Rickmers Maritime Wound Up

Rickmers Trust Management, a trustee-manager of Rickmers Maritime, informed that the trust has been wound up. The units of the trust and its notes shall cease to exist, said its trustee-manager in a Singapore Exchange (SGX) filing. The trust has made final distributions to unsecured creditors, representing a recovery of about 12.1 per cent. "There will be no further distributions or payments, cash or otherwise, to the unsecured creditors of the Trust, including the holders of the S$100 million 8.45 per cent. notes due 2017. The outstanding amount due on the Notes has been paid to the Notes Trustee, DB International Trust (Singapore) Pte Limited," said the statement.

Navios Maritime Completes Acquisition of 14 Container Vessels

The Marshall Islands-based shipping company Navios Maritime Containers has closed the acquisition of the remaining four container vessels and as a result has completed the acquisition of the entire 14 container vessels fleet. Navios Containers acquired the 14 vessels for a total purchase price of $118.0 million plus certain delivery and other operating costs. The Fleet was partially financed through two loan facilities of $61.0 million in aggregate, including a previously announced $40.0 million facility, and a recently completed $21.0 million facility. Following this acquisition, Navios Containers controls a fleet of 14 vessels, totaling 57,100 TEU and the current average age of the fleet is 9.7 years.

Navios Group Rolls Out Containers Division

Navios Group has launched Navios Containers, a vehicle dedicated to the container sector. Navios Containers has the right to acquire all containerships offered to the Group, said Angeliki Frangou, Chairman and Chief Executive Officer. Navios Containers used the proceeds of the private placement, which was closed on June 8, 2017, to acquire five 4,250 TEU vessels from Navios Partners for a total purchase price of $64.0 million. The payment terms included a $24.0 million credit by Navios Partners for a period of up to 90 days from the purchase date at LIBOR plus 375 bps, of which $14.0 million remained outstanding as of June 30, 2017.

Rickmers to Sell its Last 9 Vessels to Navios

HSH syndicate, comprising HSH Nordbank and DBS Bank, has approved the sale of the remaining nine of 14 vessels of Singapore-based Rickmers Trust Management for some $54 million to Navios Partners Containers and Navios Partners Containers Finance. The total consideration will also include an amount to support settlement of operational cash deficits to closing, said Rickmers Trust Management in an update on the winding up of Rickmers Maritime. The sales of these nine vessels are expected to be completed in parts from July 12, 2017, Rickmers said. The sale of the first five containerships was completed in late May. The vessels are secured to the HSH syndicate and as the total proceeds from the sale fall below the loan outstanding due and payable…

Navios Partners Buys Five Rickmers Containerships

Owner and operator of dry bulk and container vessels Navios Maritime Partners L.P. said it has acquired five containerships from Rickmers Maritime Trust Pte for $59 million. The five 4,250 TEU vessels are employed on charters with a net daily charter rate of $26,850 into 2018 and early 2019. The vessels, which are expected to generate approximately $45 million of EBITDA during the charter periods, will be sold to Navios Maritime Containers Inc. Under its agreement with Rickmers Trust, Navios Partners will acquire another nine vessels, four of which are laid up. None of these vessels are employed under long-term charters.

Navios Readies for Rickmers Vessel Acquisition

Navios Maritime Containers announced that it has agreed with investors to sell approximately 15 million of its shares for an aggregate of approximately $75 million of gross proceeds at a subscription price of $5.00 per share. Navios Containers intends to use the proceeds to acquire the 14-vessel container fleet that Navios Maritime Partners previously agreed to purchase from Rickmers Maritime as well as for further vessel acquisitions, working capital and general corporate purposes. The offering is expected to close in full on or about June 1, 2017. Navios Partners will invest $30 million and receive 40% of the equity, and Navios Maritime Holdings will invest $5 million and receive 6.67% of the equity of Navios Containers.

Rickmers Sells Entire Containership Fleet to Navios

Owner and operator of dry bulk and container vessels Navios Maritime Partners L.P. said it has reached an agreement to acquire Rickmers Maritime’s entire containership fleet. The deal, worth about $113 million, will see Navios Partners acquire 14 container vessels from Rickmers Maritime though a wholly owned subsidiary, Navios Partners Containers Inc. Three of the container vessels are 3,450 TEU, and 11 are 4,250 TEU, combining for a total 57,100 TEU. The average age is 9.5 years.

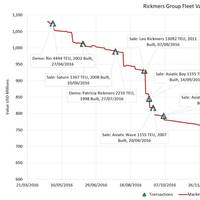

Rickmer's Group Worth $740 Million

Following last month’s news that Singapore Based Rickmers Maritime Trust is to be wound up, Rickmers Holding AG released a statement on April 19 reporting that an understanding had been reached regarding restructuring of the Rickmers Group. It is understood that sole shareholder Bertram Rickmers will reduce his shareholding to below 25 percent, while the remaining 75 percent will be taken by lenders and bondholders. The value today of the Rickmers Group (a Rickmers Holding AG subsidiary) sits at $740 million, according to VesselsValue.

