Tanker Markets Stay Bearish through '22, says McQuilling Report

Spot market earnings for VLCCs will average $2,500/day in 2022 on a non-eco, no scrubber basis (US $11,000/day for ECO-designs, without scrubbers), while the peak year for VLCC spot market earnings have been pushed out to 2025, amid substantial supply-side support. This was a key finding in McQuilling Services 25th Annual Tanker Market Outlook: 2022-2026 Tanker Market Outlook. While conditions are tight for the big ships, Suezmaxes and Aframaxes sectors are projected to return healthier levels in 2022…

Exxon, Trafigura Tap Lower Freight Rates

U.S. crude exports to Asia, which have slumped due to record freight costs, stirred on Thursday as rates slid and the premium in Asia for Russia's ESPO Blend oil sent buyers back to U.S. grades, according to market sources.Oil shipping costs for United States Gulf Coast to Asia cooled this week from record highs on the prospect of more vessels becoming available. Nearly 300 oil tankers globally were placed off limits due to U.S. sanctions on Iran and Venezuela.Seventeen supertankers returned to service in October after being sidelined for overhauls, as 11 entered drydocks.

Oxy Books Supertanker for a Record $13.25 Mln

Occidental Petroleum Corp provisionally chartered a supertanker to ship U.S. crude to South Korea for a new record of $13.25 million in November, three shipping sources familiar with the matter said on Monday.The Very Large Crude Carrier (VLCC) Maran Andromeda was chartered by Occidental on Friday for an estimated November 20 departure, according to one shipbroker and Refinitiv Eikon shipping data.Global shipping rates, and in particular U.S. Gulf Coast to Asia, have skyrocketed after the United States in late September imposed sanctions on two units of China's COSCO, alleging involvement in ferrying crude out of Iran.U.S. Gulf Coast exporters have held back on chartering COSCO-linked vessels and scrambled to replace those already on charter over the past two weeks…

Occidental Tentatively Fixes VLCC for Record $13.25 mln to Asia

Occidental Petroleum Corp provisionally chartered a supertanker to ship U.S. crude to South Korea for a new record of $13.25 million in November, three shipping sources familiar with the matter said on Monday.The Very Large Crude Carrier (VLCC) Maran Andromeda was chartered by Occidental on Friday for an estimated Nov. 20 departure, according to one shipbroker and Refinitiv Eikon shipping data.Global shipping rates, and in particular U.S. Gulf Coast to Asia <TD-LPP-SIN>, have skyrocketed after the United States in late September imposed sanctions on two units of China's COSCO, alleging involvement in ferrying crude out of Iran.U.S. Gulf Coast exporters have held back on chartering COSCO-linked vessels and scrambled to replace those already on charter over the past two weeks…

McQuilling Mid-Year Tanker Market Outlook

McQuilling Services Announces the Release of the 2019 Mid-Year Tanker Market Outlook Update.The Mid-Year Tanker Market Outlook Update provides an outlook on the global tanker market in the context of global economic growth and oil fundamentals influencing tanker demand and vessel supply. The outlook includes a view on future asset values, time charter rates, market freight rates and TCE revenues for 24 major tanker trades and four triangulated routes across eight vessel segments for the second half of 2019 through the remaining four years of the forecast period 2019-2023.

Progress in Brazil Repair Yard Project

The Brasil Basin Drydock Company (BBDC), a joint venture of McQuilling Services and Promon Engenharia, is setting up an industrial facility that will drydock and repair seagoing merchant vessels up to the largest merchant ships in the world.McQuilling announced the signing of a Protocol of Intention with the government of the state of Paraíba, Brazil, along with Chinese ship repair yard IMC YY.David Saginaw, Commercial Director for McQuilling Services, signed the Protocol on behalf shareholders of the Brasil Basin Drydock Company (BBDC). Governor João Azevedo signed on behalf of the government and Chen Yong, President of IMC YY ship repair yard in Zhoushan, China, signed on behalf of the yard.

New Ship Repair Yard Coming to Brazil

The total volume of cargo tranported by sea in Brazil from January to September 2017 was pegged at 800 million tons, according to a survey by the National Agency of Waterway Transportation (Antaq). A large number of oceangoing and cabotage ships are needed to move such a volme and many of these ships will need repairs of various kinds. Having identified a positive demand for international standard ship repair facilities in the South Atlantic basin, McQuilling Services, headquartered in New York, will be leading a project to invest nearly a billion in Lucena, on the coast of the northeast state of Paraíba, for the installation of the Brazil Basin Drydock Company (BBDC) repair yard projects.

Tanker Outlook: McQuilling Publishes 2018-2022 Report

In 2017, global ton-mile demand to transport crude and residual fuels increased by 5.4 percent, supported by a 4.9 percent increase in VLCCs (which accounted for 62 percent of the total demand for dirty tankers), according to McQuilling Services’ 2018-2022 Tanker Market Outlook report. Suezmax demand meanwhile accounted for 24 percent of all DPP demand in 2017, 1 percent higher than 2016 due to higher crude exports from the Southern Europe and North Africa load region towards the Asian refinery complex.

