ZIM and Shell Complete First LNG Bunkering in Jamaican Waters

ZIM Integrated Shipping Services Ltd. and Shell International Petroleum Company Limited announced the successful bunkering of the ZIM SAMMY OFER containership with liquefied natural gas (LNG), marking the first LNG bunkering operation in Jamaican waters. The vessel was bunkered at Kingston Freeport Terminal Limited (KFTL) on March 26, 2023. The ZIM SAMMY OFER is the first in a series of ten 15,000 TEU LNG dual-fuel containerships which ZIM plans to deploy on their ZCP trade line.

Zim Inks $1 Billion LNG Bunkering Deal with Shell

ZIM Integrated Shipping Services Ltd. on Wednesday announced it has signed a liquefied natural gas (LNG) bunkering deal valued at more than $1 billion with Shell NA LNG, LLC as the Israeli container shipping seeks to reduce emissions from its operations.Under the 10-year sales and purchase agreement, Shell will supply 10 LNG-fueled vessels that will be deployed on ZIM's flagship ZIM Container Service Pacific (ZCP), on the Asia to USEC trade. The 15,000 TEU vessels are expected to enter into service during 2023-2024 and will be transporting goods from China and South Korea to U.S.

BIMCO: Fleet Growth, Ship Size Up

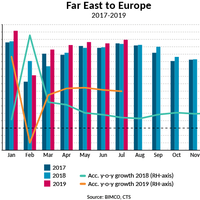

Global growth in container volumes has picked up slightly in the second quarter of the year, with growth in the first seven months reaching 1.2%, compared to the just 0.8% in the first quarter.Global growth in container volumes has picked up slightly in the second quarter of the year, with growth in the first seven months reaching 1.2%, compared to the just 0.8% in the first quarter. Despite this rise, the growth figure remains substantially below what the industry has been used to…

Frieght Cost Set to Rise Due to IMO 2020

With less than ten months before the IMO 2020 regulation on sulfur oxide emission goes into effect Jan 1, carriers and shippers alike are facing an 'uncomfortable uncertainty' over its potential effects on costs and freight rates as they enter the 2019-2020 trans-Pacific contracting period.The International Maritime Organization 2020 (IMO 2020) regulation on sulfur oxide emission will translate into an increase in freight rates, said Seabury Maritime, the global maritime and transportation investment & merchant banking and industry advisory firm, in a whitepaper.The IMO 2020 regulation mandates the reduction of sulfur oxide emission…

BIMCO: US Box Imports Break Records Despite Uncertainty Ahead

Container imports on both the US East Coast (USEC) and West Coast (USWC) had a strong year in 2018, growing 3.7% and 8% respectively in the first 11 months of the year compared to the same period in 2017.Record high levels of inbound laden containers were experienced on both coasts in October with the USWC at 1.09 million TEU and the USEC at 0.91 million TEU according to BIMCO’s own data.The first two months of 2018 saw the USWC coast’s laden imports increase 11.7% from the start of 2017, with the accumulated growth rate then stabilising to around 4% for the rest of the year.

ZIM Revenue Up by 7.7% for Q2 2018

ZIM Integrated Shipping Services (ZIM) reported total revenues were $803.2 million in Q2 2018, compared to $745.7 million in Q2 2017, an increase of 7.7%. It carried 772 thousand TEUs, an all-time record (reflecting a growth of 17.1% compared to Q2 2017).However, the operating cash flow was $52.6 million, compared to $88.9 million in Q2 2017.Eli Glickman, ZIM President & CEO, said: “Q2 2018 was characterized by the continued rise in fuel prices and chartering rates, as well as low freight rates, all with a negative impact on the results of carriers, including ZIM."Eli added: "In spite of these adverse circumstances, we were able to increase liftings, maintain exceptional service to our customers and record an adjusted EBIT margin above industry average.

Container Shipping Shakeup Needed for Higher Rates

Container shipping: Change required for higher ratesDemandThe growing imports of loaded containers into the U.S. East Coast (USEC) continues to be a focal point for the container shipping industry. Growing by 10.4 percent in Q1-2018, the first three months saw 215,000 TEU more entering the USEC than in Q1-2017. Exports grew by 55,000 TEU in the same time span, growing outbound loaded containers by 3.8 percent.This illustrates the constantly changing imbalance in U.S. foreign trade. For every five containers entering the USEC in 2013, four were exported.

Ocean Alliance Launches Day Two Product

The Ocean Alliance has launched its new Day Two Product with an estimated 3.6 million TEU carrying capacity provided by approximately 340 containerships deployed on 41 services. The new offering will commence in April 2018. Alliance partners CMA CGM, COSCO, Evergreen and OOCL will offer 20 Transpacific services, six Asia-Europe services, four Asia-Mediterranean services, four Transatlantic services, five Asia-Middle East services and two Asia-Red Sea services. “Ocean Alliance has been a fantastic success from a customer perspective since its launch last spring and we are very enthusiastic to announce our Day Two Product,” said Olivier Nivoix, Senior Vice President Ocean Alliance Lines.

