Seanergy Maritime Shares Q1 Results

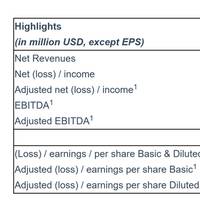

Seanergy Maritime (SHIP), a pure-play Capesize shipping company, reported Q1 results and announced a quarterly dividend of $0.05 per share—marking the 14th consecutive quarterly dividend.SEANERGY Q1:Fleet TCE2 of $13,403, outperforming the Baltic Capesize Index (“BCI”) by 3% in Q1 2025Declared $0.05 per share quarterly cash dividend – 14th consecutive quarterly dividend - Cumulative cash dividends of $2.26 per share, totaling $43.1 million$88.1 million in new financings and refinancings at improved terms and pricingEstimated fleet loan-to-value (“LTV”) below 50%…

Follow the Money: Norway is Fertile Grounds for Shipping Projects

With the world’s largest sovereign wealth fund, Norway’s financial muscle is beyond question. Howev-er, at a corporate level, the country’s capital markets offer a range of benefits to overseas companies seeking equity, debt … or both. Øivind Amundsen is CEO of Oslo Børs and, as you would expect, a strong advocate of the Norwegian capital as a place to raise money for marine-related projects. The diverse nature of the companies which are listed on the Børs, part of Europe’s largest stock exchange group…