US Offshore Wind: Figuring Out the Business

If awards were given for dominating the sustainable energy spotlight, offshore wind (OSW) would surely be in line for top honors.

Consider:

- Big money: BOEM’s February sale of New York Bight offshore wind development rights drew a record $4.37 billion in developers’ bids. Not only is that real money, but just as critically, “This week’s offshore wind sale makes one thing clear: The enthusiasm for the clean energy economy is undeniable and it’s here to stay,” exclaimed Interior Secretary Deb Haaland.

- Off Broadway: In January, BOEM approved the construction and operations plan (COP) for South Fork wind, twelve wind turbines planned for federal waters on the Outer Continental Shelf (OCS), approximately 35 miles east of Montauk Point, Long Island. Construction started in February. South Fork is expected to be operational in late 2023.

- The Big One: Last November, a groundbreaking at Covell’s Beach in Barnstable, Mass., marked the start of the huge 800-megawatt Vineyard Wind project, 15 miles from Martha’s Vineyard. Covell’s Beach is landfall for two cables, connecting to a substation further inland on Cape Cod.

- In the pipeline: A bigger picture – consider this assessment by Philip Lewis, Director of Research at Intelatus Global Partners, writing for MarineLink in January:

“At the beginning of 2022 the (OSW) situation is more positive. Twelve OCS projects are under final federal permitting review, 17.5 GW of project capacity has secured offtake commitments, 16.5 GW of new federal offshore leasing activity in the northeast, South Atlantic and California is underway, turbine component, foundation, and cable factories are being built in the U.S., awards for at least six Jones Act compliant wind farm support vessels were announced in the last quarter of 2021 and offshore wind port development is accelerating.”

It’s well known, of course, that OSW is promoted not just for energy and environmental reasons. Employment and economic development are critical drivers.

U.S. plans for OSW are gargantuan. Currently the U.S. is at the bottom of OSW production, for generation and the manufacture of equipment and infrastructure. In four years, plans are for the U.S. to be equal to or ahead of England and Germany, the current leading OSW countries; obviously, an incredible scale up.

As it starts, South Fork construction will create more than 100 jobs for Long Island skilled trades workers, including equipment operators, electricians, line workers, and delivery drivers, according to a press release.

But that’s just the beginning. New York is developing five offshore wind projects, expected to deliver a combined economic impact of $12.1 billion to the state. These projects, according to state officials, could create more than 6,800 jobs in project development, component manufacturing, installation, and operations and maintenance “and spur approximately 10,000 jobs.”

For businesses, this recent, tangible progress is tantalizing, but it raises questions: When is the big supply chain shift from metaphor to real money? How close is the ramp-up to the big show?

There’s no single answer. While OSW is presented as a singular energy resource, its implementation pulls in a myriad of complex topics, from high-tech engineering to the Jones Act to protected marine mammals to commercial navigation to interconnection and performance on the Nation’s electrical grid. Still, there are indicators of supply chain progress, examples of hard work underway to facilitate and establish the corollary framework necessary to build, in essence, a whole new industry. Here’s a look at some of this early work.

(Source: NBOC)

(Source: NBOC)

Massachusetts

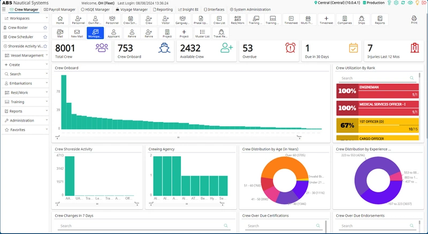

Business and wind energy interests in New Bedford, in late 2021, established a group to build out and strengthen the local and regional maritime business network. This new group is the New Bedford Ocean Cluster (NBOC). Its mission is to establish regional leadership in four core areas: offshore wind, aquaculture, commercial fishing and processing, and innovation and technology.

