Small LNG Projects Crucial for Market: Drewry

Low prices, abundant supply and an aggressive shift towards cleaner gas for energy generation are creating strong demand for LNG, not just from large buyers, but also from small importers, said Drewry.In its market opinion report, Shefali Shokeen, Senior Research Analyst, Drewry Maritime Research said that small-scale LNG projects (production and regasification capacity of less than 500,000 tonnes per annum) have reduced capex and are suitable for countries with low LNG consumption.For example Gibraltar has set up a small LNG import terminal with a total storage capacity of 5,000 cbm, which will directly provide fuel to the power plant…

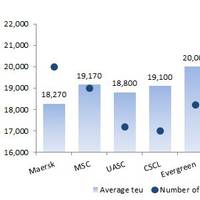

Moody's Downgrades Maersk

Moody's Investors Service has downgraded ratings for AP Moller-Maersk after a review of the Denmark-based shipping and oil company. Moody's expressed concerns about lower economic growth and the US-China trade war."The downgrade reflects our expectation that Maersk will face increased market and execution risks and, as a result, operate at a higher leverage than is commensurate with a Baa2 rating for a company in such a volatile and cyclical business as container shipping," said Maria Maslovsky, Moody's Vice President -- Senior Analyst and the lead analyst for Maersk."However, we acknowledge Maersk's leadership position as a liner and container terminal operator…

Container Shipping Bankruptcy Lends Insight on Potential Fallout from Trade War

Global trade tensions have captured headlines in recent months, as the imposition of a series of tariffs and counter-tariffs by various global trade counterparts has raised questions about the possibility of a trade war. Such development could potentially have an impact on global trade flows, and, consequently, the companies which facilitate international movement of goods.Though the situation is still developing and the final impact is uncertain, Gregory Draco, the Chief U.S. Economist at Oxford, predicted in July that the tariffs would create an 0.1 percent to 0.2 percent drag on U.S. GDP.

Container Shipping a 'Mixed Bag' - Drewry

South Asia container trade with Europe continues to outpace the Middle East, says Drewry in its Container Insight Weekly report.Container shipments in the combined eastbound Europe to the Middle East and South Asia trade performed well in the first quarter, rising by 5.2 percent year-on-year according to Container Trade Statistics. However, that aggregate rate hides two very different performances by the two destinations. CTS reports that inbound traffic to South Asia soared by 18 percent in 1Q18 to reach approximately 410…

Asia-U.S. Trade to Grow 7%

About 500 people gathered at the Long Beach Convention Center for the event, which brings together a panel of shipping and trade experts to offer their perspectives on industry trends and how they affect the San Pedro Bay port complex. One of the panelists, Drewry Maritime Research Senior Quantitative Economist Mario Moreno, predicted Asia-U.S. trade will grow 6.8 percent in 2018, the fastest pace in more than half-a-dozen years. He also estimated the overall U.S. economy will expand 2.8 percent. While President Donald Trump and China have proposed higher tariffs, an all-out trade war between China and the United States appears unlikely, according to Moreno. “Both nations have a lot to lose,” Moreno said.

Oversupply Remains - Drewry

The withdrawal of Hanjin tonnage has not been enough to rectify the trade’s supply-demand imbalance and headhaul ship utilisation is lower compared to other major East-West markets. Westbound volumes rose by 1.8% in the third quarter and the growth rate for the year to date is now registering 2.9% (see Figure 1). Asian exports shipped to the West Mediterranean (including North Africa) grew by 2.8% between July and September, while traffic to the eastern sector of the trade only expanded by 0.8%. By the end of September, the 12-month rolling average growth factor for westbound flows was touching 3.4% (see Figure 2) which is a distinct improvement on the minus 1.9% recorded a year earlier, and represents the highest point it has reached since March 2015.

No recovery for Container Traffic in sight - Drewry

Asia to West Africa container traffic fell by 19% in the third quarter; the end-year result will not be much better. The IMF’s latest World Economic Outlook, published last month, described “multispeed” growth for sub-Saharan Africa economies with the divide between the haves and have nots hinging on different nations’ exposure to commodities. The biggest West African economies of Nigeria and Angola are struggling to adjust to lower oil revenues with the former expected to see GDP contract by 1.7% this year and the latter to flat-line. The outlook is not much better for 2017 with Nigeria’s economy predicted to grow by just 0.6%, while Angola’s output is expected to rise by a meagre 1.5%.

