Ship Recycling Markets Slightly Busier

The week concluded surprisingly for sub-continent ship recycling nations which were busier (from an LDT perspective) than recent weeks, reports cash buyer GMS.“This left local recyclers scrambling to get their respective shares of the odd unit in, and that too at ever-competitive rates. As such, the dearth of vessels currently available for a recycling sale will certainly ensure that any mis-directed dreams of discounted deals at this juncture of the year, are likely to remain just that…i.e.

Scarcity of Ship Recycling Tonnage Continues

Despite the occasional smaller LDT candidate popping up for sale over recent weeks, there regrettably remains the ongoing scarcity of tonnage that is simply unable to fill the most basic of demands at the major ship-recycling destinations, reports cash buyer GMS.“As plots across Indian sub-continent markets gradually recycle through their respective shares of vessel deliveries through the first quarter of 2024, both Bangladeshi and Pakistani markets remain well-positioned despite the onset of the traditionally quieter month of Ramadan…

Bangladesh and Pakistan Ship Recycling Markets Remain Steady

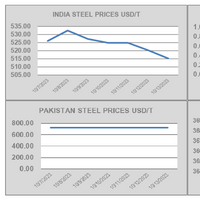

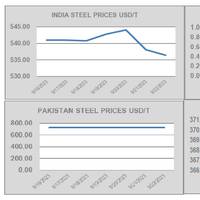

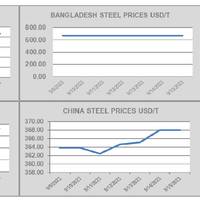

With the conclusion of week 11, the ongoing and seemingly endless dearth in the supply of viable candidates has been mercifully keeping the Bangladeshi and Pakistani ship recycling markets steady, reports cash buyer GMS.“On the other hand, the Turkish and Indian markets continue to endure their respective shares of a notably trying time, given that the Turkish Lira continues to plummet even amidst a mercifully quieter week (on account of Ramadan).”GMS says: “India continues to endure its share of nerve-racking volatility in local steel plate prices as well as the Indian Rupee…

New UTM Payload Available for Scout 137 Drone System

ScoutDI has added an ultrasonic thickness measurements (UTM) payload, complete with in-flight A-scan, to the capabilities of its end-to-end inspection data solution for the Scout 137 drone.The product is suitable for offshore applications where drones are becoming common for visual inspection and steel plate thickness sampling must be done regularly to monitor e.g. the effects of corrosion over time.Adding the UTM payload enables the Scout 137 drone to collect location-tagged…

Subcontinent Ship Recycling Market Remarkably Quiet

Despite the Pakistani & Bangladeshi markets stabilizing and displaying a far greater aggression at the bidding tables over the last five weeks, it has been a remarkably quieter start to 2024 for ship recycling than many had anticipated, says cash buyer GMS.With Houthi attacks, trading markets have remained unseasonably firmer, thereby delaying the historical ‘post-New Year aggression’ from the sub-continent ship recycling markets that the industry has become accustomed to over…

Ship Recycling Market Impacted by Middle East Situation

Bangladeshi and Pakistani markets have been making noticeable improvements over recent weeks, but there remains an ongoing shortage in the global availability of ‘market’ tonnage for ship recycling, reports cash buyer GMS.As evident from the number of arrivals and beachings this week, an increasing number of ship recyclers have clearly managed to and are reportedly still in the process of obtaining further approvals on L/Cs from their respective banks. “As a result, there is now a noticeable disparity in offers emanating from recyclers from the same sub-continent destination…

Signs of Recovery for Ship Recyclers in 2024

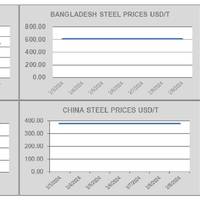

After what has been an overall miserable 2023 in the ship-recycling industry and even worse six-month tail end, 2024 seems to be off with just a little more hope and a chance at recovery as positive signs seem to permeate through the markets, says cash buyer GMS.Critical factors such as declining currency values (except in India), flatlining / declining local steel plate prices, and the dreadful (and ongoing) lack of funding on fresh acquisitions (in Bangladesh and Pakistan), all came together over the course of the summer / monsoon months of 2023.