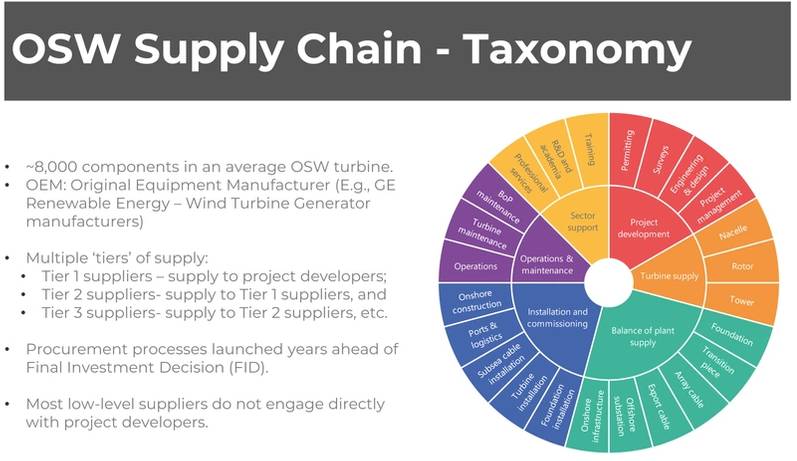

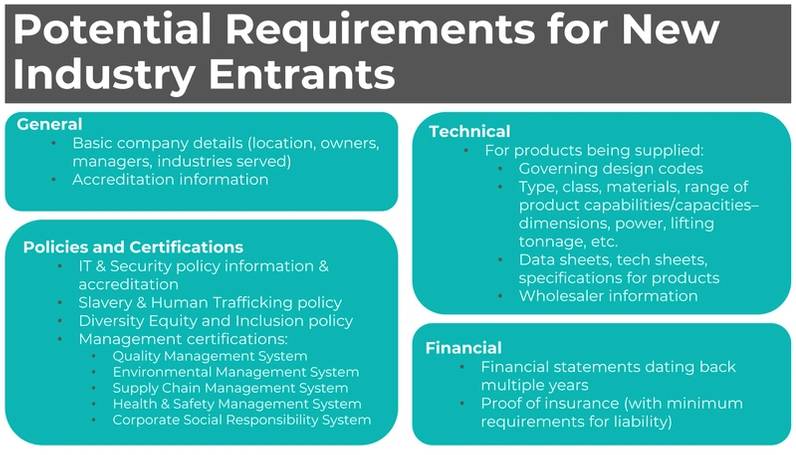

Luckily, any company interested in moving into the OSW sector can take advantage of a recent NBOC information session. Go to the NBOC website and click on the link for the “Offshore Wind Community Outreach Forum” held February 17. It’s a valuable hour and 15 minutes, providing a thoughtful foundation and a clear framework of OSW issues, from contracts, supplier tiers, timelines and where an individual company might best fit into the wind supply chain (see illustrations, courtesy of NBOC).

Two messages stand out: one, moving into this new wind sector can be intimidating; it requires study and research up front.

Second: now is the time for that advance work because the initial U.S. wind projects will largely be built overseas, considering the nascent status of the US wind industry. In two or three years, however, project developers all along the east coast will demand US based suppliers (that’s the economic development part). NBOC advises: do your homework now to be ready in 2024 or 2025.

In addition to education, NBOC has established an “Act Local Program.” Their team is out there, literally working the levers to connect developers and tier 1 suppliers with “adjacent suppliers” in New Bedford, e.g., commercial fishers who know maritime operations and can offer vessel and related services likely to be in demand.

If your business is in New Bedford, and you’re looking at OSW opportunities, get to know NBOC.

Brooklyn

On March 3 Equinor and bp announced an agreement to transform the South Brooklyn Marine Terminal into an OSW hub. This $250 million project ($57 million from New York) will prep this site for staging and assembly. An Equinor press release references “economic recovery and increasing diversity in waterfront construction, by helping local minority- and women-owned business enterprises benefit from the growing offshore wind industry and take advantage of the green jobs of the future.”

Unfortunately, the press release does not include a timeline for when this work starts, and when the site will be ready. The only temporal reference is that it is needed for power generation by 2030.

However, consider that New York’s expected timeline for permitting and approvals is between 2019 and 2023. Then, wind tower construction and installation are expected between 2022 and 2024. Those deadlines are looming. Brooklyn terminal work has to be starting soon.

Albany

In 2021, then-Governor Andrew Cuomo announced that the Port of Albany would be the site of the first OSW tower manufacturing facility. Planning is still underway. In October, the Town of Bethlehem, N.Y., had a public hearing to decide on various policy questions, including tax abatements, linked to a site permit. In early March those open issues were still undecided. However, a closure vote was expected in mid-March and this important step could be wrapped up, keeping construction on track for 2022. Supply chain pacing will likely pick up after that.

