SOVs – Analyzing Current, Future Demand Drivers

At a high-level, there are three solutions to transferring technicians from shore bases to offshore wind farms for construction and O&M activities: crew transfer vessel (CTV), helicopter, and SOVs/CSOVs.SOVs and CSOVs generally house 60-120 technicians offshore for a few weeks at a time, allowing them to transfer to structures on integrated heave compensated gangways, by daughter craft or on CTVs. The vessels are also equipped with cranes, storage, and small workshop areas.SOV: Service operations vessels…

Skanska Set for South Brooklyn Marine Terminal Buildout

Sweden-based construction and development company Skanska has signed the final contract award, worth $612 million, for the upgrade of the South Brooklyn Marine Terminal (SBMT) in New York, which will serve as an offshore wind hub.The project will transform the SBMT into one of the largest dedicated offshore wind ports in the United States and support Empire Wind offshore wind project, which is currently being developed by Equinor off New York.The award will facilitate the demolition of existing buildings…

Equinor Upbeat About Investor Interest in US Offshore Wind Farm

Norway's Equinor is confident of finding an investor for its planned Empire Wind 1 offshore wind farm in New York after a new power off-take agreement improved the project's economics, the company said on Thursday.New York State authorities in February awarded the project a new conditional power purchase contract, replacing a previous deal that was no longer competitive due to rising construction costs, higher interest rates and supply chain snags.Equinor was glad to have received the new contract, which significantly changed the economics of the project, CFO Torgrim Reitan told analysts durin

New Cranes & Offshore Wind Efficiency

The end may be in sight, but the race for bigger cranes is still having an impact on offshore wind project efficiency.The industry has already felt the need for upgrading crane lifting capacity on existing offshore wind installation vessels: NOV is upgrading the cranes on Cadeler’s existing O-class wind turbine installation vessels (WTIVs), and a gantry crane extension will soon make Van Oord’s Svanen one of the largest floating heavy-lift installation vessels.It’s a newbuild phenomenon too. NOV has developed a telescoping leg encircling crane for Shimizu’s GustoMSC-designed WTIV Blue Wind.

Bourbon Orders Exail Tech to Streamline Subsea Fleet’s Services for Offshore Energy

UK-based Exail has secured a contract with French maritime services provider Bourbon to supply several units of its Octans Attitude and Heading Reference Systems (AHRS) for integration into Bourbon Subsea Services’s fleet.These units will be installed on multiple Bourbon Evolution 800 Series multi-purpose support vessels (MPSVs) dedicated to subsea operations at depths down to 3,000 meters.IMO-HSC certified, the Octans AHRS will enhance Bourbon vessels’ efficiency in installation…

MOL and Gaz-System Sing Long-Term FSRU Charter for New Polish LNG Terminal

Mitsui O.S.K. Lines (MOL) has signed a long-term time charter party agreement for one floating storage and regasification unit (FSRU) with the Polish gas transmission system operator Gaz-System, which is the developer and operator behind the future LNG terminal.The FSRU will be constructed by HD Hyundai Heavy Industries shipyard and is expected to be completed in 2027. Thereafter, the FSRU will be managed by the MOL group.The FSRU is being built for the project that involves the…

Hess Sets Date for Shareholder Vote on Chevron Merger

Hess Corp on Wednesday said its board has set April 12 as the record date for the determination of the stockholders entitled to vote on the proposed merger with Chevron Corp.Shareholders will vote on the proposed deal in a meeting whose date is yet to be set, the company said in a U.S. securities filing. Neither Chevron nor Hess can predict the actual date on which the transaction will be completed, it said in the filing.Exxon Mobil and CNOOC Ltd filed cases before the International Chamber of Commerce last month…

US Releases Offshore Wind Liftoff Report and Promises Funding

The U.S. Department of Energy (DOE) has released its latest report in the Pathways to Commercial Liftoff series, describing how the U.S. offshore wind sector is adapting to challenges and poised for continued progress, with a path to deploying over 100 gigawatts (GW) by 2050.The Pathways to Commercial Liftoff: Offshore Wind report finds that the sector today is poised for liftoff, enabled by continued efforts to adapt to recent market challenges. The projects that move forward in the next several years will lay the foundation for consistent long-term deployment…

US Interior Department Finalizes Offshore Renewable Energy Rule

US Secretary of the Interior Deb Haaland has announced that the Bureau of Ocean Energy Management (BOEM) and the Bureau of Safety and Environmental Enforcement (BSEE) have finalized updated regulations for renewable energy development on the U.S. Outer Continental Shelf. The final rule increases certainty and reduces the costs associated with the deployment of offshore wind projects by modernizing regulations, streamlining overly complex processes and removing unnecessary ones…

US Plans 12 Offshore Wind Auctions Over Five Years

President Joe Biden's administration unveiled plans on Wednesday to hold up to a dozen auctions of offshore wind development rights through 2028, including four before the end of this year.The schedule will help companies, states and others plan for projects that require massive amounts of investment and infrastructure, the Interior Department said in a statement."Our offshore wind leasing schedule will provide predictability to help developers and communities plan ahead and will…

CBED Signs Up Siemens Gamesa for Wind Creation SOV’s First Job

Danish shipowner CBED has signed a contract with Siemens Gamesa for the first offshore wind project for its new SOV Wind Creation as part of the CBED fleet.With the new walk-to-work project, the SOV joins commissioning an offshore wind farm in the Netherlands.The project starts at the end of the second quarter of 2024 and runs for the remainder of the year, thereby securing full activity for Wind Creation until the first quarter of 2025.CBED now has all three vessels in the fleet…

U.S. Installed Offshore Wind Capacity Jumps in First Quarter

Installed offshore wind capacity in the U.S. grew to 242MW in the first quarter of the year from 42MW in the previous quarter, the Oceantic Network said in its report, showcasing a recovery in a previously volatile industry.The offshore wind industry is expected to play a major role in helping several states and, the Biden administration meet goals to decarbonize the power grid and combat climate change.The industry had a tough 2023 after developers wrote off billions of dollars in impairment charges due to high-interest rates…

Subsea Vessel Market is Full Steam Ahead

Since our last market update in the subsea space about a year ago both our current market view and forecasts have strengthened significantly.While the demand picture is looking solid and arguing for a strong multi-year upcycle, the supply side has also started to wake from its slumber albeit ever so slightly at the time of writing. Moreover, we register an interesting dynamic on the shipowner side, where everyone is trying to position themselves for the impeding market boom.Please note that vessel definitions and abbreviations in this part of our industry can vary…

One-on-One: Rob Langford, VP, Global Offshore Wind, ABS

As the U.S. offshore wind industry endures a predictable number of stops and starts during its adolescence, common mantras are ‘learn from the established European model’ and ‘embrace technology transfer from the offshore oil and gas sector.’ In Robert Langford, the American Bureau of Shipping has all of that and more bundled in one neat package.Rob Langford has worked in the offshore industry for more than three decades, ‘cutting his teeth’ in a UK design firm working in the North Sea oil and gas platforms, the holy grail of rigorous conditions in offshore energy production.

