Crude Tanker Rates Expected to Stay Strong Despite Russia Turmoil

Prospects for the crude oil tanker market are expected to stay strong for at least the next year helped by low ship ordering, despite the loss of some trade from Russia due to Western sanctions, leading ship operators say.Russia has increased exports to Asia, Africa and South America following the imposition of Western sanctions for its invasion of Ukraine.

Performance Shipping Adds Secondhand Aframax Tanker

Greek tanker owner Performance Shipping announced it has taken delivery of the a 2009-built 105,071 dwt Aframax tanker that it agreed to purchase in June 2022.The vessel, formerly known as Maran Sagitta, has been renamed P. Sophia. It was built in 2009 by Hyundai Heavy Industries Co., Ltd. in Ulsan, South Korea. Performance Shipping acquired the vessel for a gross purchase price of $27,577,320.Andreas Michalopoulos, Performance Shipping’s chief executive officer, said the delivery increases the company’s fleet to a total of six Aframax tankers, all currently operating in the firm spot charter market. “The addition of this high specification vessel…

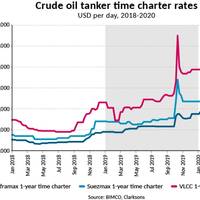

Geopolitics Dominate the Oil Tanker Market -BIMCO

Developments in the oil tanker market in the past decade dominated by geopolitics, says shipping association BIMCO.Crude oil and product tanker markets alike have faced high volatility in recent weeks and months, largely due to geopolitics and the constantly evolving situation in the global oil markets. The first major disturbance since the fall in the oil price between the fourth quarter of 2104 and first quarter of 2016 came in the fourth quarter of 2019, after which freight rates have bounced back despite a collapse in demand.In these extraordinary times…

While Oil Prices Plummets, Tanker Rates Fly High

If one ever needed proof that, no matter how dire the situation, there is always a silver lining, look no further than the crude tanker market, which has seen it day rates skyrocket in the face of a global pandemic that has effectively ground world commerce to a crawl.As is the case with other gravity defying business phenomena, geopolitics is a central factor, in this case a battle between Russia and Saudi Arabia to flood the world with oil in the face of declining demand and…

US Seaborne Crude Oil Exports Up 51%

December could boast another all-time high for US seaborne crude oil exports, totaling 13.9 million metric toes and exceeding the previous October record by almost a million metric tons. In 2019, 133 million metric tons of sweet US crude oil was exported by sea, a 51% increase from 2018.Due to the US shale revolution, the country became a net seaborne crude oil exporter in October 2019, and the record-breaking exports in December solidified the trend, as imports for the month amounted to 11.5 million metric tons crude oil.

BIMCO: Tanker Shipping and Macroeconomics Outlook

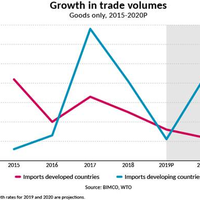

World growth and trade volumes under pressure, but still positive. A continued slowdown in global growth, as well as a lower trade multiplier will reduce overall demand for shipping for the rest of this year and through 2020.Expectations for global trade growth have also been lowered for 2020; this is now forecast at 2.7%, down from 3%. The WTO cautions that risks to these forecasts are weighted to the downside, with these risks including a potential deepening of trade tensions…

BIMCO: US Seaborne Crude Oil Exports Hit Record High

US exports of crude oil have, since August 2018, continued to rise every month, with a new record high in January of 9.6 million tonnes. Exports rose in January on the back of increased sales to Europe, which rose from 2.7 million tonnes in December to 4.8 million tonnes in January.A strong end to 2018 meant that volumes for the full year totalled 87.4 million tonnes, 96.7% higher than the 44.4 million tonnes exported in 2017. This is good news for the crude oil tanker sector…

Tanker Market Grappling with More Uncertainty

Tanker shipping: Added uncertainty is not helpful to the struggling tankersDemandJust when you thought it could not get any worse for the tanker shipping industry, the U.S. is reimposing sanctions on Iran coming into force after a six months wind-down period ending on November 4, 2018. The immediate effects are less tangible but sure to add more uncertainty to the whole shipping industry that has plenty of uncertainty to deal with already.At the same time, freight rates for both crude oil tankers and oil product tankers are mostly in loss making territory.

Jefferies Upbeat on LNG, LPG and Dry Bulk Shippers

Jefferies optimistic on stocks of LNG, LPG and dry bulk shippers With spot rates at 4-year highs, brokerage says, "we believe additional LNG liquefaction terminals will continue to stimulate LNG shipping demand above and beyond LNG shipping supply growth" All shipping sectors to improve through 2018, 2019; "seasonal patience will be required in the dry bulk, refined products and crude tanker sectors" - Jefferies Improvement in global economic conditions and Chinese preference for high-quality dry bulk commodity imports will help dry bulk carriers Refinery capacity additions to

Record crude oil tanker deliveries adds instant freight rate pressure - BIMCO

On an unprecedented scale, 5.5m DWT of crude oil tanker capacity (up 220% from January 2016), has already been delivered in 2017 (according to preliminary data from VesselsValue.com). January 2017 already accounts for 22% of the crude oil tankers previous year’s total deliveries. In comparison to the totals of 2015 and 2014, this 2017 figure amounts to 48% and 51%, respectively. January 2016, in terms of crude oil tanker deliveries of2.5m DWT, hit record levels in relation to the previous two years. However, that level has been dwarfed by the tremendous amount of deliveries in January 2017. BIMCO’s Chief Shipping Analyst Peter Sand says: “This record-high crude oil tanker delivery growth is troubling…

BIMCO: What Shipping Market can Expect for 2017

The shipping industry has its work cut out going forward in 2017 as the International Monetary Fund (IMF) forecast the lowest level of global GDP growth since 2009. 2017 will see another year of die-hard competition, which now includes tankers. In 2016, the container shipping industry bit the bullet in terms of demolition and consolidation to help the market to recover. The dry bulk sector needs to copy that approach. The longer global economic growth remains weak and lacks investment, the lower future growth potential for shipping. For eight years, the world has struggled to cope with huge changes and challenges brought around by the crash of the financial market in 2008.

