Baltic Dry Index Logs Biggest Fall in a Month

The Baltic Exchange's dry bulk sea freight index fell on Tuesday to a nearly seven-week low in its worst showing in more than a month, as rates across vessel segments hit multi-week lows.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, lost 147 points, or 7.3%, to 1,875, hitting a fresh low since Nov. 23.The capesize index dropped by 350 points, or 9.7%, to 3,249, also logging its biggest daily fall since Dec. 7.Average daily earnings for capesize vessels…

Strong Vessel Demand Lifts Baltic Dry Index to Second Weekly Gain

The Baltic Exchange's dry bulk sea freight index rose on Friday and posted a second consecutive weekly gain on the back of stronger demand across vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, rose to an over three-weeks high as it added 62 points, or 3.5%, to 1,820. It was up 10.8% this week.The capesize index added 99 points, or 3.7%, to 2,763. The index rose 6.8% for the week.Average daily earnings for capesize vessels…

Baltic Dry Index Up on Firm Rates for Larger Vessels

The Baltic Exchange's main sea freight index rose for a third straight session on Monday, buoyed by an uptick in capesize and panamax vessels rates.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, rose 9 points to 1,145.The capesize index gained 14 points to 1,832.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes carrying commodities such as iron ore and coal, increased by $112 to $15,192.The panamax index gained 20 points, or 1.8%, to 1,153, highest since June 21.Average daily earni

Baltic Dry Index Logs Second Straight Monthly Gain

The Baltic Exchange's main sea freight index gained on Monday, posting its second straight monthly gain, supported by an uptick in rates for capesize and panamax vessels.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, gained 17 points, or 1.5%, to 1,127. The index was up 3.3% for the month.The capesize index earned 43 points, or about 2.4%, to 1,873, its highest level since late June. The index has gained 10% for the month.Average daily earnings for capesizes…

SSI: Green Steel Could Be Added to Decarbonization Targets

The Sustainable Shipping Initiative (SSI) has published a green steel and shipping report calling for circularity in shipbuilding. Steel is the primary shipbuilding material, making over 75% of a vessel by weight, and the steel industry is responsible for 7-9% of global GHG emissions. Addressing steel emissions is critical to decarbonizing across the ship lifecycle, says SSI, and provides opportunities for collaboration with the steel sector and other steel demand sectors. The report identified drivers and barriers to closing the loop on steel in shipping…

Baltic Index Steady as Capesize Bounce Offsets Dip in Smaller Vessels

The Baltic Exchange's main sea freight index tracking rates for ships carrying dry bulk commodities, was flat on Thursday as higher rates for capesizes countered a dip in smaller vessel segments.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, remained unchanged at 1,463.The capesize index gained 66 points, or 3.6%, at 1,888 — its biggest rise in a week.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes carrying commodities such as iron ore and coal…

Baltic Index Falls on Weak Capesize, Supramax Demand

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, snapped a four-session winning streak on Tuesday, pressured by lower rates for capesize and supramax vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, lost 53 points, or 3.4%, at 1,507 — its biggest dip in two weeks.The capesize index fell 130 points, or 6.4%, to 1,911.Average daily earnings for capesizes, which typically transport 150…

Baltic Dry Index Rises for Second Week

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, climbed to a two-month peak on Friday, as well as marked its second straight weekly rise, supported by improving demand for capesize and panamax vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, rose 66 points, or 5.8%, to 1,211, its highest since January 3.The main index rose about 37.2% for the week.Among other vessel segments, the capesize index rose 195 points, or 19.5%, to its highest in more than six weeks, at 1,195.

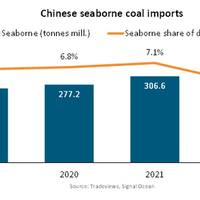

Chinese Inbound Coal Shipments Plummet 12.2%, Says BIMCO

Weak economic activity, a 10.5% increase in domestic coal mining, and a recovery in coal imports from Mongolia via rail alleviated coal shipments to China in 2022. However, the end of China’s zero Covid policy and an anticipated recovery of the Chinese economy have strengthened expectations for the country’s coal imports in 2023. A return of import tariffs, the end of China’s unofficial ban on Australian coal, and the energy transition in China could shape the coal shipment outlook.Coal shipments fell 12.2% in 2022…

Baltic Index Hits One-week High on Capesize Gains

The Baltic Exchange's dry bulk sea freight index touched a one-week high on Tuesday, supported by gains in the capesize vessel segment.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels carrying dry bulk commodities, added 19 points, or about 1.4%, to 1,356, the highest level since Nov. 1. The capesize index rose 89 points, or about 6.3%, to 1,493, the highest level since Oct. 31. Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as coal and steel-making ingredient iron ore, were up $731 at $12,379.

Baltic Dry Index Marks Worst Week in Three Months

The Baltic Exchange's dry bulk sea freight index on Friday marked its worst week since early August, primarily weighed down by weakness in the larger capesize and panamax vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, fell 78 points, or about 4.8%, to 1,534.The main index fell 16% for the week, also marking a third consecutive weekly drop.The capesize index fell 78 points, or about 4.5%…

Baltic Dry Index Up as Panamax Rates Climb

The Baltic Exchange's main sea freight index extended gains on Thursday as rates for the panamax vessel segment rose for the sixth straight session.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, was up 45 points, or about 4%, at 1,178, a two-week high.The capesize index fell for the third consecutive session, losing 4 points, or about 0.6%, to 652.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as coal and steel-making ingredient iron-ore used in construction, fell $35 to $5,407.Dalian and Singapore iro

Baltic Dry Index Marks Worst Week in Nearly Three Years

The Baltic Exchange's dry bulk sea freight index declined on Friday, posting its biggest weekly fall since early February 2019, as demand waned across its vessel segments.The overall index, which factors in rates for capesize, panamax and supramax vessels, was down 119 points, or 4.8%, to its lowest level since mid-April at 2,379.The main index lost 27.3% this week.The capesize index shed 167 points, or 5.8%, to an over six-month low of 2,727. It posted a 43.5% weekly decline…

Baltic Dry Index Extends Losses

The Baltic Exchange's dry bulk sea freight index fell for a fourth straight session Tuesday, weighed down by weak demand across all vessel segments.The overall index, which factors in rates for capesize, panamax, supramax and handysize vessels, fell by 201 points, or 4.7%, to 4,056, its lowest since Sept. 10.The capesize index fell 478 points, or 8.3%, to 5,304, its lowest since Sept.

