Asia LNG Imports Are Robust, But Record Supply Keeps Spot Prices Muted

The spot price of liquefied natural gas (LNG) is continuing to meander at low levels amid ample supply from major exporters and signs that winter demand is easing in the top-importing regions of Asia and Europe.The spot price for LNG delivered to north Asia ended at $9.60 per million British thermal units (mmBtu) in the week to Feb. 2, up slightly from the seven-month low of $9.50 the previous week.Spot LNG prices have broken their usual seasonal pattern of rising during the northern winter and again in summer…

US LNG Exports Through Panama Canal Shrink, Asia-Europe Spreads Widen

The number of U.S. liquefied natural gas (LNG) vessels transiting the Panama Canal to Asia halved in November compared with a year ago as Asia prices for the gas this week traded at their steepest premium to European prices in nearly two years.A severe drought has cut vessel traffic through the canal, increasing costs for shippers that take alternative routes or pay extra fees for auctioned slots in Panama. Further restrictions on canal transits likely will put more cargoes on lengthier routes…

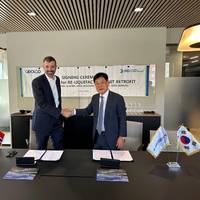

CoolCo to Retrofit Boil-off Reliquefaction Units for Improved CII Performance

HD Hyundai Global Service, a ship service subsidiary of HD Hyundai Group, has announced that it has signed contracts with Cool Company (CoolCo), an owner and operator of LNG vessels, to retrofit five LNG carriers with reliquefaction units.The contract value is approximately US$10 million per vessel.A reliquefaction unit is a device used to re-liquefy the boiled off gas (BOG) generated during the operation of LNG cargo tanks, either returning the gas to the cargo tank or preventing natural evaporation using sub-cooled LNG.

Alaska's Qilak LNG Targets Asia with $5B Project to Compete with Russia

Qilak LNG plans to invest $5 billion in a proposed liquefied natural gas (LNG) facility in Alaska's North Slope to compete with Russia's Yamal project for Asian customers towards the end of this decade, its chief executive said. Major LNG importers such as Japan, South Korea, and Taiwan are rethinking Russian supplies after sanctions on Moscow after it invaded Ukraine and more natural gas could be needed to produce lower emission and alternative fuels as nations try to reduce their carbon emissions.

Strong LNG Demand to Keep Freight Rates Firm in 2022, Beyond

Tanker rates to ship liquefied natural gas (LNG) are expected to remain firm as market players try to secure cargoes for winter demand amid soaring LNG prices and tight global supply, industry sources said on Friday.The global LNG market has recently tightened further after the war in Ukraine and a major outage at major U.S. facility Freeport LNG curtailed U.S. LNG supply, pushing players to secure vessels for longer terms that extend at times to a year.Spot tanker rates across the Pacific hit a record high at $335…

Russia's Control of Sakhalin Project Could Pose Upside Risk to LNG Prices

Russia announced on Friday a decree that seizes full control of the Sakhalin-2 gas and oil project in the country's far east, a move that could force out Shell and Japanese investors and adds another bullish factor to prices in a tight global LNG market.The order, signed on Thursday, creates a new firm to take over all rights and obligations of Sakhalin Energy Investment Co, in which Shell SHEL.L and two Japanese trading companies Mitsui and Mitsubishi hold just under 50%. Japanese…

Ban on Russian Commodity Exports to Accelerate LNG Growth, Energy Transition - Wood Mackenzie report

War in Ukraine is transforming the outlook for the supply, demand and price of hydrocarbons and the pace and cost of the energy transition. While the precise timing and implementation of future bans on Russian commodity imports are difficult to predict, a rewriting of energy trade flows is now underway. With the global economy on a knife edge and energy prices structurally higher, there a real risk of some global supply being lost. Europe’s push for more liquified natural gas…

LNG Prices Could Stay High for a Few Years, Woodside CEO Says

Woodside Energy Group, Australia's top independent natural gas producer, sees liquefied natural gas (LNG) prices staying high for a few years as the market adjusts to supply disruptions after sanctions on Russia for its Ukraine invasion."With the invasion, we are seeing the world try to move away from Russian hydrocarbons and that means that demand for LNG from places like Australia is up," Woodside Chief Executive Meg O'Neill said."We do expect ... prices to remain elevated for the next year…