Rickmers Maritime is Latest Singapore Casualty

Company struggled with debt in wake of shipping downturn. Debt includes over $270 mln in secured loans. Rickmers Maritime, a Singapore-listed trust that operates container ships, said it would be wound up as it has been unable to reach an agreement with its lenders to restructure debt or raise new equity. Struggling in the wake of a global shipping downturn, Rickmers joins other Singapore-listed companies from the offshore and marine sectors that have been grappling with debt in the last year. Singapore banks, which were caught off-guard by the collapse of oilfield services company Swiber Holdings last year, have taken a hit as the firms restructure their loans.

Struggling Rickmers Sells Off Another Vessel

Singapore-based Rickmers Trust Management (RTM), a trustee-manager of Rickmers Maritime, is selling off a new ship from its fleet to ensure the company stays afloat. This means an impairment loss in the fourth quarter 2016. Rickmers has entered into a memorandum of agreement (MOA) for the sale of Kaethe C. Rickmers, a Panamax containership. The vessel is securing senior loan facilities extended by HSH Nordbank AG, Singapore Branch and DBS Bank (the HSH Syndicate) to the trust (the HSH Facility). The net proceeds from the sale will be applied towards the payment of operating costs of the secured vessels under the HSH Facility and partial prepayment of the HSH Facility. The Trustee-Manager has also entered into a deed of consent with the HSH Syndicate to obtain their consent for the sale.

Rickmers Sells Vessel to Survive

Rickmers Maritime Trust has completed the sale of a vessel in connection with the settlement of senior loan facilities that German lender Commerzbank's Singapore branch extended to a unit of the trust. "The Trustee-Manager wishes to announce that the sale of the “India Rickmers” vessel has been completed. The Trustee-Manager will update its noteholders and unitholders if there are any further developments," Rickmers Trust Management Pte. Ltd., in its capacity as trustee-manager of Rickmers Maritime has announced in a statement. It did not say how much it had sold the vessel for and how much it had gotten for it. The vessel had been used to secure the loan facilities.

Rickmers Pact with Commerzbank AG

Financially-strapped Rickmers Maritime has entered into a deed of consent with Commerzbank AG, Singapore Branch, reports Reuters. Rickmers Trust Management Pte. Ltd., the holding Trustee, has entered into a memorandum of agreement for sale of "India Rickmers" vessel securing CMB facility. The deed in relation to a settlement of senior loan facilities is extended by CMB to a subsidiary of trust. CMB has agreed to waive repayment of a material portion of remaining debt owed under CMB facility following partial prepayment. Meanwhile, Rickmers has set 21 December as the date for its crucial adjourned bondholders meeting. Bondholders are due vote on a controversial financial restructuring package which Rickmers Trust Management says may result in the trust’s liquidation if not approved.

Rickmers Maritime: Uncertain Outcome casts Doubt on Business

Rickmers Maritime, a Singapore-listed trust that operates container ships, said it faces the risk of going out of business given the uncertain outcome of its discussions with bondholders and senior lenders about restructuring its debt. The firm said it would not be able to pay an interest of S$4.26 million, which is due on Nov. 15, on a S$100 million ($71 million) bond that it has been trying to restructure. "In view of the uncertain outcome of the discussions with senior lenders and the adjourned noteholders' meeting, the trust is unable to demonstrate that it is able to continue as a going concern," Rickmers said in a statement. Rickmers is also currently in discussions with its lenders to obtain waivers on its obligations under existing senior loan facilities.

Record Containership Demolitions has suppressed Fleet Growth - Drewry

A record year for containership demolitions in 2016 has helped suppress total fleet growth close to the rate for demand. To repeat that feat the scrapping record will need to be smashed again, and again. There are multiple ways to measure the vitality of the container industry, from looking at port and trade volumes to carrier income and balance sheet statements. Another is to look at the average age of containership demolitions. Generally, the earlier that owners decide to cut short the life cycle of their steel assets the more downbeat they are of their future revenue earning potential. So far this year there have been three cases of ships being scrapped just before they reach their 10-year birthday (a record)…

Rickmers 9M Revenue Slips

Hamburg, 11 November 2016 In the first nine months of 2016, the Rickmers Group generated consolidated revenues of € 373.6 million. This represents a decline of 15 percent versus the previous years period (€ 439.7 million). This fall is due mainly to the persistently strained market situation through the expiry of further high-margin charter contracts, temporary fleet idleness and follow-on charters at current low market rates. Furthermore, lower revenues from freight and a stronger fall in capacity utilisation in the project cargo area also had a negative impact. As a specific consequence of this revenue decline, the operating result before interest…

Sembcorp Marine Swings to Loss in Q3

Singapore's Sembcorp Marine Ltd swung to a loss in the third quarter and the rig builder's revenue was hurt by customers deferring rig deliveries amid a protracted downturn in the oil and natural gas market. The company posted a net loss of S$21.8 million ($15.7 million) for the three months ended Sept. 30, compared with a net profit of S$32.1 million a year ago. It said the bottomline was hurt by higher financing costs, share of losses from associates and foreign exchange impact. The company, majority-owned by industrial conglomerate Sembcorp Industries Ltd, said revenue dropped 21 percent.