Record Containership Demolitions has suppressed Fleet Growth - Drewry

A record year for containership demolitions in 2016 has helped suppress total fleet growth close to the rate for demand. To repeat that feat the scrapping record will need to be smashed again, and again. There are multiple ways to measure the vitality of the container industry, from looking at port and trade volumes to carrier income and balance sheet statements. Another is to look at the average age of containership demolitions. Generally, the earlier that owners decide to cut short the life cycle of their steel assets the more downbeat they are of their future revenue earning potential. So far this year there have been three cases of ships being scrapped just before they reach their 10-year birthday (a record)…

Ready for take-off? - Drewry

The recent rally in Asia to Europe spot market rates has improved carriers’ chances of securing higher 2017 contract rates. How much extra will shippers have to fork out? It has been another typically volatile year as far as the spot freight rate market (i.e. rates with a validity of up to 30 days) is concerned with the weekly ups and downs once again being most obvious in the high-volume westbound Asia to Europe trade. Table 1 shows that in many respects 2016 has thus far played out very much like 2015 with very little difference in regards to the average weekly rate, standard deviation or highs and lows. However, this year does differ in one key aspect: timing.

Drewry Finds Risk of Carrier Failure Still High

Drewry’s Z-score carrier financial stress index sunk to its lowest ever point following the first-half 2016 results. After Hanjin’s bankruptcy shippers are demanding more financial transparency from carriers. There is still much work to be done to clean up the logistical chaos created by Hanjin’s bankruptcy, but even so there are lessons from the sorry mess that need to be learned to avoid a repeat occurring. Firstly, all stakeholders must understand that no carrier is too big to fail. The hitherto expectation that some white knight would rescue an ailing carrier has been erased forever. Secondly, while Hanjin’s financial position was at the extreme edges and its demise is not expected to create a domino effect…

Freight Rates in Europe-ECSA Trade Continue Declines

Container volumes from North Europe and the Mediterranean to the East Coast of South America have now fallen in 26 of the previous 28 months, with the latest statistics from Datamar showing that shipments fell by 8% year-on-year in July. It is the smaller Med to ECSA trade that continues to experience the largest fall-off in volumes with the Datamar figures showing that exports from the Med were down by 12.2% Y/Y after seven months of 2016 to 117,500 teu; versus a decrease of 8.8% for North Europe exports to 306,400 teu. The trade is very closely balanced with generally only a few thousand teu’s difference between the south and northbound legs each month, although the latter continues to gain ground and is on course to be the dominant leg for the second year running.

Wave goodbye to $50 bln - Drewry

Container industry revenues are contracting faster than carriers can cut costs. First-half results so far suggest sales are down by around 18%, increasing the pressure to reduce costs. The container shipping industry is currently enduring a severe revenue contraction that is placing carriers under enormous pressure to squeeze more savings wherever they can and is driving the latest round of M&A activity. The first-half 2016 financial results that have been published so far from a handful of major carriers paint a very depressing picture for the industry. First-half revenue from the sample companies listed in Table 1 was down by 18% on average, which if it holds true for the industry across the full year would mean that carrier income will shrink by approximately $29 billion against 2015.

South Asia Shining in Container Growth

Amid generally weak demand around the world the South Asia region is the shining light for container growth, says Drewry's Maritime Research. Growth in container shipping is becoming a rare commodity; global port throughput only increased by 1% in 2015 (the second lowest on record behind 2009) and the first quarter of 2016 was even worse with only a 0.5% rise. That the industry can point to any growth at all is largely down to strong volumes in the South Asia/Indian Subcontinent region, which saw box port traffic (including empties and transhipment) gain 5.3% in the first three months of 2016 – the highest attained by any region and 10 times the global average.

Steady as She Goes

Ahead of the Panama Canal expansion two alliances have announced they will upsize some of their ships on the Asia-US East Coast route. How quickly will the others follow? The 9,400-teu Cosco containership Andronikos will make the first transit of the expanded Panama Canal on Sunday 26 June, and ahead of that two shipping alliances – CKHYE and G6 – have laid out their plans to upgrade the size of ships used on the Asia-US East Coast via Panama route. In November last year Container Insight Weekly noted that Drewry expected carriers to resist the urge to flood the trade with the biggest ships possible and that vessel upgrades will be incremental and in line with demand growth. That prediction seems to have come true based on the immediate plans that have been communicated thus far.

Recent strength in dry bulk shipping to be short-lived - Drewry

Drewry forecasts dry bulk freight rates in 2016 will be, on average, lower than in 2015, as the medium-to-long term fundamentals for dry bulk shipping will remain challenging, according to the latest edition of the Dry Bulk Forecaster report published by global shipping consultancy Drewry. The dry bulk sector has seen a period of recovery in recent months based on higher iron ore, coal and grain trade. The boom in iron ore trade that has resulted in record exports out of Australia and Brazil is expected to be a short term phenomenon as it has mainly been based on iron ore restocking due to low inventories, hence resulting in stronger Capesize engagement particularly in the Pacific basin.

