Eastern Awarded Contract to Complete MPSV Builds for Hornbeck

Panama City Fla. based Eastern Shipbuilding Group announced it has been awarded a contract to complete construction of two ultra high-spec 400 class multipurpose support vessels (MPSVs) for Hornbeck Offshore Services (HOS).The newbuilds were originally started by Gulf Island Shipyards in Houma, La. before Hornbeck terminated the contracts in 2018 over what it described as "performance issues". Gulf Island then sued Hornbeck, claiming the two shipyard construction contracts were wrongfully terminated.

16,000 Extra Workers Needed in UK’s Offshore Wind Sector by 2030

A new labor forecasting tool (LFT) is predicting around 16,000 additional workers could be needed in the UK’s offshore wind industry by 2030, and 12,000 extra workers will be needed specifically for carbon capture and hydrogen projects by 2027. It also highlights a significant increase in demand for workers in the West of Shetland oil and gas basin.The new resource, the first of its kind to focus on the engineering construction industry (ECI), provides insights into workforce numbers across regions and sectors…

U.S. Interior Secretary Deputy Beaudreau Bids Farewell

U.S. Deputy Interior Secretary Tommy Beaudreau is stepping down from his role at the end of October, the Interior Department said in a statement on Wednesday, without giving a reason for his departure or saying how the vacancy would be filled.The Washington Post reported earlier Beaudreau was leaving after two years in the number two spot and a total of 10 years at the agency to spend more time with family.Earlier this year, Beaudreau signed the final approval for a scaled-back version of ConocoPhillips' (COP.N) $7 billion Willow project to drill for oil and gas in Alaska…

Offshore Wind: Support Vessel Bottlenecks Loom in the US

An offshore wind industry is growing in the U.S. with an aim to meet the Biden Administration’s goal of 30 gigawatts (GW) of offshore wind by 2030, and eventually 110 GW by 2050.But as is the case for any new industry that is building up, there are going to be bumps along the way. The U.S. offshore wind industry is currently grappling with rising costs amid unprecedented supply chain issues and inflation, among other issues.One of the main challenges unique to offshore wind is a shortage of vessels.

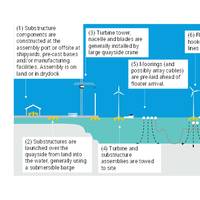

Floating Wind: What Opportunities Exist for Installation Companies and Vessel Owners?

Global floating wind capacity will have grown from less than 200 MW at the end of 2022 to around 61 GW of grid connected capacity by 2035. This activity will require over $250 billion in capital expenditure. Over 75% of the forecast activity is expected to come from four countries. The global forecast translates demand to a requirement to pre-lay more than 6,000 mooring spreads within the forecast period and the hook-up of around 5,400 turbines. The available market for vessel owners, ranging from pure T&I to full floater EPCI scopes of work, amounts to $28-145 billion in the forecast period.

NOIA Unhappy About Rice Whale Protection Recommendations

National Ocean Industries Association (NOIA) President Erik Milito has said that the Bureau of Ocean Energy Management (BOEM) issue of a Notice to Lessees (NTL) with recommended restrictions on ongoing industry activities within the expanded Rice's Whale habitat area imposes “unwarranted restrictions on U.S. energy production at a time of continued inflation with prices rising at the pump for consumers.”With likely fewer than 100 individuals remaining, Rice's whales are one of the most endangered whales in the world.

Offshore Wind: Floating Wind is the Future

$3 billion forecast to be invested in new anchor handlers to meet floating wind demand.Floating wind is an emerging technology. Currently being tested in small scale demonstration and pilot projects, global floating wind commissioned capacity at the end of 2022 was less than 200 MW. By 2030, close to 11 GW of commercial scale wind farms are planned to be commissioned in Europe and the Asia Pacific Region. 2030-2035 will see a period a high commissioning activity as the USA joins established European and Asia Pacific markets.

$3 Billion Forecast to be Invested in New Anchor Handlers to Meet Floating Wind Demand

Floating wind is an emerging technology. Currently being tested in small scale demonstration and pilot projects, global floating wind commissioned capacity at the end of 2022 was less than 200 megawatts (MW). By 2030, close to 11 gigawatts (GW) of commercial scale wind farms are planned to be commissioned in Europe and the Asia Pacific Region. Then, 2030-2035 will see a period a high commissioning activity as the U.S. joins established European and Asia Pacific markets. Floating installed capacity is forecast to reach 63 GW by 2035.

