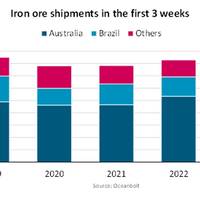

Iron Ore Shipments Drop 13.1% to Start 2023

2023 has so far been a disappointment for the dry bulk shipping sector, despite hopes that a quick economic recovery in China would boost iron ore demand,. During the first three weeks of the year, iron ore shipments fell 13.1% year on year, the lowest volume since at least 2019, worsening conditions for capesizes. In this period, the Baltic Dry Index (BDI) declined by almost 500 points to 763 on 20 January, its lowest point since June 2020.It is not unusual for the bulk market to cool during the first quarter when demand weakens during the Lunar New Year celebrations.

Baltic Dry Index Falls to Five-month Low

The Baltic Exchange's dry bulk sea freight index dropped to its lowest in five months on Wednesday, as rates across vessel segments fell.The overall index, which factors in rates for capesize, panamax and supramax vessels, fell by 295 points, or 9.3%, to 2,892, the lowest level since June 11.The capesize index fell 461 points, or 12.3%, to 3,275, its weakest since June 10.Average daily earnings for capesizes, which transport 150,000-tonne cargoes such as iron ore and coal, fell $3,825 to $27,162."Sentiment has deteriorated with FFAs (forward freight agreements) feeding into physical, while the

SSY Publishes Shipping Outlook for 2021

After a highly volatile 2020, shipbroker Simpson Spence Young (SSY) looks at the next 12 months and highlights areas of particular interest in their 2021 Outlook Report. The report looks at various drivers of the shipping markets, including how the developing emissions regulations may affect commercial fleets and shipping investments.Contributions come from a range of senior research and broking experts and cover dry bulk, tanker and gas freight markets; shipping investments, CO2 emissions, FFAs, metals and energy derivatives.

2020 Volatility Lifts Freight Derivative Volumes

The freight derivatives markets for both tankers and dry cargo vessels saw increased traded volumes in 2020, according to data released by the Baltic Exchange.Tanker Forward Freight Agreement (FFA) volumes were up 31% on the previous year, reaching 603,261 lots, with a daily record of 33,677 lots achieved on March 16 at a time when Time Charter Equivalent earnings for very large crude carriers (VLCC) exceeded $275,000. Dry FFA volumes hit 1,548,127 lots, up 17% on 2019. Options trading in the dry market hit an all-time high…

All Aboard for Hedge Funds as Trade Tide Lifts Shipping

Forced to abandon ship after mistiming their investments five years ago, hedge funds are venturing back in a bid to profit from growing global trade flows. Around 90 percent of traded goods by volume are transported by sea and global shipping sectors, including dry bulk, are on course for a recovery this year after a near-decade long crisis, ratings agency S&P said in a report last week. The IMF has forecast GDP growth at 3.9 percent for 2018 and 2019 versus 3.7 percent last year, which analysts say is boosting sentiment for shipping.

Donnelly Elected as FFABA Tanker Chairman

Pat Donnelly, of Braemar ACM-GFI, has been elected as Chairman of the Tanker FFA Brokers Association. He replaces Ben Courtney of ICAP Energy who has chaired the group, which represents the worldwide community of tanker Forward Freight Agreement (FFA) brokers, since 2016. Founded in 1997, the FFABA is the worldwide association for Forward Freight Agreement broking firms. Working with the Baltic Exchange, the FFABA organises educational workshops and industry forums in major shipping centres, with the aim of promoting FFAs as an important tool for managing exposure to freight rates.

Freight Futures Market Avoids Tougher EU Information Disclosures

The European Union's securities markets regulator has dropped proposals to make participants in the multi-billion dollar commodity derivatives market for freight rates disclose knowledge of loading conditions, the Baltic Exchange said. The European Securities and Markets Authority (ESMA) published its report on Sept. 30 on its proposals for more disclosure of inside knowledge about commodity derivatives trading to prevent market abuse. ESMA's initial proposals could have meant that a Freight Forward Agreements (FFA) trader with private information related to a commodity to be shipped could have been found to be in breach of disclosure regulations.

SGX sees Baltic buy boosting Asian freight derivatives

Singapore Exchange Ltd (SGX) sees the potential to develop new freight derivatives centred on active Asian shipping routes and expand the use of freight derivatives with its acquisition of London's Baltic Exchange, a senior SGX official told Reuters. "We believe there are a number of opportunities that the Baltic Exchange and SGX can realise together, including the creation and adoption of new benchmarks of Asian shipping routes," Michael Syn, head of derivatives at SGX told Reuters. The Baltic's daily benchmark rates and indices are used to trade and settle freight contracts as well as for settling freight derivatives, or FFAs, that allow investors to take positions on freight rates in the future.

