WinGD Issues NOL for Chevron's Taro Ultra Advanced 40

Chevron Marine Products’ Taro Ultra Advanced 40 oil has successfully passed NOL (No Objection Letter) requirements by engine manufacturer WinGD. This follows the earlier NOL award for Taro Ultra Advanced 40 from MAN Energy Solutions. This latest test validates the suitability of the oil for use in WinGD engines operating with liquid fuels containing sulphur in the range 0.00<1.50 % m/m, which includes very low sulphur fuel oil (VLSFO). The test also approved the general usage…

Chevron Supplies First Stem of 40 BN Category II Lube Oil

Chevron Marine Lubricants said it made its first delivery of a 40 BN Category II lube oil on August 30, in a breakthrough moment for operators of MAN ES Mk9 and above two-stroke engines, when it supplied a stem of its new Taro Ultra Advanced 40 to SIEM Car Carriers.“We are very pleased that Taro Ultra Advanced 40 is now available to our customers and that we have successfully made the first delivery,” said Pat McCloud, General Manager, Chevron Global Marine Lubricants. “From September, it will be available at major ports across Europe and Asia Pacific, including Singapore and Rotterdam.

Chevron Completes Testing of New Marine Cylinder Oil meeting MAN ES’ Category II Spec

Chevron Marine Lubricants’ new Taro Ultra Advanced 40 has passed the Main NOL (No Objection Letter) Service and Confirmation field tests by MAN Energy Solutions, which allows the oil’s uninterrupted use in its Mk 9 and later engines.Since the International Maritime organization (IMO) 0.5% sulphur cap came into effect on 1 January 2020, the engine designer has defined two performance standards for lube oils intended for use in their two-stroke engines. To deal with changing fuel variants and engine designs…

Shell Marine Receives NOL from MAN ES for Shell Alexia 40 XC

Shell Marine received a full No Objection Letter (NOL) from MAN Energy Solutions (MAN ES) for Shell Alexia 40 XC, its Category II (CAT II) 40BN cylinder oil, confirming the successful completion of the full approval process.Alexia 40 XC uses a proprietary and unique formulation, developed by Shell Marine’s in-house Research & Development team. The NOL was received following the conclusion of the Main NOL Service Test and Confirmation Test for Alexia 40XC. The successful approval…

CMA CGM to Buy Los Angeles' FMS Container Terminal

Shipping group CMA CGM has agreed to acquire the Fenix Marine Services (FMS) container terminal at the port of Los Angeles in a deal worth around $2 billion that will extend its presence in a crucial hub for transpacific trade.CMA CGM currently has a 10% stake in FMS and it is to buy the remaining 90% from investment fund EQT Infrastructure III on the basis of an enterprise value of $2.3 billion, CMA CGM and EQT said on Wednesday.France-based CMA CGM, one of the world's largest container shipping lines, expects to pay out around $1.8 billion for the 90% stake and will finance the deal from its

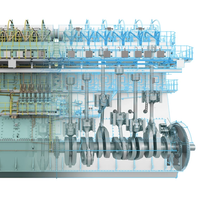

WinGD Publishes Cylinder Lube Guide

Engine designer WinGD (Winterthur Gas & Diesel) has published a cylinder lubrication guide to provide ship operators with consolidated, at-a-glance information highlighting the specific usage conditions for each and every approved cylinder oil.The guidance is the result of several months’ work with major oil companies to make usage requirements more transparent. Previously, the guidelines for each oil were found only in the industry standard No Objection Letters (NOL) issued by WinGD to oil companies, and available only upon request by a customer to an oil company directly.

Total Lubmarine's Talusia Universal Gains NOL from WinGD

Total Lubmarine’s Talusia Universal (BN57) has received a No Objection Letter (NOL) from WinGD for all fuels (liquid and gas) with a sulphur content 0.00%S - 1.50%S.The NOL was awarded with no restrictions following the successful completion of two rigorous tests carried out on two different vessels fitted with W6X72 engines.The tests were conducted on split engines comparing Talusia Universal with a BN40 reference Cylinder Lube Oil (CLO). One test carried out with compliant VLSFO <0.5%S, the other one with compliant ULSFO <0.1%S for 2350 and 2000 running hours respectively.“Following both tests, Talusia Universal performed significantly better than the reference CLO for deposit control and general piston cleanliness…

MAN Okays Total Lubmarine's VLSFO Fuel

Total Lubmarine, part of Total Lubricants, has received a No Objection Letter (NOL) from leading engine manufacturer MAN Energy Solutions, for the use of Talusia on MAN B&W 2-stroke engines operating on fuels with less than 0.5%S Very Low Sulfur Fuel Oil (VLSFO).Total Lubmarine had developed the set of marine lubricants designed to work with a range of low sulfur fuels, as the new emissions standards designed to curb pollution from ships by the International Maritime Organization (IMO) set to be implemented on January 1, 2020.Talusia Universal was tested on an 8S50MC-C MAN B&W engine operating on VLSFO (max 0.5%S) to achieve its NOL.