Old Ships, Not Enough New Tricks?

As widely expected, the opening of the new, expanded locks at the Panama Canal in June 2016 has considerably impacted the ‘old Panamax’ containership sector, says a report by Clarkson Research Services. The displacement of these narrow beam vessels, resulting from the upsizing of services through the canal, has driven a change in deployment patterns in this sector and also contributed to a record level of containership demolition. The new locks at the Panama Canal allow 16.7m TEU of current fleet capacity to transit, compared to just 7.2m TEU which is able to transit the old locks. Following the opening of the new locks in June 2016…

Widened Panama Canal to Affect Trade Patterns

It was another lacklustre month for the shipping industry as freight rates in almost all sectors softened further. Drewry’s Earnings Index declined by 0.5% during the month to 52.4. The new locks of the Panama Canal finally became operational in June, enabling vessels of up to 49-metre beam, 366-metre LOA and 15-metre draught to pass through, which in turn will affect trade patterns in various sectors. The canal can now accommodate containerships of up to 12,500 teu. As more ULCVs are being delivered each month, carriers are desperately looking for new homes for smaller vessels (8,000-12,000 teu) cascaded out of the Asia-Europe trade.

ZIM to Enhance its Asia to US East Coast and Gulf Services

ZIM Integrated Shipping Services Ltd (ZIM) has announcd an enhanced Asia to US East Coast and Gulf service offering, with seven different weekly services, extensive direct port-to-port coverage and best-in-market Transit time from key ports in Asia to US East Coast & Gulf. The full scale services offered by zim in this trade: ZIM Seven Star Express (Z7S), inaugurated in May 2015, a premium service from South China, Vietnam and India Sub continent to US East Coast, will be upgraded with a direct Port Kelang call, offering 24 days transit time to New York. ZIM Pacific Atlantic Service (ZPA) brand new service by ZIM, covering Central China and Korea to Miami, Jacksonville and Charleston, will commence in early May, subject to FMC approval.

AAL, PD Launch Joint Semi-Liner Service

AAL & PD have followed up their cooperation on a range of global multipurpose tramp solutions with the launch a new joint semi-liner service - ‘Asia - Middle East - Europe’. The route will connect mature and developing markets with regular fixed route sailings, flexible port calls and multiple classes of modern heavy lift MPP vessels and represents a highly competitive solution for the transport of project, breakbulk, container and dry-bulk cargo – big and small. This launch marks further expansion of AAL’s Tramp & Projects Division and a step forward in its cooperation with Peter Döhle Schiffahrts-KG (Peter Döhle). The joint semi-liner service will offer best-in-class multipurpose heavy lift tonnage and a full-service of chartering, engineering and operations.

South of Africa on the head haul?

Since the end of October 2015, SeaIntel Maritime Analysis showed that 115 vessels deployed on Asia-USEC and Asia-North Europe services have made the back-haul trip to Asia by sailing south of Africa instead of through the Suez and Panama Canals, their routing on the head-haul. Of the 115 voyages, three were vessels on Asia-North Europe, while the rest were deployed on Asia-USEC. We could also see that there were plans to switch more Asia-North Europe sailings to the south of Africa routing in the coming weeks. While the change of routing of some Asia-North Europe services (back-haul) to south of Africa is a blow to the Suez Canal, it will not become critical until we see more back-haul services being switched and/or the head-haul routing also is changed.

Shippers Avoid Panama and Suez Canals Due to Charges

Container lines are adopting alternative routes to the Panama and Suez Canals to avoid charges say the Copenhagen-based SeaIntel Maritime Analysis. SeaIntel state that since October 2015 115 vessels deployed on Asia-USEC and Asia-north Europe services made the trip back to Asia by sailing south of Africa rather than through the Suez and Panama canals. The Suez Canal Authority state that the number of laden container vessels passing through the Suez Canal in 2015 dropped 2.8% from 2014. The additional distance of rounding Africa is offset by faster average speeds, lower fuel prices and savings on charges. However faster speeds and larger distances result in greater CO2 emissions.

Hanjin's First Service Call at Krishnapatnam Port

Hanjin Shipping India Pvt Ltd, the South Korean shipping conglomerate, made its maiden call at KPCT on 1st February, 2016. Vessel MV Hanjin Florida had exchanged 553 TEU out of which 109 TEU are imports and 444 TEU are exports. Krishnapatnam Port Container Terminal, whose volume during Apr’15 - Jan’16 has already surpassed FY 2014-15 container volume, offers immense opportunities for new service calls to tap its huge hinterland. The Port Rotation for this service is: KRISHNAPATNAM – TANJUNG PELEPAS - SINGAPORE – QINGDAO – XINGANG – BUSAN – SHANGHAI – NANSHA. This service will cater to all import/export businesses ex INKRI (Port Code of Krishnapatnam Port) to Far East, USEC, USWC, Latin America, Europe and Inter Asia.

