Qatari Export Costs to Rise as Port Ban Disrupts Trading

Region's largest bunkering hub shuns Qatari vessels; affected shippers may face delays, higher costs. The costs of Qatari energy and commodity exports are likely to rise as the United Arab Emirates' ban on Qatari vessels cuts the ships off from the region's main refuelling port, forcing ships to sail further for fuel or pay higher prices. Saudi Arabia and the UAE, along with Egypt, Yemen and Bahrain, on Monday cut diplomatic ties with Qatar amid accusations the country supported terrorists. The Arab allies are applying many economic pressure points, including barring Qatari flagged ships from entering their waters. Around half a dozen oil…

Q4 Bounce Forecast for Dry Bulk Market

The Q4 bounce – a seasonal staple of the dry bulk markets – looks likely for Capesize and Panamax segments, but the effects may be limited. Independent research and consultancy firm Maritime Strategies International (MSI) is forecasting a fourth quarter bounce in dry bulk market earnings, driven by improving iron ore, coal and grain trades. In its latest Dry Bulk Freight Forecaster, MSI sees positive signs beyond the traditional summer lull in chartering activity for both the Capesize and Panamax sectors.

Capesize Index Weakens

Upward moves in the Capesize index are now starting to stall, according to Freight Investor Services (FIS). "Last week we witnessed some short covering in the market which was supported by the technical picture, and this appears to be now drawing to a close," says FIS. The Capesize Index has since started to stall with prices now moving lower, the index seems to be finding resistance at the upper Bollinger band, at a time that the momentum indicators are starting to weaken, suggesting the technical picture could soon be about to change to the downside. August futures started the week trading lower on lighter volume with small selling coming out of physical trading houses in both Europe and Asia. Momentum here is bearish with prices failing to hold above their 21 period moving averages.

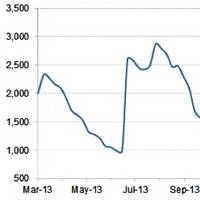

Selling Pmax Time Value To Buy Cape Volatility

With implied volatility in the Capesize sector being historically higher than that of the Panamax, this note observes and highlights their behavioral patterns (via the spread) after an expiry, says Freight Investor Services. Current Capesize Q4 implied volatility is at 103.7%. This is nearly twice that of the Panamax Q4 implied volatility which is at 53%. The graph illustrates the implied volatility differential between the Capesize 2 quarters forward, and the Panamax 2 quarters forward. Therefore the current spread in play will be on the Q4 expiry. The spread has a tendency to widen atier the previous quarter expiry (rollover). Since January 2014 we have seen a positive return on 90% of the rollovers.

Dry-Bulk Shipping: Hitting the Bottom

Dry bulk shipping companies being hit the hardest on account of the deteriorating business climate are likely to be swept by a new wave of bankruptcies, reports Nikkei. The global commodities bust has rocked the dry-bulk shipping industry, with a wave of bankruptcies washing across the sector and major players forced to restructure, divest or scrap assets. Many in the industry had hoped it would start to recover this year. But there is not much sign of that—and it looks as if more pain is still in store for shipowners. On Jan. 5, the Shanghai International Shipping Institute issued a striking report after polling about 50 of the nation's largest bulk shippers. The survey concluded that 60% of the firms it polled were struggling with long-term losses and about 40% faced liquidity problems.

Panamaxes the Filling in Another Depressing Dry Bulk Sandwich

A report from the Freight Investor Services (FIS): “When there’s blood on the streets, it’s time to buy, even if the blood is your own,” shipowner Leon Patitsas rather enigmatically told this week’s Marine Money conference. Dry bulk, he said was “a screaming buy” with asset prices so low that the bargains were too tempting to let pass. This is not unconditional advice. Patitsas said any would-be buyer needed very low or no leverage and patience to wait for a better market and he was not alone. Another owner with extensive dry bulk exposure confided that he would be happy to see the market improve but not before a further six or 12 months, so there could be a shake-out of the less committed players.

Asia-Europe Box Rate Drop Continues

Freight rates on world's busiest route down 20.6 pct; forward contracts indicate continued weak 2016 market. Shipping freight rates for transporting containers from ports in Asia to Northern Europe plunged by 20.6 percent this week and there is nothing to indicate that shippers can expect better rates in 2016, a container derivatives trader said. Freight rates for transporting 20-foot container (TEU) on the world's busiest route fell to $558 dollar from $703 a week earlier which is widely seen as a loss-making level. "Sadly for the carriers, at least, 2016 doesn't look like it will be much better," said Richard Ward from brokerage firm Freight Investor Services.

