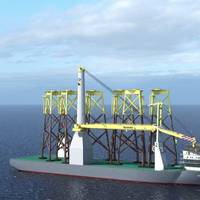

Drydocks World Completes Bokalift 2 Conversion

Dubai shipyard Drydocks World said it recently completed its latest conversion project for Dutch dredging and heavy lift company Boskalis.The former drillshipship, now a crane vessel named Bokalift 2, has been converted in preparation for carrying out a variety of offshore operations. Its maiden project will be the transport and installation of wind turbine foundations off the coast of Taiwan.The conversion scope included the fabrication and installation of 9,000 tons of steel blocks on both sides of the vessel to increase the stability of the vessel and the installation of a new work deck.

Drydocks World Starts Bokalift 2 Conversion for Boskalis

Dubai's Drydocks World shipyard has started construction of the offshore wind installation vessel for the Dutch company Boskalis.Drydocks World held a steel-cutting ceremony on Monday to mark the start of production on a conversion project for Boskalis B.V.The shipyard will convert the drillship YAN into an offshore installation vessel named Bokalift 2. The Bokalift 2 is designed to carry out a variety of offshore operations including the transport and installation of wind turbine…

NYK Secures Japan’s First ESG Loan

Japanese shipping major Nippon Yusen Kabushiki Kaisha (NYK) has entered into a 9 billion yen syndicated loan agreement in which the proceeds will be used solely for the purpose of funding environment-friendly projects."This is Japan’s first syndicated loan to be certified by Japan Credit Rating Agency (JCR) with its highest ranking of “Green 1,” thus demonstrating the loan to be aligned with the core components of the Green Loan Principles," said a press release from the global ocean transportation company.NYK’s medium-term management plan includes the group’s intent to integrate environmental, social, and governance (ESG) initiatives…

PensionDanmark, Danica Roll Out $300mln Maritime Investment Fund

PensionDanmark, Danica and Navigare Capital Partners have established the Maritime Investment Fund I, which, based on capital from the founders, shall build a diversified portfolio of maritime assets including dry bulk, container, offshore, product, crude oil and chemical tankers, to put on charter to operators. The fund will be managed by Navigare Capital Partners, which consists of partners with broad based shipping experience. ”The new investment fund will give institutional investors a possibility to invest in a broad portfolio of vessels. This is new and very positive for shipping in Denmark, “Blue Denmark”, says Henrik Ramskov…

Global Insurers Plot Cautious Course to Iran

* Caution remains over U.S. SYDNEY/LONDON, Jan 24 (Reuters) - Global insurance firms are circling Iran for business opportunities following the lifting of sanctions - and the first test of their appetite could come in March when some Iranian companies seek new cover. Insurers, the reinsurers that share their risk and the brokers that forge deals are exploring ways to tap a market worth $7.4 billion in premiums after a nuclear accord between world powers and Tehran led to the removal of restrictions on financial dealings with Iran this month. Allianz, Zurich Insurance, Hannover Re and RSA, for example, said in recent days that they would evaluate potential opportunities in the country.

Great Lakes Towing, Shipyard Announces Hiring Push

The Great Lakes Towing Company & Great Lakes Shipyard announced it is now hiring with 50 jobs currently available. The shipyard is now seeking candidates to fill a range of positions including naval architects, shipyard welders and pipe fitters, project managers and more. The Great Lakes Towing Company, owner and operator of a fleet of shipdocking tugboats on the U.S. Great Lakes-Saint Lawrence River Seaway, and Great Lakes Shipyard, a full-service ship repairs and construction operation on the Great Lakes, announced plans to hire 50 employees before the end of the first quarter of 2016 to support continued growth driven by client demand. "At The Towing Company, we’re looking for great people to join our team and grow with us,” said Joe Starck, the company’s president.

Belgian Law Firm Says Contacted by OW Bunker Investors

Belgian law firm Deminor said it had been contacted by 15 to 20 investment firms considering legal action over the failure of OW Bunker, the world's largest shipping firm which filed for bankruptcy a week ago. Deminor, which specialises in representing institutional investors in class actions against public listed companies, did not say on Friday which investors had contacted it and gave no further detail on possible actions over the company's collapse. OW Bunker, Denmark's the third-largest company by revenue, said on Nov.

Allianz Reports Strong 2Q 2014 Results

Allianz Group achieved strong results in the second quarter of 2014. Total quarterly revenues increased 10.0 percent to 29.46 (second quarter of 2013: 26.78) billion euros. Operating profit climbed 17.1 percent to 2.77 (2.37) billion euros. Net income attributable to shareholders amounted to 1.76 (1.59) billion euros, an increase of 10.5 percent. In the first half of the year, Allianz Group reported the highest total revenues in the company’s history. Total revenues rose 7.8 percent to 63.42 (58.82) billion euros. Operating profit climbed 6.4 percent to 5.49 (5.16) billion euros, while net income attributable to shareholders advanced 3.0 percent to 3.40 (3.30) billion euros in the first six months of the year.