Maersk, Major Shippers Hike Gulf-bound Box Rates

A.P.

MAN Okays Chevron's Taro Cylinder Lubricants

Following field testing, Chevron Marine Lubricants have been issued with two NOLs (No Objection Letters) from equipment manufacturer MAN Energy Solutions, for the use of three of its Taro cylinder oils with itscylinder oil mixing system, ACOM.“Receiving the NOLS from Man Energy Solutions (formerly MAN Diesel & Turbo), demonstrates the impressive performance of our products in the field. The Taro range of cylinder lubricants provides solutions for the varied range of engines, different fuels and the increasingly complex operating requirements that we are faced with.

Fuels, Lubricants & Green Marine

International Maritime Organization (IMO) fuel rules entering force in 2020 mandate a drastic sulfur reduction. By 2050 the mandate is to cut greenhouse gas emissions of shipping by at least 50 percent.Marine fuels, lubricants and additives manufacturers play their part in establishing maritime’s green credentials by introducing new environmentally acceptable technologies and products.The shipping industry is more than ever portrayed in a bad light due to increasing awareness of its contribution to global climate change, according to Dirk Kronmeijer, CEO of GoodFuels Marine.

CMA CGM Completes Sale of Los Angeles Terminal

The CMA CGM Group completed today the sale of a 90% equity interest in Global Gateway South terminal (GSS) in Los Angeles (United States) to EQT Infrastructure III (EQT Infrastructure) and its partner P5 Infrastructure (P5), for an Enterprise Value of USD 875 million. Consequently, CMA CGM received a cash consideration of about USD 820 million that may be completed according to the terms announced last July. CMA CGM will remain a minority shareholder with 10% of the GGS terminal and will continue to be a major user of the facility. The disposal of GGS enables CMA CGM to strengthen its financial structure in line with the plan communicated at the time of NOL’s acquisition in June 2016.

Shell Marine Launches New Cylinder Oil

Shell Marine has launched a new two-stroke engine cylinder oil, Shell Alexia 140, now available from the ports of Rotterdam, Bremerhaven, Hamburg, Antwerp, Tanjung Pelepas, Busan and Salalah. The launch follows receipt of a No Objection Letter (NOL) for commercial use of Shell Alexia 140 from MAN Diesel & Turbo and coincides with Shell Alexia 140’s acceptance into full scale operations by two major customers. In September 2016, Shell Marine disclosed Alexia 140’s selection as the first test oil for ‘ACOM’ - MAN Diesel & Turbo’s Automated Cylinder Oil Mixing process.

Chevron Lubricant Receives Approval from WinGD

Chevron Marine Lubricants received a No Objection Letter (NOL) from Winterthur Gas & Diesel (WinGD) for the use of its Taro Special HT 100 cylinder lubrication oil in a number of the manufacturer’s engines when operating on a wide variety of fuels from 0.0% to 3.5% sulphur, including fuels compliant with emissions control area (ECA) regulations with a maximum content of 0.10% sulphur, eliminating the need to change cylinder lubricants when operating in and out of ECAs. This follows 2,000 hours of validation testing on-board a Panamax containership fitted with a Wärtsilä 8RT-flex82T engine. The NOL applies to the use of Taro Special HT 100 in WinGD X…

Kuehne Raises Hapag-Lloyd Stake to 17 pct

Logistics entrepreneur Klaus-Michael Kuehne has raised his shareholding in German container shipping line Hapag-Lloyd to 17.15 percent from 14.1 percent, his Swiss-based Kuehne Holding said on Thursday. Kuehne was taking advantage of shares being sold by TUI , which on Tuesday completed the disposal of its remaining 7.9 percent of shares to focus on cruise ship acquisitions. TUI's move allowed Kuehne to expand its investment in Hapag-Lloyd, which it said it considered to be long-term. "The ongoing shipping industry consolidation offers Hapag-Lloyd new growth perspectives and strengthens its positions among the most important shipping companies across the world," Kuehne Holding executive chairman Karl Gernandt said.

APM Terminals Mumbai Adds New Arabian Gulf/Mediterranean Direct Service

French based CMA-CGM, a member of the Ocean Alliance, began the new INDIAMED service to Mumbai with the arrival of the 5,009 TEU capacity CMA CGM Virginia at APM Terminals Mumbai. The service, linking South Asia with ports in the Arabian Gulf and Mediterranean, was officially introduced on July 2nd, operating with vessels provided by CMA-CGM, its APL subsidiary, and Chinese-based Alliance partner COSCO. The weekly INDIAMED service provides the fastest transit times between India and CMA CGM hub ports in the Mediterranean and Arabian Gulf, and expands the transshipment network through the MEGEM (East Mediterranean to/from Middle East destinations) and MEDEX (West Mediterranean to/from Middle East and Indian Sub-Continent) services.

