Star Bulk Completes Eagle Bulk Acquisition

Star Bulk Carriers Corp. on Tuesday announced that it has completed its merger with fellow dry bulk shipping company Eagle Bulk Shipping Inc.Eagle Bulk shareholders this week voted to approve the $2.1 billion deal, which was first announced in December 2023.Under the terms of the merger agreement, each Eagle shareholder received 2.6211 shares of Star Bulk common stock for each share of Eagle common stock owned. Eagle common stock has ceased trading and will no longer be listed on the New York Stock Exchange.Petros Pappas…

Maritime Emissions Reduction Center Launched in Athens

The Lloyd’s Register (LR) Maritime Decarbonization Hub is collaborating with five leading shipowners as founding members in the establishment of a not-for-profit Athens-based global Maritime Emissions Reduction Center (M-ERC) that will focus on optimizing the efficiency of the existing fleet.The M-ERC is being created with the goal of removing technical, investment and community barriers for the uptake of solutions to reduce the greenhouse gas (GHG) emissions of the existing global fleet…

Star Bulk to Avoid Red Sea After Attacks on Its Ships

Greece-headquartered Star Bulk will halt sailings through the Red Sea after Yemen's Iran-aligned Houthis attacked two of its ships in recent days, the group's CEO said.The Houthis have targeted commercial vessels with drones and missiles in the Red Sea since mid-November in what they describe as acts of solidarity with Palestinians against Israel in the Gaza war."Going forward, we will not be passing the Suez Canal any more because we are obviously a target of the Houthis - being a public company registered in the U.S.," Star Bulk CEO Petros Pappas told a Feb.

Houthis Target Cargo Ship Bound for Iran

Yemen's Iran-aligned Houthis have targeted a cargo ship in the Red Sea which shipping analysts said on Monday had been carrying corn to Iran.It appeared to be the first time the Houthis have targeted an Iran-bound vessel since starting attacks on international shipping in solidarity with Palestinians over the Israel-Hamas war in Gaza, shipping sources said.A U.S. defence official said it was likely that the ship had been targeted but not hit, but provided no further comment. Earlier…

Houthis Fire Missiles at Two Ships in Red Sea

Yemen's Iran-aligned Houthis said on Tuesday they had fired missiles at two vessels in the Red Sea, causing damage to the ships.The Houthis have been targeting commercial vessels with drones and missiles in the Red Sea since mid-November, in what they describe as acts of solidarity with Palestinians against Israel in the Gaza war.The group's military spokesman said it had fired naval missiles at the Star Nasia and Morning Tide, identifying the Marshall Islands and Barbados-flagged ships…

Star Bulk and Eagle Bulk Agree to $2.1 Billion Merger

Dry bulk shipping companies Star Bulk Carriers and Eagle Bulk Shipping have reached a deal to merge in a $2.1 billion all-stock deal.The terms of the definitive agreement have received unanimous approval from the boards of directors of both New York-listed ocean carriers, and the companes expect the deal to close in the first half of 2024 following approvals from regulators and Eagle shareholder.Eagle shareholders will receive 2.6211 shares of Star Bulk common stock for each share of Eagle common stock owned.

Weather Routing: Sofar Ocean Plots the Course

Sofar Ocean is on a quest to extract and put to use data from the world’s waterways. Co-Founder and CEO Tim Janssen discusses how his team’s hyper-focus on data is helping to improve weather routing via Wayfinder.Tim Janssen and his Sofar Ocean team continue their ‘Epic Ocean Data Quest,’ remaining laser focused on doing its part to help extract and put to use increasing quantities of information from the world’s oceans. For its part, Sofar continues to build scalable networks to gather information premised on its Sofar Spotter buoy.

Grains Export Push to Boost Dry Bulk Shipping Market

Bumper soybean harvests in Brazil and unsold grains stocks in the United States are set to boost dry bulk shipping rates as buyers including China restock after supply shocks last year, leading freight operators said.The dry bulk shipping market has been hit in recent months by slow activity, partly driven by the COVID lockdowns in China, one of the world’s biggest generators of seaborne commodities trade including grains as well as coal and iron ore.Grains supplies were also affected by the war in Ukraine for part of last year until a United Nations-backed corridor was set up…

Partners to Develop Green Corridor for Australia-Asia Iron Ore Shipping

A consortium, led by the Global Maritime Forum and consisting of BHP, Rio Tinto, Oldendorff Carriers and Star Bulk Carriers Corp., signed a letter of intent (LOI) to assess the development of an iron ore Green Corridor between Australia and East Asia.To mobilize demand for green shipping and to scale zero- or near-zero greenhouse gas emission shipping, governments and industry decision-makers are increasingly looking to enable and simplify the task of decarbonizing the maritime sector by establishing Green Corridors: specific shipping routes where the economics…

