Esgian Week 10 Report: Additional Backlog Secured

Esgian reports that offshore drilling contractors secured additional backlog in the U.S. Gulf of Mexico, Egypt, Nigeria, and Brazil and operators confirmed new discoveries in Indonesia, Côte d’Ivoire, and China in its Week 10 Rig Analytics Market Roundup.ContractsDiamond Offshore has executed a two-year contract extension with a subsidiary of bp in the U.S. Gulf of Mexico for the 12,000-ft drillship Ocean BlackHornet.Shelf Drilling’s 250-ft jackup Rig 141 has secured a two-year…

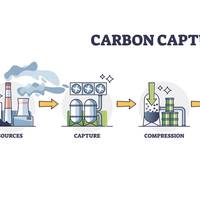

Carbon Capture Chasm Exposed at Climate Summit

Carbon capture and storage has emerged as flashpoint at the UN climate conference in Dubai about how big a role it is destined to play in reaching the target of net zero emissions.It has also prompted an unusual and bad-tempered confrontation between senior officials at the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC).In the run up to the conference, the IEA called on oil and gas producers to let go of "the illusion that implausibly…

Petrofac Hires AHTS to Assist with Northern Endeavour FPSO Disconnection

Akastor's subsidiary DDW Offshore has won a one-year contract with Petrofac for the AHTS vessel Skandi Atlantic. The AHTS will support the disconnection of the FPSO "Northern Endeavour" together with towing and well isolations work in the Laminaria Corallina oil fields in the West Timor Sea. The contract start date is September 27th, 2022.The Australian Government earlier this year awarded London-listed oilfield services giant Petrofac a contract for Phase 1 of the decommissioning of the Northern Endeavour FPSO, offshore W.

Next US Energy Boom Could Be Wind Power in the Gulf of Mexico

With passage of the Inflation Reduction Act, which contains US$370 billion for climate and energy programs, policy experts are forecasting a big expansion in clean electricity generation. One source that’s poised for growth is offshore wind power.Today the U.S. has just two operating offshore wind farms, off of Rhode Island and Virginia, with a combined generating capacity of 42 megawatts. For comparison, the new Traverse Wind Energy Center in Oklahoma has 356 turbines and a 998-megawatt generating capacity.

LNG Price Recovery Spurs Spending in Race against Carbon Targets

The investment outlook for liquefied natural gas (LNG) has improved this year but project go-aheads will not match the bonanza of 2019, as the fight against climate change clouds the prospects for gas demand growth longer term.Renewed optimism as the industry emerges from the pandemic, rapidly rebounding oil and gas prices and a better economic outlook is building confidence in short and long term LNG demand in Asia and spurring companies to look at new LNG projects, most of which were shelved last year when prices slumped.However, they need to take into account the ever tighter carbon emissio

Biden Administration Aims for US Leadership in Offshore Wind -Official

The Biden administration aims to transform the United States into the world’s leading producer of energy from offshore wind after years of lagging behind Europe, a senior official said on Wednesday.President Joe Biden’s cabinet earlier this week unveiled a plan to boost the industry that promised new acreage, faster permitting, and billions of dollars in financing - part of his sweeping plan to fight climate change by decarbonizing the economy.“The distinction now is that we have…

Valaris Gears up for Possible Debt Restructuring

Offshore oil driller Valaris PLC is exploring debt restructuring options as it grapples with a rig accident and a broader collapse in energy prices, people familiar with the matter said on Friday.Valaris has tapped debt restructuring attorneys at law firm Kirkland & Ellis LLP for advice on ways to rework its roughly $6.5 billion debt pile, and is exploring enlisting a turnaround firm that specializes in urgently addressing stressed finances to bolster its roster of advisers, the…

Russia Leads E&P Race in Arctic Region

Russian and Norwegian exploration and production (E&P) operators have been expanding their operations in the Arctic continental shelf, which is estimated to hold vast deposits of hydrocarbons and rare earth minerals.Warming temperatures in the Barents Sea and northern coastline of Russia are giving an added impetus to resource development in this region, according to GlobalData.GlobalData's report, ‘Arctic Exploitation’, discusses how Russia is keen on hydrocarbon appraisal and development from the Arctic region to such a great extent that it even settled its longstanding territorial dispute with Norway.The government is also providing tax incentives to companies that invest in this region.

