IMO 2020: Countdown to Cutting SOx Emissions

International Maritime Organization (IMO) has been preparing ahead of the implementation date. From 1 January 2020, under IMO's MARPOL convention for the prevention of pollution from ships.Accordingly, the sulfur content of fuel oil used by ships operating outside designated emission control areas shall not exceed 0.50% - representing an 80% cut from the current 3.50% limit. New requirements for ships to cut sulfur oxide emissions enter into effect on 1 January 2020, marking a sea change in fuel used by ships, globally, which will significantly reduce air pollution from ships with positive benefits for human health and the environment.At a roundtable industry meeting hosted by IMO at its London Headquarters (21 June)…

Asia VLCC Rates Fall to Four-year Low

Freight rates for very large crude carriers (VLCCs) on Asian routes show little sign of reviving although Hurricane Harvey, which threatens to ravage the U.S. Gulf coast oil refining industry over the weekend, could provide a fillip, brokers said. That came as average weighted VLCC freight rates on all routes sank to their lowest in four years this week to around $9,000 per day. Rates are even lower on some routes after CPC fixed a VLCC late Thursday for a trip from the Middle East to Taiwan at 36.75 on the Worldscale measure and S-Oil fixed a VLCC to South Korea at W36.

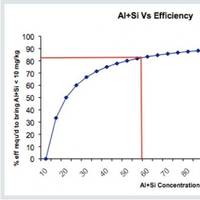

Catfines: Uncertainty Must Be Addressed

Earlier this year the International Organization for Standardization (ISO) published a revised edition of its ISO 8217 specifications for marine fuels, which still maintains a 60 mg/kg limit for catfines (catalytic fines). It’s not rare to hear comments about this threshold being on the high side. A recent test conducted by the Fuel Oil Bunkering Analysis and Advisory Service (FOBAS) takes the debate to a new level. It shows that a number of bunker samples delivered in Fujeirah…

US Refiners' Group Wants Wide Debate on Oil Exports

The U.S. oil refining industry's association is not opposed to lifting the country's 40-year-old ban on crude exports as long as the move is part of a bigger effort to lower barriers to trade, the group's new head said on Tuesday. "We're not opposed to lifting the export ban, but we would like to think there could be a broader discussion," about all trade barriers in petroleum markets, Chet Thompson, president of the American Fuel & Petrochemical Manufacturers (AFPM), told reporters. Other trade barriers include the Jones Act, which requires ships servicing coastal businesses to be built in the United States and mostly staffed by U.S.

ICS Disappointment at IMO Fuel Study

Switch to Low Sulphur Fuel has Implications for Shore Based Industry Too says ICS. The International Chamber of Shipping (ICS), whose member national shipowners’ associations represent more than 80% of the world merchant fleet, has expressed disappointment and concern at a decision by the International Maritime Organization (IMO) to reject its call to accelerate a critical study into the global availability of low sulphur fuel for ships. A small majority of IMO Members States…

Will Low-sulphur Fuel be Sufficiently Available Asks ICS

The International Chamber of Shipping calls on IMO to speed up study of global availability of low-sulphur ship's bunkers. ICS has been expressing concern for some time about whether sufficient fuel will be available to allow ships to comply with strict IMO regulations aimed at reducing sulphur emissions and whether, as result of insufficient supply, the costs for those ships which are able to obtain the required fuels might be prohibitively expensive. In an important submission to the IMO Marine Environment Protection Committee (MEPC), which meets in October, ICS is once again pressing IMO to start work now on a study that can consider the impact all of the major changes required by the new MARPOL regime, before it is too late for the oil refining industry to respond and invest.