Golden Ocean Exits CCL Pool Joint Venture

Dry bulk shipping company Golden Ocean Group Limited on Tuesdat announced it has terminated its relationship with Capesize Chartering Ltd. (CCL), a joint venture to coordinate the Capesize spot chartering services of Golden Ocean, Starbulk, CTM and Bocimar.Ulrik Andersen, CEO of Golden Ocean Management AS, said, "We have enjoyed our close cooperation with our CCL partners over the last five years. CCL was formed in 2016 to achieve greater commercial scale amid a challenging commercial environment. "Since then, the market has improved, and Golden Ocean has significantly expanded and modernized its fleet, most recently with the acquisition…

Ammonia Fuel Cells for Deep-Sea Shipping: A Key Piece of the Zero-emissions Puzzle

Interest in ammonia-powered fuel cells for the maritime sector is growing, but stakeholders have been hesitant to commit to investments in large-scale systems. Now the ShipFC project is aiming to secure a place for ammonia in the future of deep-sea shipping.The project will equip the offshore supply vessel Viking Energy, owned and operated by Eidesvik and on contract to energy major Equinor, with a 2-megawatt (MW) ammonia fuel cell, allowing it to operate for at least 3,000 hours annually on clean fuel.

Technology Enhances Crew Well-being -Report

A new report published by satellite communications provider Inmarsat examines the ways technology can benefit crew safety, health and wellbeing at sea, at a moment when COVID-19 has exposed the welfare of seafarers to global scrutiny.The report, "Welfare 2.0: How can the next generation of technology enable better crew safety, health and wellbeing at sea?", has been prepared by consultancy Thetius and follows an earlier "Trade 2.0" report focusing on the impact new technologies…

Pangaea Takes Top Spot in Dry Bulk Benchmark Study

For the second year straight, US-based Pangaea Logistics ranks highest among dry bulk owners based on Time Charter Earnings (TCE), according to a recent market benchmarking report.Notably, the Rhode Island-headquartered shipowner's 53.7% TCE performance is well above Hong Kong's Pacific Basin Shipping Ltd. (24.3%) and Thailand's Thoresen Thai Agencies (23.5%) in second and third place respectively.The Vesselindex Performance Report by Danish maritime advisors Liengaard & Roschmann measures the TCE performance of 25 individual companies in relation to the earning potential of their respective fleets, making sure that no company is neither penalized nor getting an advantage from inferior/superior fleet compositions.

Star Bulk Sells Two Supramax Vessels

Star Bulk Carriers Corp., a global shipping company focusing on the transportation of dry bulk cargoes, announced that it has agreed to sell the Star Cosmo, a 2005 built Supramax vessel and the Star Epsilon, a 2001 built Supramax vessel."We expect to deliver both vessels to their new owners by the end of this month (November)," the Greece-based shipping company said in a statement.The proceeds from these sales, after prepayment of the debt related to the two vessels, are expected to be approximately $6.0 million and we expect to incur a non-cash loss of approximately $4.5 million in the fourth quarter of 2019.Meanwhile, Star Bulk completed the installation of 44 scrubber systems…

Shipping Companies: Is Bigger Better?

“If consolidation was the solution to all that ails shipping, then container liner companies would be super profitable. They are not. In ‘commoditized’ sectors of the shipping industry, which by now includes pretty much everything apart from very small niche markets, there is hardly any economies of scale at the company level. As long as bigger is not in fact much better, then meaningful consolidation will not happen.”Dr. Roar Adland, visiting scholar at MIT Center for Transportation and Logistics and Professor at the Norwegian School of Economics (NHH).Like any other business…

WFW Advises Star Bulk on Vessels Acquisition

Watson Farley & Williams (WFW), an international law firm based in London, has advised NASDAQ listed Star Bulk Carriers Corp on the acquisition of 11 dry bulk vessels from Delphin Shipping LLC in a shares and cash transaction.Under the terms of the acquisition, the vessels that were built by Jiangsu Hantong between 2012 and 2014 will be acquired for an aggregate purchase price of US$139.5m, payable in the form of US$80m in cash and 4.503 million common shares of Star Bulk.If concluded, the transaction would increase Star Bulk’s fleet to 120 vessels, a release said."This is the third such deal that WFW have assisted Star Bulk with in the last 18 months, previously advising them in 2018 on the acquisition of multiple vessels from both Augustea and E.R.