Baltic Exchange Says Talks Ongoing with Potential Buyers

Talks between the Baltic Exchange and a number of suitors are continuing, but any potential buyer of the business will have to provide assurances that its central role in shipping will not be "undermined", the Baltic's chairman said on Wednesday. On Feb. 26 the privately held Baltic Exchange confirmed it had received a number of "exploratory approaches" after the Singapore Exchange Ltd (SGX) said it was seeking to buy the business. Both statements came a day after Reuters reported the Baltic had held talks with SGX and other potential buyers including CME Group, ICE and Platts. Sources had estimated the Baltic's valuation was $120 million.

Tanker Futures Market Booms as Rates Rally

Freight forward agreement (FFAs) trade rises. The market for hedging oil tanker freight has revived sharply this year to a value of $4.5 billion after years of torpor, with ship owners looking to profit from a freight rally and more energy companies scramble to cover risk, industry sources say. Cheap oil bargain hunters after the price drop and refineries, which have been operating at unusually high levels to meet rising demand, have helped tanker markets experience their best earnings in years after a long period of losses. Rates for crude supertankers have soared in recent weeks to over $100,000 a day - their highest since 2008. In tandem…

Baltic Exchange Eyes Move into Commodities

Baltex reaches breakeven level since start of 2015; Baltic previously faced broker opposition over platform. London's Baltic Exchange is studying a potential foray into commodities and is open to proposals on tie-ups as other exchanges attempt to boost volumes, its chief executive said. Baltex, the Baltic's digital shipping platform, was launched in 2011 as the first central electronic marketplace for freight forward agreements (FFAs), which allow investors to take positions on freight rates at a point in the future. Since the beginning of this year, the previously loss making platform, has reached break even levels after Baltex became a venue for presenting block futures at the start of December.

London's Baltic Exchange Redefines Capesize Terms

The move follows a formal consultation process with the dry bulk market which began on 11 October 2013. Trial reporting on the new routes and vessel description will begin in late January/early February with a lifting of the trial anticipated by the end of March 2014. The existing routes and new routes will be published side-by-side until there is no further open interest in either Forward Freight Agreements (FFAs) or options to be settled. This vessel will routinely be referred to as the 'Baltic Capesize 2014'. 15 knots ballast/14 knots laden on 62mt fuel oil (380 cst), no diesel at sea.

Chinese Iron Ore Imports Help Strengthen FFAs

Drewry Maritime Research’s latest Dry Bulk Insight saw the Drewry Hire Index improve to 229 points in June, a 6% increase from May. The largest improvement was seen in the Capesize vessel segment, resulting in the Drewry Capesize Demand Index increasing by over 80% during the month. This provides a more positive outlook for the dry bulk market thanks to increased chartering activity, low ordering, restricted deliveries and steady demolitions. A burst of Chinese ore importing was the catalyst for a big spike in the dry market in June. Period activity, an important indicator of sentiment, picked up in terms of activity and duration. Turnover soared in the dry ‘swaps’ market (FFAs): at the end of June…

GFI Group Conducts First "Matching" on EnergyMatch Europe Platform

GFI Group Inc. has conducted the first matching* of dry freight forward freight agreements “FFAs” trades on its premier electronic platform EnergyMatch Europe. EnergyMatch Europe is GFI Group’s electronic trading platform for energy and commodities and the market leader for the trading of Dry Freight FFAs. The screen allows for trading in co-mingled markets (co-mingling is the ability to clear trades with different clearing houses) and provides customers with the choice of CCP (Central Counter Party Clearing House) for clearing.

Euroseas Time Charter Renewals for Two Containerships

M/V Ninos, a 1,169 teu, 1990 built feeder containership, has been extended for about 1 year at a gross daily rate of $11,200. The new rate will apply from the 1st of June 2011. The new rate represnts an increase of about 65% over the vessel's current rate. M/V Kuo Hsiung, a 1,169 teu, 1993 built feeder containership, has been extended for about 1 year at a gross daily rate of $11,200. The new rate will apply from the 15th of June 2011. The new rate represents an increase of about 111% over the vessel's current rate.

Euroseas Charter Agreement for M/V Aristides N P

M/V Aristides N P, a 69,268 dwt, 1993 built Panamax bulk carrier, has been chartered until May 2012 at a gross daily rate of $14,950. The charter will commence upon completion of its present charter within the next few days and might be terminated [a month or extended by a month at the option of the charterer. This employment is expected to generate approximately $7.2m of gross revenues during the period of the charter. Following the above mentioned charter, approximately 66% of Euroseas total fleet days for 2011 and approximately 18% in 2012 are secured under period charters or Forward Freight Agreements (FFAs)**. Thus all drybulk vessels are fully covered for 2011 and 50% covered for 2012.

