Cadeler and Eneti Announce Launch of Share Exchange Offer

Cadeler A/S and Eneti Inc., two offshore wind turbine and foundation installation companies, have announced the commencement of a share exchange offer for all the outstanding shares of common stock of Eneti.The offer is being made pursuant to the Business Combination Agreement, announced on June 16, 2023. The offer is expected to close within Q4 2023.The combined group will be named Cadeler, and be headquartered in Copenhagen, Denmark, with its shares to be listed on the New York…

Cadeler Reports Strong Results, Outlook

Cadeler A/S published its interim financial report for the first half of 2023 presenting a positive result exceeding the guidance projected for the fiscal year 2023. Revenue in the first six months of 2023 was EUR 68 million, which is an increase of 57% against the same period last year. Adjusted EBITDA for the first half of 2023 was EUR 44 million, which is a EUR 21 million increase compared to the same period last year. EBITDA for H1 2023 was EUR 42 million. Profit for the period is EUR 29 million, which is EUR 19 million higher than the same period in 2022.

AMSC Sells Tanker Business

American Shipping Company (AMSC) has signed a deal with Project Merchant Acquisition LLC, a newly-formed company owned and controlled by a fund managed by Maritime Partners, for the sale of its subsidiary American Tanker Holding Company.Pål Lothe Magnussen, CEO of AMSC, said: “The management team at AMSC is pleased that a Maritime Partners managed fund, a leading Jones Act leasing company, is acquiring our Jones Act business. We believe this is the ideal new owner of this business for the next phase in the lifecycle of these assets.

Cadeler and Eneti Agree to Merge

Offshore wind turbine and foundation installation companies Cadeler and Eneti announced they have agreed to merge through a stock-for-stock exchange.The combined company will be named Cadeler, headquartered in Copenhagen, Denmark, with its shares to be listed on the New York Stock Exchange (NYSE) in addition to its current listing on the Oslo Stock Exchange (OSE) with a proforma market capitalization in excess of €1.2 billion. The combined group will operate four vessels on water today and six large-scale state-of-the-art new builds scheduled for delivery from 2024 to 2026.

Wilhelmsen Acquires Stake in Reach Subsea

Wilhelmsen has acquired a 21% stake in Reach Subsea ASA, and together the firms will form a strategic partnership to commercialize the Reach Remote concept, bringing Reach Subsea into new industry verticals and geographical regions.Jan Eyvin Wang, Executive Vice President, New Energy at Wilhelmsen says, “We have been actively assessing the subsea market to find a company that could add complementary scale to our ambition within renewables. We see potential to grow within emerging sectors such as offshore wind…

Offshore Wind: Edda Wind Orders Three Commissioning Service Operation Vessels

Norwegian offshore wind services company Edda Wind has ordered three more Commissioning Service Operation Vessels (CSOV) in addition to the six vessels the company has under construction. The vessels are designed for service operations during the commissioning and operation of offshore wind farms. The three vessels will be prepared for the installation of zero-emission technology in the same way as the first six vessels, based on funding from Enova, according to Edda Wind."Including the three latest newbuildings…

Edda Wind Bags Long-term Charter with Siemens Gamesa

Norwegian offshore wind services company Edda Wind said it has entered into a long-term contract with Siemens Gamesa Renewable Energy for one of its newbuild service operation vessels (SOV).The contract will commence mid-2023, and Edda Wind said it will be able to operate the vessel for the early part of 2023 in what it expects will be a "buoyant short-term market" before entering into the long-term charter.“This is another important milestone for Edda Wind and strong evidence that the company delivers on our ambitions.

Offshore Wind Vessel Firm Edda Wind Plans Oslo IPO

Offshore wind vessel company Edda Wind, owned by Wilhelmsen and Østensjø, on Monday announced plan to launch an offering of shares in the company and to apply for a listing on the Oslo Stock Exchange (the “IPO”).Based in Haugesund, Norway, Edda Wind develops, builds, owns, and operates purpose-built Service Operation Vessels (“SOV”) and Commissioning Service Operation Vessels (“CSOV”) for offshore wind farms.The company owns and operates two purpose-built offshore wind SOVs and…

Marine Battery Firm Corvus Plans 4Q IPO

Marine battery maker Corvus plans an initial public offer (IPO) in the fourth quarter, aiming to list its shares on the Oslo Stock Exchange, its top executive said on Wednesday.The company, which assembles battery cells into giant batteries for ships such as ferries, cruise vessels, tug boats, [and offshore support vessels] expects the global market for such solutions to be worth $10 billion in 2030."We see that already ... the backlog is three times what it was a year ago," Chief Executive Geir Bjoerkeli told an energy conference."To take that growth…

