Norwegian Seismic Specialists TGS and PGS Set to Merge

Seismic group TGS, a supplier of key data to the oil industry, has agreed to buy loss-making rival PGS in an all-share deal valued at 9.3 billion Norwegian crowns ($864 million), the two Oslo-listed companies said on Monday.The groups expect "significant economies of scale" from the combination, with a preliminary estimate of cost cuts amounting to $50 million, they said in a joint statement.The deal, if approved by regulators, will give TGS ownership of seven modern seismic ships…

Rhine Water Level Falls Again in Germany, Raising Freight Costs

Water levels on the Rhine in Germany continue to fall in hot weather, sending shipping costs higher because vessels cannot sail on the river fully loaded, vessel brokers said on Friday.Freight shipping on the river continues but with vessels sometimes forced to sail 75% empty.Low Rhine water will also hit output from two German coal-fired power stations in the coming months.The water level is particularly low at the chokepoint of Kaub near Koblenz. The reference waterline level at Kaub was only 56 centimeters on Friday…

DeepOcean Charters Volstad's Volantis Subsea Construction Vessel

Subsea services company DeepOcean has chartered Volstad Maritime's M/S Volantis subsea construction vessel, which will, before starting the charter in 2023, be upgraded with batteries to reduce fuel consumption and emissions.The time charter will run from the first quarter of 2023 until the end of 2024, with options for further extensions."DeepOcean has set a target to achieve a 45 percent reduction in CO2 emissions before 2030. By 2040 we aim to be carbon neutral. Chartering vessels from vessel owners who share the same environmental commitment is key to this strategy…

Marine Coatings: Propspeed Targets Commercial Sector for Growth

Propspeed launched a new kit packaged specifically for the commercial marine trade professional. Rusty Morgan, VP of Sales & Operations, Americas, discusses with Maritime Reporter TV.New Zealand-based Propspeed, a maker of underwater foul-release coatings for 21 years, recently signaled its intention to enter full-force into the commercial maritime space with the launch of its first coatings kit packaged specifically for the commercial marine trade professional. The Propspeed Commercial Kit includes all that is needed to coat two propellers 165-203cm in size…

Tenth Shell Tanker Joins Signal Maritime Pool

The Signal Group said Wednesday that its shipping arm Signal Maritime has taken commercial management of Silver London, its 10th Shell medium-range (MR) tanker, increasing the pool’s fleet size to 15.According to Signal, the partnership allows Shell to benefit from its seven-year investment in the development of digital technology for chartering vessels.The addition of the energy major’s tonnage as well as a cargo contract into a third-party pool is a first for Shell and a milestone for Signal. The deal was concluded following six months of discussions and detailed due diligence. Signal said the move has already attracted significant interest from other shipowners looking to leverage its technology powered platform for their own fleets.Signal Maritime’s CEO…

'Containergeddon': Supply Crisis Drives Walmart and Rivals to Hire Their Own Ships

The Flying Buttress once glided across the oceans carrying vital commodities like grain to all corners of the world.Now it bears a different treasure: Paw Patrol Movie Towers, Batmobile Transformers and Baby Alive Lulu Achoo dolls.The dry bulk cargo ship has been drafted into the service of retail giant Walmart, which is chartering its own vessels in an effort to beat the global supply chain disruptions that threaten to torpedo the retail industry's make-or-break holiday season."Chartering vessels is just one example of investments we've made to move products as quickly as possible," said Joe Metzger, U.S. executive vice president of supply-chain operations at Walmart…

Supply Chain Shocks: Ocean Shipping Challenges Abound

Supply chain issues tied to liner shipping have been front page news throughout 2021; just about everyone agrees that there’s a problem. The underlying cause is right out of Economics 101: a surge in demand for moving containerized cargo, in the face of “inelastic” throughput capacity (which includes vessels and their landside interfaces to surface transportation, trucks and rail) that could not handle the swell, attributable to re-stocking of containerized cargo as economic activity recovered from the pandemic induced jolts.

ADNOC Adds Six VLCCs

Abu Dhabi National Oil Company (ADNOC) revealed Thursday that its shipping arm ADNOC Logistics & Services (ADNOC L&S) has added six very large crude carriers (VLCC) to its fleet as the UAE sate energy company expands production and moves further into trading.Two of the tankers were purchased from Norwegian owner Hunter Group in 2020, delivered in December and are already operating, and one was purchased this week and will be joining the UAE shipowner's fleet shortly. The other three ships (plus options) are newbuilds scheduled for delivery from South Korea's Daewoo Shipbuilding & Marine Engineering in 2022 and 2023."Given recent market conditions, we were able to purchase both existing and newbuild vessels at competitive prices," said Capt. Abdulkareem Al Masabi, CEO, ADNOC L&S.