Navigation and Wind Farms: Competing Ocean Uses Raise Existential Questions

“Wind Turbines: The Bigger, the Better” -USDOE Office of Energy Efficiency & Renewable Energy, August 24, 2023Last December the Bureau of Ocean Energy Management (BOEM) published a proposed sale notice regarding new development areas for utility scale wind projects in the central Atlantic Ocean. The notice includes an upfront issue: the need to mitigate conflicts with U.S. Department of Defense (DOD) activities. BOEM explains that in certain areas the Air Force has set an airspace floor of 1,000 feet above sea level and the Air Force asked BOEM to keep structures below that height.

Esgian Week 16 Report: Rigs on the Move

Esgian reports on the many rig movements that occurred last week in its Week 16 Rig Analytics Market Roundup.Report SummaryContractsADES Holding Company has received a letter of award from an international oil company for a one-year firm drilling contract for a jackup offshore Qatar.TotalEnergies has exercised a three-well option for Transocean 12,000-ft drillship Deepwater Skyros offshore Angola at a rate of $400,000, keeping the rig working into December 2025.After initially beginning a short-term job in the US GOM in January 2024…

NOIA Appoints New Executives

The National Ocean Industries Association (NOIA) has appointed and approved the 2024-2025 term of the NOIA Board of Directors and Executive Committee. Jon Landes, President, Subsea of TechnipFMC has been elected as the NOIA Chair and Joe Leimkuhler, Chief Operating Officer of Beacon Offshore Energy, as the incoming NOIA Vice Chair.NOIA President Erik Milito said, “We are at a critical juncture where it's imperative to ensure that energy policy from Washington, D.C. does not hinder American energy production.

New York Not Moving Forward With Three Offshore Wind Farms

New York State on Friday stalled three major offshore wind-energy projects after General Electric Vernova GE.N changed the turbine design, which the state said "materially altered" the plans.New York provisionally approved the projects in October 2023. They are Attentive Energy One being developed by TotalEnergies, Rise Light & Power and Corio Generation; Community Offshore Wind, which is backed by RWE and National Grid Ventures; and Vineyard Offshore's Excelsior Wind.But since then…

KEYS Azalea Completes its First Ship-to-Ship LNG Bunkering

Japan’s first dual-fuel LNG bunkering vessel KEYS Azalea has completed its first ship-to-ship LNG bunkering in Western Japan.The vessel - owned and operated by KEYS Bunkering West Japan Corporation, a joint venture established by Kyushu Electric Power, NYK Line, Itochu Enex, and Saibu Gas - bunkered LNG for the car and truck carrier Daisy Leader 2 at the Port of HiroshimaKEYS Azalea was delivered to KEYS Bunkering West Japan Corporation earlier in April. It is equipped with a…

DEME Scoops ‘Most Extensive’ Cabling Contract in Its History

DEME has been awarded two contracts from cable solutions provider Prysmian for the engineering and installation works for the IJmuiden Ver Alpha and Nederwiek 1 offshore grid systems in the Netherlands, whose combined worth is over $315 million.This is the most extensive cabling award in DEME’s history and marks the company's first project involving Prysmian’s 525 kV HVDC cable technology, featuring increased transmission capacity, according to the company.The contracts encompass cable installation…

New CSOV Delivered to Rem Offshore

Shipbuilder Vard announced it has delivered a new commissioning service operation vessel (CSOV) to Norway's Rem Offshore.The vessel—NB 948, to be named Rem Wind—was constructed at Vard Vung Tau in Vietnam and handed over one month before contractual delivery date, the builder said.Tailor-made for worldwide services and maintenance operations at offshore wind farms, the 85-meter-long vessel is of VARD 4 19 design with a 19.5-meter beam, accommodation for 120 people, a height-adjustable motion-compensated gangway with elevators…

All Clear for Construction Start of Virginia’s 2.6GW Offshore Wind Farm

The U.S. Environmental Protection Agency (EPA) has issued the final air quality permit for Dominion Energy’s 2.6 GW Coastal Virginia Offshore Wind (CVOW) project located off the coast of Virginia Beach in the United States.Issued on April 9 following a 30-day public comment period, the permit authorizes the construction and operation of the largest offshore wind project in the U.S.

DEME’s Orion Vessel Heads to US After Finishing Scottish Offshore Wind Job

DEME’s DP3 offshore installation vessel Orion has departed for the United States to prepare for the installation of 176 foundations on the Coastal Virginia Offshore Wind (CVOW) project, following the wrap up of works at the 882 MW Moray West offshore wind farm in Scotland.DEME’s flagship Orion vessel has completed monopile installation works on Ocean Winds’ Moray West offshore wind farm project in Scotland.Despite harsh winter conditions, DEME managed to install 29 monopiles in approximately two months.Meanwhile…

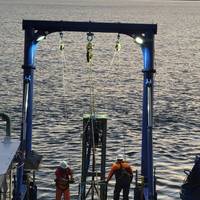

Ocean Charger for Offshore Wind Vessels Proves a Success

The industry consortium behind the Ocean Charger project, led by Vard, has completed the demonstration of the charging solution in a port as well the connection solution offshore, proving the technology designed to supply clean power to offshore wind vessels is ready for the market.By connecting vessels to the power grid in the wind farm and charging batteries regularly, the Ocean Charger solution is securing availability of emission-free vessel operations.The Ocean Charger has proved through the tests that it can power operations at the field without using any additional energy sources…

Allseas Makes Progress on Santos’ Barossa Gas Export Pipeline in Australia

Offshore installation contractor Allseas has made progress on the installation of the pipeline for Santos’ Barossa Gas Export Pipeline (GEP) project offshore Australia.Allseas’ Audacia pipelay vessel has installed her largest ever PLET in S-mode, concluding several years of in-house engineering, fabrication and testing, the Swiss-based contractor said.Due to the weight of the pipeline end termination structure, Allseas’ production crew had to install it separately to the connector head.Audacia vessels is being supported with four other vessels - Fortitude…

First US-built WTIV Charybdis Launched

The United States' first Jones Act-compliant offshore wind turbine installation vessel (WTIV), Charybdis, was launched into the water at the Seatrium AmFELS shipyard in Brownsville, Texas.The 472-foot WTIV—the first and only to be constructed in the U.S.—is being built for Blue Ocean Energy Marine, a subsidiary of Dominion Energy, who announced the milestone on Monday. Welding of the ship's hull and commissioning of the vessel's four legs and related jacking system has been completed…