Solstad Offshore Sells Six Offshore Vessels. Completes Fleet Trimming Program

Norwegian offshore vessel owner Solstad Offshore has sold six more vessels, wrapping up its fleet 'right-sizing' plan announced in 2020.As previously reported, back in 2020, Solstad Offshore said that, as part of its restructuring agreement, it would "right-size" its fleet to make it more competitive, with a plan to divest 37 vessels "over a period of time," and has been gradually offloading the unneeded tonnage ever since.In a statement on Thursday, the Norwegian offshore vessel owner said that its subsidiary Solstad Rederi had sold six vessels of which four PSV’s Sea Trout…

Solstad Offshore Sells Two AHTS Vessels

Norwegian offshore vessel owner Solstad Offshore has this week sold two anchor handling tug and supply vessels, in line with its objective to reduce fleet size to a level of 80-90 vesselsThrough its subsidiary Solstad Rederi AS, the company sold the AHTS Normand Master and Normand Mariner.The delivery of the vessels to the new owner took place on Thursday, and Solstad said the sale of the vessels would result in an immaterial accounting effect.Earlier this month, Solstad Offshore sold three anchor handling vessels…

Solstad Offshore Offloads Anchor Handling Trio, Nabs UK Work for PSV Duo

Offshore vessel owner Solstad Offshore said Thursday it had sold three anchor handling vessels to undisclosed buyers, and also secured work for two platform supply vessels in the UK North Sea.Haugesund, Norway-based company said Thursday it had sold the Nor Captain - owned by its subsidiary Solstad Offshore Singapore - and Far Sword and Far Stream, owned by its subsidiary Farstad Supply."Delivery of the vessels to the new owner took place today, February 3rd, 2022. The sale of the vessels will result in an immaterial accounting effect…

Solstad Nabs One-year Charter for PSV. Offloads AHTS

Norwegian offshore vessel owner Solstad Offshore has secured a one-year contract for its platform supply vessel Normand Flipper.Solstad Offshore said that the contract, starting in December 2021, is for work in the UK North Sea. It did not say who the client was.The 2003-built Normand Flipper was mentioned on OEDigital.com in February 2020, when Solstad Premier Oil chartered the PSV to support its Tolmount field operations in the UK sector of the North Sea.Also, Solstad Offshore said Friday it had Sold its AHTS Far Scout…

Solstad Offshore Sells Far Swan PSV

Solstad Offshore, a Norwegian offshore vessel owner, said Tuesday it had sold the platform supply vessel Far Swan.The company, which last year said it would trim its fleet to make it more competitive, with a plan to divest 37 vessels "over a period of time," said it had delivered the Far Swan to the new owner on November 16th, 2021."The sale of the vessel will result in an immaterial accounting effect for Q4 2021," Solstad Offshore said. The vessel was sold by Solstad Offshore's subsidiary Farstad Shipping.

Solstad Offshore Sells Platform Supplier

Norwegian offshore vessel owner Solstad Offshore is continuing with divestments of non-core vessels and has now sold the Rem Provider platform supply vessel.The vessel, built in 2007, was sold by Solstad Offshore's subsidiary Solstad Rederi AS and the vessel was delivered to the new owner took on Friday. "The sale of the vessel will result in an immaterial accounting effect for Q4 2021," Solstad Offshore said, without sharing further details on the buyer or on the sale value. VesselsValue values the vessel at $3,25 million, with demolition value at around $1,13 million.

Solstad Offshore Sells Seven Vessels for Recycling

Norwegian offshore vessel operator Solstad Offshore has sold seven vessels that have been laid up for a while for recycling."The vessels to be recycled are defined by Solstad as non-strategic, they are of older age and considered to be irrelevant for present and future markets," Solstad said.The vessels are Sea Tiger, Normand Atlantic, Normand Borg, Normand Neptun, Sea Pollock, Far Strider and Far Sovereign and will be recycled at the Green Yard Feda and Green Yard Kleven shipyards in Norway."We are pleased that we finally can start green recycling of a major number of our oldest vessels.

Fleet Trimming Continues as Solstad Sells AHTS Sea Ocelot

Norwegian offshore vessel owner Solstad Offshore has sold another non-core vessel as part of its plan to trim its fleet and make it more competitive.It said Thursday it had sold the AHTS Sea Ocelot to an unnamed buyer. The 70 meters long vessel, built in 2007, was sold through Solstad's subsidiary Deep Sea Supply Labuan II."Delivery of the vessel to the new owner took place today September 9th, 2021. The sale of the vessel will result in an immaterial accounting effect for Q3 -2021," Solstad offshore said, without sharing the sale price.