Diesel Traders: Shortage is Coming

Gasoil traders expect the middle distillates market to stay well supplied until almost the end of 2019 before swinging into deficit with the introduction of new maritime fuel regulations.Calendar spreads for low-sulphur gasoil delivered to Europe's Amsterdam-Rotterdam-Antwerp hub are currently in contango through until October before shifting to backwardation from November onwards.In futures markets, contango structures, where future contract prices are higher than front-month prices, are associated with expectations of adequate or rising inventories.

Diesel Traders See Shortage, but not yet

Gasoil traders expect the middle distillates market to stay well supplied until almost the end of 2019 before swinging into deficit with the introduction of new maritime fuel regulations.Calendar spreads for low-sulphur gasoil delivered to Europe's Amsterdam-Rotterdam-Antwerp hub are currently in contango through until October before shifting to backwardation from November onwards (https://tmsnrt.rs/2WgXabR).In futures markets, contango structures, where future contract prices are higher than front-month prices, are associated with expectations of adequate or rising inventories.

Baltic Exchange Developing Container Shipping Index

London's Baltic Exchange is developing a container shipping index with Hong Kong-headquartered group Freightos in another sign that the centuries-old business is moving into new markets. Founded in 1744 as a forum for chartering vessels, the Baltic Exchange now produces benchmark indexes for global shipping rates, including ones used by the multi-billion dollar freight derivatives market. The Baltic and its partner on the initiative Freightos, a digital container platform which also has a global database of freight rates, said they would be producing a weekly index for container rates on 12 top container routes that would be audited by the Baltic. Going forward the index would allow container rates to become tradable instruments by investors.

Baltic Exchange to Develop LNG Freight Index

The Baltic Exchange is looking into launching a freight index for liquefied natural gas (LNG) and is working with leading ship brokers to explore potential shipping routes that might be used as the LNG market grows, the company said on Thursday. Founded in 1744 as a forum for chartering vessels, the Baltic Exchange now produces benchmark indexes for global shipping rates, including ones used by the multi-billion dollar freight derivatives market. Singapore Exchange acquired the exchange in 2016 and since then the Baltic has been looking for new markets to develop.

Baltic Exchange Mulls New Freight Indexes for Grains, LNG

The Baltic Exchange is looking into launching freight indexes for grains and liquefied natural gas (LNG) as the London-run business targets new markets after its acquisition by Singapore Exchange last year, the Baltic's chief executive said. Founded in 1744 as a forum for chartering vessels, the Baltic Exchange now produces benchmark indexes for global shipping rates and owns a trading platform for the multi-billion dollar freight derivatives market. SGX's ownership of the Baltic has enabled the exchange to set its sights on developing new areas…

Maersk Line Deploys First Second-gen Triple-E

Four years after the arrival of the first Triple-E vessel, Maersk Line has now deployed Madrid Maersk, the first of its second-generation Triple-E containerships. With nearly 2,000 more TEU capacity than the prior generation Triple Es, the 20,568 TEU (nominal capacity) Madrid Maersk has set sail on Maersk Line’s Asia – Europe service network, calling the Port of Tianjin in China on April 27 as its first port on its maiden voyage. Madrid Maersk is the first to enter service of the 27 new vessels ordered by Maersk Line in 2015.

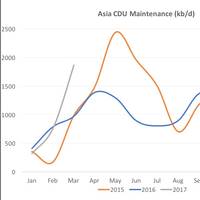

LR Tankers Taken for Gasoline Storage in Asia

Singapore gasoline cracks have averaged $10.72/bbl in February so far, down by 12 percent y-o-y but still relatively firm. Robust demand from the Middle East and intra-Asia as well as a flurry of both planned and unplanned refinery outages have been supporting gasoline cracks. ADNOC recently bought nine 27 kt cargoes over March-April delivery as its 127 kb/d RFCC remains shut from a fire. The shutdown of Pertamina’s 125 kb/d Balongan refinery and TPPI’s reformer in Tuban also led to firm buying from Indonesia, Asia’s largest gasoline importer.

Singapore Exchange Completes Baltic Exchange Takeover

Singapore Exchange has completed its takeover of the privately-owned Baltic Exchange, sealing an 87 million pound ($108 million) deal for one of London's oldest institutions, the groups said on Tuesday. The acquisition is one of the latest developments in a string of mergers, bidding wars and failed deals among global exchanges. SGX's offer also comes as the global shipping industry is struggling with its deepest downturn. "The acquisition ... has been completed today as planned, bringing together complementary strengths of Singapore and London, two of the world's most important maritime centres," the two said in a joint statement. The deal received UK regulatory approval last month after Baltic shareholders unanimously approved the takeover on Sept. 26.