Esgian Week 15 Report: South America Remains Vital

Esgian reports on new contracts for Borr Drilling and Shelf Drilling (North Sea) jackups in its Week 15 Rig Analytics Market Roundup. Additionally, Energean has selected a drillship for its upcoming drilling campaign offshore Morocco. South America remains vital to the floating rig market, with ExxonMobil moving ahead on a sixth development on the prolific Stabroek block offshore Guyana and Petrobras reporting a new discovery in Brazil's Potiguar Basin.Report Outline:ContractsBorr Drilling has announced new contract commitments for three of its premium jackup rigs…

Kongsberg Maritime Celebrates 50 Years of Ship Design

2024 marks 50 years of ship design work for Kongsberg Maritime. From setting the benchmark that set the standard for offshore supply vessels in the 1970s, to advanced anchor handlers that transformed the oil and gas industry, and a growing reference list in fishery and merchant ships, Kongsberg Maritime’s range of ship designs has continued to evolve over the past five decades.The early 1970s, at the dawn of the offshore oil and gas industry, saw the very first vessels, designed…

Arctia to Map Offshore Wind Area in Norway

Arctia Meritaito, a subsidiary of Finland's Arctia, announced it has been awarded a contract by the Norwegian Mapping Authority to perform hydrographic seabed surveying as part of the 2024 Mareano program.Under its contract from the Norwegian Mapping Authority's Hydrographic Service (NHS), Arctia Meritaito will survey approximately 1,900 square kilometers with multibeam echosounder and sub bottom profiler in potential offshore wind area Sørvest F in the North Sea.The surveys will be conducted by the multipurpose research vessel Pohjanmeri.

Siem Offshore Chairman Exits with Nine-vessel Purchase

Kristian Siem, founder and longtime leader of Siem Offshore, is stepping down as chairman of the Norwegian offshore support vessel (OSV) firm after reaching a deal to acquire nine vessels in exchange for his 35% stake in the company.The company announced it has reached an "amicable agreement" to sell Siem Barracuda, Siem Stingray, Siem Opal, Siem Pearl, Siem Topaz, Siem Pilot, Siem Pride, Siem Symphony and Siem Thiima to Kristian Siem's Siem Sustainable Energy S.a r.l and related companies in exchange for 35% of the company’s shares.The other major shareholder is Christen Sveaas' Kistefos…

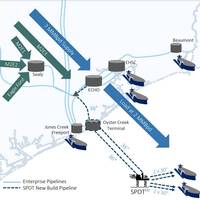

Enterprise Products Gets Port License for Gulf of Mexico Oil Terminal

Enterprise Products Partners said on Tuesday it had received a deepwater port license for its Sea Port Oil Terminal (SPOT) in the Gulf of Mexico from an agency of the U.S. Department of Transportation.The project, located near Freeport, Texas, would become the biggest offshore oil export terminal in the U.S. after completion with a capacity to load two supertankers at a time and export 2 million barrels of crude oil per day."The receipt of the license is the most significant milestone to date in the development and commercialization of SPOT…

Pelagic Partners Teams Up with Borealis Maritime to Grow PSV Fleet

Shipowner and shipping fund manager Pelagic Partners announced it has teamed up with asset management firm Borealis Maritime to invest in a pair of platform supply vessels (PSV).Built in 2021, the 89-meter Aurora Coey – formerly Viking Coey – and Aurora Cooper – ex-Viking Cooper – are both dual-fuel and capable of operating on liquefied natural gas (LNG), as well as being ammonia-ready. The ice-class sister vessels are fitted with hybrid battery power, and Low Loss Concept (LLC) solutions that further reduce emissions…

Bourbon Orders Six Crewboats from Piriou

Bourbon Mobility on Tuesday announced it has ordered six new crewboats from shipbuilder PIRIOU for scheduled delivery in 2025.These new Surfer-type vessels will enhance the fleet operating in West Africa, offering customers a balance between modularity, comfort and energy efficiency, Bourbon said, noting the newbuilds aim to reduce fuel consumption by 20%.With a length of 27 meters and a maximum speed of 30 kts, these Surfers will be able to carry between 50 and 70 passengers…

GES and Provaris Team Up for New Hydrogen Import Facility at Port of Rotterdam

Global Energy Storage (GES) and Provaris Energy have entered a collaboration agreement to develop a gaseous hydrogen import facility at the GES terminal in Rotterdam.Under the collaboration, GES and Provaris will complete a comprehensive prefeasibility study to demonstrate the technical and economic viability of berthing and unloading of Provaris’ H2Neo compressed hydrogen carriers.Activities will also include the joint marketing of the proposed facility where Provaris will be…

One Dead, Two Seriously Injured After Fire Hit Pemex Oil Platform

At least one contractor was killed after a fire struck an offshore platform operated by Mexico's national oil company Pemex, the firm said in a statement on Sunday, adding that two others were in "grave" condition.A total of nine workers suffered injuries in the blaze on Saturday afternoon that struck the company's Akal-B platform, located in the southern Gulf of Mexico, where most of Pemex oil output originates.Five of the nine were Pemex employees while the rest were contractors from local service providers Diavaz and COTER.A day earlier…

Ulstein Verft Launches CSOV Olympic Boreas

Norwegian shipbuilder Ulstein Verft on Saturday launched the new Olympic construction service operation vessel (CSOV), Olympic Boreas.The newbuild is first of two sister vessels for Olympic, designed to assist in offshore energy construction projects and service assignments.The launch saw the vessel towed out the dock hall and moored quayside for outfitting work."The general outfitting work, which consists of accommodation work, electrical installations, piping and mechanical installations, to name a few, is well underway.

Esgian Week 14 Report: Major Jackup Contract Suspensions

Esgian reports various drilling contractors disclosing details of discussions with Saudi Aramco regarding jackup contract suspensions in its Week 14 Rig Analytics Market Roundup. These contractors include Shelf Drilling, ADES, Borr Drilling, Arabian Drilling, COSL, and ARO Drilling.Meanwhile, Transocean, Noble, and COSL rigs have firmed up new work in the US Gulf of Mexico, Suriname, and the North Sea, respectively.Report overview:ContractsShelf Drilling has received a notice of suspension of operations on four jackup rigs from a customer in the Middle East.