Fleet Growth Squeezes Crude Oil Tanker Market

From January 2014 - October 2016 the crude oil tanker segment composing of VLCC, suexmax and aframax ships, had a net-fleet growth of 7.3 percent, which is equal to 24.3 million (m) DWT. The VLCC segment, with 20.7m DWT or a net fleet growth rate of 11 percent took the lion’s share, followed by the suezmax segment with 4.4m DWT or 5.5 percent. Whereas the aframax segment decreased by -0.8m DWT or 1 percent, in relation to the fleet size of the specific ship segment. The Baltic and International Maritime Council’s (BIMCO) Chief Shipping Analyst Peter Sand said…

Crude Oil Tanker Market Weakened, says OPEC

Crude oil tanker market sentiment weakened in April as average spot freight rates dropped on most reported routes, OPEC said in its latest monthly report. On average, dirty tanker freight rates were down 8% from the month before. Despite a stronger market seen in the VLCC sector, average dirty spot freight rates declined, influenced by the declines in Suezmax and Aframax freight rates. VLCC spot freight rates showed improvements, rising by around 17% on all reported routes, as a result of an active market and strong tonnage demand. Suezmax and Aframax both closed the month down by 15% and 12%, respectively, as demand for both classes remained weak amid a persisting tonnage oversupply. Following the drop seen last month, OPEC spot fixtures dropped in April by 4.2%.

Tanker Firms Eye US Listings as Market Rebounds

Inspired by an upturn in shipping markets after one of the worst sector downturns on record, a batch of oil tanker companies are looking to raise capital through U.S. listings. While crude prices have fallen more than 50 percent since June, tanker prospects have brightened, helped by a drop in bunker fuel prices and demand for oil among bargain hunters. Overcapacity, which has dogged owners for years, is also receding. Average earnings for supertankers have reached over $83,000 a day this week, not far from a peak of more than $120,000 a day seen before the 2008 slump in trade.

Crude Carriers Receives M/T Aias, Option on M/T Atlantas

Crude Carriers Corp. (NYSE: CRU) announced that it took delivery of the M/T Waltz to be renamed M/T Aias (150,096 dwt), June 3, 2010. In addition, the 12-month fixed-price option to acquire the M/T Atlantas from Capital Maritime & Trading Corp. commenced on June 1, 2010. The M/T Aias, a modern, high-specification Suezmax-class oil tanker was built in 2008 at Universal Shipbuilding Corporation in Japan, the same yard as its sister ship M/T Amoureux which was delivered to the company on May 10, 2010. The vessel was acquired at a purchase price of $66.2m, a cost significantly below the average 10-year historical values and is the fourth vessel of the Company's fleet to be delivered.

Teekay Tankers Order Four Tankships from Korean Yard

Teekay Tankers orders 4 LR2 product tankships from STX Offshore & Shipbuilding with options for 12 more. The agreement is for STX of South Korea to construct four fuel-efficient 113,000 dwt Long Range 2 (LR2) product tanker newbuildings for a fully built-up cost of approximately $47-million each. The agreement also includes fixed-price options for up to 12 additional LR2 newbuildings that can be declared over the next 18 months. Upon delivery, it is expected that the vessels will operate in Teekay Corporation's Taurus Tankers LR2 Pool…

Nordic American Tankers' 2Q Report

Cash dividend of $0.12 and dividend-in-kind of NAO shares declared (worth $0.16/sh). Operational performance remains strong as fundamentals improve. The strong winter market at the beginning of the year subsided in 2Q2014. Refinery maintenance schedules and geopolitical factors affected our results this quarter in a weaker spring market. However, there are now reaffirmed indications that a recovery may be on the horizon. 3Q2014 has started on a more positive note than 2Q2014. The spikes in rates seen this year are a sign that the crude oil tanker market is becoming more balanced. During 2Q2014 we had cashflow from operations1 of $4.3m, compared with $27.1m in 1Q2014, -$10.6m in 2Q2013 and -$4.9m in 1Q2013.

Delivery of Crude Carriers VLCC

Crude Carriers Corp. (NYSE: CRU) announced that on March 26 it took delivery of the M/T Alexander the Great, a very large crude carrier (VLCC) with carrying capacity of 297,958 mt, from Universal Shipbuilding Corporation at the Ariake Shipyard in Japan. The M/T Alexander the Great is the first of the three vessels comprising the company's initial fleet and was acquired at a purchase price of $96.5m. The remaining two vessels, the M/T Miltiadis M II, a 2006-built high specification Suezmax tanker and the M/T Achilleas, a sister newbuilding VLCC currently under construction at Universal Shipbuilding Corporation in Japan, are expected to be delivered within the next few days and at the end of June 2010, respectively.