Gulf LNG Tugs to Provide Towage at Texas LNG Terminal in Brownsville

Gulf LNG Tugs of Texas has been selected to provide towage services for the Texas LNG export terminal to be constructed in the Port of Brownsville.Gulf LNG Tugs, a consortium of Suderman & Young Towing Company, Bay-Houston Towing, and Moran Towing Corporation, will build, deliver and operate tugboats under a long term agreement to assist LNG carriers arriving at the facility.Texas LNG will be a 4 million tonnes per annum (MTPA) liquefied natural gas (LNG) export terminal owned and managed by Glenfarne Energy Transition.

Workboat Power: Alternatives Join Diesel to Power Current—and Future—Vessels

Analysts and commentators are quick to point out that fossil fuels will power maritime equipment, and indeed dominate the fueling marketplace, well into the future. However, they will do so alongside new fuels, and new technologies, that will be introduced to the maritime sector in the coming years. In its September, 2023 report “Beyond the Horizon: View of the Emerging Energy Value Chains”, the American Bureau of Shipping (ABS) explains that, “During the recent 80th meeting of the Marine Environment Protection Committee (MEPC 80)…

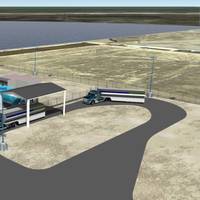

Gulf LNG Orders Four New Tugs

Gulf LNG Tugs of Brownsville has ordered four new tugs to serve the Rio Grande LNG export facility (RGLNG), which has commenced construction in Brownsville, Texas.Gulf LNG Tugs is a joint venture formed between Bay-Houston Towing Co., Moran Towing Corporation and Suderman & Young Towing Company to provide tug services for RGLNG under a long-term tug services agreement.The company announced Tuesday it signed construction contracts with Coden, Ala. shipyard Master Boat Builders and Port Neches, Texas shipbuilder Sterling Shipyard.

Harvey Gulf Operates First Carbon Neutral PSV

U.S. offshore vessel owner Harvey Gulf International Marine said it is the first in the world to operate a carbon-neutral platform supply vessel (PSV).The company announced on Monday that one of its tri-fuel vessels has started operating exclusively on battery power and renewable liquefied natural gas (RLNG), with diesel fuel as back up, moving the New Orleans-based firm a step closer to becoming the world's first ESG certified oil and gas vessel operator."We always knew the day would come when investors and customers would demand low…

Harvey Gulf Names EVP Business Development

Harvey Gulf, an offshore vessel owner focused on the Gulf of Mexico region, said Wednesday it had appointed Jon Holvik, formerly with Siemens Energy, as Executive Vice President, Business Development.Holvik has been brought on board to enhance the marketing capabilities of Harvey Gulf International Marine, Harvey Gulf Subsea Solutions, Harvey Fuel, and its Offshore Windfarm Vessel Support division. He is of Norwegian descent and spent most of his career with Kongsberg Maritime. He started with Kongsberg in his homeland of Norway, eventually moving to the United States in 1998.

Next Wave of U.S. LNG Export Projects to be Tougher

The next wave of U.S. liquefied natural gas (LNG) export projects will be “tougher” to bring online, as companies with existing facilities take advantage of lower costs to expand capacity in coming years, the chief executive of Blackstone Group said on Wednesday.Blackstone CEO David Foley said at the Gastech Energy Conference in Houston that only one or two new startup projects may reach a final investment decision (FID) in the next wave of U.S. LNG export projects.“In terms of liquefaction capacity that gets FID from the U.S.…

North America’s First LNG Bunker Barge Delivered

The first liquefied natural gas (LNG) bunker barge to be built in North America has been delivered in Jacksonville, Fla., said U.S. shipbuilder Conrad Industries.The new 2,200 cubic meter bunkering barge, Clean Jacksonville, will service TOTE Maritime Puerto Rico’s LNG-powered Marlin Class containerships, the Isla Bella and Perla del Caribe, which operate between Jacksonville and San Juan, Puerto Rico.The new barge enters operation as the maritime industry increasingly explores…

LNG Bunker Barge Completes Trials

Harvey Gulf announced the successful completion of liquefied natural gas (LNG) trials for the Conrad-built 2,200 cubic meter bunkering barge, Clean Jacksonville, using Harvey Gulf’s LNG Bunkering Facility in Port Fourchon, La.The box shaped barge arrived 15 days ago to the Harvey Gulf LNG terminal where Harvey’s LNG staff developed terminal specific procedures for review and approval by USCG. These procedures outlined the safe and efficient means of loading and receiving LNG for the trials on the bunker barge.