US Met More Than a Quarter of European LNG Demand Last Year

The United States last year became Europe’s largest source of liquefied natural gas (LNG), the U.S. Energy Information Administration (EIA) said on Tuesday.The United States this year became the world's largest LNG exporter by capacity here, exceeding Australia and Qatar, because of its development of new LNG processing plants and ample natural gas from shale reservoirs.Of LNG imported by European Union member countries and the United Kingdom last year, 26% came from the United States…

Europe Remains Top Destination for US LNG

Europe last month remained the top destination for shipments of U.S. liquefied natural gas (LNG), according to Refinitiv data, outpacing exports to Asia for the second month in a row.About two-thirds of U.S. LNG volumes went to Europe last month, compared to around 61% in December when sky-high European prices and demand drove U.S. LNG exports to a record, Refinitiv data showed.In both months, a lack of supply drove demand and led to cargoes being re-routed from other destinations.

Gas Gap in Europe Drives US LNG Exports to Record High

Sky-high European demand drove U.S. liquefied natural gas (LNG) exports to a record in December, Refinitiv data showed, with winter supply worries set to sustain orders for the fuel.About half of the record U.S. LNG volumes shipped last month went to Europe, up from 37% earlier in 2021, data from Refinitiv and the U.S. Energy Information Administration showed.The gains reflected soaring demand for the home heating and industrial fuel that pushed prices in Europe and Asia to record highs.

LNG Demand to Rise 25-50% By 2030 - Morgan Stanley

Demand for liquefied natural gas (LNG) is expected to rise by 25 to 50% by 2030, making it the fastest growing hydrocarbon over the next decade, analysts from Morgan Stanley Research said in a note on Monday.Morgan Stanley has raised its long-term LNG price outlook to $10 per million British thermal units (mmBtu), expecting spot prices of the super-chilled fuel to average 40% higher over the next decade, versus the past five years.Asian spot LNG prices hit a record above $56 mmBtu…

Singapore LNG Scouts for Spot Cargoes as Electricity Futures Surge

Singapore LNG Corp is making inquiries about buying LNG cargoes from the spot market, a rare move for the operator of the city-state's liquefied natural gas (LNG) terminal, industry sources said on Wednesday.The inquiries come on the back of surging prices globally of power generation fuels such as LNG and coal, amid power shortages from China and India to Europe.SLNG contributes to Singapore's energy security and its terminal supplies up to 30% of the city state's natural gas demand for power generation…

LNG Price Recovery Spurs Spending in Race against Carbon Targets

The investment outlook for liquefied natural gas (LNG) has improved this year but project go-aheads will not match the bonanza of 2019, as the fight against climate change clouds the prospects for gas demand growth longer term.Renewed optimism as the industry emerges from the pandemic, rapidly rebounding oil and gas prices and a better economic outlook is building confidence in short and long term LNG demand in Asia and spurring companies to look at new LNG projects, most of which were shelved last year when prices slumped.However, they need to take into account the ever tighter carbon emissio

LNG Primed for Strong Growth on Asian Demand

Liquefied natural gas (LNG) prices are poised for more gains as gas-hungry China guzzles cargoes to feed a rebound in economic growth while the easing of coronavirus-induced restrictions restores industrial demand in India.Higher oil and coal prices have also helped lift global gas prices with spot Asian LNG prices <LNG-AS> doubling in just three months."We believe this has been driven by a tightening of Asian LNG balances led by strong generation demand in southern China at the same time that South Korea reached peak nuclear maintenance…

Tellurian to Sell LNG to Gunvor, Delays Louisiana Project Start

U.S. liquefied natural gas (LNG) developer Tellurian Inc said on Thursday it signed a 10-year agreement with commodity trader Gunvor Group for 3 million tonnes per annum (MTPA) of LNG.Tellurian shares soared around 24% on the news to their highest since February.In addition, Tellurian released a presentation that said its proposed Driftwood export plant in Louisiana was positioned for first quarter 2022 commerciality.Analysts at Cowen & Co said in a note that meant Tellurian pushed…

