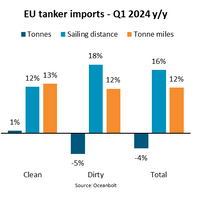

EU Tanker Import Tonne Mile Demand up 12%

In 2023, sanctions on Russian oil exports by the EU caused a major shift in tanker trades and a 10% increase in average sailing distances for EU tanker imports. Now, attacks on ships in the Red Sea area have caused average sailing distances to increase a further 16% and tonne mile demand to increase 12% despite falling volumes, says Niels Rasmussen, Chief Shipping Analyst at BIMCO.During the first quarter of 2024, tanker import volumes to the EU fell 4% year-on-year due to a 1% increase in the clean tanker trade but a 5% fall in the dirty tanker trade.

Second-hand Crude Tankers Reach Highest Values in 25 Years, BIMCO Says

“Second-hand crude tanker values for five-year-old ships hit bottom levels in late 2020 and have since increased by an average 67%. Over the past twelve eventful months values have risen by 34%, reaching their highest level in 25 years,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.Crude tanker values saw their most recent low in December 2020 when Clarksons Research estimated the combined value of a five-year-old Aframax, Suezmax, and VLCC was USD 138.5 mill. Twelve months ago, that valuation had risen to USD 172.0 mill. (+25%).

Keystone Charters Jones Act Tanker Pair from AMSC

American Shipping Company ASA (AMSC), A Norwegian-based ship finance company focused on the intercoastal U.S. Jones Act shipping market, announced it has entered into bareboat charters for two of its vessels commencing in December 2022 with U.S. tanker operator Keystone Shipping Co.The bareboat charters have minimum terms of three years which may be extended at the charterer’s options. The charters are secured by back-to-back time charters of the same duration between Keystone and a major U.S. based oil and refinery group.AMSC said the new charters add almost $60 million to its existing charter backlog, excluding any proceeds from the profit share component of the charters.AMSC CEO Pål Lothe Magnussen said…

First-Ever: Sovcomflot’s Gagarin Prospect Tanker in LNG Bunkering Milestone in U.S.

Russian oil and gas shipping giant Sovcomflot said Friday it had on March 15, together with Shell, "broke new ground," with the completion of the "first-ever Aframax tanker fuelling using LNG in the USA."Sovcomflot’s Gagarin Prospect tanker, on long-term charter to Shell, was en-route from Corpus Christi to Europe. It received 1,075 cubic metres of marine LNG from the Shell NA LNG LLC chartered Q-LNG 4000 outside the Port of Canaveral, Florida. "This represented the first ever ship-to-ship LNG fuelling of a large capacity Aframax tanker in the USA…

Secondhand Prices Put a Damper on Tanker Demolitions -BIMCO

The year 2021 has been tough on crude oil tanker freight rates across the board so far. Consequently, the industry buzz has been all about largescale scrapping of tankers, but so far, it has been all talk and very little walk, as the secondhand market has proved a much-preferred alternative, says industry group BIMCO.Although demolitions are up from the start of last year, only two shuttle tankers and two Aframax crude oil carriers (450,000 DWT) have been confirmed demolished in the first two months of 2021, according to data from Clarksons.

Odfjell Adds Bow Odyssey to its Fleet

Odfjell SE, a company specializing in worldwide seaborne transportation and storage of chemicals and other speciality bulk liquids, said that it took the delivery of Bow Odyssey - the third of its series of four newbuilt, 49,000 dwt chemical tankers.The Hudong class vessel was built by Hudong-Zhonghua Shipbuilding Co.Ltd Shanghai China.The so-called Hudong series consists of four sister vessels, all with the same high-end technology and advanced features that in 2019 earned the first vessel, Bow Orion, the award as ‘Tanker Ship of the Year’.With these four vessels as flagships, and in combination with a total of 30 new vessels that enter our fleet from 2017 throughout 2020…

Venezuela Sanctions to Boost VLCCs

US sanctions on Venezuela are likely to change the pattern of crude tanker trade, with long-haul trade replacing the short-haul trade, said Drewry. While the prospective change in trade pattern will favour VLCCs, it will work against Aframaxes.The US government has imposed sanctions against Venezuela’s state-owned energy company Petroleos de Venezuela (PDVSA) in order to choke Venezuelan oil revenues and oust Nicolas Maduro, the Venezuelan president.According to Drewry, the sanctions will effectively bar Venezuela from exporting crude oil to the US until Maduro steps down.It said that the sanctions will also halt Venezuela’s imports of the diluents (light crude and naphtha) required for blending with the extra-heavy oil from the country’s Orinoco Belt.