US West Coast Not Ready for Mega Boxships

CMA CGM is testing the ability of the U.S. West Coast ports to handle the biggest containerships – are they ready? U.S. West Coast ports are not yet in a position to handle 18,000 teu containerships regularly and have much work to do in terms of improving productivity if they are to see them call on anything other than an ad-hoc basis. The 18,000-teu CMA CGM Benjamin Franklin will become the largest containership to call at any U.S. port when it arrives at the port of Los Angeles on 26 December. The new ship was delivered to French carrier CMA CGM at the start of the month and will join the Asia-U.S. West Coast ‘Pearl River Express’ service, part of the Ocean Three network, that normally operates with seven ships of around 11,400 teu.

Balikatan to Focus on Maritime Security

Officials from the Philippine and United States armed forces participating in this year's Balikatan exercises, the largest in 15 years, insisted that the said activities will not zero in on possible response to the issue of the South China Sea. A statement earlier released by the Armed Forces of the Philippines said the US is sending 6,656 troops to the country, more than double the approximately 2,500 American servicemen who joined last year’s exercise. During the opening ceremonies at Camp Aguinaldo on Monday, some officials, including Foreign Affairs Usec. Evan Garcia and Armed Forces of the Philippines chief Gen. Gregorio Pio Catapang Jr., mentioned maritime defense and concerns in their speeches.

Hapag-Lloyd Adds North Europe-USEC Service

Hapag-Lloyd will open a new weekly service between North Europe and the US East Coast, the company said in its press release. The new route – to be christened AX4 – will see a weekly run from the ports of Bremerhaven, Rotterdam and Le Havre to Savannah and New York. The new service will complement German container line Hapag-Lloyd’s existing Atlantic network. The AX4 will have the following rotation: Bremerhaven (Germany) – Rotterdam (the Netherlands) – Le Havre (France) – Savannah (USA) – New York (USA) – Bremerhaven. Transits between north European ports and New York are between 13 and 16 days. The 2,510 TEU MV Ulysses will be the first ship to sail within AX4, departing from ETC Bremerhaven on April 28.

Ocean Three Containership Alliance v the Rest: DMR Analysis

Last Tuesday’s announcement of the formation of the “Ocean Three” alliance – actually a combination of vessel sharing, slot exchange and slot charter agreements – confirmed one of the worst kept industry secrets. But what will be its impact on the competition? Drewry Maritime Research consider in this excerpt from their latest 'Container Insight Weekly''. The coming together from late 2014 of CMA CGM with CSCL and UASC was widely anticipated after the decision in June of Maersk Line and MSC to jettison CMA CGM in their 10-year “2M” VSA that replaced the original P3 Network plan. Having been left out in the cold by its erstwhile P3 partners…

DMR Sees US Container Terminal Sector M&A Flurry

M&A (Merger & Acquisition) activity in the US container terminal sector is currently at its highest level since the boom time of the mid-2000s. However, whilst the type of buyer is largely similar to what it was, the rationale for pursuing today’s deals is different, considers Drewry Maritime Research (DMR) in their latest 'Container Insight Weekly'. The US container terminal sector has seen numerous high profile deals so far this year.Most of the parties on the buy side of the deals are infrastructure and financial players – the same type of buyers that were most active in acquiring US terminals in the mid-2000s. Their aims and motivations today though are somewhat different to what they were.

Proposed Mega-Containerships Alliance 2M: Analysis

Maersk and MSC have just announced a mega vessel sharing agreement that will replace their failed P3 alliance early next year. It will be smaller, and compare well in size with the G6 and CKYH alliances – but what about CMA CGM? Maersk and MSC have taken on board China’s objections to the P3 alliance by coming up with a new vessel sharing arrangement called 2M that they hope will be agreed by all regulatory authorities before the beginning of next year. Out has gone CMA CGM, in order to bring the agreement’s market share down to more acceptable levels, and in has come a much simpler joint co-ordination committee to monitor the carriers’ network on a daily basis.

Panama Canal Expansion May Worsen Panamax Surplus: Analyst

The continuous cascading of surplus Panamax vessels into North-South trades is still contributing to over-capacity, and the problem is likely to get worse when the Panama Canal’s widened locks are opened at the end of 2015, according to the latest edition of Drewry Container Insight. MSC’s recently announced service between Asia and West Africa deploying 10 ships averaging 4,000 teu underlines a growing difficulty for North-South trades. Surplus Panamax vessels between 4,000 teu and 4,999 teu are still keeping charter rates low, making it easier for competing carriers to penetrate the markets more deeply, regardless of need. Only four of the ships deployed in MSC’s Africa Express service have so far been identified…

Evergreen Line to Terminate a Vessel Sharing Agreement

Evergreen Line inform they have notified their vessel sharing partners NYK, Hanjin, and Yang Ming Line to terminate its Vessel Sharing Agreement (VSA) on the ANS USEC-Caucedo-Brazil service in April 2014. The last vessel to be completing a round trip voyage will be Conti Harmony 019S/N (ETA Norfolk, VA Apr/10, May/22 2014).