Ingalls Authenticates Keel of Destroyer George M. Neal (DDG 131)

HII’s Ingalls Shipbuilding has authenticated the keel of the U.S. Navy Arleigh Burke-class (DDG 51) guided missile destroyer George M. Neal (DDG 131).George M. Neal (DDG 131) is the fourth Flight III destroyer to be constructed at Ingalls. Flight III Arleigh Burke-class destroyers incorporate a number of design modifications that collectively provide significantly enhanced capability including the AN/SPY-6(V)1 Air and Missile Defense Radar (AMDR) and the Aegis Baseline 10 Combat System…

GMS: Steel Plate Prices Not Yet as High as Hoped

As Diwali holiday celebrations concluded, Alang recyclers seem to slowly be filtering back to work amidst declining plates prices, sentiments, says cash buyer GMS, and local offerings that remain stagnant.“Unfortunately, this remains the ongoing dilemma across much of the Indian sub-continent ship recycling markets, especially as steel plate prices are yet to gain ground to the extent many in the industry had been hoping for thus far, whilst currencies simultaneously continue to cause ongoing worries for respective domestic markets.”On the flip side…

Ship Recycling Markets Remain Muted

Markets remain precariously poised as Diwali holidays occupy the sub-continent markets and the industry heads into the final months of the 2023, says cash buyer GMS. Although several sales have reportedly registered into India at some impressive levels, sentiments and pricing here remains muted overall.“On the Eastern end and in the lead up to the Bangladeshi elections due in mid-January 2024 - disruptions, protests, and even strikes have embattled the country and as such, it is expected to become even more challenging to get lines of credit open and deliveries completed into Chattogram…

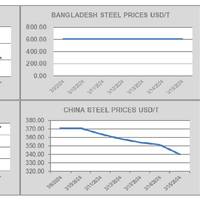

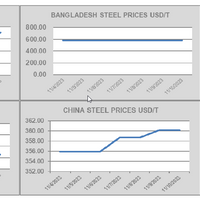

Ship Recycling Market Cools

Inflation, fundamentals, currencies (except in India), vessel pricing, and overall weakening sentiments have beset the ship recycling market over the past week, reports cash buyer GMS.The effects have been felt across all the sub-continent ship-recycling destinations (even Turkey to an extent), which have cooled by about US$ 20/LDT over recent weeks, says GMS. However, India and Bangladesh have reported surprising increases in steel plate prices over the last week.“Seemingly on the back of global steel plate prices…

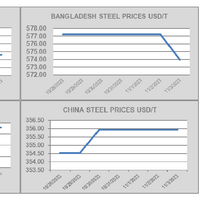

GMS: Pakistan and Bangladesh Lagging Behind Alang

As deals continue to be concluded into Alang, the Indian ship recycling sector remains on a positive footing overall, with Pakistan and (especially) Bangladesh still lagging behind, reports cash buyer GMS.Despite steel plate prices coming off by about US$ 11/Ton and the Indian Rupee weakening marginally over the course of the week, the overall outlook for India remains positive.Several ship recyclers from the sub-continent markets were gathered at the annual Tradewinds Ship Recycling Conference in Singapore this week…

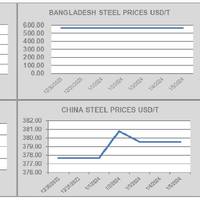

Ship Recycling Market Surges

After a dire summer that saw over USD 100/LDT wiped off vessel recycling prices in Indian sub-continent ship recycling markets (and even Turkey to an extent), nearly all of the markets have enjoyed an upward resurgence entering the fourth quarter of the year.India has been the primary beneficiary of this recent resurgence with some stunning (container) purchases, some even approaching the USD 600/LDT mark once again, reports cash buyer GMS. As China too entered a holiday period…

GMS Reports Feverish Buying in Ship Recycling Markets

Cash buyer GMS reports another week of “astonishing” activity in sub-continent ship recycling markets, with owners and cash buyers primarily focusing on the Indian market where several extraordinarily priced container sales reportedly took place over the recent weeks.The $600/ton mark was even exceeded on a container unit once again, in what seems to be the surest sign yet, that sentiments and demand in Alang are back on track, says GMS.Pakistan is not too far behind India, with some select dry bulk sales to Gadani recyclers who are now re-emerging and have line of credit approvals in place…

US' MARAD Announces Grants to Boost Supply Chain Efficiency

The U.S. Department of Transportation’s Maritime Administration (MARAD) awarded nearly $12 million in grants to eight marine highway projects across the nation under the United States Marine Highway Program (USMHP). The funding will improve the movement of goods along our navigable waterways and expand existing waterborne freight services in Alaska, Illinois, Indiana, Louisiana, Texas, Washington, and Wisconsin, which will strengthen supply chains and ultimately cut costs for consumers.“Our country has always relied on American waterways to get vital goods where they need to go,” said U.S.