Transpetro opens 342 positions for Merchant Marine officers

On Monday, February 7, 2011, Transpetro opened the selection process for the immediate admission of 342 officers of the Merchant Marine to man the vessels operating in its fleet. The period to register for the contest - which is free of charge - ends on April 4. The public notice and the registration form are available on the company's website (www.transpetro.com.br) or can be picked up at the addresses that are listed in the notice itself. To fill these 342 openings, Transpetro foresees for the registration of the 394 best qualified candidates. In total, 204 candidates will be registered for the position of 2nautical officer, of which 177 for immediate admission, and 190 candidates for the 2 engine officer, of which 165 for immediate admission.

Veson Welcomes Li, Elkin, Patel, Venkatesh

Veson Nautical, the US-based developer of software solutions for the commercial maritime community, announced the addition of four professionals to the company’s Boston headquarters office. Veson Nautical has hired Haorong Li as Director of Professional Services; Mikhail Elkin as Software Engineer; Suchit Patel as QA Engineer; and Brenna Venkatesh as Marketing and Events Associate. Haorong Li, Veson’s new Director of Professional Services, has more than 10 years of experience implementing enterprise software solutions for operations management, supply chain optimization, planning, scheduling and logistics. His combination of hands-on…

Pipavav Shipyard in Talks to Set Up Diesel Engines Factory

India’s newest private shipbuilding firm,Pipavav Shipyard Ltd, is the latest in a growing list of firms looking to enter the business of making diesel ship engines in an attempt to meet growing demand for these in India and in other parts of the world, and is talking to two multinational firms for a partnership. Last week, Pipavav Shipyard started work on the first four of 26 Panamax bulk carriers that have been ordered by Norwegian, French and Greek fleetowners for a total of $1.1 billion (Rs4,360 crore). The contract makes Pipavav the world’s second biggest Panamax size shipbuilder by order size after Japan’s dry bulk cargo shipbuilding specialist Oshima Shipbuilding Co. Ltd.

CENTRE GROUP, TUFTON OCEANIC STRUCTURE HIGH-YIELD CDO

Shipping Bond Fund Ltd. A member of the Centre Group and TuftonOceanic have completed what is believed to be the first collateralized debt obligation (CDO) comprised entirely of high-yield shipping bonds. The $50 million CDO, Shipping Bond Fund Ltd., is unique due to its size and the fact that it selected assets solely from a select group of shipping industry bonds with high asset coverage ratios. Centre looks for opportunities to work with experienced partners to structure and provide capacity to CDOs and other asset-backed structured finance transactions through the application of non-traditional insurance and reinsurance products.

Commission Seeks Information From UK on Regulation and Supervision of Lloyd's

The European Commission has decided to request the UK to provide additional information concerning the regulation and supervision of the Lloyd's insurance market. The request is the first stage of the infringement procedure under Article 226 of the EC Treaty. Based on the information currently available, the Commission has concerns about the supervision and regulation of Lloyd's with respect to the requirements of the first non-life insurance Directive (73/239/EEC). The Commission is examining the compatibility of the current regulatory and supervisory arrangements for Lloyd's, and on the basis of the information received from the UK, the Commission will decide whether or not it considers there is a violation of Community law.

Avondale Workers Approve Agreement

Avondale Shipbuilding employees voted to approve the terms of their first union contract with Litton Industries. The company's 1,500 Metal Trades -represented workers approved the agreement by a four-to-one margin. The 45-month agreement, negotiated by the New Orleans Metal Trades Council, provides an immediate three percent wage hike in January as part of an overall nine percent wage hike paid in three increments. Also in the area of wages, the contract sets up a formal skill progression system that will move the majority of employees into higher-paid categories after working 500 hours in any lower classification. Wages under the agreement range from $8.25/hour for semi-skilled new hires to $16/hour at the top of the highest skill level.

Golden Ocean Resells Six Bulk Carriers

A multinational shipping firm that has signed a deal to have its ships built at an Indian shipyard, which is still under construction, has already sold the ships, an indication of growing demand for ocean-going vessels. This is the first time such a thing is happening at an Indian shipyard. The yard, Pipavav Shipyard Ltd, is under construction and will not start building ships before February 2008. On 19 March, the Bermuda-based Golden Ocean Group Ltd.—the dry bulk cargo ship operating firm controlled by Norwegian shipping tycoon John Fredriksen—had placed orders with Pipavav Shipyard to build four Panamax bulk carriers, each with a cargo carrying capacity of 75,000 tonnes. The agreed price of each vessel was $35.5m. The company also placed an "optional" order for two more Panamax vessels.

