Golden Ocean Orders Three Kamsarmax Newbuilds, Sells Two Ultramaxes

Dry bulk shipowner Golden Ocean Group on Friday announced it has entered into agreements for the construction of three bulk carrier newbuilds, as well as for the sale of two owned bulkers.The newbuilds will be 85,000 dwt ECO-type dual-fuel Kamsarmax vessels constructed at the same Chinese shipyard group as the company's seven previously contracted newbuilds. Deliveries are scheduled to take place from the third quarter of 2024 through the first quarter of 2025.The aggregate sale price of the Ultramax vessels Golden Cecilie and Golden Cathrine is $63 million, and Golden Ocean said it expects to record a gain of approximately $22 million from sale and receive net cash proceeds of approximately $41 million in late Q3/early Q4 2022.

Eagle Bulk's Scrubbers Investment Pays Off

U.S. shipowner Eagle Bulk's 2018 decision to outfit the majority of its dry bulk fleet with scrubbers has proven to be an environmentally sound and profitable decision, with an expected payback on investment by the end of 2022.The company's CEO Gary Vogel and Chief Strategy Officer Costa Tsoutsoplides said in a recent trade press interview that Eagle Bulk answered the MARPOL 2020 0.5% emissions ceiling with a $100 million investment to equip 47 ships—89% of its fleet of supramaxes and ultramaxes—with CR Ocean Engineering (CROE) scrubbers.Having already recorded $60 million of fuel savings…

Eagle Bulk Buys Modern Ultramax Duo for $44M

The U.S.-based dry bulk shipowner Eagle Bulk Shipping said Wednesday it had bought two high-spec 2015-built scrubber-fitted Ultramax bulk carriers for $44 million.The vessels, which will be renamed the M/V Antwerp Eagle and M/V Valencia Eagle, are of the SDARI-64 design and were constructed at Jiangsu Hantong Ship Heavy Industry Co. The company expects to take delivery of both ships during the third quarter of 2021.Eagle Bulk Shipping said it would fund the acquisition will with cash on hand, which includes equity issued under the company’s ATM program.

Genco Buys Newbuild Ultramax Bulker Pair

Dry bulk shipping company Genco Shipping & Trading Limited announced on Wednesday that it has entered into agreements to acquire two 2022-built 61,000 dwt Ultramax vessels to be constructed at Dalian Cosco KHI Ship Engineering Co. Ltd. (DACKS). The vessels are expected to be delivered to Genco in January 2022.The purchases mark the fifth and sixth high specification, fuel-efficient Ultramax vessels that Genco has agreed to acquire since December 2020, doubling its core Ultramax presence over that time, the company said in a statement.Genco CEO, John C. Wobensmith, said, “This latest acquisition continues the expansion of our fleet at an attractive point in the dry bulk cycle as asset values continue to trail the strong freight rate environment leading to attractive returns on capital.

Oldendorff Orders Two Ultramax Bulk Carriers

German shipowner Oldendorff Carriers revealed on Tuesday that earlier this year it ordered two 61,300 dwt Ultramax newbuilds from Dalian Cosco Kawasaki Ship Engineering Co Ltd (DACKS) for delivery July 2022.The 61,300 Ultramaxes are of the Kawasaki eco design, of which Oldendorff had previously built nine units at DACKS and sister yard NACKS until 2019. The vessels feature Masada / Mitsubishi cranes, bollards for the new Panama Canal, Erma First ballast water treatment systems (BWTS)…

Eagle Bulk Buys Two Ultramaxes

Eagle Bulk Shipping has acquired two Ultramax bulk carriers, the U.S.-based dry bulk owner-operator announced Tuesday.The first vessel, which was built in 2015 and will be renamed the Helsinki Eagle, has been acquired for $16.5 million. The second vessel, which was built in 2016 and will be renamed the Stockholm Eagle, has been acquired for $17.65 million. Both SDARI-64 scrubber-fitted ships were constructed at Chengxi Shipyard Co. Ltd.Closings are expected during the first quarter of 2021, with the M/V Stockholm Eagle delivering to Eagle in the Atlantic basin.The sales follow the company’s recently-announced acquisition of a similar specification vessel renamed Oslo Eagle.Gary Vogel…