Star Bulk Acquires 11 Dry Bulkers

Greece-based global ship manager of seaborne transportation Star Bulk Carriers Corporation has entered into an en bloc definitive agreement with entities controlled by Delphin Shipping to acquire eleven operating dry bulk vessels.The company focusing on the transportation of dry bulk cargoes said in a press release that the acquisition of bulkers from Delphin, an entity affiliated with Kelso & Company, is for an aggregate purchase price of $139.5 million, payable in the form of a) $80.0 million in cash and b) 4.503 million common shares of Star Bulk.Star Bulk Carriers has secured exhaust gas cleaning systems (“EGCS” or “Scrubbers”) for all of the Vessels with attractive delivery dates.

Star Bulk Carriers Reports Q1 Loss

Greek shipping company Star Bulk Carriers Corp reported a net loss of $5.3 million, or $0.06 loss per share for the first quarter ended March 31, 2019.Net income for the first quarter of 2018 was $9.9 million, said the global shipping company providing worldwide seaborne transportation solutions in the dry bulk sector."By the end of May 2019 we are on track to have 40 vessels scrubber fitted. We expect to have a fully scrubber fitted fleet by January 2020. Because we expect 2020 to be a more profitable year, we want to maximize the operating days in 2020 and we thus bring forward to 2019 all our drydocks that would otherwise be due in 2020…

Swedish Bank to Finance Star Bulk

Swedish financial group Skandinaviska Enskilda Banken AB (SEB) is providing US$71.42m term facility to Star Bulk Carriers for the refinancing of two Newcastlemax-size bulk carriers. Watson Farley & Williams (WFW) is the advisor for the deal.The London based international law firm said that the deal also involved partly financing the prospective capital expense for the retrofitting of the ships with scrubbers, ahead of the entry into force of the 2020 IMO regulations.The two ships were part of a portfolio of 16 vessels acquired from Augustea Atlantica SpA and York Capital Management in an all-share transaction concluded in May 2018, on…

Star Bulk, ER Capital Shelve Vessel Deal

Star Bulk Carriers Corp and entities affiliated with E.R. Capital Holding GmbH & Cie. KG mutually waived their respective Call and Put Options relating to the four optional operating dry bulk vessels.On August 29, 2018, Star Bulk, the global shipping company focusing on the transportation of dry bulk cargoes, entered into an en bloc definitive agreement with entities affiliated with E.R. Capital to acquire three firm operating dry bulk vessels within 2018 and four optional operating dry bulk vessels.Now the companies informed that they have walked away from a potential deal involving four capesize bullkers.Pursuant to the above developments…

Will Shipping IPOs Comeback in 2019?

The market for Initial public offerings (IPOs) across the global shipping industry has remained understandably muted in recent years but secondary offerings continue to be an important funding mechanism, according to a recent report from Drewry Maritime Financial Research.Despite low interest in shipping IPOs in the US over the last few years, listed shipping companies continue to raise money through secondary/additional offerings and bond offerings in the US market with Oslo emerging as the preferred platform for shipping companies to raise equity.Investor appetite for shipping sector IPOs has remained weak as earnings have remained negative or sub-par at best…

Star Bulk Adds Two More Vessels to its Fleet

Greece-based Star Bulk Carriers Corp. took delivery of the last two of the three firm dry bulk vessels from an entity affiliated with E.R. Capital Holding GmbH & Cie. KG.According to the global shipping company focusing on the transportation of dry bulk cargoes announced it added the 2010 built Capesize vessels M/V E.R BRANDENBURG and M/V E.R BOURGOGNE, to its fleet on on January 7th, 2019 and January 14th, 2019 respectively, The Vessels were acquired for a combination of cash and shares. The vast majority of the cash portion of the transaction will be funded from senior secured financing which will be drawn within this week.Following…

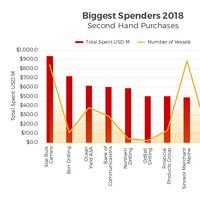

Biggest Spenders of 2018

With less than a week until Christmas and most of our presents bought, we're feeling the pinch. However, that's nothing compared to the amount that some have been spending this year. VesselsValue's Senior Analyst Court Smith gives a rundown on which countries have splashed the most cash on second hand vessel purchases over 2018.USAJP Morgan Global Maritime is the US company who has spent the most on second hand vessels: 308 million USD so far in 2018. However, they have changed their purchasing strategy half way through the year.