Multipurpose Shipping Eyes Recovery -Drewry

The multipurpose shipping market, including the breakbulk and project cargo sectors, has struggled over the last few years, but conditions are ripe for recovery, according to a recent report from shipping consultancy Drewry. A strong start to 2018 in the multipurpose shipping segment is expected to continue as the sector’s recovery advances further on increasing demand, contracting vessel supply and shrinking threats from competing sectors, Drewry reported in the latest edition of its Multipurpose Forecaster and Annual Review.

Silver Lining for the Multipurpose Shipping Market

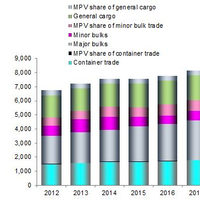

Following another poor year for multipurpose shipping with further erosion of rates making it the worst market in over 10 years, signs of recovery are now evident with momentum expected to build over the next few years, according to the latest Multipurpose Shipping Market Annual Review and Forecast 2017 report published by global shipping consultancy Drewry. Dry cargo demand is forecast to grow by around 3% in 2018, but within that figure it is the market share available to multipurpose vessels which is more interesting. Drewry estimates that the multipurpose (MPV) share of bulk trades in the peak year of 2007 was about 17%, while the share of general cargo trades was nearer 20%.

Multipurpose Shipping Awaits an Elusive Recovery

The multipurpose shipping market is not expected to recover until the end of 2017, when it is anticipated that there will be more bulk demand for the Handy vessels and therefore more breakbulk cargoes for multipurpose vessels, according to the latest Multipurpose Shipping Market Review and Forecast 2016 report published by global shipping consultancy Drewry. The last 12 months have been dreadful for the multipurpose vessel (MPV) market with rates at rock bottom and competition for cargo from every angle. Weak demand, coupled with falling commodity prices and the oversupply of tonnage in competing sectors has brought rates down to levels not seen since just after the global financial crisis.

Drewry: Breakbulk Market Weak Until 2017

Global shipping consultancy Drewry Maritime Research said the breakbulk shipping market is expected to remain weak until 2017, citing low freight rates and high competition. Although demand growth is expected to recover next year after a very poor 2015, and supply growth is likely to be minimal, competition from other sectors will maintain pressure on the breakbulk shipping market, according to the latest edition of the Multipurpose Shipping Market Review and Forecaster, published by global shipping consultancy Drewry. The IMF has downgraded its expectations for both GDP and trade volume growth for 2015 and 2016. Added to this, container shipping demand recorded its slowest rate of growth in the third quarter of this year since 1979 (excluding 2009).

Drewry: Breakbulk Market Weak Until 2017

Although demand growth is expected to recover next year after a very poor 2015, and supply growth is likely to be minimal, competition from other sectors will maintain pressure on the breakbulk shipping market, according to the latest edition of the Multipurpose Shipping Market Review and Forecaster, published by global shipping consultancy Drewry. The IMF has downgraded its expectations for both GDP and trade volume growth for 2015 and 2016. Added to this, container shipping demand recorded its slowest rate of growth in the third quarter of this year since 1979 (excluding 2009).

Multi-purpose Cargo Ships – Market Survey Predicts Rise in Rates

Drewry’s latest Multipurpose Shipping report reveals that rates have started to firm again and the demand outlook is steady for both breakbulk and project cargo, while the fleet supply is under control. MPV market share continued to rise over 2011 as non-containerised cargo volumes benefited from the rise in general cargo trade. Those volumes are expected to continue to rise throughout the forecast period, however Drewry expects the MPV share to drop from 2014 onwards, due to competition from both the container and Handy sectors. One of the principal contributing factors to MPV demand is general and project cargo where there was a significant increase in volumes during 2011.