Nine Injured in Pemex Platform Fire

Mexico's state energy company Pemex said on Saturday that a fire broke out at one of its platforms in the Gulf of Mexico, adding that it had activated emergency protocols and contained it but that nine workers were injured in the accident.Pemex said in a statement that two of the workers were its own employees and seven were from other companies, adding that none were severely injured.The fire broke out late afternoon in a part of the Akal B platform where gas pipelines are located.Videos…

MDL Assists Saipem on Gastrade’s LNG Development Off Greece

Maritime Developments (MDL) has assisted Saipem in progressing an LNG project offshore Greece, which included work on the connection of Gastrade’s Alexandroupolis floating storage regasification unit (FSRU) to the country’s gas transmission system.The project consisted of a FSRU and a mooring and pipeline system, connecting the floating unit to the Greek National Natural Gas Transmission System (NNGTS).An MDL flex-lay spread was used for the installation of two flexible risers…

SEACOR Marine Upgrades PSV with Hybrid Battery Power System

U.S.-based SEACOR Marine has completed the installation of a hybrid power system on its platform supply vessel (PSV) SEACOR Yangtze.Beginning in February 2024 in Norway, Kongsberg Maritime started the upgrade of the UT771 CDL SEACOR Yangtze with the Deckhouse Energy Storage System.The installation of the system has been completed, SEACOR Marine informed on April 4, 2024, adding to its fleet of hybrid battery-powered PSVs.To remind, SEACOR Marine announced it will convert four other of its PSVs to battery hybrid power in a move to enhance efficiency and slash emissions.The Houston-headquartered

MOL Puts FSRU for Indonesia's Jawa 1 LNG Power Plant Into Operation

Mitsui O.S.K. Lines (MOL) has started commercial operation of the floating storage and regasification unit (FSRU) Jawa Satu for the Jawa 1 LNG-fired power plant in Indonesia.MOL owns the FSRU through PT Jawa Satu Regas (JSR), jointly established by PT Pertamina (Persero), Marubeni Corporation, Sojitz Corporation, and other partners.Built by Samsung Heavy Industries in South Korea, the Jawa Satu FSRU has a storage capacity of 170,000 m3, with 300 MMcsfd of regasification capacity.The…

Con Edison, NGV Propose Offshore Wind Project for New Jersey

Con Edison Transmission and National Grid Ventures submitted a plan to carry offshore wind power to New Jersey's electric grid as the state aims to meet renewable energy goals, according to a press release on Thursday.If awarded, the 'Garden State Energy Path' proposal involves building transmission infrastructure that would be operational by early 2029 and deliver about six gigawatts (GW) of offshore wind power, Con Edison said."This project is foundational to helping New Jersey reach its goal of 11 GW of offshore wind by 2040," it said.Earlier this week, California’s grid operator recommende

NextGeo Taps Frank Koopman as Offshore Wind Strategy Director

Marine geosciences and offshore construction support services company NextGeo has appointed Frank Koopman as Offshore Wind Strategy Director.Koopman is an experienced executive and leader in the offshore energy sector, with over 20 years of experience in leading complex organizations, projects and innovation programs. He was Global Director Offshore Wind and Global Director Marine Site Characterization at Fugro from 2019 to 2023.Giovanni Ranieri, CEO of NextGeo, said, “We are thrilled to confirm our collaboration with Frank Koopman, who will serve as NextGeo's Offshore Wind Strategy Director.

Biden Administration Approves Eighth US Offshore Wind Project

The U.S. Interior Department on Tuesday approved the country's eighth commercial-scale offshore wind project, which will be built off the coast of Massachusetts, bringing online electricity to power more than 900,000 homes.The approval for Avangrid’s New England Wind Project brings the U.S. one-third of the way to President Joe Biden's goal of permitting 30 gigawatts of offshore wind capacity by 2030—a key part of the president's climate change agenda.The project comes just a week after the Interior Department approved another offshore wind project, Orsted's Sunrise Wind, in New York.

Wärtsilä Lifecycle Agreement for Installation Vessel Green Jade

Wärtsilä reports it has signed a long-term Guaranteed Asset Performance agreement with CSBC-DEME Wind Engineering Co Ltd (CDWE), a joint venture between CSBC Corporation and DEME Offshore. The agreement covers CDWE’s new 216 meters-long installation vessel, the Green Jade. Marco Kanaar, CEO of CDWE, owner of the Taiwan-designed and -built offshore heavy lift DP3 installation vessel Green Jade says: "High utilization of our Green Jade is of utmost importance to our business which is why we have selected the Wärtsilä thrusters and engines for its reputation for excellent quality and reliability.

Astilleros Balenciaga Delivers New SOV for Edda Wind

Norway-based Edda Wind on Tuesday announced it has taken delivery of a newly built service operation vessel (SOV) from Spanish shipbuilder Astilleros Balenciaga.The vessel, C416—to be renamed Edda Goelo at a later stage—was delivered on March 26. It will be the permanent vessel in the contract with Siemens Gamesa Renewable Energy at the Saint-Brieuc wind farm in France, running until Q2 2028. C416 is of Salt 0358 design and the sister vessel of Edda Brint, delivered from Astilleros Balenciaga in October 2022.

TDI-Brooks Completes Survey Off New York & New Jersey

Between January 2023 and February 2024, TDI-Brooks conducted an extensive site investigation program in two offshore wind blocks in state and federal waters. The projects involved surveying in excess of 20,000 line-kms of analogue and either single or multi-channel seismic in lease blocks and cable routes along the coasts of New York and New Jersey. Various tasks were carried out at different stages, such as offshore geophysical surveys, UHRS detailed surveys, archaeological identification surveys…

Esgian Week 13 Report: Demand Shifts

Esgian reports shifts in demand in its Week 13 Rig Analytics Market Roundup.Report overview:ContractsADES has received a Letter of Intent (LOI) from PTTEP Energy Development Company Limited for an 18-month jackup drilling contract in the Gulf of Thailand. Operations are expected to begin in the second half of 2024, with an unspecified jackup.Drilling Activity and DiscoveriesThe Norwegian Offshore Directorate (NOD) has granted Aker BP a drilling permit for an exploration well in…

Sima Christens New Crew Tender Vessel

Maaskade Group's Sima Charters has christened its latest newbuild crew tender vessel in the Netherlands.The high-speed aluminum monohull vessel, SC Ruby, was built by Neptune Marine.The 23-meter-long vessel is equipped with triple Volvo Penta IPS 1050 propulsion and features a Seakeeper gyrostabilization system for increased workability.

Welsh Port Steps Closer to Becoming Floating Wind Hub

A project to transform the Port Talbot into a major hub for floating offshore wind (FLOW) and green energy development has come one step closer to securing a share of up to $200 million (£160 million) of UK Government funding.The UK Government has agreed to take forward the Future Port Talbot project and the Port of Cromarty Firth to undergo due diligence as part of the next stage of its Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS).The due diligence process…

Seaway7 Gets Baltica 2 Offshore Wind Job

Subsea7's renewables-focused offshore installation subsidiary Seaway7 has secured a ‘sizeable contract’ by PGE Polska Grupa Energetyczna and Ørsted for the transport and installation of the substations for the Baltica 2 offshore wind farm in Poland.Seaway7’s scope includes the transport and installation of four substations. Offshore activity is scheduled to take place in 2026 utilising both heavy lift and heavy transportation vessels.The ‘sizeable contract’ for Seaway7 means it…