Euroseas Charter Agreement for Panamax Bulk Carriers

M/V Eleni P, a 72,119 dwt, 1997 built Panamax bulk carrier, has been chartered for about two years period at a gross daily rate of $16,500. The charter will commence in March 2011 upon the completion of the necessary drydocking works following her release from the Somali Pirates. This employment is expected to generate approximately $12m of gross revenues during the period of the charter. M/V Irini, a 69,734 dwt, 1988 built Panamax bulk carrier, has been chartered for about two and a half years period at a gross daily rate of $14,000. The charter has already commenced since the 10th of December 2010. This employment is expected to generate approximately $12.7m of gross revenues during the period of the charter.

Euroseas Results, Six-Months Quarter

Euroseas Ltd. (NASDAQ: ESEA), an owner and operator of drybulk and container carrier vessels and provider of seaborne transportation for drybulk and containerized cargoes, announced today its results for the three and six month periods ended June 30, 2010. • Net income of $0.5 million or $0.02 per share basic and diluted on total net revenues of $13.7 million. Excluding the effect of unrealized gain and realized loss on derivatives and unrealized loss on trading securities and amortization of the fair value of charters acquired, the net income for the period would have been $0.5 million, or $0.02 per share basic and diluted. • Adjusted EBITDA was $5.0 million. Please refer to a subsequent section of the Press Release for a reconciliation of adjusted EBITDA to net income.

Braemar Seascope and Tullett Prebon Announce Joint Arrangement

Braemar Seascope Limited and Tullett Prebon PLC announce joint arrangement for FFA broking Braemar Seascope Limited and Tullett Prebon PLC announced the formation of TP Braemar, a joint arrangement that will broke forward freight agreements (FFAs). The TP Braemar team will be based at Braemar’s offices in and will employ four FFA brokers to work on the wet FFA market. Operations will commence on August 18.

Britannia Bulk Talks About Financial Difficulties

While the company has not yet concluded the review of its financial results for the three months ended September 30, 2008, the company expects to announce a significant net loss for the period compared to the net income achieved during the second quarter of 2008. The company believes that the expected loss will have resulted from the substantial decreases in dry bulk charter rates that occurred during the period, exacerbated by the company’s increase in chartered-in capacity during the same period and its entry into the forward freight agreements (FFAs) and a bunker fuel hedge more fully described below. Historically the Company has chartered-in vessels to increase its overall dead weight tonnage capacity and enhance its service offering to customers.

Navios 3Q, 9 Mo. Report

Navios Maritime Holdings Inc. (NYSE:NM) , a global, vertically integrated seaborne shipping and logistics company, today reported financial results for the third quarter and nine months ended September 30, 2008. "We believe that Navios' flexible business model and conservative strategy will benefit us during this difficult period in the drybulk market," stated Angeliki Frangou Chairman and CEO of Navios Holdings. "Consistent with past practices, we entered into long-term charters-out and, as a result, our core fleet is 82% covered for 2009 and 59% covered for 2010. Ms. Frangou continued, "We are paying dividends for the third quarter of $0.09 per share. We remain committed to returning capital to shareholders while allowing for future growth.

Veson Debuts IMOS Trading Module

Veson Nautical, which delivers chartering, operations and accounting solutions for cargo transportation, introduced IMOS Trading, a complete system module for handling Forward Freight Agreements (FFAs), Options and Freight Exposure. “Commercial maritime organizations need to implement strong risk management processes to protect their business from volatile markets. Many have outgrown the Excel spreadsheet method and in fact, need a much more sophisticated, automated system,” said John D. Veson, President of Veson Nautical. “After listening to the needs of our customers, we developed IMOS Trading. Our solution provides access to powerful analytical tools that promote intelligent business decisions.

Euroseas Q4 & Year End Report

Euroseas Ltd. (NASDAQ: ESEA), an owner and operator of drybulk and container carrier vessels and provider of seaborne transportation for drybulk and containerized cargoes, announced its results for the fourth quarter of 2009 and year ended December 31, 2009. - Net loss of $16.3 million or $0.53 loss per share basic and diluted on total net revenues of $16.5 million. The results include a $9.0 million loss from the sale of two vessels. Excluding the effect on the losses for the quarter of the loss from the sale of the vessels as well as the effect from the unrealized losses on derivatives and trading securities and the amortization of the fair value of time charter contracts acquired…