Asia Dry Bulk-Capesize Rates to Remain Steady

Owners seeking to push rates higher, close to year-long highs; dry bulk sector to see greater consolidation - BIMCO. Freight rates for large capesize dry cargo ships on key Asian routes are likely to remain steady next week even as owners try to push rates up close to year-highs, ship brokers said. That came as charter rates stayed firm despite China's week-long National Day holiday which ends at the weekend. "Owners were asking around $6.10 per tonne from Western Australia to China on Thursday and $13 per tonne from Brazil to China," a Singapore-based capesize broker said on Thursday. Freight rates are climbing towards the year-highs touched on Sept. 22. "The market has been rising on the back of operators chartering vessels to move iron ore, but all the miners are in the market today.

Baltic Exchange Succumbs to Singapore as Shipping Turmoil Deepens

The crisis in global shipping and a tax exodus by big Greek vessel owners have helped finally seal the fate of London's Baltic Exchange after at least three approaches to buy it over the last six years of its near-three centuries history. Some 95 percent of shareholders voted on Monday in favour of a takeover deal from Singapore Exchange, valued at 87 million pounds ($112.87 million), trumping more than one effort from the London Metal Exchange to snap it up. "For Baltic shareholders it does release value…

Singapore Exchange Looks to Buy Baltic Exchange

Singapore Exchange Ltd (SGX) said it planned to offer 77.6 million pounds ($103 million) to buy London's Baltic Exchange and was seeking support from Baltic's shareholders for the deal. In a statement on Thursday, SGX said it sought to acquire from Baltic shareholders their issued ordinary share capital for 160.41 pounds in cash per share, representing a total consideration of 77.6 million pounds. "SGX again states that there is no assurance that the exclusivity agreement signed on 25 May 2016 will lead to any definitive agreement(s) or completion of the Potential Transaction," SGX said in the statement. The announcement came after Reuters…

SGX Prods Baltic Exchange Shareholders to Okay Bid

Total valuation of potential deal at least $113 million; Baltic shareholders key to clinching sale agreement. Singapore Exchange Ltd (SGX) plans to buy one of London's oldest institutions, the Baltic Exchange where shipping rates are published, and urged shareholders on Thursday to support a deal. As the global shipping industry struggles with the worst market conditions for decades, SGX offered shareholders in the privately-owned Baltic Exchange 160.41 pounds in cash per share, for a total 77.6 million pounds ($102 million). Founded in 1744 as a forum for chartering vessels, the Baltic Exchange now produces benchmark indexes for global shipping rates and owns a trading platform for the multi-billion dollar freight derivatives market.

Ince to Advise Danaos on HMM Restructuring

Ince & Co’s London and Piraeus corporate, finance and shipping teams have advised long-standing client Danaos Corporation on Korean container line Hyundai Merchant Marine Co. (HMM), Ltd.’s US$2.1 billion restructuring. New York Stock Exchange listed Danaos Corporation is a leading international owner of container ships, chartering vessels to many of the world's largest liner companies. The restructuring completed on 23rd July 2016 when HMM issued 151,292,727 new shares to creditors as part of a debt for equity swap. With 13 vessels on long-term charter to HMM, Danaos is the largest single shipowner in HMM’s fleet. Along with other container shipowners…

Baltic Exchange Board Backs SGX Bid

The Baltic Exchange board has unanimously backed a takeover bid from Singapore Exchange Ltd , a deal that will give SGX access to a trading platform for the multi-billion dollar freight derivatives market. On Aug. 4, SGX offered shareholders in London's privately owned Baltic Exchange 160.41 pounds in cash per share, for a total 77.6 million pounds ($102 million), and urged them to back the deal. The exchanges have agreed on the terms of the SGX offer, they said in a joint statement on Monday. "The proposed acquisition will accelerate the growth and development of the Baltic Exchange beyond what it could achieve on its own," Baltic Exchange Chairman Guy Campbell said.

Baltic Exchange Shareholders Approve Singapore Exchange Takeover

Baltic Exchange shareholders on Monday approved an 87 million pound ($112 million) takeover by Singapore Exchange for one of London's oldest institutions, in a deal that will give SGX access to the multi-billion-dollar freight derivatives market. The proposed transaction, unanimously recommended by the Baltic's board last month, was approved by shareholders at a general meeting in the historic City of London. It will now need regulatory approval, which shipping industry sources say is likely to be given. As the global shipping industry struggles with poor market conditions, SGX offered - after months of talks - Baltic shareholders 160.41 pounds per share plus 19.30 pounds per share as a final dividend, giving the privately owned business a total valuation of about 87 million pounds.