U.S. To “Drown The World” In Oil

A staggering 61% of the world’s new oil and gas production over the next decade is set to come from one country alone: the United States.According to a report by Global Witness, the sheer scale of this new production dwarfs that of every other country in the world and would spell disaster for the world’s ambitions to curb climate change – the effects of which we’re already witnessing through massive heat waves, flooding, and extreme weather.Earlier this year, we crunched the numbers from the latest climate science and industry forecasts and found that we can’t afford to drill up any oil and gas from new fields anywhere in the world if we’re to avoid the worst impacts of climate change.In our analysis…

China's Tariffs on U.S. LNG Mean Nothing, Everything

China's decision to hike import duties on U.S. liquefied natural gas (LNG) is a move that means very little for the market in the short term, but it has the potential to deliver outsized consequences the longer the levies remain in place.As part of its latest round of retaliatory tariffs on U.S. imports, Beijing increased the duty on LNG shipments from 10 percent to 25 percent.This will make it even more uneconomic for Chinese buyers to purchase LNG cargoes from the United States. The 10 percent tariff put in place last year has already devastated the trade, with China's imports of the fuel dropping sharply.China imported 25 U.S. LNG cargoes in the first half of 2018…

Interview: Rolf Stiefel, Winterthur G&D

The May 2019 edition of Maritime Reporter & Engineering News features a 10-page feature section on "Thought Leadership" in the marine power sector. Here we extract and present the interview with Rolf Stiefel, Vice President Sales, Winterthur Gas & Diesel Ltd., in its entirety.Please put in perspective and discuss – using your career as the time span – the current environment and pressure to reduce emissions in the maritime industry.When I started in the marine industry (coming from the power generation markets) back in the early 2000’s…

CNOOC Storing LNG Offshore

China's state-owned CNOOC is temporarily storing liquefied natural gas (LNG) in a tanker off South Korea as a warmer than usual winter cuts expected spot demand for the fuel, industry sources said on Wednesday.China faced a severe winter gas shortage last year after switching millions of households to natural gas from coal for heating, prompting Chinese companies this winter to secure supply well ahead of time, they said.However, the winter so far has been relatively mild and weather data from Refinitiv Eikon largely points towards warmer than usual temperatures ahead…

Diamond Offshore Posts Smaller-than-expected Loss

Diamond Offshore Drilling Inc posted a smaller-than-expected loss on Monday, as a fall in revenue was offset by a 15 percent drop in costs.The Houston-based company's total operating expenses fell to $321.2 million from $378.5 million, a year earlier.As oil prices stay above $70 a barrel, oil and gas producers are again showing an interest in expensive offshore projects that can take up to a decade to develop.The rig contractor recorded a loss of $69.27 million, or 50 cents per share, in the second quarter ended June 30, compared to a profit of $15.95 million, or 12 cents per share, a year earlier.Excluding items, the company posted a loss of 33 cents per share.

UAE's Adnoc Awards USD 1.6bln Contract to China’s CNPC

The Abu Dhabi National Oil Company (ADNOC) has awarded contracts worth AED 5.88bn (US $1.6bn) for the world’s largest continuous 3D onshore and offshore seismic survey, covering an area up to 53,000 square kilometres, as the company continues to identify and unlock new opportunities and maximize value from its hydrocarbon resources and deliver on its 2030 smart growth strategy.Adding to the 2D and 3D seismic data already acquired across Abu Dhabi, the new seismic survey will cover an area of up to 30,000 km2 offshore and 23,000 km2 onshore.The contract has been awarded by ADNOC to BGP Inc., a subsidiary of China National Petroleum Company (CNPC)…

Asian Oil, Gas Producers Stepping up Activity after Long Lull

Asia's oil and gas producers are starting to revive projects aimed at deflating years of ballooning energy imports after new investment dried up following the 2014 industry crisis. Spending has so far been driven mainly by state oil companies such as India's ONGC, Thailand's PTTEP and PetroVietnam, which need to produce more oil and gas to ensure their countries' energy security, executives said this week during an industry event in Kuala Lumpur, Malaysia. Asia is by far the biggest, fastest-growing consumer of oil, yet its output is falling faster than in any other region.

