MOL and Gaz-System Sing Long-Term FSRU Charter for New Polish LNG Terminal

Mitsui O.S.K. Lines (MOL) has signed a long-term time charter party agreement for one floating storage and regasification unit (FSRU) with the Polish gas transmission system operator Gaz-System, which is the developer and operator behind the future LNG terminal.The FSRU will be constructed by HD Hyundai Heavy Industries shipyard and is expected to be completed in 2027. Thereafter, the FSRU will be managed by the MOL group.The FSRU is being built for the project that involves the…

US Releases Offshore Wind Liftoff Report and Promises Funding

The U.S. Department of Energy (DOE) has released its latest report in the Pathways to Commercial Liftoff series, describing how the U.S. offshore wind sector is adapting to challenges and poised for continued progress, with a path to deploying over 100 gigawatts (GW) by 2050.The Pathways to Commercial Liftoff: Offshore Wind report finds that the sector today is poised for liftoff, enabled by continued efforts to adapt to recent market challenges. The projects that move forward in the next several years will lay the foundation for consistent long-term deployment…

US Plans 12 Offshore Wind Auctions Over Five Years

President Joe Biden's administration unveiled plans on Wednesday to hold up to a dozen auctions of offshore wind development rights through 2028, including four before the end of this year.The schedule will help companies, states and others plan for projects that require massive amounts of investment and infrastructure, the Interior Department said in a statement."Our offshore wind leasing schedule will provide predictability to help developers and communities plan ahead and will…

U.S. Installed Offshore Wind Capacity Jumps in First Quarter

Installed offshore wind capacity in the U.S. grew to 242MW in the first quarter of the year from 42MW in the previous quarter, the Oceantic Network said in its report, showcasing a recovery in a previously volatile industry.The offshore wind industry is expected to play a major role in helping several states and, the Biden administration meet goals to decarbonize the power grid and combat climate change.The industry had a tough 2023 after developers wrote off billions of dollars in impairment charges due to high-interest rates…

USCG Seeks 18 Members for National Towing Safety Advisory Committee

The U.S. Coast Guard said it is seeking to fill 18 vacancies on the National Towing Safety Advisory Committee, which advises the Secretary of Homeland Security, via the Commandant of the U.S. Coast Guard on matters relating to shallow-draft inland navigation, coastal waterway navigation, and towing safety.The Coast Guard said it will consider applications for the following 18 vacancies:Seven members to represent the barge and towing industry, reflecting a regional geographic balance.One…

ABS Publishes Advisory on Methanol Bunkering

Classification society ABS has published what it says is the industry's first advisory on methanol bunkering as the cleaner-burning fuel continues to gain interest among shipowners seeking to reduce their environmental footprint.A key component of the methanol value chain and the overall scalability of the fuel will be the ability to bunker methanol, either by truck-to-ship, ship-to-ship or land storage tank/terminal-to-ship, ABS said.The new ABS Methanol Bunkering: Technical…

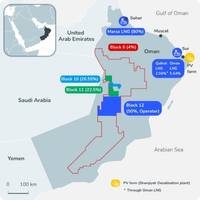

TotalEnergies, OQ Reach FID for Marsa LNG Project in Oman

French energy giant TotalEnergies and Oman National Oil Company (OQ) have reached the final investment decision (FID) on the Marsa LNG project, which will feature an LNG plant completely powered by renewable energy that will produce LNG for use as a marine fuel for maritime transportation.Through their joint company Marsa Liquefied Natural Gas (Marsa), TotalEnergies (80%) and OQ (20%) have launched the integrated Marsa LNG project which combines upstream gas production, downstream gas liquefaction…

New York Not Moving Forward With Three Offshore Wind Farms

New York State on Friday stalled three major offshore wind-energy projects after General Electric Vernova GE.N changed the turbine design, which the state said "materially altered" the plans.New York provisionally approved the projects in October 2023. They are Attentive Energy One being developed by TotalEnergies, Rise Light & Power and Corio Generation; Community Offshore Wind, which is backed by RWE and National Grid Ventures; and Vineyard Offshore's Excelsior Wind.But since then…