Ships Swap: Genco Trades Six Older Vessels for Three Ultramaxes

Genco Shipping & Trading has entered into an agreement to acquire three modern, eco Ultramax bulk carriers in exchange for six older Handysize vessels, the largest U.S. headquartered dry bulk shipowner announced Monday. The transaction with an unnamed trading partner is structured as an asset swap without monetary consideration or additional capital required. The vessels are scheduled to be delivered to both parties through the first quarter of 2021.Genco, which aims to continue building scale in the Ultramax sector while divesting non-core assets, said the swap is part of its fleet moderniztion efforts, reducing the average age of its fleet by 0.3 years.

Eagle Bulk Acquires Secondhand Ultramax

Eagle Bulk Shipping Inc. has purchased a 2015-built bulk carrier for a purchase price of $16 million, the U.S.-based dry bulk owner-operator announced Wednesday.The ship, which will be renamed Oslo Eagle, is a high-specification SDARI-64 scrubber-fitted Ultramax constructed at Chengxi Shipyard Co. Ltd. in 2015. It is expected to be delivered into the Eagle Bulk fleet during the first quarter of 2021.The company’s fleet totals 48 ships, including 21 Ultramaxes acquired over the past few years.

Scorpio Bulkers Sells Another Ultramax Amid Offshore Wind Pivot

Scorpio Bulkers said on Thursday it has sold another Ultramax bulk carrier, the sixth ship to leave its fleet since the Monoco-based shipowner announced plans to pivot away from dry bulk shipping toward offshore wind services. The sale of the 2016-built SBI Hera to an unnamed unaffiliated third party for $18.5 million follows close on the heels of Wednesday's sale of the 2017-built Ultramaxes SBI Phoenix and SBI Samson for $34 million. Since September 28, Scorpio has also sold three Kamsarmax vessels, including the 2015-built SBI Conga for $18.4 million and 2016-built SBI Sousta and SBI Rock for $18.5 million and $18 million respectively.Following delivery of the six ships to their new owners in the fourth quarter…

Scorpio Bulkers Sells 3 Vessels

The provider of marine transportation of dry bulk commodities Scorpio Bulkers has entered into agreements with unaffiliated third parties to sell two ultramaxes and one kamsarmax for about $53.5 million in aggregate.The vessels are the SBI Jaguar and SBI Taurus, 2014 and 2015 built Ultramax vessels, respectively, and the SBI Bolero, a 2015 built Kamsarmax vessel.None of the three vessels have been fitted with scrubbers, said a press release from the Monaco-headquartered firms said.Delivery of the vessels is expected to take place between March and May of 2020.It is estimated that Scorpio Bulkers' liquidity will increase by approximately $18.3 million after the repayment of outstanding debt.Upon the completion of the sale of the three vessels, Scorpio Bulkers Inc.

Tomini Adds 3 New Ultramaxes to its Fleet

Dubai-based ship owner and operator Tomini Shipping has boosted its shipping fleet with the delivery and naming of three ultramax carriers.Three vessels named Tomini Entity (63,500 DWT), Tomini Felicity (63,300 DWT) and Tomini Tenacity (63,601 DWT) were delivered on 7 January 2020.According to the company statement, the naming ceremony was held at the COSCO Shipping Ltd, Hudong Shipyard, Shanghai, China. Shoaib Seedat, Head of New Buildings and Pradeep Bajpai, Head of Fleet Management attended from Tomini Shipping together with representatives of the builder and seller, it said.Tomini’s newbuilding program seeks to replenish the fleet with modern…

