Russian Warship Fires Warning Shots at Cargo Ship in Black Sea

A Russian warship on Sunday fired warning shots at a cargo ship in the southwestern Black Sea as it made its way northwards, the first time Russia has fired on merchant shipping beyond Ukraine since exiting a landmark UN-brokered grain deal last month.In July, Russia halted participation in the Black Sea grain deal that allowed Ukraine to export agricultural produce via the Black Sea. Moscow said that it deemed all ships heading to Ukrainian waters to be potentially carrying weapons.On Sunday, Russia said in a statement that its Vasily Bykov patrol ship had fired automatic weapons on the Palau-flagged Sukru Okan vessel after the ship's captain failed to respond to a request to halt for an inspection.Russia said the vessel was making its way toward the Ukrainian port of Izmail.

Obscure Traders Ship Half Russia's Oil Exports to India, China After Sanctions

A Liberian-flagged oil tanker set sail in May from Russia's Ust-Luga port carrying crude on behalf of a little-known trading company based in Hong Kong. Before the ship had even reached its destination in India, the cargo changed hands.The new owner of the 100,000 tonnes of Urals crude carried on the Leopard I was a similarly low-profile outfit, Guron Trading, also based in Hong Kong, according to two trading sources.The number of little-known trading firms relied on by Moscow to export large volumes of crude exports to Asia has mushroomed in recent months…

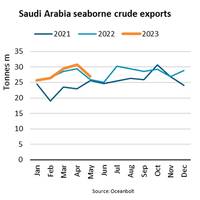

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

US Confiscates Iran Oil Cargo on Tanker Amid Tehran Tensions

The U.S. confiscated Iranian oil on a tanker at sea in recent days in a sanctions enforcement operation, three sources said, and days later Iran seized another oil-laden tanker in retaliation, according to a maritime security firm.As oil markets remain jittery, the cargo seizure is the latest escalation between Washington and Tehran after years of sanctions pressure by the U.S. over Iran's nuclear program. Iran does not recognise the sanctions, and its oil exports have been rising.Tehran says its nuclear program is for civilian purposes while Washington suspects Iran wants to develop a nuclear bomb.Maritime security company Ambrey said the U.S. confiscation took place at least five days before Iran's action on Thursday.

Russia Accuses Ukraine of Sabotaging Grain Deal with Bribery Scheme

Russia on Wednesday accused Ukraine of sabotaging the Black Sea grain deal by demanding bribes from ship owners to register new vessels and carry out inspections under the cover of a deal the United Nations hopes could ease a global food crisis.There was no immediate comment on the allegation, levelled by Russia's Foreign Ministry, from Ukraine which has blamed Moscow for problems with the agreement. Moscow did not immediately provide documentary evidence to back its assertion.Russia and Ukraine both say the deal…

Outlook for Black Sea Grain Deal is 'Not So Great', Kremlin Says

The Kremlin on Wednesday said the outlook for the landmark U.N.-brokered Black Sea grain deal was not great as promises to remove obstacles to Russian agricultural and fertilizer exports had not been fulfilled.The grain deal is an attempt to ease a food crisis that predated the Russian invasion of Ukraine, but has been made worse by the most deadly war in Europe since World War Two.The agreement was first signed by Russia, Ukraine, Turkey and the United Nations in July last year and has twice been extended.On paper…

Russia Warns West: We May Work Around the Black Sea Grain Deal

Russia warned the West on Friday that unless obstacles to its exports of grain and fertilisers were removed, then Ukraine would have to export grain over land and Moscow would work outside the UN-brokered landmark grain export deal.The Black Sea grain deal is an attempt by the United Nations to ease a food crisis that predated the Russian invasion of Ukraine, but was made worse by the most deadly war in Europe since World War Two.The deal, first signed by Russia, Ukraine, Turkey…

US Plans No Wider Easing of Sanctions on Venezuela, Official Says

The U.S. government is not planning a systematic easing of sanctions on Venezuela after an initial round allowed partners of state-run oil firm PDVSA to resume taking oil for past debts, a State Department official said.In November, Washington issued a six-month license allowing Chevron Corp. to expand operations and export Venezuelan oil to the United States. Eni and Repsol also began taking Venezuelan crude for debt with U.S. approvals, This year, Trinidad and Tobago received a U.S. nod to jointly development an offshore natural gas field with Venezuela. Those moves by U.S.

