Suez Blockage May Lead to Large Reinsurance Claims, Broker Says

The blockage of the Suez Canal is likely to lead to large reinsurance claims, adding to upward pressure on marine reinsurance rates, James Vickers, chair of reinsurance broker Willis Re International, told Reuters.Formal investigations began this week into how the giant container ship Ever Given ran aground in the canal, shutting down shipping in the major global waterway for almost a week.The incident and its impact on hundreds of ships delayed in the canal would be a “large loss” for insurance market Lloyd’s of London…

Brokers Calculate Marine Insurance Losses from Beirut Blast

Insurance claims for damage to ships, goods and the port itself after a warehouse explosion last week in the port of Beirut were likely to total less than $250 million, reinsurance broker Guy Carpenter said on Monday.Overall insured losses - including property damage - from the August 4 port warehouse detonation of more than 2,000 tonnes of ammonium nitrate may reach around $3 billion, sources told Reuters last week.The explosion killed at least 163 people, injured more than 6…

Tianjin Blasts a Blip as Marine Insurance Prices Keep Falling

Reinsurance rates in the marine sector continued to fall at the start of the year, in spite of the huge cost of explosions at China's Tianjin port last August, reinsurance broker Guy Carpenter said on Thursday. Rising competition to offer reinsurance and slower activity in China, were two factors depressing rates, it said. The blasts at Tianjin caused insured losses of up to $3.3 billion, Guy Carpenter has estimated, while reinsurer Swiss Re has called it the largest man-made insurance loss in Asia. The explosions killed more than 170 people. "Tianjin has had little or no impact on marine pricing," Chris Klein, head of EMEA strategy management at Guy Carpenter, told a news conference.

China Port Cargo Losses to Reach $1.5 bln

Explosions in the Chinese port of Tianjin last month would lead to cargo losses of at least $1.5 billion, and were having a "significant impact" on the marine insurance sector, a trade body said on Tuesday. "We are expecting to see cargo losses of at least $1.5 billion, with some reports stating that the final figure could be as high as $6 billion," Nick Derrick, chairman of the International Union of Marine Insurance's cargo committee, said in a statement. The incident should provide a "substantial wake-up call to all cargo insurers", he added. Reinsurance broker Guy Carpenter, a unit of Marsh & McLennan , said earlier this month that insurance losses for buildings, cargo, containers and property as a result of the explosions could total up to $3.3 billion.

New Maritime Cargo Insurance – 'Undercover'

Willis Group Holdings has launched a new insurance facility, called Undercover, to protect cargo in transit and in store against all types of political violence, terrorism and war risks, informs shipping trade association Maritime London. The global risk adviser, insurance and reinsurance broker says that, in recent years, cargo losses worth more than one hundred million dollars have not been recovered under traditional cargo insurance policies due to critical exposures being excluded. Willis explains that traditional cargo insurance policies typically exclude certain losses, such as those arising from civil war, insurrection, rebellion and terrorism for goods in store.

Energy Industry Needs Insurance Against Cyber Attacks

Energy companies have no insurance against major cyber attacks, reinsurance broker Willis said on Tuesday, likening the threat to a "time bomb" that could cost the industry billions of dollars. Willis highlighted the industry's vulnerability to cyber threats in its annual review of the energy sector's insurance market, which called on insurers to find a way to provide cover. "A major energy catastrophe - on the same scale as ... Exxon Valdez or Deepwater Horizon - could be caused by a cyber attack, and, crucially, that cover for such a loss is generally not currently provided by the energy insurance market," the insurance broker said.

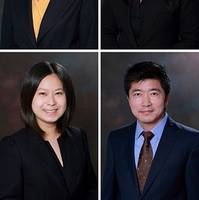

Peak Re Makes Senior Appointments in Hong Kong

Peak Reinsurance Company Ltd., a Hong Kong reinsurer backed by Fosun International Limited and International Finance Corporation, announced four appointments to strengthen its underwriting and research capabilities in the Asia Pacific region. These new hires are part of Peak Re’s strategic plan to bring world-class reinsurance experience to the region, the company said. Lay-Hui Lim joins Peak Re as Senior Vice President (SVP) of Underwriting and will lead the company’s marine business.