Solstad Sells Sea Panther AHTS for Recycling

Norwegian offshore vessel operator Solstad Offshore said Friday it had sold its AHTS Sea Panther vessel for recycling.The vessel was sold through Solstad Offshore's subsidiary Solstad Rederi, and the delivery to the buyer took place today August 20th, 2021."The sale of the vessel will result in an immaterial accounting effect for Q3 -2021," Solstad Offshore said, without sharing the sale price."Solstad Offshore ASA is considering several vessels for green recycling as a part of our efforts to be in the forefront of sustainable and [environmentally] optimal operations.

Solstad Offshore Sells Platform Supply Vessel

Norwegian offshore vessel owner Solstad Offshore has sold another vessel. This time the platform supply vessel Far Spirit.The company said Tuesday the vessel had been sold by its subsidiary Farstad Marine to an undisclosed buyer."Delivery of the vessel to the new owner took place today June 22nd, 2021. The sale of the vessel will result in an immaterial accounting effect for Q2-2021," Solstad Offshore said, without revealing the sale price. The Far Spirit vessel, of the VS 470 Mk II design, was built in 2007 by Westcon Olen yard in Norway.Solstad Offshore last year said that, as part of its restructuring agreement, it was to "right-size" its fleet to make it more competitive…

White House Names Beaudreau as Deputy Interior Secretary

The White House on Wednesday nominated attorney Tommy Beaudreau, who oversaw energy development programs at the Interior department during the Obama administration, as the agency’s second in command.Beaudreau will return as deputy to Secretary Deb Haaland after serving nearly seven years there under former President Barack Obama, becoming the first person to lead the Bureau of Ocean Energy Management, which oversees offshore oil and gas activity.He later served as chief of staff…

Offshore Oil Wells, Ports Shut as Hurricane Sally Advances on U.S. Gulf

Energy companies, ports and refiners raced on Monday to shut down as Hurricane Sally grew stronger while lumbering toward the central U.S. Gulf Coast, the second significant hurricane to shutter oil and gas activity over the last month.The hurricane is disrupting oil imports and exports as the nation's sole offshore terminal, the Louisiana Offshore Oil Port (LOOP), stopped loading tanker ships on Sunday, while the port of New Orleans closed on Monday.The U.S. government said 21%…

Kirby Reports Q1 Loss, Withdraws 2020 Guidance

America's largest tank barge operator Kirby Corporation on Tuesday announced a net loss of $248.5 million for the first quarter, down from $44.3 million earnings for the same period last year. The company also withdrew its full year earnings guidance.The sharp deceline in energy prices and oil and gas activity negatively impacted the revenue and operating income of Kirby's distribution and services segment, leading the Houston-based company to implement workforce reductions, furloughs and reduced work schedules…

TGS, Quantico Join for AI Seismic Inversion

TGS and Quantico Energy Solutions announced a technology collaboration to leverage their respective offerings in seismic data, AI-based well logs, and artificial intelligence (AI)-based seismic inversion.TGS is a provider of multi-client geoscience and engineering data for exploration & production (E&P) companies. Quantico is a AI company focused on subsurface solutions for E&P companies.The joint solution addresses the critical challenges in earth modeling workflows; specifically, insufficient seismic and log data, lengthy time until results, and difficulties mapping advanced geomechanical and petrophysical attributes.TGS will leverage its industry leading data library of seismic and well log data in the key regions of oil and gas activity across the world.

East Anglia Expecting $77 Bln in Offshore Projects

Based on the latest forecasts, engery-sector specialists Nautilus Associates claim more than £59 billion ($77 billion) could be invested in new offshore energy and infrastructure projects between now and 2040 in the Lowestoft and Great Yarmouth Enterprise Zones.Johnathan Reynolds, director at Nautilus Associates, said, “We are seeing huge new investments in new offshore wind projects off the East Anglian coast, with an annual operational spend close to £1.3 billion per year by 2025. Offshore oil and gas activity is picking up following the most recent downturn, and decommissioning projects are now being contracted. It is an exciting time to be in the energy supply chain with so many opportunities for growth.”The Lowestoft and Great Yarmouth Enterprise Zones…