Ocean Infinity Inks Deal with Shell for Subsea Data Capture Services

Ocean Infinity signed a global framework agreement (GFA) with Shell to provide its robotic fleet for servicing the offshore energy sector.The GFA marks a significant milestone in the provision of lean-crewed and robotic seabed geomatics, spanning geophysical and geotechnical services, within the offshore energy sector.It covers a 5-year period, encompassing all countries where Shell is currently active or plans to operate in the future.Services governed by the GFA include the Armada fleet of uncrewed and lean-crewed vessels."This agreement enables new…

New England Offshore Wind Auction Draws Multiple Bidders

Several offshore wind developers bid in a combined Connecticut-Massachusetts-Rhode Island offshore wind solicitation on Wednesday, including units of European energy firms Iberdrola and Orsted.The U.S. offshore wind industry is booming so far this year, with several projects in various stages of development and construction, after a disastrous 2023 of developers cancelling contracts and taking roughly $9.1 billion in write-offs and impairments on U.S. projects.So far, Avangrid…

Cadeler Signs Wind Turbine Installation Contract Worth Up to $150M

Danish offshore wind installation firm Cadeler has signed a contract to provide its vessel Wind Scylla for the installation of offshore wind turbines for an undisclosed client.The contract is valued between $75 million and $150 million, including both the firm period and potential options.The installation work is set to start in 2025 with Wind Scylla vessel, according to Cadeler.During the project duration, spanning between 300 and 550 days, the client will utilize Cadeler’s team…

Strategic Marine to Build CTV for Polish Offshore Wind Industry

LOTOS Petrobaltic, an ORLEN Group company, signed a contract for the construction of a Crew Transfer Vessel (CTV) with Singapore-based Strategic Marine, set for service in the Polish offshore wind market.The StratCat 27 CTV is scheduled to be completed this summer, with delivery to Europe planned for early September 2024.This CTV will join the existing fleet managed by Miliana Shipmanagement Limited, a company belonging to the LOTOS Petrobaltic capital group, which owns five offshore…

US Approves Orsted's Sunrise Wind Offshore Wind Farm

The Biden administration on Tuesday gave final approval to Orsted and Eversource's Sunrise Wind offshore wind facility, which is expected to provide power to more than 320,000 homes in New York.The announcement was the latest positive development for the project, which Denmark's Orsted warned just months ago could fail without a new contract that would cover soaring costs for equipment and financing.Orsted and Eversource said separately that they had taken a final investment decision…

New CTV Ordered for Polish Offshore Wind Sector

Singaporean shipbuilder Strategic Marine reports it has secured an order to construct a newbuild crew transfer vessel (CTV) for the Polish offshore wind sector.The order comes from LOTOS Petrobaltic S.A., an ORLEN Group company, and will see the new vessel—a BMT-designed StratCat 27—delivered to Europe in September of this year.This CTV will join the fleet managed by Miliana Shipmanagement Limited, owned by the LOTOS Petrobaltic capital group, which owns five offshore vessels.

Surface Effect Ship Designed for Crew Transfer Vessels

ESNA and Strategic Marine have signed an agreement to develop a SES CTV (Surface Effect Ship Crew Transfer Vessel) for offshore wind applications.According to Wikipedia, a surface effect ship or sidewall hovercraft is a watercraft that has both an air cushion, like a hovercraft, and twin hulls, like a catamaran.The vessel type offers the combination of higher speed, increased operational wave height and reduced fuel oil consumption.The plan is to start building the first offshore…

Esgian Week 12 Report: New Finds in Guyana, China and Norway

Esgian reports fresh finds confirmed in Guyana, China and Norway in its Week 12 Rig Analytics Market Roundup.Report Outline:ContractsDolphin Drilling has announced the award of a $154 million drilling contract from India's exploration and production company, Oil India Limited (Oil India), to the 6,000-ft semisub Blackford Dolphin.Malaysian offshore drilling firm Velesto confirmed Friday it had recently secured long-term contract extensions for three of its jackup rigs with Petronas Carigali…

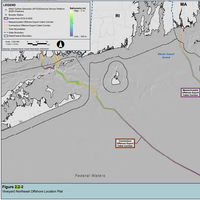

BOEM Announces Review of Proposed Vineyard Northeast Project

The US Bureau of Ocean Energy Management (BOEM) will initiate an environmental review of Vineyard Northeast’s proposed offshore wind energy project, located 29 miles offshore Nantucket, Massachusetts at its closest point. BOEM estimates the proposed project would generate up to 2,600MW of electricity, enough to power more than 900,000 homes with clean renewable energy. The approximately 132,370-acre Lease Area is located some 29 miles (mi) from Nantucket and approximately 39 mi offshore Martha’s Vineyard…

US Revises Tax Credit Rule to Help Offshore Wind Projects

The Biden administration on Friday released new rules that will make it easier for offshore wind developers to claim a subsidy for facilities planned in areas that have historically relied on fossil fuel industries for employment.The revision follows nearly a year of warnings by offshore wind companies that their projects might not move forward without access to certain subsidies in President Joe Biden's landmark climate change law, the Inflation Reduction Act.Offshore wind is a critical part of Biden's plan to decarbonize the U.S.

German Wind Sector Welcomes Offshore Terminal Funding

The German Offshore Wind Energy Foundation said the government's decision to help fund the expansion of an offshore terminal is important to achieve expansion goals for wind energy at sea.In a statement late Friday, the foundation said it welcomed a government move to contribute to the costs of expanding the terminal at the port of Cuxhaven, on the North Sea coast.The government has agreed to finance the 30-hectare (74 acres) expansion of the offshore terminal, together with the state of Lower Saxony and the private port industry…

Rem Offshore Places Order for Next-Gen Subsea Construction Vessel

Norway-based offshore vessel owner Rem Offshore and shipbuilder Myklebust Verft have signed a contract for the construction of an Energy Subsea Construction Vessel (ESCV) with a 250-tonne crane.The vessel will be delivered in 2026 and will be the first of its kind that can perform heavy construction work in both offshore wind and subsea with net zero emissions, according to Rem Offshore.The contract also contains an option to build one more vessel, the company confirmed.The vessel will be equipped with dual-fuel methanol engines in combination with battery packs.

