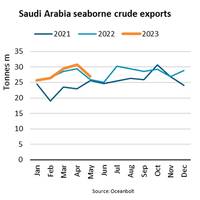

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

TechnipFMC Shelves Spin-off Due to Market Turmoil

Franco-American oil services firm TechnipFMC Plc is putting on hold plans to split itself into two due to turbulence in financial markets linked to the coronavirus outbreak, it said on Sunday.The group, created three years ago via the merger of Technip and FMC, had been planning to separate its engineering and construction activities from its upstream oil services business in the first half of this year."Market conditions have changed materially due to the COVID-19 pandemic, the sharp decline in commodity prices, and the heightened volatility in global equity markets," TechnipFMC said in a sta

Shale Growth could Overwhelm U.S. Refiners, Fuel Exports

Rising U.S. shale oil production will overwhelm the nation's refining capacity, with three-quarters of the additional oil produced in the United States by 2023 shipped to Europe and Asia, according to a new study by consultancy Wood Mackenzie. The research points to the continued impact of U.S. shale on global markets and the mismatch between domestic refining capacity and rising crude output. The oil could bottleneck at U.S. Gulf Coast ports unless new infrastructure is built, researchers said. U.S. refineries will absorb between 900,000 barrels per day (bpd) and 1 million bpd of the expected 4 million bpd of additional production to emerge from U.S. oil fields, Wood Mackenzie said in a study released on Monday.

Crude Oil Markets Bullish, But Not Really: Russell

Sentiment is often a somewhat flighty and nebulous concept, but it appears that crude oil markets are turning increasingly bullish about the prospect for higher prices. Certainly the mood at this week's major industry conference in Singapore was a marked change from recent years, with several upbeat presentations, panel discussions and off-the-record chats giving the view that prices were more likely to rise than fall. The most bullish commentary at the Asia Pacific Petroleum Conference (APPEC) was from trading house Trafigura, whose co-head of group market risk, Ben Luckock, said the era of prices being lower for longer was coming to an end, and the market would be in a supply deficit of between 2 and 4 million barrels per day (bpd) by the end of 2019.

LNG Could Follow Crude Oil's Lead: Russell

In contrast to the carnage in crude oil markets, liquefied natural gas (LNG) prices in Asia have enjoyed relative stability for the past three months, but it's unlikely the calm will persist much longer. Spot Asian LNG prices <LNG-AS> ended last week at $5.60 per million British thermal units (mmBtu), about 28 percent below the recent peak of $7.80 reached on Nov. 22. In contrast, Brent crude oil has dropped 46 percent from its recent peak in early October to trade currently around $28.55 a barrel. The relative outperformance of spot LNG holds over the longer term as well, with the price of the super-chilled fuel having dropped 68 percent since its all-time high of $20.50 per mmBtu in February 2014.

Local Glitches Drag U.S. Refinery Capacity Down

U.S. oil refiners work to recover from weekend glitches, fires. Three of the largest U.S. oil refineries will be working to restore operations on Tuesday after a series of weekend glitches temporarily knocked out some 1 million barrels per day (bpd) of processing capacity, the worse spate of outages in years. A fourth plant, Husky Energy Inc's 155,000-bpd Lima, Ohio, refinery, is not expected back online until the end of the week after a blast at its 25,000-bpd isocracker unit, which sources have said was extensively damaged. The disruptions - which included three fires on Saturday and one shutdown late last week - affected about one-fifth of the refining capacity in the eastern half of the United States, fueling deeper losses in U.S.

Oil Price Slid Beyond Fundamentals - OPEC

The secretary-general of the Organization of the Petroleum Exporting Countries (OPEC) said on Sunday the price of oil had fallen further than market fundamentals would have dictated. Speaking at an event in Dubai, Abdullah al-Badri added that the November meeting which ruled out a cut in production by members of the group was not aimed at anyone specific. "The fundamentals should not lead to this dramatic reduction (in price). Some people say this decision was directed at the United States and shale oil. All of this is incorrect. Some also say it was directed at Iran. And Russia. This also is incorrect." Crude oil markets are at five-year lows. (Reporting by William Maclean; Writing by David French, editing by John Stonestreet)

CEO Lone: China, India to Dominate Oil Trade

China and India will account for about 35% of global oil trade in the next 10 to 15 years, according to predictions by Harald Lone, Chairman and CEO of Newport Shipping Group. Many traditional global shipbuilding patterns are in flux with the proliferation of oil and gas coming from the U.S. shale, and oil supplies traditionally bound for the U.S. will have to find new markets. Lone contends that China and India will become “very important” to the crude oil markets. “There is no doubt that shale oil and gas is changing the oil industry and it will have a major impact on trade flows…

Crude Oil Markets Roiled by Sell Off

A sell-off that began last week continued to roil crude markets, which have been weighed down by worries of oversupply and lackluster demand, pushing Brent crude to a contract low on Monday. U.S. crude traded below $90 a barrel, despite a brief mid-morning rally, while Brent traded below $92 a barrel. Traders and analysts expressed uncertainty about how far global oil benchmarks could fall. "Supply continues to weigh heavy on the market and demand isn't keeping up with it," said Oliver Sloup, director of managed futures at iitrader.com LLC in Chicago. U.S. November crude was down 23 cents at $89.51 a barrel 11:35 a.m. EDT (1535 GMT). The benchmark had touched an intraday low of $88.76 a barrel at 10:38 a.m. EDT (1438 GMT) before rallying some 86 cents in the next 45 minutes.

Not All Contangos are Created Equal

After the collapse of the global financial system in 2008, crude oil forward curves moved into steep contango. Fortunes were made in storage asset plays in 2009-2010, which is likely the reason that so much attention is being devoted to the topic today; however, the contango is inherently different today than it was after The Great Recession. As the U.S. energy revolution continues to develop, global crude oil supply and demand dynamics have begun to evolve. Improvements to hydraulic fracturing processes have helped the U.S. become the world’s largest crude oil producer.

Coal Prices Jump on Russian Gas Cutoff Fears

Reuters - European physical coal prices rose on Monday along with gains in gas, power and crude oil markets across the region, reflecting escalating tensions between Russia and Ukraine. Cargos for delivery in April to the ports of Amsterdam, Rotterdam and Antwerp (ARA) were trading at $74.25 a tonne at 1720 GMT, up $0.25 from the previous settlement. Physical cargos for May delivery jumped $0.60 to $74.40 per metric ton. In the futures market, API2 coal contracts for delivery in 2015 edged up $1.49 to $82.10 a metric ton. Commodity prices rose on fears that a standoff between Russia and Ukraine could disrupt the shipment of gas from Europe's biggest supplier.