Allseas Plans World's Largest Construction Vessel

Swiss offshore services firm Allseas is planning to build a vessel big enough to be able to remove the world's largest oil and gas platforms when they reach the end of their production lives, its chief executive said. The vessel, to be called Amazing Grace, is designed to remove the heaviest platforms in a single lift and could reduce decommissioning costs for global oil and gas producers, the firm said. It would be a bigger version of Allseas' existing Pioneering Spirit ship…

Offshore Oil Service Firms Dominate Energy Bankruptcies

Offshore oil drilling and service companies, hurt by the energy industry's shift to lower-cost shale and away from deepwater projects, are dominating the year's energy bankruptcies in North America, according to law firm Haynes and Boone. There were fewer oilfield service companies seeking protection this year than last but those that did have had larger debts. Through October, 44 oilfield services companies filed for bankruptcy in the United States and Canada owing creditors $24.8 billion, compared with 72 companies and $13.48 billion for all of 2016.

US Drillers Add No Oil Rigs as Harvey Slows Production

U.S. energy firms did not add any oil rigs this week as Hurricane Harvey barrelled into the nation's energy heartland, forcing drillers to halt production and refiners to shut plants. The total oil rig count for the week ended Friday stayed at 759, General Electric Co's Baker Hughes energy services firm said in its report on Friday. That compares with 407 active oil rigs during the same week a year ago. Drillers have added rigs in 56 of the past 67 weeks since the start of June 2016. The rig count is an early indicator of future output.

Diamond Offshore Sees Recovery when Oil 'Well over $60'

Rig contractor Diamond Offshore Drilling Inc's Chief Executive Officer Marc Edwards said on Monday oil prices needed to be "well over $60" to spur a recovery in offshore drilling. The company's shares reversed course and were down 2.3 percent at $16.67, with investors shrugging off a beat on quarterly profit and revenue. Global benchmark Brent crude prices have stabilized after a more than two-year slump, with prices hovering around $55 per barrel. "Offshore drilling is cyclical in nature…

US Offshore Regulator to Unveil Tougher Environmental Safeguards

The U.S. government agency created after the 2010 Deepwater Horizon oil spill plans in coming weeks to unveil tougher financial requirements for offshore oil producers aimed at protecting taxpayers from the risk of cleaning up abandoned oil rigs, an agency executive told Reuters. Under the new guidelines, the Bureau of Ocean Energy Management (BOEM) will demand additional guarantees to cover producers' legal obligation to plug offshore wells and dismantle rigs in the Outer Continental Shelf once they have extracted oil and gas…

Weak Oil Pushes SBM Offshore to Axe More Jobs

SBM Offshore's first-half results lagged analysts' expectations on Wednesday as challenging conditions persisted in the oil industry and the Dutch oil services company announced an additional 250 job cuts. It said it did not expect a full recovery in its business until 2018, after its revenues slid 40 percent in January-June. Oil and gas producers slashed their budgets in the past two years as crude oil prices tumbled, which in turn dented revenues and profits at oilfield service providers.

Hurricane Warning Issued for Florida; Madeline Weakens off Hawaii

Forecasters and public officials urged Floridians to prepare for potentially catastrophic flooding and damaging winds as Tropical Storm Hermine was expected to become a hurricane by the time it reached Florida's northern Gulf Coast on Thursday. A hurricane warning was in effect for the Florida panhandle from the Suwannee River to Mexico Beach as the strengthening storm was expected to sweep across northern parts of the state and then northeast along the Atlantic Coast, the National Hurricane Center said in an advisory. The forecast of rough weather prompted Florida Governor Rick Scott to declare an emergency on Wednesday as many school districts along the Gulf Coast canceled after-school activities and ordered students to stay home on Thursday.

GE to Merge Oil & Gas Unit with Baker Hughes

General Electric Co said on Monday it would merge its oil and gas business with Baker Hughes Inc, creating the world's second-largest oilfield services provider as competition heats up to supply more-efficient products and services to the energy industry after several years of low crude prices. The deal to create a company with $32 billion in annual revenue will combine GE's strengths in making equipment long-prized by oil producers with Baker Hughes's expertise in drilling and fracking new wells. Shares of Baker Hughes were down nearly 7 percent, a drop that executives said likely was due to the deal's complicated structure. GE is already the world's largest oilfield equipment maker, supplying blowout preventers, pumps and compressors used in exploration and production.