Trafigura, Mercuria Switch Bunkering to Mauritius Amid Attacks

With more ships heading around the Cape of Good Hope due to attacks in the Red Sea region and a shutdown in their main South African bunkering operations, Mercuria and Trafigura have started refuelling services in Mauritius, four sources said.The two trading houses have opened operations in Port Louis to compensate for the shutdown at South Africa's Algoa Bay which stems from a tax dispute with authorities, sources familiar with the matter told Reuters.Algoa Bay is South Africa's…

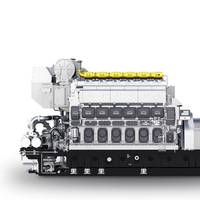

Gensets: New Fuels but Perennial Goals

Fuel flexibility may be a key driver for recent developments in gensets, but the perennial goals of lowering CapEx and OpEx remain.Fuel flexibility is one of the pillars of decarbonization that is being embraced by genset OEMs. Fuel efficiency, a second pillar, goes hand in hand with that because new fuels will be more expensive, but these concerns come in addition to the on-going drive to reduce CapEx and OpEx for shipowners.MAN Energy Solutions introduced its auxiliary MAN 35/44DF CD engine in June 2023. It is designed to be future-proof and will be ready for methanol operation by 2026.

Mercuria and ÈTA Shipping Partner on Vessels with Modular Power Systems

Global energy and commodity group, Mercuria, and Netherlands-based ÈTA Shipping have established a joint venture for the construction of six diesel-electric shortsea general cargo vessels with the option for another 10.The vessels will be built by Taizhou Sanfu Ship Engineering in China and will be owned by Mare Balticum BV, a subsidiary of Mercuria, with ÈTA Shipping acting as a minority shareholder. The maiden voyage of the first vessel is planned for the second quarter of 2025.ÈTA Shipping’s modular design of the ÈTA 6700 vessel involves an electric motor that powers the propeller.

Oil Spills and Near Misses: More Ghost Tankers Ship Sanctioned Fuel

An oil tanker runs aground off eastern China, leaking fuel into the water. Another is caught in a collision near Cuba. A third is seized in Spain for drifting out of control.These vessels were part of a "shadow" fleet of tankers carrying oil last year from countries hit by Western sanctions, according to a Reuters analysis of ship tracking and accident data and interviews with more than a dozen industry specialists.Hundreds of extra ships have joined this opaque parallel trade…

African Penguins Endangered by Ship Bunkering Noise in Algoa Bay, Study Finds

The already endangered African penguin is being driven away from its natural habitat off the east coast of South Africa due to noise from ship refueling, a scientific study has found.The number of African penguins on St Croix island in Algoa Bay, once the world's largest breeding colony of the birds, has plummeted since South Africa started to allow ships in the area to refuel at sea, a process known as bunkering, six years ago, the study found.Situated in a busy shipping lane along South Africa's east coast…

Gunvor Reports Highest Profit Since 2015

Global energy trader Gunvor Group reported a net profit of $726 million for 2021, the highest since 2015, buoyed by its natural gas and liquefied natural gas (LNG) divisions, the company said on Tuesday.The profit was the highest since 2015 when net profit was boosted by the sale of most of its Russian assets and was up on the $320 million the Geneva-based company made in 2020 when refining impairments took the shine off its record gross profit.Gunvor's rivals have seen record profits on higher oil volatility and skyrocketing natural gas prices in the second half of 2021.

Vitol Made Record Net Profit in 2021

Global energy trader Vitol Group made a record net profit of just over $4 billion last year, sources familiar with the matter said, as oil, natural gas and other commodity prices soared.Vitol, the world's biggest independent oil trader, declined to comment.The unaudited result beats its previous record net profit in 2020, when oil markets were upended by the COVID-19 pandemic. Bloomberg reported Vitol made $3.2 billion in 2020. The company does not disclose its net profit.Last week, Vitol said revenues leapt to $279 billion in 2021 as oil prices recovered from 2020 lows.

Mercuria Joins Tankers International VLCC Pool

The Mercuria-operated Seaways Kilimanjaro has joined Tankers International’s specialist VLCC Scrubber Pool.The Seaways Kilimanjaro (296,999 DWT / Built 2012) was delivered to Tankers International on March 15. The total size of the Tankers International fleet now stands at 58 VLCCs, and the specialist Scrubber Pool has increased in size to 21 vessels, with four more retrofits expected to join throughout 2022.Charlie Grey, Chief Operating Officer, Tankers International, said, "The addition of the Seaways Kilimanjaro further improves the unrivalled strength and depth of our pool, which will deliver unique benefits for Mercuria as well as our other Pool partners.