ABS and DOE Partner to Study Clean Energy and Maritime Decarbonization

ABS and U.S. Department of Energy (DOE) are to collaborate on clean energy development in the maritime domain and decarbonization of maritime operations after signing a new memorandum of understanding (MOU).The agreement between the DOE’s Office of Energy Efficiency and Renewable Energy (EERE) and ABS is designed to leverage experience and capabilities from both organizations to support emissions reduction initiatives that benefit the maritime industry.“This new agreement allows…

Houthis Conduct 'Operations' in Indian Ocean, Leader Says

The leader of Yemen's Iran-aligned Houthis, who have been attacking shipping in the Red Sea, said on Thursday the group had carried out "operations" in the Indian Ocean and towards southern Israel.Abdul Malik al-Houthi's comments made clear that the Houthis have acted on earlier threats to expand operations to the Indian Ocean region and attacks towards southern Israel.The Houthis have repeatedly launched attacks towards the southern Israeli port of Eilat in what they have described…

Marine News' 2024 US Shipbuilding Report

If nothing else, building vessels in the U.S. is a complicated business.In a session on the domestic shipbuilding marketplace, at Marine Money’s late-November 2023 conference held in New Orleans, Ben Bordelon, president and CEO of Bollinger Shipyards (with more than a dozen facilities, in Mississippi and Louisiana), described his company’s architecture as a “three-legged stool approach: commercial newbuilds, government newbuilds and repair/conversion capabilities”.On the same panel…

Norway's Myklebust Verft to Build World's Largest Hydrogen Ferries

Norwegian shipyard Myklebust Verft has been selected to build a pair of innovative hydrogen-powered passenger ferries ordered by Norwegian transport company Torghatten Nord.The design, produced by The Norwegian Ship Design Company for operations in the challenging waters of the Vestfjordstrekninga fjord in the Arctic Circle, received approval in principle (AIP) in August 2022 from Lloyd's Register, who has signed on to class the first-of-their-kind vessels.At 117 meters long with a 120-car capacity…

Akastor’s Subsidiary Wins $101M Case Against Seatrium's Jurong Shipyard

MHWirth, a subsidiary of Norwegian oil services investment firm Akastor, has received an arbitration award issued by a tribunal in a dispute with Seatrium’s subsidiary Jurong Shipyard over the termination of four drilling rig unit contracts.As part of the ruling, MHW has been awarded an amount of $101 million as payment of termination fees.In addition, MHW has been made eligible for the reimbursement of legal costs and certain suspension costs (totaling about $7 million), as well as interest.Although the drilling rig unit contracts are held by MHW…

Singapore Plans Big Build-up Of Methanol Bunker Supply

Singapore has the potential to supply over 1 million metric tons of low-carbon methanol annually by 2030 to meet rising demand for alternative bunker fuel, a Singapore minister said on Tuesday.Singapore's Maritime and Port Authority (MPA) late last year started seeking proposals from companies to supply methanol as a marine bunker fuel at Singapore from 2025."On aggregate, the submissions have the potential to supply over one million tonnes per annum of low-carbon methanol by 2030," said Amy Khor, a senior minister of state, at the Singapore Maritime Week conference on Tuesday.The submissions

Maritime Risk Symposium 2024 – Great Power Competition and Gray Zone Engagement

For 15 years the Maritime Risk Symposium (MRS), an annual three-day event, has brought together government and maritime industry leaders, port representatives, international and domestic researchers and solution providers to examine current and emerging threats to maritime security. World events highlight that maritime security is increasingly at risk during the current period of great-power competition and ongoing conflicts. The active competition between nations who are not…

US Sanctions Impacting Sovcomflot's Ability to Trade, CEO of Russian Tanker Group Says

U.S. sanctions are limiting tanker activity for Russia's top shipping group, Sovcomflot, the company's head said on Tuesday, as Washington tightens the screws on Moscow.The U.S. imposed sanctions on Sovcomflot on Feb. 23 as Washington seeks to reduce Russia's revenues from oil sales that it can use to support its military actions in Ukraine.Sanctions have impacted the company's operations, "limiting our geography and commercial prospects", Sovcomflot CEO Igor Tonkovidov told reporters.He added that as sanctions are a relatively new instrument to the shipping market…