Share Offer Will Fund Shipping Expansion

China State Shipbuilding Co. said it has completed a private offer of $1.6b worth of new shares to strategic investors to fund expansion. The company sold 400 million new shares to eight investors including its state-owned parent at $3.99 a piece, less than one-eighth of its current share price, according to a filing to the Shanghai Stock Exchange. The share placement was initially announced in January by Hudong Heavy Machinery Co, which in August changed its name to China State Shipbuilding. In January, its shares were quoted around $3.99. But the stock has since rocketed, becoming the most expensive on the mainland market, amid fund buying and an injection of assets by its parent. The company has said it will acquire more assets from its parent.

Art Anderson Associates Receives AWB Award

The Association of Washington Business (AWB) recently presented Art Anderson Associates with one of fifteen Better Workplace Awards, given to Washington businesses who demonstrate innovation in the areas of workplace safety, job training and advancement and benefit and compensation packages. The award was presented by Governor Christine Gregoire and AWB President Don Brunell at the Association’s 2007 Legislative Day, held on February 7th, 2007. The award was given specifically to recognize Art Anderson Associates for its benefits and compensation package. In order to help employees make better health care decisions, the company recently changed its health care plan to one that features a Health Savings Account combined with a high-deductible health plan.

Hudong to Invest in Shipyards and Tech

Hudong Heavy Machinery Co., said that it will use proceeds to fund its purchase of shipyards and to invest in new technologies. With the proceeds, Hudong will buy 100% of Shanghai Waigaoqiao Shipbuilding Co. and CSSC Chengxi Shipyards and 54% of Guangzhou Wenchong Shipyard. It will also invest in technology upgrades. The company, which is the biggest maker of diesel engines for ships in China, will sell up to 400 million A-shares at RMB 30 per share in exchange for RMB 9 billion in assets and RMB 3 billion in cash, it said in a statement to the Shanghai Stock Exchange Monday. Hudong’s controlling shareholder, China State Shipbuilding Corp., will buy 59% of the share issue. The other buyers include Baosteel Group Corp., China Life Insurance Co., Shanghai Electric Group Corp.

Spirit Energy Partners To Acquire Assets of Tana Oil and Gas

Unocal Corporation's Spirit Energy 76 unit announced its Spirit Energy Partners, L.P., affiliate has agreed to acquire substantially all the Gulf of Mexico shelf assets of Tana Oil and Gas Corporation. The Tana acquisition includes interests in 12 proven properties and nine offshore platforms. The purchase price was not disclosed. Tana has an estimated net risked resource potential of more than 18 million barrels of oil equivalent (MMBOE), including more than 10 MMBOE in proved reserves. Estimated average annual production for 2000 is more than 10,000 BOE per day. "The acquisition of the Tana assets will provide the opportunity to enhance Spirit Energy's position in areas where we already possess a strong foothold and enjoy highly profitable operations," said John T.

Mitsui Marine, Sumitomo To Merge

Sumitomo Marine & Fire Insurance and Mitsui Marine & Fire Insurance have agreed to merge by April 1, 2002, in a move that would create Japan's largest non-life insurer. With combined assets of $51.7 billion, the merged company would outstrip current industry leader Tokio Marine & Fire Insurance, whose assets stand at $48.5 billion. Mitsui Marine is Japan's third largest non-life insurer, and Sumitomo Marine the fourth biggest. Analysts say the merger is set to accelerate consolidation in the sector, where competition is intensifying due mainly to the deregulation of insurance premiums in July 1998. Sumitomo Marine and Mitsui Marine said they will unveil a detailed merger plan in March. Both companies had said two weeks ago that they were in talks on forming an alliance.

Port of NY/NJ Sets Record, Announces Security Initiatives

International cargo volumes in the Port of New York and New Jersey hit record levels in 2005, New Jersey Governor Jon S. Corzine, Port Authority Chairman Anthony R. Coscia and Port Authority Vice Chairman Charles A. Gargano said today as they revealed new port security initiatives, including a public-private task force and a demonstration of technology to enhance security at the East Coast’s largest seaport. Containerized cargo volumes in the Port of New York and New Jersey rose 7.6 percent in 2005 to a new record high, continuing to exceed the authority’s projected cargo growth levels. The dollar value of all cargo moving through the port exceeded $132 billion for the first time, up 15.6 percent from 2004.