Major Buyers of Russian Oil Struggle with Bank Guarantees

The global oil market was thrown into chaos on Thursday after Russia invaded Ukraine, with top buyers of Russian oil struggling to secure guarantees at Western banks or find ships to take crude from one of the world's largest producers.At least three major buyers of Russian oil have been unable to open letters of credit from Western banks to cover purchases on Thursday, four trading sources said, citing market uncertainty after the Russian invasion.Russia produces every 10th barrel in the world and oil prices jumped to above $105 per barrel on Thursday, their highest since 2014, due to fears of disruptions.In the Black Sea, a Turkish-owned ship was hit by a bomb off the coast of Ukraine's port city Odessa…

Two Gasoline Tankers Divert from Nigeria

Two tankers carrying gasoline loaded in Antwerp, Belgium, have turned back to their load-port after initially being destined for Lagos in Nigeria, Refinitiv Eikon ship tracking and sources said on Friday.The two tankers, STI Symphony and Velos Diamantis, turned back in last week. The U-turns happened after Nigeria rejected other gasoline cargoes loaded in Antwerp for containing too much methanol.Reuters was not able to immediately confirm the methanol content in these two cargoes or why they turned back.Earlier this week…

PetroChina Tops Singapore's List of 2021 Bunker Fuel Suppliers

PetroChina International Singapore Pte Ltd climbed three spots to be the top marine fuel supplier in the world's biggest ship refueling hub in 2021 while the overall number of licensed suppliers fell by four to 41, official data showed on Monday.Shell Plc's Singapore bunkering unit, Shell Eastern Trading Pte Ltd, fell from the top ranking in 2020 to third, behind Singapore's Equatorial Marine Fuel Management Services Pte Ltd in second place, unchanged from 2020, the Maritime and Port Authority (MPA) of Singapore data showed.Vitol Bunkers Pte Ltd…

Minerva Sets Up Bunkering Ops in Yanbu and Jeddah

Marine fuel supplier Minerva Bunkering announced it has launched a new marine fuels supply service in the Red Sea ports of Yanbu and Jeddah in the Kingdom of Saudi Arabia."The Red Sea is one of the shipping industry's most important waterways yet one that has historically offered limited bunkering options to serve the global fleet. We believe Minerva's new operation will support the increasing number of vessels calling these ports as well as provide a highly efficient service with minimal deviation for transiting vessels needing bunkers…

Gunvor to Cut Emissions by 40%, Sets up Renewables Arm

Energy trader Gunvor Group aims to cut its Scope 1 and 2 emissions by 40% in absolute terms by 2025, the company said on Tuesday, and has set up a new subsidiary to invest in non-hydrocarbon projects.The Geneva-based firm, which is among the top five global oil traders, aims to cut emissions it produces directly, and those from the electricity it uses, against its 2019 total of 1.9 million tonnes of carbon dioxide equivalent.Its new unit will invest in biofuel, renewable power projects such as solar and biomass…

Minerva Bunkering Announces Carbon Offsets Offering

Minerva Bunkering said it launched a new offering enabling customers to mitigate carbon emissions associated with the bunker fuel they consume. With each transaction, Minerva retires verified carbon offset certificates in an equal and offsetting amount to the emissions value of the bunker fuel as calculated per the International Maritime Organization’s (IMO) published emissions factors.“Our global client base of ship owners and operators is increasingly seeking to reduce the emissions intensity of their operations as well as provide carbon-neutral freight services to their own customers.

Mercuria Teams Up with Envysion for Project Investment

Trading house Mercuria and Singapore-based asset manager Envysion Wealth Management have agreed to co-invest in mining and energy projects, as default-hit banks tighten their purse strings and leave commodities firms seeking other funding.The deal, signed on Wednesday, will see Mercuria present potential projects for investment to Envysion, founded and led by former Julius Baer banker Veronica Shim. Envysion will then decide whether to participate via a fund with a start-up amount…

Singapore Adds Minerva Bunkering and TFG Marine to List of Bunker Suppliers

The Maritime and Port Authority of Singapore (MPA), home the world's top marine refueling hub, said it has awarded two new bunker supplier licenses to Mercuria's Minerva Bunkering and Trafigura's TFG Marine."MPA and ESG welcome the entry of Minerva Bunkering and TFG Marine, which will consolidate Singapore's position as the global bunkering and oil trading hub," the MPA said in a joint statement with Enterprise Singapore (ESG).The licences are the first to be issued by the port regulator since 2017, bringing the total number of licensed bunker suppliers to 45 in Singapore, and come after the M