LNG: Lagging, Not Gone

Low energy prices, depressed day rates and slow growth of bunkering infrastructure has dampened progress for the marine industry’s ‘white knight’ of environmentally friendly fuels. LNG, nevertheless, is here to stay. Liquified Natural Gas (LNG) is a clean fuel in abundant supply. The green advantages of LNG are well known: Class Society DNV-GL, a pioneer in the commercialization of LNG fueling for maritime applications, offers that use of LNG fuel provides “the complete removal of SOX and particle PM emissions and a reduction of NOX emission of up to 85 percent ...

Gulf LNG Liquefaction Project on the Anvil

The Gulf LNG Liquefaction Project proposed by Kinder Morgan and minority partners officially filed Friday for federal approval to add exporting capabilities to an existing liquefied natural gas (LNG) terminal. The $8 billion LNG export project near Pascagoula, Mississippi is for adding export capabilities to a pre-existing LNG terminal there. Subject to obtaining sufficient long-term customer commitments, anticipated capital expenditures for the project at full development total approximately $8 billion. Anticipated capital for a single LNG train in phase one totals approximately $5 billion and approximately $3 billion for a second train in phase two. In service for phase one is anticipated in the fourth quarter of 2020 and the fourth quarter of 2021 for phase two.

OSV Technology: Notable Designs & Deliveries

Though the market for Offshore Support Vessels (OSVs) is soft, advances in technology, fit and finish in the sector is unrivaled in any other maritime niche over the past five years. Here’s a look at some of the more notable designs and deliveries. Few vessels have inspired as much attention or coverage as the Harvey Energy, the first OSV of its kind in North America, able to run on both Liquefied Natural Gas (LNG) and diesel. Harvey Energy, chartered to Shell for its deepwater operations in the Gulf of Mexico and owned by Harvey Gulf International marine…

USMRC LNG Bunkering Safety Course for Harvey Energy Crew

The United States Maritime Resource announced that its training partner, Harvey Gulf International Marine, recently launched the PSV Harvey Energy, the first LNG-fueled vessel to enter service in North America. In March, the PSV Harvey Energy began working on charter to Shell in the Gulf of Mexico shortly after the vessel’s first successful LNG bunkering operation. Middletown, R.I.-based USMRC developed the LNG bunkering safety training course for Harvey Gulf in 2014 as it prepared to launch its first dual fuel offshore supply vessel.

Harvey Gulf Breaks Ground with LNG Facility

Louisiana out in front on LNG bunkering infrastructure. New Orleans-based Harvey Gulf International Marine (HGIM) has announced the ground breaking of construction on its $25 million Phase 1, Slip B, LNG (Liquefied Natural Gas) fueling facility at their Port Fourchon, LA terminal. When operational later this year, HGIM’s LNG facility will be the first of its kind in the United States. This technologically-advanced, environmentally-safe, clean energy facility will be a vital addition to the growing national LNG supply infrastructure…

First Harvey Gulf LNG OSV Launched by GCSG

Gulf Coast Shipyard Group (GCSG) has launched of the first of six Harvey Gulf International Marine 302’ x 64’ Dual Fuel Offshore Supply Vessels. Incorporating breakthrough clean-burning LNG technology, these vessels position Harvey Gulf as the leader in the environmental application of liquefied natural gas and demonstrates GCSG’s ability to meet marketplace demand. Harvey Gulf CEO, Shane J. Guidry, comments, “Certification of these vessels will be made by the American Bureau of Shipping to achieve ‘ENVIRO+, Green Passport’ status.

OSV’s, LNG and Deepwater: a New Climate Change for HVAC

Dometic Marine recently strengthened its position as a quality supplier of heating, ventilation and air conditioning by growing its footprint in the wider commercial marine sector. One such high-profile project includes the onboard systems for Harvey Gulf International’s newbuild projects. After securing the contract through Lemoine in 2011, Dometic worked Harvey Gulf, builder Gulf Coast Shipyard Group (formerly Trinity Offshore) and Louisiana-based Lemoine Marine Refrigeration to develop custom systems for the forthcoming liquefied natural gas (LNG)-powered Offshore Support Vessels. This allowed Dometic Marine to enhance, adapt and…

Harvey Gulf Inks LNG OSV Contracts

Harvey Gulf signs contracts to buld two additonal U.S. flag LNG-powerd vessels. Harvey Gulf International Marine ordered two additional 302’ X 64’, Dual Fuel Offshore Supply Vessels, bringing its total order to four. The contract signed today with Trinity Offshore is a follow on to the first two vessel order placed in October of 2011. Trinity will build all four vessels at their Gulfport, MS shipyard where the first Harvey Gulf LNG Powered Vessel hull fabrication was started last week.

