MSI: Dry Bulk Trade Volumes Positive but Prospects Hold Downside Risks

According to Maritime Strategies International, the unwinding of supply chain inefficiencies and rising vessel orders are expected to dampen positive deadweight demand in the dry bulk market.COVID-related supply chain inefficiencies and associated port congestion have almost fully unwound, and while the MSI outlook on the prospects for trade volumes this year is considered positive, growth in actual dwt demand is limited to only 0.25% year on year.MSI’s Q3 Dry Bulk market report notes that while this quarter’s demand forecasts for 2023 are higher by 1m dwt…

Positive Volumes for Dry Bulk Trade, but Prospects Set to Dampen

The unwinding of supply chain inefficiencies and rising vessel orders are set to dampen positive deadweight demand in the dry bulk market, according to Maritime Strategies International (MSI).COVID-related supply chain inefficiencies and associated port congestion have almost fully unwound and while the MSI outlook on the prospects for trade volumes this year is considered positive, growth in actual dwt demand is limited to only 0.25% year on year.MSI’s Q3 Dry Bulk market report notes that while this quarter’s demand forecasts for 2023 is higher by one million dwt…

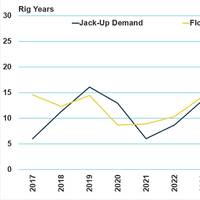

West Africa Market Harbors Positive Potential for MODU Operators

The region could be a key growth market for the oil and gas industry going forward, writes Joshua Belo-Osagie, Maritime Strategies International (MSI).Improving sentiment surrounds energy market prospects offshore West Africa, the positive mood underpinned by higher oil prices, reformed regulatory frameworks in key markets including Angola and Nigeria and the discovery of major prospects off the Ivory Coast and Namibia.In addition, the implications of Russia’s invasion of Ukraine have only reinforced some of these pre-existing dynamics…

MARKETS: Cruise Woes Continue, Full Recovery Unlikely before 2023 says MSI

MSI analysis finds ‘big three’ cruise companies could have less than 50% of capacity back in service by year end but a recovery to pre-pandemic levels is unlikely before 2023A new report from MSI says that a restart to full operations can’t come soon enough for cruise lines, whose financial position has become increasingly precarious given high debt levels incurred from fleet expansions and the fundraising required to survive the COVID crisis.The latest cruise market report from Maritime Strategies International (MSI) finds that net revenue losses for the ‘big three’ lines (Carnival…

Inside Cruise Shipping's Fight for Survival

In early 2021, the somber news from the cruise sector continued. For some cruise brands, their own version of “lockdowns” will have spanned an entire year. By late January, 2021, Carnival and others were hesitantly pegging their restarts for April/May 2021, and for some markets, late summer, under a Conditional Sail Order promulgated late last year by the Centers for Disease Control and Prevention (CDC).What else to do but look ahead?In preliminary earnings guidance, Carnival Corporation (NYSE: CCL)…

Uncertainty Weighs on Tanker Markets -MSI

Increasing port delays in Asia, U.S. and Europe will provide only limited support and MSI predicts rates will fall further in Q3.After three months of OPEC+ production cuts, tanker markets are feeling the pressure with both crude and products sector earnings moving lower in July according to Maritime Strategies International.Back in May MSI forecast quarterly average Aframax one year time charter rates to fall from $32,400/day to $21,600/day at a time when spot markets were seeing record levels.

Bottlenecks and Inefficiencies Are Key Upside Risks for Dry Bulk Market -MSI

Port days and diverted voyages are having an unusually strong impact on market balances and will play a key role in the short term outlook.Summer may be drawing to close in the northern hemisphere but for dry bulk shipowners, the positive tone could continue into early autumn as port delays and diversions provide continued upside, says Maritime Strategies International.July was another positive month for the dry bulk sector, with average monthly spot rates rising to their highest level this year for all benchmark vessels…

Containership Markets Plot Uncertain Course to Recovery -MSI

New HORIZON Monthly report shows freight rates remain high, blanked sailings have hit charter markets and coming quarters continue to hold riskContainership markets are exhibiting contradictory signals as the global economy continues its tentative emergence from lockdown. In the first of its new HORIZON Monthly reports, Maritime Strategies International (MSI) analyzes the forces at play in freight and charter markets as well as the impact of global policy on demand.On nearly all trade lanes…