Asia-Europe Box Rates Drop 10 pct

Shipping freight rates for transporting containers from ports in Asia to Northern Europe fell by 10.4 percent to $1,175 per 20-foot container (TEU) in the week ended on Friday, one source with access to data from the Shanghai Containerized Freight Index told Reuters. The fall came after last week's jump of 88 percent on the world's busiest route. Container freight rates have so far increased in 12 weeks this year but fallen in 32 weeks. "Within just one week carriers have witnessed their most recent general rate increase erode by 22 percent, reflecting how ineffective such increases are at improving revenue streams in the medium or long term," wrote container derivative trader Richard Ward from Freight Investor Services in London.

Global Forwarders Favour Index-Linked Container Contracts

Index-linked contracts between shippers and carriers, and between shippers and forwarders, appear to be increasing for valid reasons, according to the latest edition of Drewry's Container Insight Weekly. According to Freight Investor Services, which specialises in helping contracting parties soften market volatility through hedging, shipper interest in Index-Linked Container Contracts (ILCCs) has increased significantly during the past 12 months. Most of the top 10 global forwarders now have quarterly ILCCs with shipping lines…

Free App Makes Freight Markets Mobile

Freight Investor Services (FIS), a broker of freight and commodity swaps, launched a mobile app that puts the freight and commodity swaps market in the hands of users, wherever they are. The app combines indicative market prices across the main freight and commodity groups with powerful graphing to display forward curves and historical spot prices. Also included are FIS daily reports for all markets, including closing curves, commentaries, spreads and ratios. The app is available in both English and Mandarin…

FIS Bunker Digitalizes Fuel Oil Trading

Freight Investor Services launches a live bunker fuel pricing service that for the first time makes bunker hedging practical for its biggest users. Firm bids and offers, updated in real time for six months of bunker forward curve will provide unrivalled degree of price transparency and liquidity. Ali Ersen, Bunker Broker with FIS, said: “When a shipowner knows they are performing a given voyage or charter, they can use the screen to hedge their fuel like-for-like in the volume that they need. The FIS Bunker Screen automatically collates prices from multiple market-makers and provides firm bids and offers in tight spreads along six months of the forward curve.

FIS Bunker Screen Brings Trading into the Digital Age

Firm bids and offers, updated in real time for six months of bunker forward curve will provide unrivalled degree of price transparency and liquidity. Freight Investor Services, one of the world’s leading brokers of freight and commodity derivatives, has launched a live bunker fuel pricing service that for the first time makes bunker hedging practical for its biggest users. The FIS Bunker Screen automatically collates prices from multiple market-makers and provides firm bids and offers in tight spreads along six months of the forward curve. Screen prices move with the market, reflecting up-to-the-minute changes in prices of the three key bunker fuel contracts: Singapore 180CST, Singapore 380CST and Rotterdam 3.5% Sulphur Barges.

FIS Makes Bunker Swaps Simple

London - Freight Investor Services has expanded its rapidly growing commodity broking business into cleared, over-the-counter bunker swaps. The new service – the Fuel Oil Single Swap (FOSS) - comes in response to escalating bunker prices, which are hurting shipowner margins at a time of historically low freight rates. The new FIS offering will include three fuel oil contracts: Singapore 380 centistokes (CST), Singapore 180 CST and Rotterdam 3.5% sulphur barges FOB. In contrast to existing swaps, these contracts will be traded in lot sizes of just one tonne, enabling easier access to these markets for smaller players such as shipowners who need to manage their fuel cost risk for small fleets or even individual vessels.

Implications of the Japan Crisis

In the aftermath of the devastating earthquake that has hit Japan, fears are growing over the potential for radiation leaks from damaged nuclear plants. Equity markets have been hit while FFA prices have also sustained significant losses. With the situation still unfolding, the longer term impact of the disaster on commodity markets is unclear, although some initial conclusions can be drawn. In the short term, shipping has been disrupted with 13 ports reported by Reuters to have closed, with some of these unlikely to be operational for several months or even years. Initial assessments by Macquarie and the Steel Index put production at five large steel mills in the worst-affected region at risk, accounting for 15-18 million tonnes (Mt) of annualized steel production capacity.