Shifting Oil Market Dynamics Key to Tanker Trade Prospects -MSI

The Q3 2017 tanker market is proving vexatious for owners still struggling with the effects of fleet oversupply. But in its latest monthly forecast, Maritime Strategies International (MSI) observes that changing trade patterns could help stabilize the market toward year-end and into 2018. With all-OPEC crude exports setting record highs in July, the cartel’s attempts at lowering production are clearly open to question. There was a reduction in flows from OPEC’s Gulf producers while China’s imports tumbled to seven-month lows in July.

Frontline Sees Strong Start to 2017

Crude tanker operator Frontline expects strong demand for its vessels at the start of 2017 and could benefit from oil producers' pact to cut output if it forces Asian buyers to go further afield for supplies, its chief executive said. Spot rates for very large crude carriers (VLCCs) have doubled since October to around $70,000 per day, far above the level Frontline needs to earn a profit, as OPEC output hit a record in November and seasonal demand for oil kicked in. "Our all-in break-even rate for VLCCs is below $22,000, so we're optimistic with regards to our own earnings," CEO Robert Hvide Macleod told Reuters. Even though OPEC and non-OPEC producers agreed on Dec.

Turkey’s Role for the Tanker Market

Even though the coup attempt in Turkey failed and the transportation situation normalized quickly thereafter, Poten & Partners take a look at the importance of Turkey to the tanker market. Turkey is not a large oil or gas producer; according to JODI its crude oil production amounts to about 48 thousand barrels per day (Kb/d) of crude oil and almost 400 million m3 of natural gas in 2015. The country’s oil consumption averaged about 927 Kb/d in 2015, about 1% of the global consumption. Neither of these statistics would make the country an important energy market player. However, the importance of Turkey to the energy market is related to its geographical location; the country is a major transfer hub for oil and gas.

RBS Receives Bids for Greek Shipping Business

The Royal Bank of Scotland has received bids for its Greek ship finance business, banking and financial sources familiar with the matter said, following a leap in bad shipping debts at the lender over the past few months. They told Reuters that the operation was worth about $3 billion although sources in the shipping business said that problems with lending to the industry, much of which is in a deep downturn, would affect the value of what could be recouped via a sale. Credit Suisse and China Merchants were among the suitors bidding, the sources said. RBS and Credit Suisse declined to comment, while China Merchants did not immediately respond to an emailed request for comment.

New Entry Criteria for vessels calling French Ports

The French State has implemented new provisions regarding tax exemptions on commercial vessels of at least 15 meters in length, including yachts. The provisions came into force on the 1st January 2016. These provisions can be found in the Official Bulletin of the Tax-Public Finance of the French Republic (BOI). New procedure: According to the BOI, merchant vessels are subject to VAT on port rights and some other services. The vessel needs to have a permanent crew on board; The vessel is assigned to the needs of a commercial activity; and The vessel should carry out at least 70% of her trading outside the French territorial waters during the previous year (from the 1st January to 31st December).

Nordic Tankers joins forces with Borealis Maritime

Nordic Tankers and Borealis Maritime Ltd has announced the intention to form a jointly held company, Crystal Nordic A/S – a strong player in the short-sea, ice class chemical tanker trade in the Baltic and North-Western European market. Crystal Nordic A/S will be owned on a 50/50 basis by Nordic Tankers and Embarcadero Maritime (Borealis Maritime). The new company will take over the respective ice classed stainless chemical tankers businesses from its owners, which currently operate under the Nordic Tankers and Crystal Pool trade names. All other Nordic Tankers and Borealis Maritime operations and ventures are unaffected by the new partnership.

Decade Old India Shipping Summit Makes History

In ten years, India Shipping Summit held consistently in Mumbai, has sailed on a robust growth course despite the worldwide witnessing recessionary waves buffeting any endeavors to grow and gain. The reasons are not too far to see. From the very beginning it has been reputed to be a mega event of South East Asia. It sought consistently to bring government representatives and the leading lights of the industry on to a common platform thus acting as a beacon for the country’s maritime trade to move on the road to progress. It has continued to garner support from every section of the trade and industry each time the event has taken place. This year the three-day event held last week brought together a bigger gathering of shipping elites and the who’s who in the industry.

