economy remained a major concern. November crude imports were 187,000 bpd higher than October, essentially all Omani oil. The report said Chinese refiners had cut back on imports of Angolan, Nigerian and North Sea oil and boosted imports of heavier Iranian, Kuwaiti and Saudi crude. - (Reuters)

MISC Sees Growth Opportunities

Amidst fears of a tanker glut, MISC Bhd sees growth opportunities in the tanker business. President and chief executive officer Datuk Shamsul Azhar Abbas said shipping was a cyclical business and industry players recognized that there would be opportunities to expand during a downturn. An increase in oil prices, a number of new tankers transporting crude oil and increasing size of oil tankers fleet worldwide had raised concerns among the shipping fraternity of a potential tanker glut. It was reported that the size of the oil tanker fleet expanded 3.8% this year, overwhelming the 1.7% growth in in crude oil demand estimated by the International Energy Agency.

The U.S. Gulf Market: When Will It Turn Around?

Discussions around our office and with various clients usually entail an exchange of anecdotal information believed to explain the current situation with the quest to predict when things will turn around. There are a host of different viewpoints, most seemingly relevant, but no one satisfactory answer. In previous downturns in the offshore service sector, there was usually a fairly clear understanding embraced by most of why things were slow. This downturn is more difficult to understand. Back in 1998 when the Asian financial crisis impacted oil prices, it was easy to see why E&P fell. This downturn also affected most oil fields around the world about the same. The price of oil was too low to drill new wells and upgrade production at a profit.

Projections center on When, not If

The cyclical nature of the offshore exploration and production beast is legendary in financial circles, riding boom and bust waves for years at a time. While industry analysts and insiders alike had forecast a pick-up in activity no sooner than mid-year 2000, the collective industry is “itching” to get back to the business of building, repairing and supplying the myriad of rigs, boats and other business opportunities that abound in a full-blown boom oil market. Patience, it seems, is wearing thin, particularly in the face of dwindling business prospects and the lingering of the $30+ barrel of oil. While it seems all too natural that sustained high prices would sooner than later drive a resurgence of the moribund offshore business…

Offshore Recovery Stalled For Now

As crude oil prices reach Gulf War highs and recent memories of historic low crude prices fade, capital spending on finding and developing new oil reserves continue to play catch up. "The recent oil-price crisis set back non-OPEC output growth for at least a year," a recent report released by Deutsche Banc Alex. Analysts say there is a lag time for exploration spending to play catch up with oil prices - for every one month when crude prices are below the cost of production, it takes three months of high prices to regain the volume of production lost during the low cost period. Crude prices began to rebound from lows near $10 a barrel when OPEC and other major producers cut crude production to raise prices in March 1999.

Tsakos Releases 3Q Results

Tsakos Energy Navigation, the Greek oil tanker owner, recently reported better-than-expected third quarter earnings on an expanded fleet and a large capital gain. Net income for the third quarter ending Sept. 30 soared to $50m, or $2.61 per share, up from $44.5m, or $2.33 per share, in the previous year. The third quarter included capital gains of $31.8m compared to capital gains of $13.3m in the previous year. Sales rose to $122.5m up from $115.2m a year ago. Analysts polled by Thomson Financial forecast earnings excluding items of $1.12 per share on sales of $106m. Although it was a seasonably weak third quarter due to refiners scaling back crude oil demand ahead of the switch to heating oil, Tsakos was able to realize $96m in capital gains because of the sale of three tankers.