Profitability Still a Way Off for Tanker Shipping -BIMCO

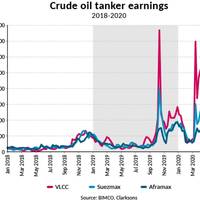

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

China Crude Processing Spikes to All-time High

Chinese refinery crude oil throughput has reached its highest level ever, with total processed volumes up 12% in the first five months of this year compared to 2020, and up 10.9% from the same period in 2019. In total 292.7m tonnes have been processed so far this year according to the National Bureau of Statistics China.Despite the 12.0% growth in crude oil processing, Chinese crude oil supply, which includes imports and domestic production, has only grown by 2.3% in the first five months of this year.

BIMCO Tanker Rate Analysis: Reality Kicks In, Rates Fall

Tanker shipping: sky high freight rates replaced by reality of falling global oil demandGeopolitical tensions have now eased, leaving freight rates to feel the full effects of the weak underlying market and falling demand. Tanker shipping looks set to be under pressure for the rest of the year.Demand drivers and freight ratesThe tanker shipping industry was once again caught in a whirlwind, as freight rates skyrocketed with little regard to the poor market fundamentals before the latter once again caught up with rates.

Coronavirus Leaves China-bound Tankers Stranded

The coronavirus's effect on energy markets is worsening, as the sharp fall in demand in China, the world's largest importer of crude, is stranding oil cargoes off the country's coast and prompting shippers to seek out other Asian destinations.More than 1,360 people have died from the coronavirus in China, which has disrupted the world's second largest economy and shaken energy markets, with international benchmark Brent crude oil down 15% since the beginning of the year.Major international energy forecasters expect demand to fall in this quarter…

US to Overtake Saudi in Oil Exports

United States will soon export more oil and liquids than Saudi Arabia, thanks to the continued rise in oil production from US shale plays and the increased oil export capacity from the Gulf Coast.According to Rystad Energy, energy research and business intelligence company, it is a a pivotal geopolitical shift. The US has for decades relied on large-scale imports to satisfy its thirst for oil, but this is about to change.The Energy Information Administration (EIA) reported last week that the United States exported more crude and petroleum products than it imported. Granted, the EIA followed up with a report this week that US crude oil stocks had risen by 7.1 million barrels in a week…

Hedge Funds Watch U.S. Refinery Restarts

Hedge funds are betting crude oil stocks will adjust quickly to the aftermath of Hurricanes Harvey and Irma but gasoline and distillate inventories may take more time to normalise. Hedge funds and other money managers increased their combined net long position in the five major petroleum contracts linked to crude, gasoline and heating oil by 46 million barrels in the week to Sept. 5, according to the latest regulatory and exchange data. Fund managers recovered some of their pre-hurricane bullishness after cutting net long positions in the petroleum complex by a total of 116 million barrels over the previous two weeks (http://tmsnrt.rs/2jhR0sX).

Oil's Price Fall Stalls Despite Supply Glut

Brent down 12 pct since OPEC-led production cut extension. Oil prices steadied on Friday after steep falls earlier in the week under pressure from widespread evidence of a fuel glut despite efforts led by OPEC to tighten the market. Brent crude oil was up 10 cents at $47.96 a barrel by 1130 GMT, but still 12 percent below its opening level on May 25, when an OPEC promise to restrict production was extended into 2018. U.S. crude was 10 cents higher at $45.74. The Organization of the Petroleum Exporting Countries and other big producers have agreed to pump almost 1.8 million barrels per day (bpd) less than they supplied at the end of last year, and hold output there until the first quarter of 2018. But world markets are still awash with oil.

US Crude Stocks up, Product Inventories Fall -EIA

U.S. crude oil stocks unexpectedly rose last week, while gasoline and distillate product inventories dropped, the U.S. Energy Information Administration said on Thursday. Crude inventories were up 614,000 barrels in the week to Dec. 23, compared with expectations for a decrease of 2.1 million barrels. Oil prices were little changed on the news after a bit of volatility immediately following the release. U.S. crude oil futures were up 1 cent to $54.08 a barrel at 11:38 a.m. EST (1638 GMT), leaving the benchmark just shy of the year high of $54.51 reached on Dec. 12. "What seems to be giving this report kind of a bullish tilt is the fact that we saw pretty a good drawdown in both gasoline and distillate inventories," said Phil Flynn, trader at Price Futures Group in Chicago.

Low Tanker Rates Boost Long-distance Trade -EIA

Recent expansion of the global crude oil and petroleum product tanker fleet has resulted in falling or lower tanker rates for much of 2016 that have widened the geographic scope for economically attractive trade at a time when inventories of both crude oil and petroleum products are at high levels, according to the U.S. Energy Information Administration (EIA). In recent years, growing global oil production and growth in global refining capacity in markets distant from crude sources led to an increase in orders for new vessels in anticipation of an increasing need for tanker transportation.