US FERC OKs LNG Projects in Mississippi

The Federal Energy Regulatory Commission on Thursday gave final approval to two liquefied natural gas import terminals along the Mississippi coast. The LNG Clean Energy Project, located in the Port of Pascagoula, will be able to send out up to 1.5 billion cubic feet of gas a day. The $450m terminal, which will be owned by the Houston-based private investor group Gulf LNG Energy LLC, will be able to handle 150 LNG tankers a year. Separately, Chevron Corp's Casotte Landing LNG project will be located next to the company's Pascagoula refinery and will process imported LNG for distribution to industrial, commercial and residential customers in Mississippi and the Southeast region, including the growing Florida market. The terminal will be able to send out 1.6 billion cubic feet of LNG a day.

Gulf LNG May Get Tax Breaks

According to The Mississippi Press, there are several state and local tax incentives that Gulf LNG could seek as it proceeds with plan to construct a $600 million liquid natural gas terminal off Industrial Road. Gulf LNG, Jackson County Board of Supervisors and the Port of Pascagoula entered a sublease agreement Monday that enables the company to use 106 acres of land south of Chevron Refinery on the east side of the Bayou Casotte channel that the state leases to the Port of Pascagoula. On the state level, two tax incentives are exemptions for state corporate income tax liability and access to tax exempt bond financing. Locally, ad valorem exemptions are available.

Gulf LNG Clean Energy Marine Terminal Project – Meeting

The U.S. Coast Guard is preparing a letter of recommendation as to the suitability of the Pascagoula Bar, Horn Island Pass, Lower Pascagoula Bay, and Bayou Casotte Channels for liquefied natural gas (LNG) marine traffic. The letter of recommendation is in response to a letter of intent submitted by Gulf LNG Clean Energy Marine Terminal Project to operate a LNG facility in Jackson County, Mississippi. A public meeting will be held in Pascagoula on December 7 to receive input. Written comments should be submitted by December 14. Source: HK Law

Gulf LNG Clean Energy Marine Terminal Project

The U.S. Coast Guard is preparing a letter of recommendation as to the suitability of the Pascagoula Bar, Horn Island Pass, Lower Pascagoula Bay, and Bayou Casotte Channels for liquefied natural gas (LNG) marine traffic. The letter of recommendation is in response to a letter of intent submitted by Gulf LNG Clean Energy Marine Terminal Project to operate a LNG facility in Jackson County, Mississippi. A public meeting will be held in Pascagoula on December 7 to receive input. Written comments should be submitted by December 14. 70 Fed. Reg. 69772 (HK Law).

Gulf LNG Energy, LLC – License Application

The Federal Energy Regulatory Commission (FERC) issued a Notice stating that on October 28 it received an application from Gulf LNG Energy, LLC for authorization to site, construct, and operate: (1) an LNG receiving facility, including docking facilities and associated piping appurtenances; and (2) an LNG storage and vaporization facility, including two LNG storage tanks, vaporization units and associated piping and control equipment, to import liquefied natural gas (LNG) into the United States. The proposed site is located in Jackson County, Mississippi. Comments on this proposal should be submitted by November 28. 70 Fed. Reg. 69326 Source: HK Law

LNG Projects Clear FERC Review

Federal Energy Regulatory Commission (FERC) staff recently said two proposed liquefied natural gas import terminals on the Mississippi coast would not significantly harm the environment, clearing a major hurdle for the projects to win final approval from the agency. The proposed LNG Clean Energy Project that would be located in the Port of Pascagoula would be able to send out up to 1.5 billion cubic feet of gas a day. The $450 million terminal, which would be operated by the Houston-based private investor group Gulf LNG Energy LLC, would be able to handle 150 LNG tankers a year. Separately, Chevron Corp's Casotte Landing LNG project would be located next to the company's Pascagoula refinery and will process imported LNG for distribution to industrial…

FERC Requires Pre-Filing Process for New LNG Projects

The Federal Energy Regulatory Commission adopted a final rule requiring potential developers of new liquefied natural gas (LNG) terminals to initiate pre-filing procedures at least six months prior to filing a formal application with the Commission. Initiating the rulemaking was the Commission’s first formal action under the recently enacted Energy Policy Act of 2005. The new law requires the Commission to issue within 60 days of the law’s August 8, 2005, enactment rules mandating the Commission’s previously voluntary pre-filing process for LNG facility proposals. Commission Chairman Joseph T. Kelliher said: “Congress set a lot of ambitious targets for implementation of the Energy Policy Act.