OOCL is 'The Perfect Bride' -Drewry

Orient Overseas International (OOIL) and its container unit OOCL have a good track record for above-average profits in a challenging market and a reputation for being a very well-run company, earning the moniker “The Perfect Bride” by Drewry Maritime Financial Research. Retaining the management team, processes and systems is a wise move and could be of enormous value to Cosco Shipping Holdings (Cosco), Drewry said. OOCL has an owned-fleet of 66 containerships aggregating approximately 440,000 teu. It is a young and modern fleet with an average age of 7.1 years and average nominal capacity of 6,600 teu. It is introducing its first 21,000 teu vessel with five more to deliver and options for another six which it could easily exercise.

CMA CGM Sells L.A. Box Terminal Stake

French container shipping firm CMA CGM said on Monday it had agreed to sell a 90 percent stake in a Los Angeles terminal to infrastructure funds for $817 million in cash. CMA CGM will retain a 10 percent interest in the Global Gateway South terminal after the deal with funds EQT Infrastructure and its partner P5 Infrastructure, the company said in a statement. The terminal came under CMA CGM's ownership through its 2015 takeover of Singapore's Neptune Orient Lines (NOL), a $2.4 billion deal that marked the Marseille-based group's biggest-ever acquisition. CMA CGM said the sale would help it pay down debts following the NOL takeover and that it was part of its strategy of focusing on shipping.

CMA CGM Posts Higher Q1 Profits

Container shipping line CMA CGM posted higher first-quarter profits, helped by a turnaround at recently acquired NOL, and gave an upbeat assessment for the current quarter in another sign that the shipping industry is emerging from a slump. The French-based group reported on Friday a first-quarter net profit, including Singapore-based NOL which it consolidated in June last year, of $86 million compared with a $100 million loss in the same period of 2016. This was also above the…

CMA CGM Returns to Net Profit in Q4

CMA CGM, the world's third-largest container line, swung back to a net profit in the fourth quarter of last year, supported by a recovery in freight rates and efficiency measures taken during a prolonged downturn in shipping, the company said. The improvement in the shipping market had continued at the start of 2017, but the sector remained fragile and CMA CGM did not plan to order any new vessels in the near term, it said in a financial results statement on Friday. It had also delayed taking delivery of three vessels scheduled for this year until 2018…

Consolidated Container Fleets Worth $33.4 Billion

Following the sale of Hamburg Süd to Maerskfor $4 billion, VesslesValue senior analyst William Bennett has compiled a report on the top consolidated container fleets. Currently these top five fleets are worth $33.4 billion and account for 33 percent of the entire container fleet. Maersk have confirmed rumors that they will acquire German container shipping line Hamburg Süd. Hamburg Süd’s strong position in north-south trades will complement Maersk's current business. Maersk is thought to have paid roughly $4 billion for Hamburg Süd whose fleet is worth $1.5 billion.

WFW advises CMB Financial Leasing on Sale, Leaseback of Eight Vessels

International law firm, Watson Farley & Williams (“WFW”), advised CMB Financial Leasing Co. Ltd (“CMB”) in respect of: (i) the sale of eight container vessels by NOL Liner (Pte.) Ltd to certain Singapore incorporated SPVs wholly owned by CMB International Leasing Management Ltd; and (ii) the bareboat charter of each vessel by the relevant buyer to APL Co. Pte. Ltd. The transaction was backed by French incorporated CMA CGM, of which both NOL Liner Pte Ltd and APL Co Pte Ltd are indirect subsidiaries. The WFW maritime team was led by Hong Kong Partner Christoforos Bisbikos, supported by Associates Andrew Chou and Ryan Tan and Legal Assistant Dongchen Shi. Hoff and Juliette Vroom. market is depressed, leasing remains one of the strongest sources of equity in the sector”.

CMA CGM Stays in Red, Pays Back NOL Takeover Loan

CMA CGM, the world's third-largest container shipping company, posted on Friday another net loss in the third quarter as freight rates remained weak and it integrated Singapore-based NOL, its biggest-ever acquisition. The sector was showing the "first signs of stabilisation" as operators adjusted capacity but freight rates remained historically low, CMA CGM said on Friday. The French-based company's net loss including NOL was $268 million, compared with a $51 million net profit in the third quarter of 2015. Excluding NOL, the net loss was $202 million.