Trends and Projections for Future Fuels and Decarbonization

ABS has published the latest trends and projections on carbon-reduction strategies for shipping as the industry looks to meet decarbonization ambitions.Setting the Course to Low Carbon Shipping examines new fuels, technologies and operational measures and matches that with forecasts for the world’s key trade lanes to envision what shipping may look like in 2030 and 2050.The second of two ‘Outlook’ documents – the first was published in June 2019 – it applies what ABS currently…

COVID-19 Cuts a Swath Through Containership Charter Earnings -MSI

While the implications of COVID-19 for containership demand and freight rates are directionally clear, the time charter market often marches to its own drum.The latest Container Shipping Forecaster from Maritime Strategies International analyzes the impact of the pandemic on time charter markets in the light of reduced demand and falling fright rates.Containership time charter rates have broadly retreated in recent weeks, and since the start of 2020 the majority of benchmarks have seen earnings retreat by 10-15% - hardly a historic correction.

Could Coronavirus Disruption Offer an Opportunity for China Shipyards?

A decline in the rate of infections in China provides yards with the opportunity to reorganize their delivery schedules to address an approaching output slump, says Maritime Strategies International (MSI)The welcome news of declining rates of coronavirus infections in China, together with steps already in place and still to come in terms of government intervention, provide the barest glimmer of good news in the dry bulk market.But the impact on dry bulk shipping has gone much further than demand…

MSI Unveils Digital Platform

UK-based shipping consultant Maritime Strategies International (MSI) has unveiled MSI HORIZON, a new digital platform which enables clients to access the consultancy’s proprietary macro and shipping market models and asset valuations data via a single interface.According to a release, the creation of an integrated data platform means MSI clients can quickly and easily run market simulations and see the results across multiple shipping sectors.This includes creating their own forward outlook on valuations and earnings scenarios by adjusting inputs such as GDP growth and vessel supply and demand. This will indicate the impact on newbuilding and second-hand values…

NorShipping 2019: A “Koselig” Event

"Koselig" is a Norwegian adjective used to describe situations that give a feeling of comfort, warmth, and relaxation. The NorShipping exhibition and conference, one of the largest in northern Europe, could definitely be described as koselig. Occurring in Oslo, Norway between June 4-7, 2019, the conference featured close to 1,000 exhibitors from around the world. With the prominently featured Blue Economy Hall, terms such as marine sustainability and environmental ocean awareness held the center stage at a number of the events. In true Norwegian fashion, most of the major press announcements were delivered in semi-intimate gathers with copious amounts coffee by maritime CEOs and VPs who enjoyed being called by their first names.

Scrubber-fitted Dry Bulk Vessels to Command Premiums -MSI

A two-tier market will reward early adopters with higher timecharter rates and asset values as cost of low sulphur fuel increases dramatically, says research and consultancy firm Maritime Strategies International (MSI).According to MSI, scrubber-fitted dry bulk vessels could be earning a significant premium over those burning more expensive low sulphur fuel and higher asset values will reward those owners that fitted the technology early.In an article ‘Scrubbing Up: the impact…

EU Must Speed Up Approvals of Asian Shipbeaking Yards

The European Union should step up its assessment of Asian shipbreaking yards to allow the effective implementation of the Hong Kong Convention, said Maritime Strategies International (MSI).In its MSI Foresight, the independent research and consultancy firm noted that by December 31 2018, all vessels flying the flag of an EU member state (around 12% of the current global merchant fleet) will need to comply with the EU Ship Recycling Regulation (SRR); the rule that brought the Hong Kong Convention into EU law.From 2019 onwards, any end-of-life, EU-flagged vessel will need to be scrapped at an approved ship recycling facility, a list which the EU last updated in May.

Dry Bulk Market Looks Up: J. Lauritzen

Both the dry bulk market and the market for small gas carriers are anticipated to benefit from the expected rise in economic activity in 2018, more so as supply growth will be rather limited in both segments, says J. Lauritzen, the Danish shipping company with worldwide operations. For dry bulk though, slow steaming and congestion are at levels where capacity releases could dent the rise. After strong rises in dry bulk rates in 2017, the outlook for 2018 is for continuation of this trend, but at a lower rate of change. Tonnage prices are forecast to continue increasing. The market for gas carriers is in general expected to be weak for most segments due to sustained demand-supply imbalances.