LNG Demand in Asia to Slow Down Next Year

Liquefied natural gas (LNG) demand growth in Asia will slow down next year as the economic recovery stagnates and the capacity of competing fuels nuclear and coal expand in Japan and South Korea, research consultancy Wood Mackenzie said on Thursday.LNG demand in Asia is expected to rise by 12 million tonnes per annum (mmtpa) in 2022, down from the 19 mmtpa growth in 2021, Robert Sims, head of Woodmac's LNG short-term, gas and LNG research, said in a note."LNG demand growth in Asia will slow down as the economic recovery decelerates…

LNG Shipping Costs: A Roller Coaster in Early 2021

For most of 2020, the liquefied natural gas (LNG) shipping market was in a depressed state like many other segments of the global gas industry. LNG export cargoes fell by 0.2% y-o-y in 2020 to reach 5,682 shipments, driven by a slowdown in LNG demand amid the COVID-19 pandemic. The commissioning of various LNG carriers around the world exacerbated that trend. Between the period 2018 and 2020, the market witnessed the record commissioning of LNG carriers, with 134 LNG carriers coming on line, with 41 of those being commissioned in 2020.

Cheniere Expects Rising LNG Demand with Vaccine Rollout

Cheniere Energy Inc, the top U.S. liquefied natural gas producer, on Wednesday raised its full-year adjusted earnings forecast, predicting higher demand for the fuel as COVID-19 vaccinations boost economic recovery.Lockdown measures implemented to curb the pandemic slashed demand for energy and hurt prices for natural gas in 2020. But with economic recovery in Asia, particularly in China, fuel sales have picked up.Shares rose 1% to $70.37 in midday trading, a more than two-year…

Asian Gas Prices, LNG Shipping Costs Soar on Freezing Temperatures

Freezing temperatures across Asia and Europe are driving liquefied natural gas (LNG) prices to record highs and pushing up the cost of shipping the fuel globally as buyers grapple with tight inventories and a shortage of tankers.Demand for super-cooled natural gas has surged in recent years as buyers, particularly China and India, move away from dirtier coal-polluting power plants. Prices had remained relatively low until late 2019, when unexpected cold weather and bottlenecked shipments caused prices to surge.Spot Asian LNG prices are up more than 1…

Petronas Completes First LNG Cargo Delivery to Myanmar

Malaysia's Petronas has delivered the first liquefied natural gas (LNG) import cargoes to Myanmar, the company said on Thursday, marking a new consumer for the super-chilled fuel.The state-owned company's subsidiary Petronas LNG delivered two LNG cargoes to Yangon, Myanmar, in May and June as part of a sales and purchase agreement it had signed with joint-venture company CNTIC VPower earlier this year, Petronas said.As part of the deal, the cargoes were sold on a free-on-board (FOB) basis from the Petronas LNG complex at Bintulu…

Yamal LNG on Fast Boat to China as Northern Route Melts Early

The first vessel to deliver a liquefied natural gas (LNG) cargo from Russia's Yamal plant via the Northern Sea Route this year is on its way to China, ship-tracking data showed and analysts said.The direct route to Asia, shorter than the westward journey via Europe, is frozen for much of the year, but is being used increasingly as climate change means it is free of ice for longer.This year's opening is more than a month earlier compared to 2019, when first vessel to go via the route left Yamal LNG on June 29.The Christophe de Margerie vessel, an Arc7-classed LNG tanker, left the Sabbeta port in Russia's Arctic on May 18 and is expected at China National Petroleum Corp' (CNPC) Tangshan LNG terminal on June 11…

Samsung Delivers LNG Carrier to GasLog

Greek shipowner GasLog has taken delivery of a newbuild liquefied natural gas (LNG) carrier from Korean shipbuilder Samsung Heavy Industries. The 180,000-cubic-meter-capacity GasLog Wales will operate on a 12-year time charter agreement with the principal LNG shipping entity of Japan’s JERA, GasLog said in its latest quarterly report.The handover follows the April 1 delivery of Samsung-built sister ship GasLog Windsor, now on a seven-year charter with a wholly owned subsidiary…