Asia Tankers-VLCC Rates to Remain Low on Tonnage Glut

Around 90 ships charter free for early September loading. Freight rates for very large crude carriers (VLCCs) on Asian routes will remain under pressure for at least the next month, facing strong headwinds from a glut of tonnage, brokers said. "There are around 80 to 90 ships available for charter in the first 10 days in September - that's about three ships for every cargo," a Singapore-based supertanker broker said on Friday. "There are about six or seven VLCCs free for charter now, but the earliest they'll see any cargo is early September," he said. That came as owners were attempting to resist moves by Chinese oil trading house Unipec to push rates lower on its latest charter.

2017-2021 Tanker Market Outlook: McQuilling

McQuilling Services has released its 20th Anniversary Edition 2017-2021 Tanker Market Outlook. This 200-page report provides a five-year spot and time charter equivalent (TCE) outlook for eight vessel classes across 19 benchmark tanker trades, plus two triangulated trades. Also included in the report is a robust five-year asset price outlook as well as a one and three-year time charter forecast through 2021. With 20 years of tanker rate forecasting expertise, McQuilling Services is a leader in the industry and continues to support a variety of stakeholders in the energy, maritime and financial services industries with its annual Tanker Market Outlook.

McQuilling Releases 2016-20 Tanker Outlook

McQuilling Services has announced the release of the 2016-2020 Tanker Market Outlook. This report is a five-year outlook for eight vessel classes across 18 benchmark trades and represents the company’s 19th forecasting cycle. After over 10 years of tanker rate forecasting, McQuilling Services is a leader in the industry and continues to support a variety of stakeholders in the energy, maritime and financial services industries with its annual Tanker Market Outlook. Our full-year 2015 projection from last year’s Tanker Market Outlook tracked within 5% of actual market levels on the 15 trades forecasted. For the nine DPP trades, the original forecasts ended the year within 3% of recorded levels, while the six CPP trades ended within 7%.

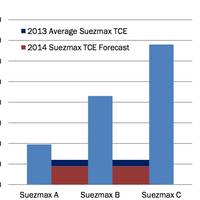

Suezmax Tankers Bullish

Global fixture activity for suezmax crude tankers rose in the first quarter by 5% year on year, with most of the activity coming out of West Africa. Suezmax fixtures out of the Caribbean rose by 48%, most of which headed to the US Gulf and East coast Panama. During the first quarter 2015, there was a 45% rise in suezmax fixtures from the Middle East Gulf (MEG) to West Coast India, compared to the same period last year, according to new research from New York-based marine transportation consultancy McQuilling Services. India is easing its dependence on traditional crude markets, much as China is doing. McQuilling recorded two fixtures from south Brazil to West Coast India during the period. Fixtures loading in the Caribbean also increased by 48% during the same period.

Rebalancing Trade Flows

Many types of crude oil are produced around the world. Depending on the requirements of a particular refinery, a blend of heavy and light crudes is processed to manufacture a variety of petroleum products. After peaking at 9.6 million b/d in 1970, US crude oil production steadily declined until reaching a low of 4.94 million b/d in 2008. From 1970 to 2008, US crude oil imports increased sharply to bridge the gap of decreasing domestic supply and increasing demand. In response to declining North American production and anticipation of rising heavy grade imports from the Caribbean, Latin America and Saudi Arabia, many US refineries were reconfigured to process a heavy crude slate in the 1990’s.

Larger Tankers May Offer Better Return Chances

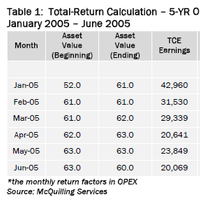

Investors looking for returns in the tanker markets can invest their capital in a variety of ways. Should an owner invest in a VLCC or an Aframax? How about an LR2 or an MR2? What is the historical rate of return for these tankers? Which tanker class is the riskiest? These questions face owners and investors in each investment decision. To compare the different tanker classes on a total-return basis, McQuilling Services has developed a return-on-shipping index that calculates…

Ebola & the Shipping Industry: Latest McQuilling Analysis

Although the Ebola epidemic has remained predominantly in West Africa, fears about the virus have spread globally and it is becoming a cause for concern in the transportation industry. From air to sea, companies are beginning to take precautionary measures including suspending flights to various airports in West Africa and refusing to call at specific West African ports reports Marine Transport Advisors, McQuilling Services, in a 'Tanker Industry Note'. In what’s being described as the largest and deadliest outbreak in history to hit West Africa, the current Ebola epidemic has claimed the lives of roughly 2,400 people as of mid-September, according to estimates from the World Health Organization (WHO).