EU Tentatively Agrees $60 Price Cap on Russian Seaborne Oil

European Union governments tentatively agreed on Thursday on a $60 a barrel price cap on Russian seaborne oil - an idea of the Group of Seven (G7) nations - with an adjustment mechanism to keep the cap at 5% below the market price, according to diplomats and a document seen by Reuters.The agreement still needs approval from all EU governments in a written procedure by Friday. Poland, which had pushed for the cap to be as low as possible, had as of Thursday evening not confirmed if it would support the deal…

New Dry Bulk Commodity Analytics Company Launched

DBX, a new dry bulk commodity analytics firm based in London, officially launched earlier this year having successfully completed Signal Venture’s incubation program, and it has now initiated a round of seed funding.The venture started in the summer of 2020 with all around support from Signal Ocean. This support included financial, data, technology and recruitment, OilX, an oil commodity analytics firm previously launched by Signal, also provided high level technical support.DBX…

IEA Says World Oil Demand to Rise 2% in '23

World oil demand will rise more than 2% to a record high of 101.6 million barrels per day (bpd) in 2023, the International Energy Agency said on Wednesday, although sky-high oil prices and weakening economic forecasts dimmed the future outlook.The Paris-based IEA also said in its monthly report supply was being constrained because of sanctions on Russia over its invasion of Ukraine."Economic fears persist, as various international institutions have recently released downbeat outlooks…

Vitol Made Record Net Profit in 2021

Global energy trader Vitol Group made a record net profit of just over $4 billion last year, sources familiar with the matter said, as oil, natural gas and other commodity prices soared.Vitol, the world's biggest independent oil trader, declined to comment.The unaudited result beats its previous record net profit in 2020, when oil markets were upended by the COVID-19 pandemic. Bloomberg reported Vitol made $3.2 billion in 2020. The company does not disclose its net profit.Last week, Vitol said revenues leapt to $279 billion in 2021 as oil prices recovered from 2020 lows.

Oil Hits Seven-year High

Oil prices surged to seven-year highs on Friday, extending their rally into a seventh week on ongoing worries about supply disruptions fueled by frigid U.S. weather and ongoing political turmoil among major world producers.Brent crude rose $2.16, or 2.4%, to settle at $93.27 a barrel having earlier touched its highest since October 2014 at $93.70.U.S. West Texas Intermediate crude ended $2.04, or 2.3%, higher at $92.31 a barrel after trading as high as $93.17, its highest since September 2014.Brent ended the week 3.6% higher…

How a Russian-Ukraine Conflict Might Hit Global Markets

A potential invasion of Ukraine by neighboring Russia would be felt across a number of markets, from wheat and energy prices and the region's sovereign dollar bonds to safe have assets.Below are four charts showing where a potential escalation of tensions could be felt across global markets:Safe havensInflation at multi-decade highs and impending interest rate rises have made for a bad month for bond markets, but an outright Russia-Ukraine conflict could change that.Two-year U.S.

US Gulf of Mexico Oil Production Losses Lead to Cargo Cancellations

U.S. oil offshore losses remained at 76% on Thursday after Hurricane Ida hit the Gulf of Mexico, according to government data, which prolonged outages and caused the first oil cargo shipment cancellations to buyers in Asia.Production should be disrupted for several more days amid lasting damages to transfer stations and offshore facilities used by different companies, analysts said, with impact to oil prices."It seems to be at least more than a week away until most of the shut-in Gulf of Mexico production is restored…