Carbon Capture @ Sea: Evergreen Ship Notches World First

ClassNK has granted its SCCS-Full class notation to Evergreen’s Neopanamax container vessel Ever Top.Short for Shipboard Carbon dioxide Capture and Storage-Full, the SCCS-Full notation signifies that the vessel is now equipped with onboard CO2 capture and storage (CCS) systems.This also marks it as the world's first Neopanamax container vessel to be retrofitted with such systems, according to ClassNK.The CCS systems, designed and developed by Shanghai Marine Diesel Engine Research Institute…

Euroports and BlueFloat Forge Strategic Offshore Wind Alliance

One of the largest port-infrastructure companies Euroports and Spanish offshore wind developer BlueFloat Energy have signed a memorandum of understanding (MoU) to foster cooperation in supply chain and ports infrastructure for the delivery of offshore wind in Europe.The strategic alliance marks a significant step forward in building capabilities and infrastructure critical to establish an offshore wind energy sector.Euroports, with its distinguished reputation as a premier offshore wind port operator…

Petrobras Exec Says Gas Export Possible from Colombia Project

A promising area off Colombia's coast where Brazil state-run Petrobras is drilling this year could justify a large project to supply natural gas to the Andean country and for exports, Petrobras' head of exploration and production said on Wednesday.As oil production in Brazil's prolific presalt region is set to plateau in coming years, Petrobras is expanding its horizons to new frontiers including the Equatorial Margin, Colombia and Africa.At Colombia's Tayrona block, Petrobras…

ABB to Supply Shore Connection System for DEME’s Fleet in Vlissingen Port

ABB has secured a contract to deliver shore connection installations that will enable DEME’s fleet to avoid emissions when berthed in the Port of Vlissingen in the Netherlands.ABB’s shore connection technology will support DEME’s long-term decarbonization strategy, providing the flexibility required to adapt to changing grid capabilities.Shore connection enables the diverse fleet of dredgers, offshore construction and support vessels to avoid carbon emissions by shutting off their…

Reach Subsea Extends Olympic Taurus Charter and Orders Two ROVs

Norwegian company Reach Subsea has extended the charter for the Olympic Taurus subsea vessel and ordered two new Constructor-type remotely operated vehicles (ROVs) from Kystdesign.Back in February, Reach Subsea announced a 100-day project charter for the subsea vessel Olympic Taurus, with extension options for 2+1+1 years.The company has now extended the charter for an additional two years and retain options for another 1+1 years."With a solid backlog and substantial tender pipeline for the coming periods…

World’s First Floating Wind Innovation Centre Opens

The world’s first dedicated innovation centre for floating offshore wind has opened in Scotland.Located in the heart of Aberdeen’s Energy Transition Zone, ORE Catapult’s £9 million National Floating Wind Innovation Centre (FLOWIC), delivered in collaboration with ETZ Limited, is designed to help supercharge the development of floating offshore wind technology in the UK, with funding from both the Scottish Government and Innovate UK.Floating offshore wind represents a huge economic opportunity…

Vestdavit Hits New Sales Record as Orders Increase 76% From Last Year

Norwegian davit supplier Vestdavit has notched up a new annual sales record for another consecutive year after seeing its order intake surge by 76% in 2023 on high demand from the offshore wind and oil and gas sectors, as well as increased sales in its core naval market.Vestdavit has expanded its market position in offshore wind after both gaining new customers and winning repeat orders with existing clients, including Esvagt and Rem Offshore, with orders in this sector accounting for more than $9.4 million (NOK 100 million)…

Saipem and Fincantieri Form Subsea Alliance

Saipem and Fincantieri have signed a memorandum of understanding (MoU) to evaluate commercial and industrial opportunities for cooperation in the field of autonomous subsea vehicles (AUV) and their integration with surface and underwater units.The MoU is among the initiatives aimed at promoting and developing Italy’s national excellence in the underwater sector.The agreement aims to enable the two companies to participate in major programs in the Italian and international markets in the area of surveillance and control of critical underwater infrastructure and rescue activities…

OMSA Announces New Board Members

Industry trade group the Offshore Marine Service Association (OMSA) announced the addition of four CEOs to its board of directors.The new board members include Wes Bordelon, Chief Executive Officer, Bordelon Marine; Stacy Jo Stanley, Chief Executive Officer, Offshore Oil Services, Inc.; David Dantin, Chief Executive Officer, Odyssea Marine; and Lasse Petterson, Chief Executive Officer, Great Lakes Dredge and Dock."With the addition of these four executive leaders, OMSA pays homage to its roots while welcoming expanded opportunities in emerging energy frontiers…

CEO Says Exxon Mobil Not Trying to Buy Hess

Exxon Mobil CEO Darren Woods on Monday said his company is trying to establish it has rights over Hess Corp's Guyana assets in its dispute with Chevron, not buy the company itself.In his first public remarks on the company's pursuit of an arbitration case that could block Chevron's $53 billion deal for Hess, Woods said Exxon would not have waited for Chevron to announce its Hess deal if it had wanted to buy Hess."We're basically standing up for what we believe is a fundamental right," Woods told Reuters at the CERAWeek energy conference in Houston.

Strategic Marine Delivers Crewboat for Truth Maritime Services

Singaporean aluminum boat builder Strategic Marine recently delivered TMS Ranod, the first of two Gen 4 Fast Crew Boats to growing Thai offshore services provider Truth Maritime Services (TMS). The pair of newbuild contracts were signed in 2023.Strategic Marine launched the 42m Gen 4 FCB design in collaboration with Southerly Designs, and the vessel comes with a highly efficient new hull form and Z-bow which improves seakeeping and requires less power for the same speed and deadweight tonnage…

JUB Pacific Bolsters Liftboat Fleet

JUB Pacific, a Singapore-based provider of specialized offshore liftboat services, has acquired one of the largest liftboats in Africa, said to be perfectly suited for servicing major players in the oil and gas sector within the Africa region.JUB Pacific acquired the Caracal Pioneer liftboat, which shall be renamed to JUB Pioneer, in a strategic move to extend the company’s global reach and solidify its position as one of the leading liftboat players.The unit is well-equipped to support a diverse range of offshore operations which is highly required by large oil companies in Africa…

Boskalis Wraps Up Moray West Offshore Wind Farm Ops

Dutch marine services firm Boskalis has completed its activities in support of the development of Ocean Winds’ 882 MW Moray West offshore wind farm in Scotland.As part of its multidisciplinary role in the project, Boskalis deployed six vessels to carry out large number of activities off the east coast of Scotland in the Moray Firth.First, Boskalis’ wholly-owned subsidiary Gardline carried out extensive geotechnical and geophysical survey works prior to the installation work.Then…

Port of Skagen and Maersk’s Stillstrom Partner Up to Decarbonize Anchorage Zone

The Port of Skagen and Maersk’s offshore vessel-charging venture Stillstrom have signed a memorandum of understanding (MOU) to jointly explore the integration of offshore power and charging solutions into the anchorage zone of the Danish port known as Skagen Anchorage.The strategic collaboration aims to address the pressing need for decarbonization in the maritime industry by leveraging innovative technology and sustainable practices.As one of the busiest anchorage zones in Northern Europe…

Esgian Week 11 Report: New Discoveries in UK and Namibia

Esgian reports that drilling contracts have been announced this week for operations in Brazil and the Philippines, and new discoveries have been confirmed in the UK and Namibia in its Week 11 Rig Analytics Market Roundup.ContractsCOSL Drilling has emerged as the winner for Petrobras' moored semisubmersible tender with the 4,600-ft Nanhai 8 (also known as Nan Hai Ba Hao).Noble has secured a high-dayrate drillship contract with Prime Energy in the Philippines.Drilling Activity and…

BOEM Starts Environmental Review of Proposed Wind Project off New Jersey

The Bureau of Ocean Energy Management (BOEM) will initiate the environmental review of a proposed wind energy project offshore New Jersey.At its closest point, the approximately 81,129-acre lease area, OCS-A 0549, known as Atlantic Shores North, is located 8.4 miles from the New Jersey coast and approximately 60 miles from New York.The Atlantic Shores’ proposal currently includes installation of up to 157 wind turbine generators, eight offshore substations, one permanent meteorological tower, and two temporary metocean buoys - for a total of up to 168 offshore structures.