India’s Seaborne Oil, Bulk Liquids & Gas Tanker Trade Conference

India Tanker Conference the biggest event of Hinode Events and Services Pvt Ltd, and the first one on the Tanker trade is set to take off on JUNE 5 in Mumbai at the Hotel Vivanta by Taj - President, in MUMBAI. This First Annual Conference on the Outlook for India’s Seaborne Oil, Bulk Liquids and Gas Tanker Trade, will explore the current challenges and outlook for the seaborne transportation of crude oil, bulk liquids AND gas cargoes encompassing the shipment of crude oil, petroleum products, petrochemicals, liquefied gases as well as vegetable oils, etc. Over 200 delegates are expected to attend. They will represent a wide cross section of the trade and industry including Ship owners and operators, charterers, cargo interests.

Sequestration? What Sequestration?

Smaller boatyards carve out a profitable niche in this challenging, yet target rich maritime environment. For Kvichak and USMI; so far, so good. The May edition of MarineNews brought analysis of possible downstream consequences of the U.S. federal government’s ongoing austerity measures, especially where it could impact U.S. boatbuilders with backlogs tied to government funding. Susan Buchanan’s “Budget Battles Bumping Backlogs” piece brought out the good, bad and potentially ugly realities of the new normal in Washington, DC, where lawmakers tussle over spending priorities, while also leaving various casualties in their messy wake. The August announcement that the U.S.

“Lies, Damned Lies & Statistics”

Popularized by Mark Twain and generally credited to 19th-century British Prime Minister Benjamin Disraeli (1804–1881)*, the above line, which in its full form is “There are three kinds of lies: lies, damned lies, and statistics” is one of my favorites. This being our June 2013 “Yearbook” edition, a publication literally packed with – statistics – I will leave it up to you, the discriminating reader of our pages, to determine the veracity of the numbers reported within. I start with a sincere thanks to Dr.

Tanker Market Outlook: 2011–2015

According to a McQuilling Services Outlook report for 2011-2015, global economic recovery is underway, supported by robust emerging markets growth. Expectations are for a continuation of this trajectory in 2011, leading to increased oil demand, but risks to the downside still exist, particularly in the area of sovereign debt. Tanker demand recovered in 2010 and will increase on the back of increased oil demand. The patterns of trade are changing however, leading to new routes and deployment considerations. Spot freight markets increased in 2010 over 2009, in line with our expectations and our 2010 forecast was within 1.2% of actual market levels for the year.

Tanker Market Outlook 2008 – 2012

McQuilling Services has released its January 2008 Tanker Market Outlook for the period 2008 through 2012. The report, produced each year in January, presents a forecast for 10 trades in the five major tanker sectors through 2012. Six dirty trades and four clean trades are evaluated and discussed. Since a year ago the world economic outlook has changed significantly in the short term. Growth is expected to slow from 5.2% in 2007 to 4.8% in 2008. The slowdown was sparked by the US economy and its travails in the sub-prime mortgage market which have spread to the international financial markets.

Industry Leaders to Meet in Dubai

With a weakening dollar, predictions oil could hit $100 a barrel, and a boom in multi-billion dollar refinery construction, finance and shipping leaders will be meeting in Dubai this November to assess the impact on the regional and global maritime industries. The Middle East shipping industry is dominated by the tanker trade. Bookings for supertankers sailing from the Middle East to Asia account for 47% of global demand for the carriers, compared with shipments to the US and Caribbean, the second-biggest market, which accounts for 14% of demand. The balance of supply and demand, in the tanker sector in the Middle East, will be part of a special Charterers Forum that will take place during the Middle East Money & Ships 2007 conference, from 4-5 November, at Mina a'Salam, Madinat Jumeirah.

BIMCO to Hold Tanker Seminar

BIMCO will hold a tanker seminar on March 6-7 in collaboration with the Dubai Shipping Agents Association. BIMCO Courses has, for the last 21 years, staged a large number of courses and seminars. Over 10,000 participants from 65 countries can attest that these events are an effective method of obtaining practical information on the latest developments in shipping in general, as well as on matters of local or specific interest. In addition the seminar will include case studies and a mock arbitration.