Profitability Still a Way Off for Tanker Shipping -BIMCO

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

China’s 2021 Crude Oil Imports Down 5.7% - BIMCO

Chinese crude oil imports fell year-on-year in June and July, ending a streak of five months of accumulated year-on-year growth. After the first seven months of 2021, China’s crude oil imports are down 5.7% compared with the same period last year. January to July imports stood at 301.9m tons, an 18.1m tons decline from January to July 2020.The June and July decline in crude oil imports is not attributable to unusually low imports as much as to unusually high imports in June and…

China Crude Processing Spikes to All-time High

Chinese refinery crude oil throughput has reached its highest level ever, with total processed volumes up 12% in the first five months of this year compared to 2020, and up 10.9% from the same period in 2019. In total 292.7m tonnes have been processed so far this year according to the National Bureau of Statistics China.Despite the 12.0% growth in crude oil processing, Chinese crude oil supply, which includes imports and domestic production, has only grown by 2.3% in the first five months of this year.

2021: A Year of Offshore Energy Potential

After what has seemed like the longest year ever, the offshore energy sector is emerging from a position of strength, from the standpoint of both economics and sustainability. Between the lockdowns implemented to reduce COVID-19, which reduced energy demand, to the oil price war between state-backed producers, 2020 was an unprecedented storm that hit the American offshore energy market. Now, there are unmistakable signs of a recovery, and policy makers in Washington, D.C. should embrace the opportunity before us to for sustained economic…

Tanker Shipping Facing a Tough Year Ahead, Says BIMCO

After a turbulent year, low demand looks set to plague the market in the coming months combined with too many ships fighting for too few cargoes in both the crude oil and oil product segments, says the oil tanker shipping overview and outlook released today by BIMCO.Demand drivers and freight ratesThe realities of the pandemic are setting in for the tanker market. The record-breaking Q2 2020 is a distant memory and, instead, the market faces a slow recovery with low demand, stock…

BIMCO: Tanker Market Hangover Continues

Tanker shipping was in many ways the odd one out of the shipping sectors in 2020; at the start of the pandemic, the market was strong, only to finish off the year in the doldrums, while the other sectors stayed profitable. Even a demand boost in December only managed to lift earnings slightly, raising the question, what will it take for tankers to return to profitability?In the immediate aftermath of the pandemic being declared, tanker shipping appeared immune, but it too has suffered from lockdowns and travel restrictions.

BIMCO: Zero Tonnes of Saudi Crude Oil Imported by the US

In the seven days up to 1 January 2021, the US did not record any crude oil imports from Saudi Arabia. It is the first time this has happened. Previously, imports have averaged several hundred thousand barrels per day (bpd), BIMCO said in "BIMCO’s Shipping Number of the Week" report.For the moment, this drop to zero appears to be a one off as imports in the week ending 8 January totalled 328,000 bpd. The drop does however not come completely out of the blue as volumes on this trade have been falling for many years now.On average…

Interview: John Batten, CEO, Twin Disc

How have major events such as the U.S./China trade war, oil price fall and COVID-19 impacted Twin Disc’s commercial marine business to date, and what adjustments have you made in response?These are the three things that I’ve been highlighting in employee communications and with investors over the last few months. For us, COVID was just the third punch after the other two. China is typically our second largest market after the U.S., and we lost lots of orders to our competitors as the trade war started to affect us. It’s rebounding a little, but it definitely impacted our sales into China.

Oil Tanker Transits Through the Suez Canal Drop 27% YOY -BIMCO

The number of oil tankers passing through the Suez Canal in October has declined sharply, down 27% for the month year-on-year amid persisting subdued demand for oil transport since the April crash in oil prices that fueled high demand for oil tankers, according to shipping association BIMCO.A total of 3,708 oil tankers passed through this key chokepoint for global shipping between January 1 and October 31, representing 76 less oil tanker transits (or a 2% decline) compared to the same period last year, BIMCO says.

U.S. Sends First Crude Shipment to Saudi Arabia in Years

The United States sent a shipment of crude to Saudi Arabia in June, data from the U.S. Census Bureau showed on Wednesday, in what appears to be the first such delivery since the U.S. ban on crude exports ended in 2015.The United States shipped about 550,000 barrels, or 18,300 barrels per day (bpd), of crude to Saudi Arabia in June, U.S. Census data shows. The U.S. Energy Information Administration has no recorded instances of a U.S. crude shipment to Saudi Arabia.U.S. Census data shows a miniscule 1,000-barrel shipment to Saudi Arabia in 2002.

Suez Canal Ship Transits Rise Amid COVID-19

Transits through the Suez Canal, the beating heart of the Egyptian economy, have stayed remarkably resilient to the fallout of the COVID-19 pandemic if judging by total transits of the three commercial shipping sectors which are up 8% year-on-year. This is despite bleak economic growth prospects world-wide following the pandemic, and highlights that shipping remains the backbone of the global economy.It is often said that a picture says more than 1,000 words, but 6,166 ship transits in the Suez Canal can certainly also tell an interesting tale.