Rickmers’ Investors Demand Prompt Bond Repayment

Singapore-based shipping trust Rickmers Maritime announced that it has already received a letter from lawyers representing a group of bondholders demanding for the immediate payment of their share of bonds, reports Bloomberg. The development comes after some holders of the firm’s S$100 million ($72 million) of 8.45 percent notes due in May 2017 sought accelerated repayment last month, as the operator of container ships proposed a debt restructuring plan to help avoid potential liquidation or judicial management. The letter said that the trustee DB International Trust (Singapore) Ltd. has “failed to institute any action against the issuer,” according to a statement Thursday from Rickmers. The letter said that the notes trustee DB International Trust (Singapore) LTd.

Rickmers Maritime Trust May Face Liquidation

[ Updated ] The Singapore-based Rickmers Maritime Trust has come to a sitatuation where the choice is between restructuring the securities in the company to less than half their current value or shutting down. So it has warned the investors that if its proposed debt restructuring plan is not approved by its noteholders, it could be headed for a potential liquidation or judicial management. The shipping trust, has asked for clemency from its creditors regarding $179.7 million of debt and a following $100 million of interest that it cannot pay, reported Bloomberg. If Rickmers Maritime Trust is unable to restructure, it could be liquidated or placed in court receivership, which would likely result in a “total loss” for noteholders.

Rickmers Maritime to Restructure Debt

Singapore-listed Rickmers Maritime, which owns and operates containerships, said on Thursday it was seeking noteholders' support to restructure debt worth S$100 million ($73.21 million) in a bid to avoid potential liquidation. The business trust also said it was unable to repay $179.7 million of senior debt due March 2017. "Rickmers Maritime needs to restructure its debt to operate as a going-concern," it said in a presentation to noteholders, a copy of which it sent to the stock exchange. It is seeking bondholders' approval to convert their debt into S$28 million of new perpetual convertible bonds with a step-up coupon starting at 3.88 percent, to avoid potential liquidation or judicial management, which it said would be "likely to result in zero recovery for noteholders".

Rickmers Maritime Gets Breathing Space

Marine transport company Rickmers Maritime has been offered a credit facility worth USD 260 million in order to cover bank debt. The carrier is also considering converting its debt to bonds worth more than USD 70 million as part of an ongoing restructuring of the listed company's debt burden. Rickmers Maritime received an offer from HSH Syndicate for a restructured secured amortising term loan facility of up to US$260.2 million, says a report in Singapore Business Review. This is to refinance the company’s outstanding debt under existing facilities granted by its lenders. Rickmers revealed that a successful entry into the new loan facility would extend the maturities of a large part of the company’s secured bank debts to the first quarter of 2021…

Rickmers Profit Nosedives, Plans Lay-ups

Rickmers Maritime incurred a loss of US$55.6m in the second quarter, wider than the year earlier $15.7m on the back of a non-cash impairment charge as charter market conditions deteriorate. The Singapore-based consider is planning to lay up some of the 11 containerships it has operating in the spot market to save costs when the vessels are redelivered. Charter revenue fell 37 per cent to $18 million, due to reduced charter rates and lower vessel utilisation rates. The company’s net loss for the first half of this year was $56.9 million, compared to $8.6 million during the first six months of last year. Additionally, charter revenue in the six-month period this year was $ 39.3 million, compared to $57.1 million in the first half of 2015.

Rickmers Maritime Reports Significant Loss

Rickmers Maritime, which is affiliated to the Hamburg-based Rickmers Group, slumped to a $129.2 million loss in 2015 from a $16 million profit a year earlier on increased write offs on the value of its ships and depressed container charter rates. The Container ship operator's charter revenue from its fleet of 16 container ships shrank by 17 percent to $108.5 million from $130.3 million last time. The bulk of the full-year loss was in the fourth quarter when the deficit widened to $129.6 million from $16 million last time, due mainly to an impairment charge of $128.4 million. This took the impairment bill for the full year to $148 million against $63 million in 2014.

Rickmers Maritime in Red

Rickmers Trust Management (Rickmers Maritime) suffered a loss of USD15.7 million for the second quarter ended 30 June 2015 from a profit of USD16 million in 2Q14. Rickmers Maritime recorded a net loss after tax of US$15.7 million in 2Q2015, compared to a net profit of US$16.0 million in 2Q2014, due mainly to the non-cash recognition of a US$2.8 million goodwill impairment, and US$16.8 million provision for vessel impairment as market charter rates are still below historical averages. As a result of these impairments, Rickmers Maritime registered a net loss of US$8.6 million in 1H2015. Excluding the impact of the impairments totalling US$19.6 million, the Trust would have been profitable in both 2Q2015 and 1H2015, with net profit of US$4.0 million and US$11.0 million respectively.