US Fuel Supply Response Slowed by Mothballed Oil Tankers

Efforts to get fuel supplies to areas in the United States facing shortages have been slowed because shipowners have mothballed U.S.-flagged oil tankers that can make coastal voyages, shipping sources said on Wednesday.The shutdown of the Colonial Pipeline network to thwart a cyber attack has disrupted nearly half the East Coast's fuel supply and left parts of the southeast facing a severe shortage of gasoline and diesel. Colonial said it began to restart on Wednesday but warned it would take several days for fuel supply chain to return to normal.Pump prices have risen to a seven-year high as motorists rush to fill their tanks.One way…

Fourteen US States Sue Biden Administration Over Oil and Gas Leasing Pause

Fourteen U.S. states including Louisiana and Wyoming filed suits on Wednesday against President Joe Biden's administration to challenge his pause on new oil and gas leasing on federal lands and waters.The legal actions, which seek to restore regular federal drilling auctions, come a day before the administration is set to launch a review of the oil and gas leasing program.Biden, a Democrat, in January signed an executive order putting on hold new leasing pending that review. During his election campaign…

Oil Prices Jump 5% on OPEC+ Output Talks, Iran Tension

Oil prices climbed nearly 5% on Tuesday after news that Saudi Arabia will make voluntary cuts to its oil output, while international political tension simmered over Iran's seizure of a South Korean vessel.Brent crude futures rose $2.51, or 4.9%, to settle at $53.60 a barrel. U.S. West Texas Intermediate crude ended $2.31, or 4.9%, higher at $49.93 a barrel.Saudi Arabia will make additional, voluntary oil output cuts of 1 million barrels per day (bpd) in February and March. The…

Petrobras Moves European Commercial Activities from London to Rotterdam

Brazilian oil giant Petrobras will concentrate its European commercial activities in Rotterdam. This will result in the transfer of Petrobras Europe Ltd.’s commercial activities from London, England to Petrobras Global Trading B.V. in Rotterdam. The change will start in the next quarter and must be completed by the second half of 2021.The focus on Rotterdam is in line with the Petrobras policy of rationalizing its international presence in 2021, taking into account the world’s three major oil markets: Europe, North America and Asia.

China Ramps up US Oil Purchases Ahead of Trade Deal Review

U.S. crude oil shipments to China will rise sharply in coming weeks, U.S. traders and shipbrokers and Chinese importers said, as the world’s top economies gear up to review a January deal after a prolonged trade war.Chinese state-owned oil firms have tentatively booked tankers to carry at least 20 million barrels of U.S. crude for August and September, the people said, moves that may ease U.S. concerns that China’s purchases are trending well short of purchase commitments under the Phase 1 of the trade deal.China had emerged as a top U.S.

China's Oil Port Congestion to Stretch On Well into August

Congestion at China's east coast oil ports that is adding to costs for shippers and importers is likely to run well into August, with crude shipments set to hit another record high this month, according to analysts and Refinitiv data.The massive inflows are straining offloading facilities, while refiners and port operators in Shandong province -- home to a quarter of China's refining capacity -- are rushing to build new storage tanks.July seaborne arrivals into the world's biggest oil importer are expected to surge to 14.4 million barrels per day…

Wärtsilä’s Eskola: Impact of COVID-19 "Clearly Visible" on 1H Results

Wärtsilä Corporation’s half year financial report through June 2020 was littered with bad news due to the impact of the COVID-19 pandemic, with order intake and order book both down – 19% and 12% respectively in the January to June 2020 period. But the bad news was countered with a report of stable net sales and strong cash flow.“The adverse impact of COVID-19 on both our own operations and those of our customers increased during the second quarter. This was clearly visible in the decrease in orders received across all businesses,” Jaakko Eskola, President and CEO, Wärtsilä.

Interview: Eddie Brown, Cummins' Director of Business Development, Marine

How do you see business today, and where is Cummins looking for opportunities as COVID-19 and volatile oil markets generate market uncertainty?Even in the current state, we are still seeing a solid level of interest and activity in the commercial marine space. Scheduling has been impacted and some areas have slowed down, but overall, the marine industry is very much still active around the world. When we take a closer look at some of the segments within the commercial marine space, differences begin to emerge.