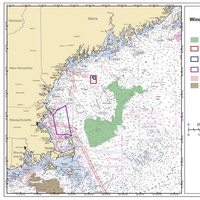

BOEM Finalizes Wind Energy Area in the Gulf of Maine

The Bureau of Ocean Energy Management (BOEM) has finalized its designation of a Wind Energy Area (WEA) in the Gulf of Maine. The Final WEA has the potential to support generation of 32GW of clean energy, surpassing current state goals for offshore wind energy in the Gulf of Maine: 10GW for Massachusetts and 3GW for Maine. The WEA totals about two million acres offshore Maine, Massachusetts, and New Hampshire, ranging from approximately 23 – 92 miles off the coast.BOEM finalized the WEA after extensive engagement with the states of Maine…

Launch Ceremony Held for A-O-S' New Jones Act CTV Gripper

An official launch ceremony was held to celebrate the commissioning of a new Jones Act compliant crew transfer vessel (CTV) built for American Offshore Services (A-O-S)—the company's first.Constructed by Blount Boats in Warren, R.I., the 100-foot-long aluminum catamaran is owned and operated by A-O-S, a joint venture formed in 2020 by leading European CTV operator Northern Offshore Services (N-O-S) and U.S.-based investment firm OIC.The vessel will support Ørsted and Eversource’s portfolio of offshore wind farms in the Northeast…

Ulstein Introduces New Subsea Vessel for Offshore Energy Market

Norwegian shipbuilder and ship designer Ulstein has developed a new subsea vessel - ULSTEIN SX232 – designed to service the offshore wind market for floating and fixed installations as well as offshore oil and gas industry.Designed for walk-to-work operations in the offshore energy market, the ULSTEIN SX232 features an optimizes hull based on the ULSTEIN TWIN X-STERN design.The vessel is equipped with smart power and propulsion system developed to minimize energy consumption during DP operations and an integrated energy recovery system utilizing all the waste heat in the machinery systems…

Dutch Government Picks France's Naval Group for Submarines Order

The Dutch government on Friday said it had picked French defense company Naval Group to build four new submarines in coming decades in a long-brewing deal seen by politicians as a potential lifeline for the national shipbuilding industry.The government said the first two submarines would be operational within the next 10 years. It did not specify the exact value of the multi-billion euro contract.The submarines will be of a size to both operate in shallow waters and take part in missions far from base.The agreement still has to be approved by the Dutch parliament…

New International Partnership Set to Speed Up Offshore Wind Installations in US

Danish offshore marine services company Maersk Supply Service and U.S. vessel owner Edison Chouest Offshore (ECO) have partnered up for the construction and operation of a windfarm feeder concept specifically designed for Maersk Supply Service’s next-generation wind installation vessel (WIV).The purpose-built feeder spread includes two tugs and two barges to be delivered in 2026. They will be owned and operated by ECO and constructed by Bollinger Shipyards – the largest privately-owned shipyard group in the United States.As a key component to the installation process…

TotalEnergies Awards New Contracts to Siem PSV Pair in Brazil

Norwegian shipowner Siem Offshore has secured new contracts with TotalEnergies for two of its platform supply vessels (PSV) for work offshore Brazil.The contracts are for Siem Giant and Siem Atlas PSVs.The new duration for Siem Giant is three years firm with options up to four more years.For Siem Atlas, the new duration is nine months firm with options until the end of the second quarter in 2027.Both vessels will start the contracts in June 2024 in direct continuation of present contracts…

Saipem Gets Offshore Pipelines Installation Job for CCS Schemes in UK

Saipem has signed a letter of intent for the development of CO2 offshore transportation and storage facilities as part of the Northern Endurance Partnership (NEP) and Net Zero Teesside Power (NZTP) projects for the East Coast Cluster in the UK.Saipem signed a Letter of Intent, received by the Northern Endurance Partnership (NEP), a joint venture between the operator BP, Equinor, and TotalEnergies, and Net Zero Teesside Power (NZT Power), a joint venture between BP and Equinor.The…

Ørsted Powers Up All Turbines at First US Commercial-Scale Offshore Wind Farm

Ørsted has installed and powered up all 12 turbines at the landmark South Fork project, and the first utility-scale U.S. offshore wind farm has started delivering power to Long Island and the Rockaways, offshore New York.The commissioning of the wind farm is in its final stage, and when at full capacity of 130 MW, it will generate enough renewable energy to power approximately 70,000 homes.The renewable energy is generated roughly 35 miles off the coast of Montauk, and will eliminate up to six million tons of carbon emissions over the life of the project…

TotalEnergies Renews Contract for Bibby WaveMaster 1 SOV’s Services

Bibby Marine has secured a three-year contract extension with long-standing client TotalEnergies EP Nederland for its ‘walk-to-work’ service operation vessel (SOV) Bibby WaveMaster 1.The three-year charter extension will begin in the first quarter of 2025, and the vessel will be deployed on the Dutch continental shelf in the Southern North Sea.The SOV will continue to accommodate and transport service engineers and maintenance personnel, supporting gas production activities across…

NYK and Astomos Energy Christen New Jointly-Owned Dual-Fuel LPG Carrier

As their first jointly owned liquefied petroleum gas (LPG) carrier in 21 years, NYK and Astomos Energy have named the new vessel Gas Garnet.The companies held a naming ceremony at the Sakaide Works of Kawasaki Heavy Industries on March 1, 2024.The 86,953 m3 capacity vessel was christened Gas Garnet by Yoshihito Takahashi, senior executive officer of Astomos Energy. This is the first jointly owned LPG vessel by the companies after they shared ownership of Gas Capricorn from 2003.The vessel has a breadth of 37.2 meters…

Equinor Extends Drilling Contracts

Equinor, on behalf of the partners, is exercising two options to extend contracts with Archer AS, KCA Deutag Drilling Norway AS and Odfjell Operations AS for a total of four years.The options for drilling services on fixed installations on the Norwegian continental shelf provide jobs for 2,000 people per year and have an estimated value of NOK 18.4 billion.The contracts were signed in 2018 with three option periods of two years. The first two-year option was exercised in 2022.

