Crude Oil Tanker Earnings Drop 68% in Nine Days -BIMCO

Crude oil tanker earnings have come down sharply in recent weeks with very large crude carrier (VLCC) earnings from the Middle East Gulf to China dropping 68% in just nine days (from $222,591 per day on April 22 to $71,885 per day on May 4), according to BIMCO. In the same period, daily VLCC earnings from the Middle East Gulf to the U.S. Gulf have plunged nearly 80% (from $162,433 per day to $36,249).The window of extraordinary earnings closed at the end of April with the OPEC+ oil production cuts of 9.7 million barrels per day (bpd) on May 1, reducing the flood of oil in the market.

MISC Group Q1 Financial Results

MISC has announced its financial results for the financial period ended March 31, 2019.Financial Highlights:Group revenue for the quarter ended March 31, 2019 was higher than the corresponding quarter ended March 31, 2018.Group profit before tax for the quarter ended March 31, 2019 was higher than the corresponding quarter ended March 31, 2018.Group Revenue, Operating Profit and Profit Before Tax for the Quarter Ended March 31, 2019Group revenue for the quarter ended March 31,2019 of $544 million was 12.7% higher than the corresponding quarter’s revenue of $482 million.

Euronav Freight Rates Sag in Challenging Market Conditions

Belgian tanker operator Euronav's average spot rates for its very large crude carriers (VLCCs) fell 53.8 percent to $18,725 per day in the first quarter, as challenging conditions continued in the freight market, the company said on Wednesday. Tanker companies have been suffering from a glut of excess capacity which has weighed on rates, while OPEC oil production cuts have added to the pressure. "The rebalancing of the tanker market requires further affirmative action in reducing primarily older tonnage, restraint from contracting and a supportive oil price structure," Chief Executive Paddy Rodgers said in a statement. So far in the second quarter the company's VLCC fleet has earned about $13,187 per day and 42 percent of the available days have been fixed, Euronav said.

US to Become Oil and Gas World Leader in Long Term - IEA

The head of the International Energy Agency Fatih Birol said on Thursday the United States would - in the long term - become the "undisputed leader of oil and gas production worldwide". Speaking at the U.N. climate conference in Bonn, Germany, he said the agency expected oil markets to rebalance next year if oil demand remained "more or less" as robust as it is today and if OPEC and non-OPEC continued with their oil production cuts. (Reporting by Ahmad Ghaddar; Editing by Mark Potter)

Euronav Reports Lowest Freight Rates since 2013

Belgian tanker operator Euronav reported a sharp drop in core profit for the first nine months of the year as freight rates in the oil tanker sector continued to fall. Excess tonnage in the global tanker market has put pressure on freight rates, as a large wave of new deliveries this year has offset scrapping. "Freight rates remained under sustained pressure ... particularly in August as seasonally low levels of cargo and new tonnage entering the market combined to drive rates to lowest levels since 2013," Chief Executive Paddy Rodgers said in a statement.

Saudi, UAE Ports Bar Qatari Flagged Ships

Ports in Saudi Arabia and the United Arab Emirates' barred ships flying Qatari flags after the two countries broke off diplomatic ties with Doha, in a move that raised fears of disruption to oil and gas shipments from the Gulf OPEC member. The Saudi Ports Authority has notified shipping agents not to accept vessels flying Qatari flags or ships owned by Qatari companies or individuals, it said on its Twitter account on Monday, adding that Qatari goods would not be allowed to be unloaded in Saudi ports. "Vessels flying the flag of Qatar or vessels destined to or arriving from Qatar ports are not allowed to call on the Port of Fujairah or Fujairah Offshore Anchorage regardless of the nature of their call until further notice…

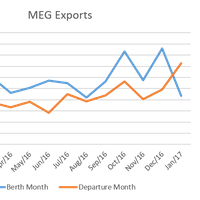

Middle East Gulf Exports Soar in January 2017

During January – a month when all eyes were on oil production cuts – exports leaving the Middle East Gulf (MEG) region hit the highest level in at least two years, according to Genscape. At the end of November 2016, the Organization of the Petroleum Exporting Countries (OPEC) addressed the perceived global oversupply of oil and consequent low prices. OPEC members agreed that all countries, except Iran, would cut total production by 1.2 million barrels per day (bpd), starting on January 1.

Asia Tankers-VLCC Rates to Slide on Lower Cargo Volumes

34 VLCC MidEast cargoes fixed for early Jan -Reuters terminal; only nine fixed so far for mid-Jan. Freight rates for very large crude carriers (VLCCs), which hit a new nine-month high this week, are on course to soften amid a weaker cargo market as owners wait for more charters to be released from the Middle East and labour unrest affects loading programmes from West Africa. "I think a lot of owners have started to give up now. It's way too quiet - a lot of owners expected this week to be really busy but it has been dead quiet," a European supertanker broker said on Friday. "Owners are sitting on tonnage but there is no cargo," the broker added. Around 34 cargoes have been fixed for loading in the Middle East in the first 10 days in January, according to data on the Reuters Eikon terminal.

Prices Stay High As OPEC Plans To Maintain Curbs

Oil prices marched boldly along near 32-month highs last week after key OPEC exporters said output cuts should be kept in place until March next year. On Sept. 14 Benchmark Brent blend for delivery in October was trading 20 cents firmer at $23.68 a barrel, just four cents off a 32-month high touched the day before. Brokers cautioned that technical factors to do with the expiry Sept. 15 of the October contract on London's futures market had inflated Brent's value. However, they agreed the trend was moving in favor of the Organization of the Petroleum Exporting Countries, the producer group of Middle Eastern, Asian, African and Latin American countries responsible for 60 percent of the world's oil exports.