Navis Solution on Evergreen Newbuilds

Navis, the provider of maritime software solutions for cargo and vessel performance and compliance, announced that its MACS3 loading computer will be installed on two newbuilding series of container vessels owned and operated by Taiwan-based Evergreen Marine Corporation.Navis, a part of Cargotec Corporation, said that due to the owner’s decision to have this loading computer installed, they are moving to support safer and more effective onboard cargo handling.The newbuildings are currently being built at two different Chinese shipyards. The Jiangnan shipyard is currently building four container ships with a capacity of 2,500 TEU, which will be delivered between February and November 2020.Two other 1…

Scorpio Bulkers Refinances Ultramax Vessel

Monaco-based Scorpio Bulkers announced that the Company has entered into a financing transaction in respect of one of the Company’s Ultramax vessels with an unaffiliated third party in Japan. As part of the transaction, the Company will sell a 2015 Japanese built Ultramax dry bulk vessel, SBI Tango, for a consideration of $19.0 million and then lease it back from the buyer through a five-year bareboat charter agreement at a rate of $5,400 per day. If converted to floating interest rates, based on the expected weighted average life of the transaction, the equivalent cost of financing at current swap rates would be LIBOR + 1.73%. The transaction…

Scorpio Bulkers Gets Loan for Kamsarmax

Monaco-based international shipping company Scorpio Bulkers said it has received a commitment for a loan facility of up to $12.75 million from a leading European financial institution to finance the Company’s Kamsarmax bulk carrier. The bulker will be delivered from Jiangsu New Yangzijiang Shipbuilding in China in the third quarter of 2018. The loan facility has a final maturity date of five years from delivery and bears interest at LIBOR plus a margin of 2.40% per annum. The terms and conditions are similar to those set forth in the Company's existing credit facilities. The loan facility is subject to customary conditions precedent and the execution of definitive documentation. Scorpio Bulkers is a provider of marine transportation of dry bulk commodities.

Scorpio Bulkers Losses Narrow

Monaco-based dry bulk commodities shipping company Scorpio Bulkers reported a significantly narrowed fourth-quarter loss as it cut expenses and doubled revenue. For the three months ended December 31, 2017, the Company’s GAAP net loss was $1.1 million, or $0.01 loss per diluted share. For the same period in 2016, the Company’s GAAP net loss was $20.6 million, or $0.29 loss per diluted share. Total vessel revenues for the three months ended December 31, 2017 were of $51.1 million, compared to $26.8 million for the three months ended December 31, 2016. The Company acquired nine Chinese built Ultramax dry bulk vessels in two separate transactions for a total consideration of $207.0 million…

Scorpio Bulkers Acquires Four Vessels

Scorpio Bulkers, announced that it has entered into two separate agreements with unaffiliated third parties to acquire three Ultramax dry bulk vessels and one Kamsarmax dry bulk vessel. The deal was for an aggregate of $90 million, of which $77.1 million is payable in cash and the remaining consideration is in the form of approximately 1.592 million common shares of the Company to be issued to one of the sellers. All of the Ultramax vessels were built at Chengxi Shipyard Co Ltd in China, of which two were delivered in 2014 and one was delivered in 2015. The Kamsarmax bulk carrier is a resale unit whose construction will be supervised by the Company and which will be delivered from Jiangsu New Yangzijiang Shipbuilding Co Ltd in China in the second quarter of 2018.

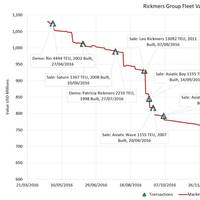

Rickmer's Group Worth $740 Million

Following last month’s news that Singapore Based Rickmers Maritime Trust is to be wound up, Rickmers Holding AG released a statement on April 19 reporting that an understanding had been reached regarding restructuring of the Rickmers Group. It is understood that sole shareholder Bertram Rickmers will reduce his shareholding to below 25 percent, while the remaining 75 percent will be taken by lenders and bondholders. The value today of the Rickmers Group (a Rickmers Holding AG subsidiary) sits at $740 million, according to VesselsValue.

Star Bulk Acquire Two Modern Kamsarmax Vessels

Star Bulk Carriers, a global shipping company focusing on the transportation of dry bulk cargoes, announced that it has entered into definitive agreements to acquire two modern Kamsarmax drybulk carriers from an unaffiliated third party for an aggregate total consideration of approximately US$30.3 million. Each of the Vessels has a carrying capacity of 81,713 deadweight tons and was built with high specifications at Jiangsu New Yangzijiang in 2013. The Vessels are expected to be delivered to Star Bulk between March and May 2017. The Company is currently in advanced discussions with a financial institution to secure financing for up to 50% of the acquisition costs of the Vessels.