USS Fallujah Keel 'Truly and Fairly Laid'"

HII’s Ingalls Shipbuilding division authenticated the keel on Wednesday for the America-class amphibious ship Fallujah (LHA 9).The ship’s sponsor, Donna Berger, former first lady of the Marine Corps and spouse of Gen. David H. Berger, 38th commandant of the Marine Corps, was in attendance to declare the keel “truly and fairly laid.”During the authentication ceremony, Ingalls welder Seveta Gray welded the initials of the sponsor onto a ceremonial keel plate that will remain with…

India and Pakistan Ship Recycling Market Bullish

Bullish buyers in both, the Indian and Pakistani markets, continue to push on for another week as they manage to secure some of the recently recorded, high-priced sales from both the dry bulk and container sectors, reports cash buyer GMS.“Some of the recent container sales in particular have caught the eyes of many in the industry, especially as levels gradually edge back up into the high USD 500s/LDT (approaching USD 600/LDT), thereby providing prospective owners of vintage units…

A Glimmer of Optimism Shines in Ship Recycling Market

A glimmer of optimism seems to have been aroused in the sub-continent ship recycling markets this week, reports cash buyer GMS.The sentiment comes as several units were reportedly concluded to optimistically fervent cash buyers (at increasingly firmer levels) who are perhaps eager to book tonnage pre-Monsoon end. This could potentially satiate some of the forthcoming increase in demand from the sub-continent markets once the traditionally busy year-end / Q4 kicks in.“Several sales…

Electric Boat Lays Keel for Submarine Tang (SSN 805)

General Dynamics Electric Boat held a keel laying for the Virginia-class submarine Tang (SSN 805) at its facility in Quonset Point, North Kingstown, R.I.The submarine will be the third ship in the U.S. Navy to carry the name Tang. The first USS Tang was a Balao-class submarine, SS 306, credited as the most successful U.S. submarine of WWII, sinking the most tonnage of any U.S. submarine—33 enemy ships—on five war patrols over the course of just 14 months."This ship represents…

Everett Ship Repair Completes Refrigeration Refit on the MV Excellence

Everett, Wash. repair yard Everett Ship Repair said it recently completed hull repairs and upgrades of the MV Excellence, a steel-hulled mothership processing vessel built in the 1970s in Japan. The vessel, measuring 367.5 feet in length and 56 feet in width, is undergoing extensive upgrades to the onboard ammonia-based refrigeration system. The modernization of this system will provide additional refrigeration capacity to the vessel, without an increase in power demand.The new refrigeration equipment was installed in a large opening cut below the waterline, necessitating drydocking.

Recycling Quiet After Eid Holidays

With many sub-continent yards still closed after Eid holidays, mixed in with the ongoing monsoon season, cash buyer GMS reports a lack of tonnage and an inactive week in the ship recycling market.Most of the year has been quiet for recycling sales, and prices being quoted are so unworkably below market expectations at present, a bounce back anytime soon seems unlikely, says GMS.“As such, before proposing any further candidates, most cash buyers and (especially) ship owners have decided to continue to wait and watch the markets for greater stability and a better handle on pricing.”Meanwhile…

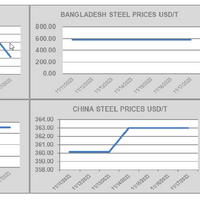

Ship Recycling: Prices Continue to Fall

Prices continue to struggle across the major ship recycling markets, reports cash buyer GMS.Bangladesh further declined after depreciating currencies and sustained credit struggles, while Turkey suffered similarly with declining steel plate prices, the Lira, and its vessel prices.The supply of tonnage seems to have increased slightly over the last couple of weeks, particularly from the Chinese market. This has left owners and cash buyers chasing various recycling destinations amidst weakening prices.As forecasted a few weeks ago…

Interim Report: Trainee Died After Being Trapped by Steel Plates

Germany’s Federal Bureau of Maritime Casualty Investigation (BSU) has published the Interim Investigation Report into the fatal accident on board the bulk carrier Peter Oldendorff on August 3, 2022.The fatal accident occurred when the vessels was moored for cargo operations at a berth in the port of Mukran, Germany. A crewmember (fitter-trainee) was to perform welding works in the steering gear room. This required the removal of a plate from a stack stored vertically in a corner of the steering gear room so a piece could be cut out.The stack was secured against falling over by means of a cross strut locked by a screw connection. Due to the dimensions of the plates forming the stack (dimensions of the plates approximately 300cm x 130cm x 1cm…