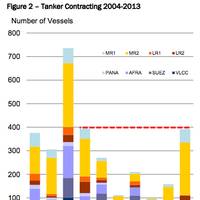

Product Tankship Demand & Overcapacity: An Industry Note

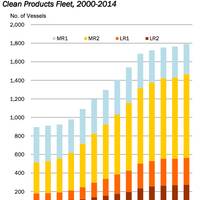

Concern about oversupply only occurs when there are too many ships relative to demand, and in a recent 'Industry Note', McQuilling Services attempts to quantify the situation. Much has been said about the product tanker market recently, mainly about tonnage supply. More industry voices are speaking about their concern of over-ordering and too many ships. However, the number of vessels on order and planned for delivery is really only half the story. As long as there is enough demand, any number of ships on order may be acceptable. Concern about oversupply only occurs when there are too many ships relative to demand. In this note we look at product tanker demand to try to quantify the other half of the story.

Stefanos Kazantzis speaks about VLCC Asset Market Contango

Stefanos Kazantzis, Financial Advisor of McQuilling Services Marine in an interveiw discusses the recent upswing in VLCC asset prices and current developments in the asset markets. Asset Contango is a situation where the future price of an asset is trading at a higher level than the spot price. We can see this in commodities viz oil represented by the future contracts. Coming back more specifically to the VLCC asset market we view new building as future assets price and secondhand tonnage represents the current asset environment. Back in October 2013 we saw prices for new buildings on VLCC prices at $ 87 million and at the same time the prices for five year old vessels were well above $ 57 million.

McQuilling Services Industry's Spot Market Review for First Quarter

There’s no denying that the wave owners rode into 2014 on was a welcome way to start the new year (at least from their perspective). Earnings in the large crude tanker segment reached levels that hadn’t been obtained in three years and in the smaller dirty segment, in five or more years. But, with all things in life, “what goes up must come down,” a famous quote by physicist and mathematician Sir Isaac Newton, that quickly became the mantra for the first quarter of 2014. The prevailing factor behind the downturn in the crude tanker market was an overall decline in activity. Ultimately, this led to an increased oversupply situation, specifically in the VLCC segment.

MR Tankship Market Analysis: Second-Hand Price-Rise Outstrips Newbuild

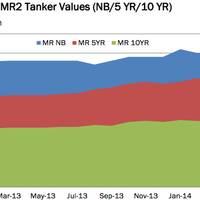

In their latest analysis, shipbrokers & marine transport consultants, McQuilling Services, in their latest analysis discuss observations, current and historical, for the clean tanker market, specifically MR tankers. The report concludes that they believe the current MR secondhand asset market will adjust to reflect the weak TCE (Time Charter Equivalent) environment over the longer term. " In Figure 1 [shown here] we display the price movements over the last 15 months for MR2 newbuildings, five-year and 10-year old vessels.

Tankship Market Analysts Say Timing Essential for Success

Marine transport advisors McQuilling Services explain in a tanker industry note that timing is everything in a volatile tanker market. McQuilling explain that on the outset, one might not directly see a similarity between Valentine’s Day and the tanker market; however, both can sometimes require serendipitous timing in order for desired outcomes to transpire. Furthermore, just like the dating world, the tanker market is full of volatility. Industry participants have been reminded…

Tanker Market 2014 Foundations Shaky Say Analysts

Looking at the global economy, although markets seemingly having a hard time digesting recent moves by the US Fed to scale back its bond purchasing program, a recovery appears to be on the horizon. One notable difference when compared to recent years has been that OECD economies, in particular the US, comprises a larger contribution to this development. This has been spurred by reduced energy costs on the back of the US oil boom which has been helping to reign in the unemployment level.

Tankship Ocean Transportation Demand: Forecasting Essentials

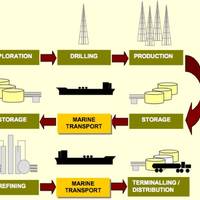

Marine transport advisors, McQuilling Services, give an insight into how they forecast the development of tanker demand, which is a constituent part of their recently published '2014-2018 Tanker Market Outlook' report. At a global level, marine transportation demand is related to world trade, which is directly related to the state of the world economy. This means that demand for crude oil and petroleum products grows with an expanding global economy. Marine transportation demand for tankers is a derived demand. It arises from the energy consumption requirements of regional economies.

Tankship Asset Price Forecasting Mysteries Explained

Marine transport advisors, McQuilling Services recently released its 2014-2018 Tanker Market Outlook that forecasts spot freight rates across eight tanker classes and 13 major trading routes. This year’s edition also includes a forecast of asset prices over the same period for newbuilding, 5-year old and 10-year old tankers in these eight tanker classes. "This note discusses an important element of McQuilling’s forecasting process – the development of tanker supply. Tonnage supply…