China Shipyards Bag the Week's Ocean-going Newbuild Orders

Reported ordering this week has been exclusively focussed on the Chinese yards, says Clarkson Hellas in their latest 'S&P Weekly Bulletin'. COSCO Shipyards have announced a number of orders, inform Clarkson Hellas with two firm plus two option x 82,000 dwt Kamsarmaxes contracted for KC Maritime and a two further 82k Kamsarmax for a European owner. Both orders were placed at COSCO Dalian, with delivery from the later part of 2015 and the majority to be delivered in the first half of 2016. At COSCO Zhoushan, KC Maritime have also increased their orders for 64,000 dwt Ultramax by adding two further vessels taking the total series to four. The latest additions are due for delivery in the first quarter of 2016.

Latest Global Ocean-Going Shipbuilding Round-Up

A relatively active past week in the dry bulk newbuilding market is noted by Clarkson Hellas in their S&P Weekly Bulletin. Oldendorff Carriers have contracted two firm plus two option 208,000 DWT Newcastlemax at Hantong Shipyard, with delivery of all four vessels in 2016. Oldendorff have also declared one further option at Jiangsu New Yangzijiang and two options at Taizhou CATIC all for 208,000 DWT Newcastlemax and delivering in 2016. Oldendorff are also understood by Clarkson Hellas to have declared two options for 82…

Latest Bulk Carrier, Tankship, Newbuilding Order Round-up

Starting with the larger sizes Hyundai Merchant Marine (HMM) are understood by Clarkson Hellas to have placed an order for two firm 210,000 dwt Newcastlemax at Bohai, with delivery of both vessels due in early 2017. The majority of ordering this week has been focussed on the Kamsarmax market; Weihai Samjin (Korean owned yard with facility based in China) has taken two separate orders for 82,000 dwt Kamsarmax from NK Shipping for four firm plus two options, and two further firm vessels from another Korean buyer, although yet unknown.

Global Dry Bulk Carrier Newbuilding Orders on the Rise

Starting with the large sizes in dry, Oldendorff Carriers are reported to have declared the sixth in a series of 207,000 DWT Newcastlemax at HHI, with delivery in the second quarter of 2015. Clarkson Hellas report that at Hanjin Subic, STX Pan Ocean have contracted two firm 150,000 DWT Capesize, planned for delivery in the second half of 2016 and for charter to KEPCO. One order to report in the Kamsarmax sector, with Klaveness declaring the third and fourth in a series of 82,000 DWT bulk carriers at Jiangsu New Yangzijiang.

Latest Global Shipbuilding Orders

Rizhao Steel (Cara Shipping) are understood by Clarkson Hellas to have contracted two firm 180,000 DWT Capesize at both Dalian and Qingdao Beihai, with an additional two options at the latter. These orders are understood to have been concluded in the middle of this year, with delivery of the first vessel from Beihai lined up for 2015 and the remainder all due in 2016. Following a limited number of new orders so far this year, the VLCC orderbook, which currently stands at around 50 vessels, has seen the addition of two firm plus two option 300,000 DWT crude tankers from Metrostar at HHI. Although pricing remains undisclosed delivery of both firm vessels is planned for the first half of 2016.

China Shipyard Delivers 4,800 TEU Emirates Containership

Emirates Shipping Line (ESL) has received the first of two 4,770-TEU vessels ordered by Hamburg's Hammonia Shipping & constructed by Jiangsu New Yangzijiang shipyard. The Hammonia Istria will be chartered to Emirates Shipping Line and remamed Emirates Pearl for deployment on its CIS China-India service to replace the 4,250-TEU Jpo Vela. ESL runs the service in partnership with OOCL and APL, which markets the loop as CIX. Emirates Shipping Line provides one of the six vessels on this service. The new containership is 255.10 m in length with a breadth of 37.3 m and has reefer plugs for 600 containers.

China Shipyard Wins Four Bulkship Orders

Jiangsu New Yangzijiang Shipbuilding has been contracted to build four 82,000 dwt bulk carrier orders for Hong Kong owner Everbright Metal. Each ship will have a length of 229 m (751 ft) breadth of 32.26 m (106 ft) and draft of 14.45 m (47.4 ft), and all the four ships are expected to be delivered between the fourth quarter of 2013 and the third quarter of 2014. Currently New Yangzijiang Shipbuilding has orders for 53 vessel on hand made up of 16 bulkers, 6 woodchip transport vessels and 31 containerships.[

RINA celebrates ties with China

International certification, verification and ship classification company RINA is celebrating its ties with China on its 150th anniversary. It also took the opportunity to celebrate the ties between Italy and China on the 150th anniversary of Italian Unification. Formed in Genoa, Italy, in 1861 as a ship classification society, RINA is today a global multi-disciplinary and multi-cultural company with growing business in China and the surrounding region. Today in Shanghai RINA CEO Ugo Salerno and Vincenzo De Luca…