Eagle Bulk Adds Shanghai Eagle to Fleet

Eagle Bulk Shipping (EBS), the US-based fully integrated shipowner-operator engaged in the global transportation of drybulk commodities, has taken delivery of the fifth of six Ultramax drybulk vessels it has recently agreed to acquire.The ship, which has been renamed the M/V Shanghai Eagle, is a 2016-built, high specification SDARI-64 Ultramax vessel built at Jiangsu Yangzijiang Shipbuilding Co., Ltd, said the owner-operator within the Supramax / Ultramax segment.The acquisition was made by the EBS’ wholly-owned subsidiary, Eagle Bulk Shipco LLC , and was fully funded by restricted cash generated from previous vessel sale proceeds; the M/V Shanghai Eagle will form part of the security for the Subsidiary’s outstanding bond due in 2022.Proforma for the remaining acquisition vessel…

Oldendorff Signs 23 Deals with Chinese Firms

German dry bulk shipping company Oldendorff group has revealed a series of 23 deals with Chinese leasing companies over the last year.None of these deals involve lease finance, said the company.The deals involve six capesizes, four kamsarmaxes and 13 ultramaxes and comprise a range of resales and both fixed and floating time charters. Ten of the vessels will have scrubbers fitted."The charters we provided are market related and mostly on a floating index rate basis. The 10 Capes and Kamsarmaxes will all be equipped with scrubbers, eight of them with open loop scrubbers and two of them with hybrid scrubbers," said a release from the company."In the meantime…

Eagle Bulk Shipping Adds Hamburg Eagle to its Fleet

The owner-operator in the Supramax/Ultramax segment Eagle Bulk Shipping announced that it has taken delivery of its newly acquired vessel, the M/V Hamburg Eagle, a 2014-built SDARI-64 Ultramax.The acquisition has been funded by cash on-hand and new debt equating to USD 12.8 million. This new loan represents an upsize to the existing Eagle Bulk Ultraco LLC loan facility which carries an interest rate of LIBOR plus 2.95% and has a maturity of October 31, 2022.With the addition of the M/V Hamburg Eagle, the Company’s fleet is now comprised of 47 vessels, including 13 Ultramaxes acquired over the last 24 months.Eagle Bulk Shipping is a Marshall Islands corporation headquartered in Stamford, Connecticut.

Eagle Bulk Shipping Adds New Ultramax

U.S. based owner of Handymax dry bulk vessels Eagle Bulk Shipping has announced that it has taken delivery of its newly acquired vessel, the M/V New London Eagle, a 2015-built CROWN-63 Ultramax. The acquisition has been funded by cash on-hand and new debt of USD 8.6 million. This loan, which equates to approximately 40% of the purchase price, represents an upsize to the existing Eagle Bulk Ultraco LLC Debt Facility which carries an interest rate of LIBOR plus 2.95% and has a maturity of October 31, 2022. With the addition of the M/V New London Eagle, the Company’s fleet is now comprised of 47 vessels, including 12 Ultramaxes acquired over the last 14 months. Eagle Bulk Shipping is a Marshall Islands corporation headquartered in Stamford, Connecticut.

Eagle Bulk Buys Ultramax Bulkcarrier

Eagle Bulk Shipping announced that it has acquired a 2015-built CROWN-63 Ultramax bulkcarrier for a purchase price of USD 21.275 million. The vessel was constructed at Yangzhou Dayang Shipbuilding CO.,LTD., the same yard as the nine Ultramaxes acquired by the Company earlier this year, and is of similar design. The vessel is scheduled to be delivered to the Company in January 2018, and will be renamed the M/V New London Eagle. Including the M/V New London Eagle, the Company’s fleet will consist of 47 vessels, including 12 Ultramaxes acquired over the last 12 months. Eagle Bulk Shipping Inc. is a Marshall Islands corporation headquartered in Stamford, Connecticut. Eagle Bulk owns one of the largest fleets of Supramax/Ultramax dry bulk vessels in the world.

