Keppel Listed on Global Sustainability Indices

Driven by a firm commitment to continuously strengthen its environmental, social and governance (ESG) management and strategy, Keppel Corporation's sustainability efforts have gained momentum, affirmed by inclusion on several global sustainability benchmarks in recent months. Keppel Corporation has been included on the latest Euronext Vigeo World 120 index released 28 November 2014. The company has been listed among the top 120 companies in Europe, North America and Asia Pacific for control of corporate responsibility risk and contribution to sustainable development. In September 2014, Keppel Corporation was the only industrial conglomerate and one of four Singapore companies to be listed as an index component of the Dow Jones Sustainability Asia Pacific Index (DJSI Asia Pacific) 2013/14.

Better Operational News from Fugro

Fugro says that (an as yet unidentified vessel) recently affected by a fire is back in operation. The total time out of operation amounted to seven weeks. Secondly, the company also confirmed that a divers strike in Brazil has reached a negotiated settlement and the divers have returned to work aboard all three of the company's diving vessels. The strike lasted for five weeks. Fugro acquires and interprets Earth and engineering data to support the design, construction, installation, repair and maintenance of infrastructure. The company works predominantly in energy and infrastructure markets offshore and onshore, employing approximately 12,500 employees in over sixty countries. Fugro is listed on NYSE Euronext Amsterdam and is included in the AEX-Index.

HK International Airport Nearshore Contract for Fugro

Fugro inform that the Airport Authority of Hong Kong has awarded them a contract to carry out a major nearshore geotechnical and environmental ground investigation programme in the waters near the Hong Kong International Airport at Chek Lap Kok. The contract, which is worth approximately EUR 8.8 million, will provide essential engineering and environmental information and will run until November 2014. Fugro will carry out the works using a fleet of up to five vessels. The company says that having performed several projects in the waters around Chek Lap Kok in recent years, it is very familiar with the challenges caused by the restrictions of working adjacent to one of the world’s busiest airports.

Navios to Ring NYSE Closing Bell

Navios Maritime Holdings Inc. announced that Chairman and CEO Angeliki Frangou, along with members of the Navios Maritime Holdings Inc. management team, will commemorate the Company's 60th Anniversary by ringing the NYSE Closing Bell on Wednesday, February 19, 2014. Frangou commented, "We are pleased to be back at the NYSE to ring the closing bell, celebrating of our 60th anniversary. We are also delighted that the Uruguayan Minister of Foreign Affairs, Luis Almagro, and the Minister of Finance, Mario Bergara will join us to celebrate our long-time activities in Uruguay. A live feed of the bell ringing can be found on Livestream at http://new.livestream.com/NYSEeuronext starting at 3:56 p.m. An archive of the bell ringing will be available shortly after.

Exmar NV and Teekay LNG Partners Complete Joint-Venture

Exmar NV (NYSE Euronext: EXM) is pleased to announce that together with Teekay LNG Partners L.P. (NYSE: TGP) they have successfully closed their 50/50 LPG joint-venture. The Exmar LPG BVBA joint-venture controls 15 owned Midsize Gas Carriers (MGC), out of which 4 are currently under construction at Hyundai Mipo, and one owned Very Large Gas Carrier (VLGC). Exmar LPG BVBA also time-charters in three MGCs and two VLGCs (33.33% share) and bareboat-charters in one MGC and one VLGC. The joint venture has successfully secured financing for its fleet (including the 4 newbuildings at Hyundai Mipo) under a USD 355 million facility, co-arranged by Nordea and DNB. The syndicated loan facility has been substantially oversubscribed and is expected to close before the end of the first quarter 2013.

Dockwise Increase Holdings in Fairstar

Dockwise, through subsidiary Dockwise White Marlin B.V., now controls 93.63% of the outstanding shares of Fairstar Heavy Transport N.V. Following various trades Dockwise purchased approximately 10.2% in Fairstar, increasing its holdings from 83.4% to 93.63%. Shares were bought from ODIN and certain other shareholders. Dockwise, headquartered in Breda, The Netherlands. is a leading marine contractor providing total transport services to the offshore, onshore and yachting industries as well as installation services of extremely heavy offshore platforms. Dockwise shares are listed on the Oslo Stock Exchange under ticker DOCK and on NYSE Euronext Amsterdam under ticker DOCKW.