Decarbonization is a Major Challenge for US Ports -Report

A large number of ports across the United States are making headway toward ambitious decarbonization targets, but many are running up against significant challenges that threaten their progress, according to a new report from classification society ABS and trade group the American Association of Port Authorities (AAPA).Financial constraints, low technology readiness and physical space limitations are among key obstacles identified the ABS and AAPA report, "Port Decarbonization Survey: Trends and Lessons Learned"…

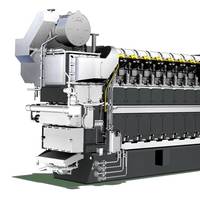

MAN Bags First Propulsion Order for Its Methanol-fueled MAN 21/31DF-M GenSet

MAN Energy Solutions reports it has received an order for three MAN 6L21/31DF-M (Dual Fuel-Methanol) GenSets capable of running on methanol in connection with the construction of a 7,990 dwt IMO Type II chemical bunker tanker.The dual-fuel engines will form part of a diesel-electric propulsion system on board the vessel with electrical motors driving twin fixed-pitch propellers via gearboxes; an onboard battery-storage system will optimize the use of the dual-fueled generators.

Siem Offshore Chairman Exits with Nine-vessel Purchase

Kristian Siem, founder and longtime leader of Siem Offshore, is stepping down as chairman of the Norwegian offshore support vessel (OSV) firm after reaching a deal to acquire nine vessels in exchange for his 35% stake in the company.The company announced it has reached an "amicable agreement" to sell Siem Barracuda, Siem Stingray, Siem Opal, Siem Pearl, Siem Topaz, Siem Pilot, Siem Pride, Siem Symphony and Siem Thiima to Kristian Siem's Siem Sustainable Energy S.a r.l and related companies in exchange for 35% of the company’s shares.The other major shareholder is Christen Sveaas' Kistefos…

Singapore Marine Biofuel Premiums Drop Further on Soft Demand

Spot marine biofuel premiums have weakened further at the world's largest bunker hub Singapore, weighed by slow demand, market sources said this week.Premiums for the flagship B24 marine biofuel blend recently traded between $120 to $130 a metric ton over 0.5% low sulphur fuel oil quotes, on a delivered Singapore basis, according to sources from bunker suppliers, trading firms and shipowners.The premiums extended declines from early first quarter when the product traded down to about $140 a ton…

Singapore Alliance Building Electric Tug and Supply Boat

The Coastal Sustainability Alliance (CSA), an industry collaborative effort led by Kuok Maritime Group (KMG), has announced the start of construction of its first fully electric PXO-series tug (e-tug) and supply boat (e-supply boat) by PaxOcean Group.The zero-emissions vessels are among the first and largest local electric harbour craft designed for operation in Singapore’s coastal waters. They are targeted for deployment in 2025, ahead of the nation’s goal for all new coastal…

New Order for MAN’s Ammonia Engine

Imabari Shipbuilding will install a MAN B&W 7S60ME-Ammonia engine with SCR in connection with the construction of a 200,000 dwt bulk carrier for a joint venture between K Line, NS United and Itochu Corporation.The business represents one of the first projects for MAN Energy Solutions’ ammonia-powered engine that is currently under development in Denmark. MITSUI E&S will build the engine in Japan.Bjarne Foldager – Country Manager, Denmark – MAN Energy Solutions, said: “The interest in this revolutionary engine had been overwhelming…

HMD's Ammonia-powered LPG Carrier Designs Earn DNV Approval

DNV has awarded HD Hyundai Mipo Dockyard an approval in principle (AIP) for the design of ammonia dual fuel 45,000 m3 liquefied petroleum gas (LPG) carriers.The presentation took place at the HD Hyundai Global R&D Center (GRC) in Seongnam, Korea. HD Hyundai Mipo (HMD), who have developed the basic ship design, provided detailed engine specifications and operational data from global engine maker, WinGD, and reviewed the safety and suitability of the design with DNV. The designs are based around a new 10…