Golden Ocean Exits CCL Pool Joint Venture

Dry bulk shipping company Golden Ocean Group Limited on Tuesdat announced it has terminated its relationship with Capesize Chartering Ltd. (CCL), a joint venture to coordinate the Capesize spot chartering services of Golden Ocean, Starbulk, CTM and Bocimar.Ulrik Andersen, CEO of Golden Ocean Management AS, said, "We have enjoyed our close cooperation with our CCL partners over the last five years. CCL was formed in 2016 to achieve greater commercial scale amid a challenging commercial environment. "Since then, the market has improved, and Golden Ocean has significantly expanded and modernized its fleet, most recently with the acquisition…

Seismic Firm Polarcus Set for Business Wind-down, Delisting from Oslo Exchange

Polarcus Limited, a seismic surveyor in liquidation, is set to be wound down and delisted from the Oslo Stock Exchange.As previously reported, in January this year, lenders took control of the company's vessels after a debt payment default, and decided to sell them and let go all the employees.On February 8, 2021, David Griffin and Andrew Morrison of FTI Cayman, and Lisa Rickelton of FTI London were appointed Joint Provisional Liquidators (JPL) of the struggling seismic services provider by an order of the Court. Liquidators were specifically authorized by the Court to take all necessary steps to develop and propose a restructuring of the company’s financial indebtedness with a view to making a compromise or arrangement with the company’s creditors.Since their appointment…

MPC Container Ships to Acquire Songa Container

MPC Container Ships ASA (MPCC) announced it has reached a deal to acquire fellow Norwegian-based container shipping company Songa Container AS for $210.25 million on a debt and cash free basis. The transaction is expected to be completed by the end of July 2021.Upon closing, MPCC will acquire Songa’s fleet of 11 container vessels, with an average size of 2,250 TEU and an average age of 11.9 years , creating a combined fleet of 75 ships and a total capacity of roughly 158,000 TEU. Nine of the acquired ships are fitted with scrubbers while three are equipped with the highest ice-class.Constantin Baack, MPC Container Ships CEO, said, “This…

New Offshore Wind Service Firm Looking to Raise up to $89M via Private Placement

Integrated Wind Solutions, a newly formed offshore wind service company owned by Norway's Awilhelmsen investment group, is eyeing a private placement of new shares in the company in connection with a listing on Euronext Growth Oslo, aiming to raise up to $89 million.Integrated Wind Solutions describes itself as a company that aims to be a leading offshore wind service player by integrating service operation vessels with engineering and manpower services in the windfarm’s construction and operations phase.

Siemens Gamesa Picks Cadeler to Transport and Install Giant 14MW Offshore Wind Turbines

Offshore wind installation company Cadeler said Wednesday it had won the largest contract in its history.Cadeler, previously known as Swire Blue Ocean, said that offshore wind turbine maker Siemens Gamesa had awarded Cadeler a contract of valued at around $90 million, with an additional $30 million in options, to transport and install giant SG 14-222 DD offshore wind turbines.The turbines are expected to be the largest wind turbines in the world at the time of installation and have an individual capacity of 14 MW.

Danish Offshore Wind Installation Firm Set for Oslo IPO. Picks New Name

Danish offshore wind turbine transportation and installation company Swire Blue Ocean (SBO) is getting ready for listing on the Oslo Stock Exchange, to position the company for the next phase of its growth.Also, Swire Blue Ocean, as a subsidiary of Swire Pacific Offshore, will be rebranded and renamed Cadeler. The company said the new name would reflect the company’s Scandinavian maritime heritage "and its commitment to excellence in maritime operations."In connection with the Mikkel Gleerup…

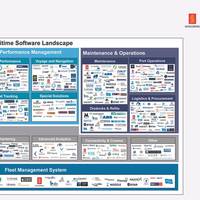

Mapping the Maritime Software Landscape in 2020

Another year has passed since our last mapping of the maritime software landscape, and it is once again time to review the latest developments and trends in this space.Overall, 2019 was another turbulent year for most shipping markets, overshadowed by preparations for the IMO 2020 sulfur regulations, rising geopolitical tensions, the trade war between the USA and China, as well as natural disasters disrupting global supply chains. This article provides insight into the changes seen in the maritime software landscape under these turbulent conditions: On a high-level…