A New Role for Service Providers Amidst Energy Upheaval

In today’s energy industry, things are moving fast. The upheaval brought about by COVID-19 and exacerbated by the Russia-Saudi Arabia oil price war has been so profound that the International Energy Agency (IEA) has described the situation as “a once in a century event for energy demand”. This is supported by current IEA predictions which suggest a 6% drop in global energy demand in 2020 – seven times worse than the plunge in demand that followed the 2008 recession.Amid what the IEA has dubbed a “dismal” year for fossil fuels…

LR’s Nick Brown: Climate Emergency is “same magnitude, different time domain" to COVID-19

As the maritime industry settles in on a COVID-19 induced ‘new norm,’ and long-range planning is dramatically shortened,, Nick Brown, Marine and Offshore Director, Lloyd’s Register, said that while much deserved focus must be paid to the current crisis, the industry cannot lose sight of another one looming just as large: climate change. “We strongly maintain that the climate emergency is an event of the same magnitude, just with a different time domain to COVID-19," Brown told Maritime Reporter & Engineering News recently.

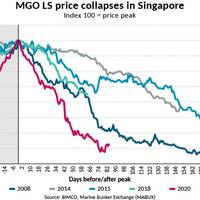

BIMCO: 2020 and the Collapse of Bunker Fuel Markets

The sulfur regulation from the International Maritime Organization (IMO) that came into force on 1 January 2020 took the center stage in the shipping industry at outset of the new decade. Four months on, the spotlights have turned to the coronavirus and the OPEC+ oil price war.The outlook for global economic growth remains bleak as the world is faced with the largest recession since the Great Depression in the 1930s.Commodity prices have declined across the board and most recently…

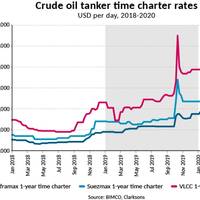

Crude Oil Tanker Earnings Drop 68% in Nine Days -BIMCO

Crude oil tanker earnings have come down sharply in recent weeks with very large crude carrier (VLCC) earnings from the Middle East Gulf to China dropping 68% in just nine days (from $222,591 per day on April 22 to $71,885 per day on May 4), according to BIMCO. In the same period, daily VLCC earnings from the Middle East Gulf to the U.S. Gulf have plunged nearly 80% (from $162,433 per day to $36,249).The window of extraordinary earnings closed at the end of April with the OPEC+ oil production cuts of 9.7 million barrels per day (bpd) on May 1, reducing the flood of oil in the market.

While Oil Prices Plummets, Tanker Rates Fly High

If one ever needed proof that, no matter how dire the situation, there is always a silver lining, look no further than the crude tanker market, which has seen it day rates skyrocket in the face of a global pandemic that has effectively ground world commerce to a crawl.As is the case with other gravity defying business phenomena, geopolitics is a central factor, in this case a battle between Russia and Saudi Arabia to flood the world with oil in the face of declining demand and…

Valaris to Lose $620,000 a Day Rig Deal with Total after BOP Drop off Angola

Valaris, the world's largest offshore drilling company by fleet size, is set to lose one of the most lucrative contracts in the offshore drilling industry today after it recently accidentally dropped a blowout preventer stack to seabed offshore Angola.The contract, at a day rate of $620,000 per day, is with the French oil major Total for the drillship Valaris DS-8. The Samsung GF12000 designed drilling rig has been drilling for Total since 2015.As previously reported, Valaris earlier in March said it had accidentally dropped Blowout Preventer Stack to the seafloor of Angola, while the rig was moving between well locations. It then warned the customer might seek to terminate the contract as a result of the incident.In an update on Thursday…

No Need for a Jones Act Waiver -AMP

America's maritime industry has hit back at a recent request by U.S. shale drillers to waive the Jones Act, a law requiring goods transported between U.S. ports to be carried on ships that are built, owned and operated by Americans.The American Exploration and Production Council, which represents independent oil firms that have been thrashed by an oil price war between Saudi Arabia and Russia and the fallout from the global coronavirus outbreak, sent a letter to congressional…

Saudi's Bahri Books 14 VLCCs

Saudi Arabian shipping company Bahri chartered more than a dozen very large crude carriers (VLCCs) in Persian Gulf in 24 hours.According to Reuters, the Saudi Arabia’s National Shipping firm has tentatively chartered as many as 14 super-tankers to ship crude oil to customers worldwide, as the Kingdom follows through with its promise to boost crude oil output.The spike in bookings by Bahri has helped to more than double the charter rates for VLCC amid this week’s ‘fixing frenzy’, shipping sources said. The bookings by Bahri are in addition to its own fleet of 42 VLCC’s which it mainly uses to ship Saudi oil to customers across the world…

Valaris Gears up for Possible Debt Restructuring

Offshore oil driller Valaris PLC is exploring debt restructuring options as it grapples with a rig accident and a broader collapse in energy prices, people familiar with the matter said on Friday.Valaris has tapped debt restructuring attorneys at law firm Kirkland & Ellis LLP for advice on ways to rework its roughly $6.5 billion debt pile, and is exploring enlisting a turnaround firm that specializes in urgently addressing stressed finances to bolster its roster of advisers, the…