MPA Awards Two Bunker Licenses

The Maritime and Port Authority of Singapore (MPA) has awarded two new bunker supplier licences to Minerva Bunkering and TFG Marine, following its call for applications for new licences in December 2019.Bunkering services in the Port of Singapore and oil trading remain resilient despite the global COVID-19 pandemic. Bunker sales in Singapore grew 5.4%, from 12.07 million tonnes in the first quarter of 2019 to 12.72 million tonnes in the first quarter of 2020.MPA and Enterprise Singapore (ESG) welcome the entry of Minerva Bunkering and TFG Marine, which will consolidate Singapore’s position as the global bunkering and oil trading hub.These…

Record Number of VLCC Liftings at LOOP

Medium-sour crudes from the U.S. Gulf of Mexico are being snapped up by overseas buyers, paving way for a record six supertankers to load at the Louisiana Offshore Oil Port (LOOP) in a matter of weeks, according to people familiar with the matter.The six scheduled loadings in late May and early June would double the record of Very Large Crude Carriers (VLCCs) reached in December. An unusual influx of Gulf of Mexico crudes to the U.S. deepwater export port and weakening prices are contributing to the exports…

Aegean Marine Files for Chapter 11

Aegean Marine Petroleum Network Inc. announced Tuesday that it has filed for chapter 11 bankruptcy protection as the New York listed marine fuel supplier is being investigated to determine whether there was $200 million fraud involving fake transactions with brass-plate companies.Aegean said it has financial support of Swiss strategic partner Mercuria Energy Group Ltd., one of the world’s largest independent energy and commodity companies. Mercuria has pledged more than $532 million in postpetition financing to fund the chapter 11 process and the Aegean’s working capital needs, and has agreed to serve as the stalking horse bidder in…

Minerva Bunkering Names Tyler Baron as CEO

Minerva Bunkering, formerly Aegean Marine Bunkering Network now a fully-owned subsidiary of Mercuria Energy Group, appointed Tyler Baron as the Chief Executive Officer (CEO).Baron will be based in Geneva, and will oversee Minerva’s global business operations across Europe, the Americas and Asia, said a press note from the physical supplier of marine fuels.“Given Tyler’s history with and dedication to the company, as well as his breadth of experience in financial markets and capital allocation, he is the ideal candidate to lead Minerva Bunkering,” said Magid Shenouda, Global Head of Trading at Mercuria.“Through his leadership the new Minerva is positioned for success through a customer centric global platform and dedicated team of employees.

Aegean Marine Becomes Minerva Bunkering

Marine fuel logistics company Aegean Marine Petroleum Network announced that its plan of reorganization became effective and it has emerged from the voluntary Chapter 11 restructuring commenced on November 6, 2018.The company will now operate under the name of 'Minerva Bunkering', a fully-owned subsidiary of Mercuria Energy Group Limited, a major privately-held energy and commodities group with an annual turnover in excess of $100 billion.“We are pleased that Aegean has completed its restructuring, and now as part of Mercuria, is a significantly stronger company with greater supply capabilities and access to liquidity,” said Aegean Board Director Tyler Baron.“As the new Minerva Bunkering…

POTAC Signs Dock Usage Pact with Port of Corpus Christi

POTAC (Pin Oak) announced the execution of a ten year exclusive use agreement for Suezmax vessels at Public Oil Dock 14 with the Port of Corpus Christi, including extension options, exercisable by the Company, which could extend the agreement for up to an additional ten years.In addition to Suezmax vessels, Pin Oak will be able to efficiently load / unload Aframax, Panamax, and other smaller vessels and barges. This agreement follows the commencement of construction on Pin Oak's nine pipelines crossing under the Corpus Christi Ship Channel, eight of which will connect to Public Oil Dock 14.The dock is designed to load product at a minimum rate of 40…

Big Oil Set to Cash in on IMO 2020 Rules

The world's biggest oil traders are gearing up to cash in on big disruptions that could hit the shipping fuel market in just over a year due to new U.N.-mandated environmental rules.International Maritime Organization (IMO) regulations will cut the limit for sulphur in marine fuels globally from 3.5 percent to 0.5 percent from the start of 2020."We're going to hopefully facilitate the new rules in 2020 by helping out the industry and the participants in general to have a reasonably smooth transition…