GOGL Profits Up in Q3

The Bermuda registered, Norway based dry bulk shipping company Golden Ocean Group (GOGL) announced a net income of $36.7 million and earnings per share of $0.26 for the third quarter of 2019 compared with net loss of $33.1 million and loss per share of $0.23 for the second quarter of 2019.EBITDA stood at $81.1 million for the third quarter of 2019, compared with $21.5 million for the second quarter of 2019.Birgitte Ringstad Vartdal, Chief Executive Officer of Golden Ocean Management AS, said: “Our strong performance in the third quarter is the result of our strategic decision to gear our fleet towards modern, fuel-efficient vessels in…

BW Offshore Completes Bond Issue

BW Offshore, a provider of floating production services to the oil and gas industry, has successfully completed a NOK 900 million senior unsecured bond issue with a coupon of three months NIBOR + 4.50% and maturity in December 2023.The Oslo Stock Exchange-listed company said that the settlement of the new bond issue is scheduled for 4 December 2019.The existing NOK bonds have either been repurchased as part of the offering or will be called with settlement mid-January 2020.In combination with the USD 297.4 million convertible bond issue announced on 5 November 2019, the new bond successfully concludes the company’s refinancing of its existing NOK bonds maturing between 2020 and 2022…

Borr Drilling Launches US IPO

Offshore drilling contractor Borr Drilling has launched the initial public offering (IPO) in the United States of 5 million of its common shares on July 29.The drilling company that operates 27 rigs said that the offering of common shares on the New York Stock Exchange is at prices it expects to be ‘substantially similar’ to its share price on the Oslo Bors.The IPO price will be determined based on the book-building process and the closing price of its shares on the Oslo Børs on the pricing date of the offering. The offering will not be conducted as a rights offering and no repair offer will be made as the existing shareholders of the company do not have any pre-emptive rights.NYSE approved the company to list under the ticker symbol BORR.

Ocean Yield Adds Another VLCC Newbuild

Norway-based shipping company Ocean Yield has taken delivery of Nissos Antiparos, a VLCC newbuild delivered from Hyundai Heavy Industries in South Korea, the fourth and final VLCC that has been delivered to the company in 2019.The VLCC commenced a 15 years' bareboat charter to Okeanis Eco Tankers Corp with a 5 years' sub-charter to Koch Shipping Pte. Ltd.Okeanis Eco Tankers was established in 2018 by the Alafouzos family to take over its fleet of modern tanker vessels and tanker newbuildings.With seven tankers built 2015 to 2018 and eight VLCCs for delivery in 2019, the company will focus on eco-designed vessels fitted with scrubbers. The company is listed on the Oslo Stock Exchange under the ticker "OET".

Ocean Yield Takes Delivery of New VLCC

Norway-based ship owning company Ocean Yield ASA has taken delivery of the very large crude carriers (VLCC) Nissos Despotiko.The vessel was delivered from the yard Hyundai Heavy Industries in South Korea and is the second in a series of four VLCCs that will be delivered to the Company in 2019.Upon delivery, the vessel commenced a 15 years' bareboat charter to Okeanis Eco Tankers Corp (Okeanis Eco Tankers) with a 5 years' sub-charter to Koch Shipping Pte. Ltd.Okeanis Eco Tankers was established in 2018 by the Alafouzos family to take over its fleet of modern tanker vessels and tanker newbuildings.With seven tankers built 2015 to 2018 and eight VLCCs for delivery in 2019, the company will focus on eco-designed vessels fitted with scrubbers.

DNO Completes $400mln Bond Placement

The Norwegian oil and gas operator focused on the Middle East and the North Sea, DNO ASA said it has completed the private placement of USD 400 million of new, five-year senior unsecured bonds with a coupon rate of 8.375 percent.The bond placement received strong investor demand across international markets and was oversubscribed, said a press release from Norway's oldest oil company. The bond issue is expected to be settled on or about 29 May 2019, subject to customary conditions precedent.An application will be made for the bonds to be listed on the Oslo Stock Exchange. In connection with the bond placement, the Company has agreed…

Klaveness Combination Carriers to List in Oslo

Norway's Klaveness Combination Carriers (KCC) has raised 350 million Norwegian crowns in a private share placement, valuing the shipping firm at 2.27 billion crowns ($259.57 million) ahead of an Oslo stock market listing on May 22.Following the successful private placement, KCC has declared two options for the construction of the seventh and eight CLEANBU combination carrier with Jiangsu New Yangzi Shipbuilding Co., Ltd in China.The two newbuilds are scheduled for delivery in January and February 2021. Following the declaration, the KCC fleet will grow to 17 vessels within 1st quarter of 2021. The company holds options for further vessels.“We…