New UTM Payload Available for Scout 137 Drone System

ScoutDI has added an ultrasonic thickness measurements (UTM) payload, complete with in-flight A-scan, to the capabilities of its end-to-end inspection data solution for the Scout 137 drone.The product is suitable for offshore applications where drones are becoming common for visual inspection and steel plate thickness sampling must be done regularly to monitor e.g. the effects of corrosion over time.Adding the UTM payload enables the Scout 137 drone to collect location-tagged…

Tokyo Gas, 13 Others to Jointly Develop Offshore Wind

Tokyo Gas and 13 other Japanese companies plan to set up a consortium "soon" to develop technology to mass produce floating offshore wind power facilities at a low cost, the Nikkei business daily reported on Wednesday.The other companies include Japan's biggest power generator JERA and regional utilities Kansai Electric Power, Tohoku Electric Power and Chubu Electric Power, the Nikkei said.Although Japanese companies have offshore wind assets in countries from Taiwan to Belgium and Britain, they have yet to build large-scale farms at home.(Reuters- Reporting by Kiyoshi Takenaka; editing by Mil

Nord Stream Sues Insurers in London Over 2022 Pipeline Blasts

Nord Stream is seeking more than 400 million euros ($436 million) from its insurers over explosions in 2022 which ruptured pipelines designed to transport Russian gas to Germany, court filings show.Nord Stream AG names Lloyd's Insurance Company and Arch Insurance (EU) DAC as defendants in its lawsuit, which was filed at London's High Court last month.Switzerland-based Nord Stream confirmed in an email there is a contractual dispute in London commercial courts between itself and insurers of the pipeline system."However…

Huisman to Supply Two Subsea Cranes for Toyo’s New Cable Layer

Dutch company Huisman has secured a contract to supply two subsea cranes for Toyo Construction’s new cable laying vessel (CLV), being built by Norwegian shipbuilder Vard.The contract Huisman signed with Vard is for the delivery of full electric 250 mt Hybrid Boom Subsea Crane, and a 100 mt Knuckle Boom Crane that will be integrated into Toyo’s CLV newbuild.The purpose-built VARD 9 15 design is expected to advance capabilities for cable-laying and turbine foundation installation works in the Japanese offshore wind sector.Designed to meet the specific Toyo’s requirements and preferences of Toyo…

MOL Teams Up with Rio Tinto for Decarbonization of Maritime Transportation

Mitsui O.S.K. Lines, Ltd. (MOL) and Rio Tinto have signed the partnership agreement to enhance collaboration on both safety and crew welfare initiative and decarbonization of maritime transportation.MOL and Rio Tinto have agreed to further collaborate on shipping decarbonization in addition to the existing commitment to the DOO program through a deal signed on January 24, 2024.The DOO program is a Rio Tinto initiative aimed at enhancing safety and improving crew welfare in the…

DOF Bags Shell’s Decommissioning Contract for Knarr and Gaupe Fields

Norwegian offshore vessel operator DOF Group has secured a ‘substantial’ subsea engineering procurement removal and disposal (EPRD) contract from Norske Shell in the Atlantic region.The contract outlines 100 combined days of utilization of DOF’s vessels Skandi Hera and Maersk Installer.DOF will deliver an integrated solution of project management, engineering, design, analysis and survey.Described as ‘substantial’ by DOF, this means that the contract is valued between $23.8 million and $47.8 million (NOK 250 million to NOK 500 million).The scope includes recovery and recycling of umbilicals…

Source of Huntington Beach Oil Spill Uncertain

The Unified Command concluded its response to an oil sheen observed offshore of Huntington Beach, California on Monday, but the source of the oil remains unclear.Over the weekend, cleanup crews recovered approximately 85 gallons of product from offshore recovery efforts and removed roughly 1,050 pounds of oily waste/sand and tar balls from the shoreline.The U.S. Coast Guard and the California Department of Fish and Wildlife, Office of Spill Prevention and Response (CDFW-OSPR) collected samples from the offshore sheen and tar balls along the shoreline to help determine the source of the oil.

Strategic Marine Delivers Support Vessel for Yunlin Offshore Wind Farm

Singapore’s Strategic Marine and Taiwan’s Prosperous Wind Shipping have delivered the hybrid-ready support vessel for the Yunlin offshore wind farm in Taiwan.The StratCat 27 hybrid-ready vessel is designed for the transfer of technicians and cargo, essential for the construction, operation, and maintenance of offshore wind farms.Owned and operated by Prosperous Wind Shipping, the vessel will be able to meet the specific needs of the offshore wind industry in Taiwan.Set to start operations at the Yunlin offshore wind farm in April 2024…

Norway Offers $193 Million Funding to Arctic Floating Wind Farm Project

A floating offshore wind farm planned in Arctic waters on Friday received 2 billion Norwegian crowns ($193 million) in state funding, with Norway viewing the still costly technology as a key contributor for industry development and emission cuts.The GoliatVind project in the Barents Sea, consisting of five 15 megawatts turbines and seeking to supply power to the Arctic town of Hammerfest, beat out six other applicants in a tender by government agency Enova.Norway hopes that floating offshore wind will provide an industrial future for its offshore supply industry as well as a means of cutting e

Esgian Week 10 Report: Additional Backlog Secured

Esgian reports that offshore drilling contractors secured additional backlog in the U.S. Gulf of Mexico, Egypt, Nigeria, and Brazil and operators confirmed new discoveries in Indonesia, Côte d’Ivoire, and China in its Week 10 Rig Analytics Market Roundup.ContractsDiamond Offshore has executed a two-year contract extension with a subsidiary of bp in the U.S. Gulf of Mexico for the 12,000-ft drillship Ocean BlackHornet.Shelf Drilling’s 250-ft jackup Rig 141 has secured a two-year…

No Remaining Recoverable Oil Sheen Seen off California

The U.S.

TDI-Brooks' Retrofitted Vessel Arrives to US for Offshore Wind Work

TDI-Brooks' latest dynamic positioning vessel, the RV Nautilus, has reached the shores of the East Coast of the United States ahead of work for offshore wind sector.After undergoing a six-month retrofit in Las Palmas, the 2000-built vessel will be put to work to provide support for offshore wind projects and various other subsea needs.With the length of 75-meters, the DP2 vessel is equipped with advanced technology, including a Geomil Manta-200 CPT that can be deployed through the mid-ship moonpool.The system can penetrate the soil up to 40-50 meters…

Siem Offshore Secures Contract Extension for Multi-Purpose Support Vessel

Norwegian offshore vessel owner Siem Offshore has been awarded a contract extension for the multi-purpose support vessel (MPSV) Siem Dorado.According to Siem Offshore, the extension secures the utilization of Siem Dorado MPSV for a period reaching towards the end of the fourth quarter in 2024.The contract is expected to start in direct continuation of the current contract with continued operations expected outside the North Sea.The Siem Dorado is a 2009-built diesel electric-driven vessel.