Cash-strapped Trada Maritime Risks Default

Indonesian shipping company PT Trada Maritime Tbk is at risk of defaulting on its debt of around $31 million to the International Finance Corp (IFC), the private sector lending arm of the World Bank. Trada Maritime received a letter dated May 28 from the IFC requiring it to pay a principal amount of $30.57 million as well as interest and other costs of $774,360 within three working days, the company said in a stock exchange filing on Thursday. Trada Maritime also owes $15 million to Bank of Tokyo-Mitsubishi UFJ Ltd. The company had discussed ways to pay off its debt to its creditors and they will have another meeting on June 17, it said.

Investors Snap Up Shipping Loans, Reflecting Growing Confidence

Global private equity firm KKR has bought $150 million worth of shipping loans from two European banks amid a surge of interest in the industry as world trade in goods picks up along with the global economy. There have been a flurry of deals in recent months for ship finance loans, many of which are being put up for sale by banks under pressure to boost their capital in order to adhere to new, stricter industry legislation born of the financial crisis. The banks have suffered alongside the shipping firms they lent to, as the latter endured one of their worst downturns in decades.

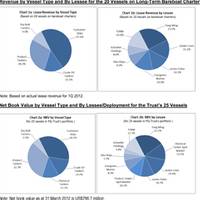

FSL Trust Reports $23 Million 1QFY13 Revenue

FSL Trust Management Pte. Ltd. (FSLTM), as trustee-manager of First Ship Lease Trust, announced the financial results of FSL Trust for the quarter ended 31 March 2013. Revenue for 1QFY13 declined by 11.6% to $23.0 million (USD) compared to the corresponding quarter last year. In 1QFY13, all the trust’s vessels continued to generate revenue from their respective employments on bareboat charters and time charters as well as in the ‘Nordic Tankers 19,000 Stainless Steel Pool’ (Nordic Pool). On a bareboat charter/bareboat charter equivalent (BBCE) basis, revenue fell 4.0% to $19.9 million compared to 1QFY12. The rentals received from 20 vessels leased on long-term bareboat charters continued to support the overall earnings of FSL Trust.

PT Berlian Laju Tanker Restructuring at Crossroads

The company is subject to the jursidiction of several courts, but restructuring is essential in order to avoid bankruptcy. The Company previously announced on 5 October 2012 that some of its subsidiaries which had obtained protective orders from the Singapore High Court under section 210(10) of the Companies Act had the validity of those orders extended for a further 2 months. At a hearing on 27 November 2012, the Singapore High Court granted a further extension of those orders until 10 January 2013. This extension was obtained with the support of several major secured creditors of the Company. The extension granted by the Singapore High Court complements the ongoing PKPU process in Indonesia.

FSL Trust Improves Operational Profile

Deploys all redelivered vessels on longer term employment. FSL Trust Management Pte. Ltd. (“FSLTM”), as trustee-manager of First Ship Lease Trust (“FSL Trust” or the “Trust”), has announced the financial results of FSL Trust for the third quarter ended 30 September 2012 (“3QFY12”). In 3QFY12, FSL Trust successfully delivered its three chemical tankers into the ‘Nordic Siva’ pool as well as a second product tanker, FSL Hamburg, to Petròleo Brasileiro S.A. (“Petrobras”) for the commencement of her three-year time charter. Prior to their redeployment, these vessels were trading in the spot market where earnings were more volatile. Revenue declined 6.5% to US$26.7 million against the same period last year.

FSL TRUST: Vessel Portfolio Positioned for Stability, Opportunity

SINGAPORE – FSL Trust Management Pte. Ltd. (FSLTM), as trustee-manager of First Ship Lease Trust, announced the financial results of FSL Trust for the quarter ended 31 March 2012. Revenue for 1QFY12 rose $2.2 million or 9.3% year-on-year to $26.1 million. The net increase in revenue was contributed by the full quarter lease revenue from the two vessels leased to TORM A/S which were acquired in June 2011, as well as higher freight income from the vessels trading in the spot market.

First Ship Demands Return of Chem Tankers

FSL Trust Management Pte. Ltd., as trustee-manager of First Ship Lease Trust reportes that it has sent notices to its lessees, wholly-owned subsidiaries of PT Berlian Laju Tanker Tbk, to demand for the redelivery of its three chemical tankers, Pertiwi, Prita Dewi and Pujawati, in accordance with the terms of the lease agreements between the Lessees and FSL Trust. This is in addition to the demand for payment stated in the notice of default issued to the Lessees on 7 February 2012.

ABS New Council and Committee Members

Melvyn J. Dennett, Admanthos Shipping Agency, Inc. Jim Bradford, General Manager – Operations, Gulf Offshore N.S. Dr. William J. Dr. David W. Costas M. Fostiropoulos, Chairman, Almi Tankers S.A. Dr. Ian J. Jim Miller, President & CEO, Aker Philadelphia Shipyard, Inc. Mrs. Leif Kristian Nielsen, Executive Vice President, A.P. Dimitrios Patrikios, General Manager, Springfield Shipping Co., S.A. Leonidas S. Polemis, Manager, Remi Maritime Corp. Gerard H. Capt. Yodchai Ratanachiwakorn, Operations Director, Thoresen & Co., (Bangkok) Ltd. I.S. Dalton Marcio Schmitt, Managing Director, Astromaritima Navegacao S.A. William Scott, Manager, Engineering & Technical Services, Tidewater Inc. Peter S. Josh M. Suhartoko, Senior Vice President – Shipping, PT.

Chembulk Announces New Leadership

It has been about fours months since the deal was sealed for PT Berlian Laju Tanker to acquire Chembulk Tankers—the 21st Century Chemical Tanker Company, and the vision of the acquisition is being realized. The addition of 19 new chemical tankers, coupled with the strong Chembulk management team, results in an organization that boasts the third largest stainless steel chemical tanker company in the world. The fleet of 19 includes the Chembulk Kings Point, delivered last month in…

Berlian Acquires Chembulk Tankers

Publicly listed shipping company PT Berlian Laju Tanker (BLT) has acquired Marshall Islands-based chemical tanker company Chembulk Tankers LLC, through its subsidiary Asean Maritime Corporation. Director of BLT, Kevin Wong, said in a statement to the Jakarta Stock Exchange that the cost of the acquisition was $850m. He said the purchase made BLT the third largest chemical tanker operator in the world with 54 ships with a total capacity of 820,600 deadweight tons (DWT). Chembulk now operates 16 double-hull ships capable of carrying a total of 397,200 DWT. It plans to add three more ships by 2009, which will increase its total capacity to 468,200 DWT. [Source: The Jakarta Post]

S&P: Credit Quality of SE Asian Owners Drops

Standard & Poor's said the credit quality of shipping companies across Southeast Asia has suffered in the last two years, with most companies in the "weak to vulnerable" range, compared with "fair to weak" previously. "Earnings vulnerability and aggressive capital structures, characterized by modest and volatile cash flows and high debt levels, have strained the ability of many companies to meet financial obligations in a timely manner," shipping analyst Ee-Lin Tan said. Tan said underpinning the deterioration were limited geographic diversity and exposure to regional trade flows, intense price-based competition led by lower cargo traffic in certain trade routes and excess capacity within several shipping segments.