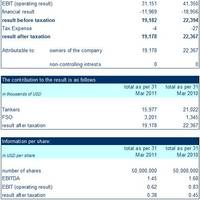

Euronav Q1 2011 Results

The executive committee of Euronav NV (NYSE EURONEXT: EURN) reported its preliminary financial results for the three months ended 31st March 2011. For the first quarter 2011, the company had a net income of USD 19.2 million or USD 0.38 per share (first quarter 2010: USD 22.3 million and USD 0.45 per share). EBITDA for the same period was USD 72.7 million (first quarter 2010: USD 84.2 million). The result is affected positively by the revaluation at marked-to-market levels of non cash items such as hedge instruments on interest rates and rate of exchange for a total of USD 5.2 million.

EURONAV Q4 2010 Results

The executive committee of Euronav NV (NYSE EURONEXT BRUSSELS: EURN) reported its preliminary non-audited financial results for the fourth quarter and full year 2010. The company had a net result of USD -17.6 million (fourth quarter 2009: USD -23.6 million) for the three months ended 31st December 2010 or USD -0.35 per share (fourth quarter 2009: USD -0.47 per share). EBITDA was USD 34.5 million (fourth quarter 2009: USD 34.3 million). For the full year ending 31 December 2010, the net results before deferred tax are USD 20.2 million (2009: USD -17.6 million) or USD 0.40 per share (2009: USD -0.35 per share). The average daily time charter equivalent rates (TCE) obtained by the company’s fleet in the Tankers International (TI) pool was for the fourth quarter approximately USD 17…

Dockwise to Finance New Type 0 Vessel

Dockwise Ltd. Board of Directors approved of the commissioning of a newbuild vessel to serve the emerging demand for ocean transports with capacity of above 100,000 metric tons, and the notice of the same date for a special general meeting (SGM) to authorize the proposed rights issue to part-finance the investment. The SGM of the company was held on Nov. 23 in Amsterdam, the Netherlands, and all items were resolved in accordance with the Board of Directors' proposals as set out in the notice of the SGM. The minutes of the SGM are attached hereto. On basis of the authorization granted by the SGM, Dockwise has resolved to carry out a rights issue of 4…

Dockwise Results, Q4 & Full Year 2009

Dockwise Reported Financial highlights Q4 2009 Adjusted EBITDA of USD 42.1 million, with margin at 36% (Q3 2009: 43%); Net profit of USD 2.8 million before non-recurring items: Deal & financing-related net cash costs of USD 4.6 million Non-cash impairments on assets and loan fees of USD 14 million Vessel operating expenses reduced 12% to USD 11 million (Q3 2009: USD 12.5 million); Cashflow of USD 43 million generated by operations (Q3 2009: USD 29 million) Financial highlights FY 2009 Adjusted EBITDA of USD 223 million with margin at 45%, maintaining 2008 levels; Strong cash flow of USD 195 million generated by operations; CAPEX of USD 28 million (below annual runrate of USD 50 million); Year end net debt of USD 641 million (2008: USD 1,003 million); Year end net

CGGVeritas to Acquire Wavefield

CGGVeritas (ISIN: 0000120164 - NYSE: CGV) announced today it will make a voluntary exchange tender offer for 100% of the shares of Wavefield Inseis ASA ("Wavefield") (OSE: WAVE). Wavefield is a Norwegian pure-play seismic company which operates a fleet of 8 vessels and develops geophysical equipment based on fiber optic technology. In the third quarter 2008, Wavefield revenue was $110m, and operating income was $37m. The transaction strengthens CGGVeritas' fleet capability with immediate access to five recently equipped high capacity 3D vessels. The additional complement of three mid 3D and 2D Wavefield vessels increases overall fleet management flexibility.