Nigeria: What are the Implications for Tanker Demand?

Nigeria’s crude oil production and exports have been hit by severe outages as a result of attacks on oil infrastructure by rebel fighters in the Niger River Delta. Various sources report that Qua Iboe Terminal has shut down operations until further notice. All tanks on the facility were emptied of crude, operations have ceased completely and all personnel have been evacuated from the terminal, which is operated by ExxonMobil. Qua Iboe is Nigeria’s largest crude oil stream and exports usually more than 300,000 barrels per day (b/d). Exports of Nigeria’s other large crude oil grades, like Forcados, Bonny Light and Escravos have also been restricted, primarily due to sabotage and attacks on pipelines. As a result of the outages Nigeria’s oil production has dropped below 1.5 mb/d.

Crude Spreads Remain Firm in face of "Massive Oversupply": Kemp

The oil market was massively oversupplied in the second quarter and remains so today, the International Energy Agency (IEA) wrote in its latest monthly oil market report. "The market's ability to absorb that oversupply is unlikely to last. Onshore storage space is limited. So is the tanker fleet. New refineries do not get built every day. Something has to give," the agency warned starkly. If so, someone forgot to tell the futures markets, where timespreads have remained firm and give no indication storage might be running out (http://link.reuters.com/zyt25w). Brent and WTI futures imply the market is willing to pay less than 45 cents per barrel per month to finance and store crude on average over the next half-year, down from more than $1 at times between January and March.

Brent Oil Rises as Euro Gains Against Dollar

Brent oil prices rose on Wednesday as the euro strengthened against the dollar following a boost in business morale in the euro zone's top two economies. The euro was up 0.6 percent against the dollar, the currency in which crude oil futures trade. The dollar lost 0.5 percent against a basket of currencies, making dollar-traded commodities more attractive for holders of other currencies. Brent crude oil was up 74 cents at $55.85 a barrel by 1236 GMT. U.S. light crude oil was up 35 cents at $47.86 per barrel. Germany, Europe's largest economy, saw business morale rise for the fifth month in a row in March, hitting its highest since July 2014, Ifo's business climate index showed. Business morale also rose in France to its highest for nearly three years. U.S.

U.S. Oil Traders Storing W.African Crude

Glencore, Suncor, ENI, Vitol all booking tankers; U.S. crude oil stocks at highest ever level for time of year. Traders are shipping West African crude to the United States to store the oil until prices recover, as the global glut forces them to source any tanks available and as seaborne cargoes are able to compete better on price with U.S. crude. Oil firms including Swiss-based Glencore, Italian energy major ENI and Canada's biggest oil company Suncor have lined up ships to take at least 10 million barrels of West African crude to North America, ship brokers say, with freight bookings and tanker tracking also showing the moves. The move reinvigorates a trade that had been largely shut off by the U.S.

Oil Falls Towards $111 on Libya Ports Deal

Oil fell towards $111 a barrel on Wednesday, its lowest in almost three weeks, on a possible substantial recovery in Libyan exports after rebels said they would reopen two oil terminals. Libyan rebels blockading eastern oil ports have agreed to reopen the remaining two terminals at Es Sider and Ras Lanuf. The port seizures have crippled the OPEC producer's oil industry since last summer. If fulfilled, the deal would bring back around 500,000 barrels per day (bpd) of crude oil export capacity, although production would remain well below the total of around 1.4 million bpd. There have been repeated reports in the past that ports would reopen and production increase, but analysts said the latest developments were likely to have more impact.

The ATB – What Does The Future Hold?

The AT/B comes of age: operating coastwise, Jones Act – and beyond the horizon, too. A great deal has been written about the capabilities of the AT/B, or “Articulated Tug/Barge” unit in recent years. Without a doubt, though, the concept is firmly established as a viable ocean and coastwise transportation system in North America. But like any transportation asset, the concept has to not only expand its’ capabilities, but also conform over time to ever-changing rules and regulations. It must also be able to embrace and adapt to changes in technology that hold the promise of reduced emissions as well as savings in fuel and protection of the environment.

U.S. Crude Supplies Up Slightly

U.S. crude oil supplies rose mildly last week, according to data from the American Petroleum Institute. The Energy Information Administration reported U.S. crude stocks rose 3.4 million barrels last week. The American Petroleum Institute on Tuesday showed stocks rose by 7.4 million barrels but it revised downward its previous week's data by 3.6 million barrels, meaning stocks rose by a net 3.8 million barrels. The stock reports were closely watched after the API showed crude oil stocks fell to a 24-year low in last week's numbers and that crude stocks fell by more than nine million barrels in the previous week's report.