Containership Scrapping Gathers Momentum

After a slow start scrapping of containerships gathered momentum towards the end of 2015 and has continued into 2016, says Drewry Maritime Research. A record intake of newbuild containershps (1.7 million teu) in 2015 coincided with an unusually low scrapping total, serving to widen the supply and demand gap that is assisting the erosion of carrier profits. The amount of scrapping halved in 2015 with only about 195,000 teu worth of capacity removed from the world’s cellular fleet, well down on the previous three years from 2012 to 2014 when the annual scrapping totals averaged nearly twice as much. Last year, owners of older scrapping…

Low Bunker Prices to Support Tanker Earnings

Lower oil prices performed wonders for the tanker market in 2015, says Drewry Maritime Research. Tonnage demand surged and oil trade expanded because of high consumption demand and increased stocking activity. Tonnage supply was also kept in check as the contango in oil prices engaged many large tankers as floating storage because onshore storage tanks were full. The most important positive effect of lower oil prices came in the form of reduced bunker costs for vessel owners. Spot rates for VLCCs increased by 27% on the benchmark TD3 route in 2015, but TCE earnings surged by more than 50% because bunker prices touched bottom. For example, bunker prices for IFO-380 in Fujairah plummeted by more than 71% from $612/tonne in June 2014 to only $177/tonne in December 2015.

Drewry: Breakbulk Market Weak Until 2017

Global shipping consultancy Drewry Maritime Research said the breakbulk shipping market is expected to remain weak until 2017, citing low freight rates and high competition. Although demand growth is expected to recover next year after a very poor 2015, and supply growth is likely to be minimal, competition from other sectors will maintain pressure on the breakbulk shipping market, according to the latest edition of the Multipurpose Shipping Market Review and Forecaster, published by global shipping consultancy Drewry. The IMF has downgraded its expectations for both GDP and trade volume growth for 2015 and 2016. Added to this, container shipping demand recorded its slowest rate of growth in the third quarter of this year since 1979 (excluding 2009).

Box Ship Oversupply Stoking Trouble

Despite positive growth momentum, the container shipping industry continues to suffer new, big ship deliveries with no let-up to the ordering frenzy according to the Container Forecaster, published by Drewry Maritime Research. Drewry forecasts another year of excess growth in relation to demand in 2015. This will make it harder for carriers to repeat the estimated 92% load factors across the main headhaul East-West trade lanes achieved in 2014. New orders for Ultra Large Container vessels of at least 18…

7th Annual UK Ports Conference to Take Off Tomorrow

Tomorrow 23rd June international law firm Hill Dickinson LLP will be holding its UK Ports Conference focusing on ‘The Future of UK Ports: changing regulation, shipping trend updates and new opportunities in the supply chain’. The 7th Annual UK Ports Conference will allow senior representatives from across the ports, shipping and maritime sector to network and discuss policy updates, shipping trends and the latest logistics and supply chain guidance. The day will also look at how to approach port development and funding and hear from UK ports on how ports can support the economic development of the local area and the wider UK. Another discussion point will be on EU state aid and the key risk factors are for UK ports.

Chinese Slowdown Hitting Container Shipping

The slowdown in China’s economy poses some risks for container shipping, according to Drewry Maritime Research. According to a new report from Drewry Shipping Consultants Ltd, the risks from a slowdown in Chinese consumption to container shipping are far smaller than for the dry bulk sector, but they are not inconsiderable and will contribute to slowing world box growth. Container-shipping lines, already concerned about demand from struggling economies in Europe and many emerging markets, can now add China to their list of problems. The analyst is now predicting a growth in Chinese container throughput of 4.9%, down from 5.8%. This shortfall accounts for around 1.85m teu, roughly 1% of world traffic in 2014.

Will Cosco-CSCL Merger be a Trend-setter?

A China Ocean Shipping Company COSCO-China Shipping Container Lines (CSCL)merger makes financial sense, but would have huge implications for competition in the container shipping industry, according to Drewry Maritime Research. Drewry Shipping Consultants has released a report examining the consequences of a rumoured merger between China’s two shipping giants. The merger will have a domino effect on the existing alliance structure of the container shipping industry and could see other Asian countries follow China’s lead. The merger will have a severe impact on the current shipping alliances, with the Middle East’s United Arab Shipping Company standing to lose the most.

Idling Container Fleet Continues to Surge

Carriers are intensifying their capacity-withdrawal activity, with November seeing a big rise in the number of idle containerships, says Drewry Maritime Research. The size of the idle fleet swelled by 52% from October to November to reach 900,000 teu, the largest monthly total since early 2010 following the market crash of 2009. Idle tonnage now accounts for 4.6% of the world’s fleet, which is still some way off the peak of around 11% seen at the end of 2009. For clarification, Drewry classifies a ship as idle when it has been stationary for a minimum of 14 days. So-called missed voyages do not count because these vessels continue to sail without calling at ports so that they can be easily fitted back into the schedule.