Great Lakes-St. Lawrence Seaway System Sees Surge in Construction Material Shipments

U.S. Great Lakes ports and the St. Lawrence Seaway have experienced a rise in cargo shipments to feed domestic construction and manufacturing activity and global export demand, according to the latest June figures.The Great Lakes-Seaway System serves a region that includes eight U.S. states and two Canadian provinces, and is seen as a marine highway that extends 2,300 miles from the Atlantic Ocean to the Great Lakes, supporting more than 237,868 jobs and $35 billion in economic activity.If the region were a country…

Baltic Dry Index Books Biggest Weekly Gain Since Mid-February

The Baltic Exchange's main sea freight index climbed on Friday to post its best weekly gain since mid-February thanks to higher demand for capesize vessels.The Baltic dry index, which tracks rates for capesize, panamax and supramax vessels ferrying dry bulk commodities, rose 38 points, or 1.4%, to 2,788, its highest since September 2010.The main index firmed 16.9% this week, its best since February 19.The capesize index gained 115 points, or 2.8%, to 4,192 - its highest since October 6, 2020.The index added 21.9% for the week, its best since March 5 and marking a fourth straight week of gains.

Baltic Dry Index Rises to 1.5-year Peak

The Baltic Exchange's main sea freight index, which tracks rates for ships ferrying dry bulk commodities, rose to 1-1/2-year peak on Monday as demand improved across vessel segments.The Baltic dry index, which tracks rates for capesize, panamax and supramax vessels, added 47 points, or 2%, to 2,432, its highest level since September 2019.The capesize index gained 37 points, or 1.1%, to 3,476, its highest in more than six months.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes of coal and steel-making ingredient iron ore, were up $310 to $28,830.Iron ore pri

China’s One-sided Recovery Drives Iron Ore Market Back Up -BIMCO

In the first two months of 2021, Brazilian iron ore exports have risen by 9.1% to 53 million tonnes, driven by China. So far this year, 35.2 million tonnes of iron ore has been exported to China, representing a 15.2% increase from the same period last year and standing in contrast to slightly declining exports to all other countries: down 1.2% to 17.8 million tonnes, continuing the trend from 2020.Despite the strong growth rates in the first months of this year, total exports of iron ore have failed to recover to 2019 levels following the 21.8% drop in volumes in 2020.

Baltic Index Posts Weekly Gain

The Baltic Exchange's main sea freight index gained on Friday, and notched a weekly rise, on stronger rates across all vessel segments.The Baltic dry index, which tracks rates for capesize, panamax and supramax vessels, rose by 50 points, or 4.3%, at 1,211, its highest since Nov. 30. The index rose 1.2% for the week.The capesize index gained 114 points, or 8.6%, at 1,434, a one-week high.But the index fell 5.7% this week, its worst in about a month.Average daily earnings for capesizes…

Iron Ore Under Pressure as China Port Stockpiles Grow

Iron ore futures slipped on Monday on rising port inventory of the steelmaking ingredient in China, though optimism over prospects of strong domestic steel demand for the rest of the year kept losses in check.The Dalian Commodity Exchange's most-traded September iron ore contract closed down 0.3% at 817 yuan ($116.91) a tonne, stretching losses into a third consecutive session.Iron ore's August contract on the Singapore Exchange dropped 0.7% to $106.31 a tonne in afternoon trade, extending losses into a fourth session.China's imported iron ore inventory stocked at ports rose for a fourth strai

Fleet Growth to Outstrip Demand: BIMCO

Fleet growth expected to outstrip demand growth in 2019 and 2020, making the near future look unappealing, says BIMCO.In the first four months of 2019, yards delivered 10m DWT of newbuilt dry bulk shipping capacity. The demolition of 3.9m DWT limited the immediate negative impact, but even a fleet growth of 0.7% harms the market, as cargo demand is seasonally low.Capesize accounted for 87% of the demolished capacity pushed out of the market, as freight rates fell and the outlook turned bleaker.Because of this unexpectedly dramatic start to the year, BIMCO revised its demolition forecast for 2019 up to 8m DWT from 4m DWT. It’s worth noting that Panamax…

China to Cut Steel Capacity by 2025

China will shut down more outdated steel plants and bring total capacity to less than 1 billion tonnes by 2025, the president of the country's steel industry association said, adding that national demand for the metal is set to decline gradually. With more than three quarters of firms suffering losses as a result of a price-sapping capacity surplus, China vowed in early 2016 to shut 150-150 million tonnes of annual production in five years in a bid to raise profitability and utilisation rates in the sector. Its capacity then was estimated at 1.2 billion tonnes.

Baltic Index Inches Down

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, edged lower on Friday on weaker rates for smaller vessels. The overall index, which factors in rates for capesize, panamax, supramax and handysize shipping vessels, was down one point at 956 points. The capesize index rose 30 points, or 1.8 percent, to 1,668 points. Daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were up $221 at $12,239. Capesize rates were supported by hopes that steel demand in top consumer China would remain strong.