Are South Korean Shipbuilders Back from the Abyss?

Sparks light up the night-shift at giant shipyards on Korea’s southeast coast, as welders and fitters at some of the world’s biggest marine engineers forge next-generation container ships, oil rigs and even ice-breaking tankers in a bid to clamber out of a global industry abyss. Sunk by drastic cuts in orders from customers hit by the 2008 financial crisis, South Korea’s shipping landscape has been littered with bankruptcies and billion-dollar losses. But some, like Busan’s DSME, are adding innovation to craftsmanship to tap new demand for nimbler ships and offshore energy platforms.

Shifting Oil Market Dynamics Key to Tanker Trade Prospects -MSI

The Q3 2017 tanker market is proving vexatious for owners still struggling with the effects of fleet oversupply. But in its latest monthly forecast, Maritime Strategies International (MSI) observes that changing trade patterns could help stabilize the market toward year-end and into 2018. With all-OPEC crude exports setting record highs in July, the cartel’s attempts at lowering production are clearly open to question. There was a reduction in flows from OPEC’s Gulf producers while China’s imports tumbled to seven-month lows in July.

MPC Rolls Out New Box Ship Investment Firm

MPC Capital AG, an international asset and investment manager, has initiated an investment company with a focus on small-size container ships between 1,000 and 3,000 TEU. The newly formed 'MPC Container Ships AS' raised USD 100 million in equity in a private placement towards international institutional investors and family offices in the Norwegian capital market. Following its corporate investment strategy, MPC Capital is a co-investor. Based on the current pipeline exceeding 100 vessels, capital proceeds are expected to be fully deployed within 2017. An initial fleet of attractive assets has already been secured. Among other partners, MPC Capital's subsidiaries, Ahrenkiel Steamship and Contchart, are offering technical and commercial management services to the fleet.

MSI: OPEC’s cut is deepest for VLCC, Suezmax markets

Maritime Strategies International (MSI), a leading independent research and consultancy has forecast a testing time for the crude tanker market over the next six months – and perhaps longer if OPEC is successful in extending production cuts beyond the first half of 2017. In its latest Tanker Freight Forecaster* MSI notes that the VLCC and Suezmax markets moved unequivocally downwards in January, with spot rates sliding rapidly from a seasonally strong December. Pressure has persisted in these sectors in February leaving the crude tanker spot market under increasing strain. More mixed dynamics and volatile conditions characterised the Aframax and product tanker sectors in January…

Dry Bulk: Less Pain, Not Much Gain

The dry bulk market’s strong end to 2016 is unlikely to last long into 2017, according to the latest research from Maritime Strategies International. In its latest quarterly dry bulk market report*, MSI predicts a depressed year for rates in 2017, a year marked by multiple risks to recovery. Stronger freight markets in Q4 2016 had been broadly expected by MSI, albeit for slightly different reasons. While iron ore trade undershot its expectations, coal trade overshot them with geographical imbalances playing a key role.

‘Frothy’ Capesize Sector Threatens New Year Hangover for Dry Bulk

Maritime Strategies International (MSI) is forecasting a firm festive season for the dry bulk market, swiftly followed by a New Year comedown. In its latest Dry Bulk Freight Forecaster* MSI notes that after a steady fall in average daily TCE spot earnings in October, November saw an inflection point for Capesizes, with rates soaring to over $16,000/day, the highest since mid-2015. Some of this strength has translated to the Panamax market, although Supramax and Handysize earnings have been broadly unaffected.

Shipping Recovery Faces Supply/Demand Challenges

The shipping industry faces a stormy road to recovery, with uneven supply/demand trends set to test the nerve of investors and operators, according to independent research and consultancy firm Maritime Strategies International (MSI). Addressing the Hansa Forum in Hamburg, Germany this week, MSI Senior Analyst James Frew warned that the industry will continue to face multiple challenges to a sustained recovery despite positive demand fundamentals. “The commodity shipping sectors…