Brian Sabina, Chief Economic Growth Officer, New Jersey Economic Development Authority (Photo: NJEDA)

Brian Sabina, Chief Economic Growth Officer, New Jersey Economic Development Authority (Photo: NJEDA)

New Jersey

Like New York, New Jersey has ambitious OSW goals—both for generation and economic and social benefits. NJ has two upcoming major projects near term: Atlantic Shores, 1,510 MW and Ocean Wind, 1,148 MW. Each will use a new manufacturing facility, under construction, at the Port of Paulsboro. New Jersey is also investigating a new Wind Institute for R&D. The state released a request for proposals on January 7, seeking developers’ interest. Replies were due February 23. Once a contract is awarded, officials want initial work completed within nine weeks. That could spur a third study component, but the total project is to be completed within 20 weeks. If the Institute idea is a go, that adds more momentum to wind developments this year, or at least next year. State officials would not say what level of response they received from the Wind Institute RFP.

Brian Sabina is the Chief Economic Growth Officer for the New Jersey Economic Development Authority. He was asked about supply chain and related opportunities in 2022. He explained that a core driver in New Jersey is the procurement, by the state, of offshore renewable energy credits (OREC), an every-other-year process in N.J., with the next OREC sale in 2023. ORECs are a confirmatory market signal because they help fund green energy projects.

Sabina said that some preliminary work on Atlantic Shores and Ocean Wind has started. He expects this to expand, at a quicker pace, in 2023 and 2024. He said maritime operators are inquiring about work now. New Jersey partners with the Business Network for Offshore Wind, and Sabina referenced a series of conferences called “Offshore WindReady, Industry Education.” These sessions are designed to help New Jersey-based businesses understand the offshore wind industry and identify supply chain opportunities.

In addition, N.J. has an OSW supplier registry. State officials use it as their database for outreach to companies. Just as important, out of state companies use it to search for local suppliers. OSW is one of nine strategic sectors identified in Governor Murphy’s economic development plan. Sabina said businesses can contact sector leadership for help with OSW questions. Again, timing is critical. Suppliers need to investigate opportunities at least two to three years in advance of when a particular service or product might actually be needed for construction or operation.

Sabina was asked about new challenges for maritime operators thinking about OSW work, but otherwise new to that field. He said that if a company has experience with offshore oil and gas projects that history provides insight into pivoting to OSW. Since oil and gas is not part of New Jersey’s offshore operations, he said operational concerns should be discussed now with project developers. He noted that Gulf-based maritime operators are coming to the state, not for temporary work, but to establish themselves in preparation for wind. “We’re seeing companies who are in the Gulf look at east coast opportunities for OSW and thinking about localizing their operations here. That is definitely happening,” Sabina said. He referenced new partnerships and company expansions. “Those companies,” he commented, “recognize there’s a massive market opportunity that’s off the New Jersey shore.”

(Source: NBOC)

(Source: NBOC)

Conference April 26-28: Business Network for Offshore Wind

Brian Sabina leads New Jersey’s OSW economic growth programs. Sabina said N.J. works closely with the Business Network for Offshore Wind, and in an interview about supply chain development he referenced a BNOW conference scheduled for April 26-28 in Atlantic City, N.J. The April event is the 2022 International Partnering Forum (IPF) at the Atlantic City Convention Center. IPF is BNOW’s premier offshore wind energy conference in North America. The conference goal is to connect global leaders and businesses in the supply chain via networking opportunities and to provide industry updates, from technology to policy.

From even a quick check on the conference website the IPF agenda presents as an in-depth resource. It’s another indicator that businesses are prepping for big work in OSW.

Consider attendance: 1,500 people attended last year’s conference. At this writing, BNOW staff expect registration to exceed 2,000. Nearby hotels are sold out.

One conference highlight is the BNOW WindMatch program, serving to directly connect potential clients and partners. “With the rapid expansion of offshore wind, attending IPF will secure your place in the industry,” BNOW writes.

For New Jersey businesses, the agenda has a strong state focus, including a ports tour, sponsored by N.J.’s Economic Development Agency, the team leading N.J.’s wind projects and a N.J. “supply chain day.” More general topics cover standards, workforce development and even a “pitch presentation,” a chance to promote innovations in the OSW field. Plus, plenty of opportunities to network. This kind of interaction might be just what it takes to be ready for work, hopefully soon, ready to make the jump from concept to contract.