Oldendorff Revives Newbuild Contracts at Samjin

Last month saw the resurrection of two newbuilding contracts, which Oldendorff had concluded originally in June 2012 with Weihai-based Samjin Shipbuilding Ind. Co Ltd (SSI), at the time controlled by Korean shareholders. The initial order was for four 36,000 dwt Handysize newbuildings of the Korean designed FESDEC-36k eco type. The yard went through financial restructuring due to the problems of its Korean parent, leading Oldendorff to cancel all four ships and recollect its down payments in 2014 and 2015 after excessive delays.

Eagle Bulk Takes Delivery of Stonington Eagle

Eagle Bulk Shipping has taken delivery of the M/V Stonington Eagle, the third of nine Crown-63 Ultramax dry bulk sister vessels acquired from Greenship Bulk Trust for an aggregate price of $153 million. With the addition of the M/V Stonington Eagle, the current Eagle Bulk fleet consists of 43 vessels on the water, including five Ultramax vessels. Another six Ultramaxes are scheduled to be delivered over the coming months, growing Eagle Bulk's owned fleet to 49 Ultramax and Suezmax vessels.

Dry Aulk Awakens from Slumber

After a quiet holiday period, the market has slowly awakened from its slumber, says the weekly report by Fearnleys A.S. Rates are not running away but the market looks like it is finding a bottom. Averages for a Surpa are now around mid $4,000s and only marginally down from pre Christmas levels. 2016 has started with a couple of period fixtures reported at low $6,000s for Ultramaxes. Thus by default Supras will only be worth something in the $5,000s for a 12 month deal. Activity in the Atlantic seems to increase a bit after X-mas and new year, especially grain from USG and ECSA to far east absorbing tonnage. Transatlantic roundvoyages paying arnd 4000 USD depending delivery, duration and redelivery.

Dry Bulk Back from the Brink

While the tanker industry worries about OPEC reducing output and the container industry rushes to consolidate, dry bulk values have been quietly increasing. VesselsValue senior analyst William Bennett digs through the data to uncover the reasons why. Bulker values in the last 12 months have hit rock bottom and are now looking to show considerable promise. Five-year-old handysize values are up by over 40 percent; as are 15-year-old Panamax and Supramax asset prices. Pre-2002 built Capes are up by around 35 percent since February 2016.

AO Shipping Selects Wallem for 2 Newbuilds

AO Shipping has selected Wallem Europe as the managers of its two newbuild I-Star Ultramaxes, which will be delivered in 2015 from Imabari Shipbuilders. Wallem has been managing vessels for AO Shipping since 2009, and with the addition of the I-Star Ultramaxes, from 2015 Wallem will be managing five vessels on behalf of the owner. Wallem Europe Managing Director Ulrich Paulsdorff said the new vessel contracts were an endorsement of the maritime services offered by Wallem in Europe.

Euroseas Faces Headwinds, Reports Loss

Euroseas Ltd. (NASDAQ: ESEA), an owner and operator of drybulk and container carrier vessels and provider of seaborne transportation for drybulk and containerized cargoes, announced today its results for the three month period ended March 31, 2016. •Total net revenues of $6.5 million. Net loss of $2.8 million; net loss attributable to common shareholders (after a $0.4 million of dividend on Series B Preferred Shares) of $3.3 million or $0.40 loss per share basic and diluted. Adjusted net loss attributable to common shareholders1 for the period was $3.0 million or $0.38 loss per share basic and diluted. •Adjusted EBITDA1 was ($0.1) million. •An average of 11.54 vessels were owned and operated during the first quarter of 2016 earning an average time charter equivalent rate of $6,565 per day.

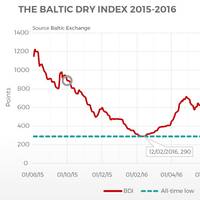

Dry Bulk’s Biggest Spenders

In the last month, we have seen the Baltic Dry Index (BDI) recover to the same level it was 12 months ago (see circles in fig.1). Vessel values have started to firm, but not at the same rate and are still at historically low levels. In the last 12 months, contrarian owners have taken advantage of the low values and have been buying cheap tonnage. With hindsight, this looks to have paid off with many values having increased above the purchase price. This article takes a look at which dry bulk owners have been buying the most in the last year.