Red Sea: Far East-US Spiraling Ocean Freight Rates Set for Decline

Spiraling ocean freight rates from the Far East to the United States, caused by the Red Sea crisis, may have peaked, with some relief on the horizon emerging for the shippers, according to the latest analysis from Xeneta, and ocean and air freight rate benchmarking and market analytics platform.The latest data released by Xeneta indicates a peak may have been reached after spot rates from the Far East into the US declined slightly since the last round of General Rate Increases (GRIs) were implemented at the start of February.Into the US East Coast…

Rebuilding the Foundations of US Offshore Wind

As we enter a New Year, the memories of the shocks to the foundations to the U.S. offshore wind segment remain fresh. In short, supply chain inflation and capacity/availability, interest rate increases, and tax credit monetization have been the key themes highlighted by developers to explain why many projects became commercially unviable.Several Northeast and Mid-Atlantic states have reacted rapidly, accepting the termination of power sales & purchase agreements and allowing the canceled projects to be rebid into new solicitations.

US Trade Deficit Shrinks on Falling Imports

The U.S. trade deficit unexpectedly narrowed in November as imports of consumer goods fell to a one-year low amid slowing domestic demand, a trend that, if it persists in December, could result in trade having no impact on economic growth in the fourth quarter.The report from the Commerce Department on Tuesday also showed exports declined in November amid cooling demand overseas. Demand is slowing both in the United States and abroad following hefty interest rate increases by global central banks since 2022 to tackle rampant inflation.The Federal Reserve's rate hiking cycle has likely ended…

Shipping Firms Impose Surcharges as Red Sea Attacks Hit Global Trade

Maersk and CMA CGM, two of the world's largest shipping firms, will impose extra charges after deciding to re-route ships following attacks on vessels in the Red Sea, as worries about the disruption to global trade grow.The surcharges, designed to cover longer voyages around Africa compared with routes via the Suez Canal, will add to rising costs for sea transport since Yemen's Houthi militant group started targeting vessels.Maersk and CMA CGM are among leading shipping lines to have suspended the passage of vessels through the Red Sea that connects with the key Suez Canal…

Stolt-Nielsen Confirms Strong Third Quarter

Stolt-Nielsen Limited has reported unaudited results for the third quarter ending August 31, 2023 including a net profit of $90.1 million with revenue of $694.4 million.This compares with a net profit of $8.3 million, with revenue of $721.9 million, in the second quarter of 2023. The second quarter included an incremental loss provision of $155.0 million (net profit impact of $105 million) related to the loss of the MSC Flaminia after a fire onboard in 2012.The net profit for the nine months of 2023 was $198.2 million with revenue of $2…

Capesize Spot Rates Hesitant Despite 5% Rise in Demand -BIMCO

“During the first five months of 2023, demand for Capesize ships increased 5% y/y while supply increased 3% y/y. Nonetheless, spot rate increases remain hesitant, largely due to concerns over China’s fragile economic recovery,” says Filipe Gouveia, Shipping Analyst at BIMCO.Demand growth was supported by a 4% increase in average haul while cargo volumes increased only marginally. Average haul increased due to higher exports from Brazil and Guinea and higher volumes of long-haul Russian coal.Supply rose due to a 2% y/y increase in the Capesize fleet and a 1% increase in fleet productivity.

Analysis: Container Shipping and Falling U.S. Retail Sales

“Despite falling 1.1% m/m in both November and December, US retail sales volumes remain 13% above 2019 levels and 6% higher than the pre-COVID trend. However, sales volumes could return to trend during 2023 and thereby pose a risk for Asia to North America container volumes,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.Supported by COVID stimulus packages and mobility restrictions limiting spending on services, retail sales volumes in the US have remained on average 15% higher than 2019 levels since early 2021.

Chinese Export Container Rates Plunge 27%

The bad news for liner operators appears to have no end. In a normal year, the weeks leading up to Chinese New Year (CNY) bring an increase in volumes and freight rates. So far, however, the lead-up to CNY in 2023 has been the worst in 13 years. Spot rates for containers loading in Shanghai will normally be 12% higher just before CNY than 10 weeks earlier. Similarly, average rates for all containers loading in China will normally end 4% higher. This year, both spot and average rates, however, continue to fall.

CMA CGM to Halt Spot Freight Rate Rises until February

French container shipping group CMA CGM said on Thursday it was stopping all increases in its spot freight rates until February in a gesture to customers after a surge in shipping costs during the coronavirus pandemic.The pandemic has strained global logistics due to sanitary restrictions and a sharp rebound in economic activity following a slump last year."Although these market-driven rate increases are expected to continue in the coming months, the group has decided to put any further increases in spot freight rates on hold for all services operated under its brands," it said in a statement.

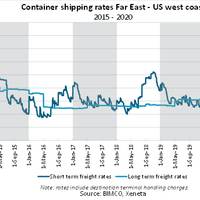

Container Shipping Rates Continue to Deliver 'Positive Surprises', BIMCO says

Trans-Pacific short vs long contract freight rate gap hits record $2,400 per FEUAs the year 2020 continues to deliver positive surprises for the container shipping sector, the gap between short and long term contract freight rates on the Trans-Pacific trade lane has never been wider, according to a recent market note from BIMCO, noting that conditions are right for carriers to achieve higher long term contract rates.On 17 September, for containers shipped from the Far East into the US west coast…

China to Europe Container Spot Rates in Rare Reversal -BIMCO

Throughout April, container shipping spot freight rates on the back-haul trade from North Europe to China were higher than those on the front-haul trade from China to North Europe. This is a rare occurrence that has developed in the wake of the massive supply chain disruptions in the world’s top manufacturing hub due to the COVID-19 outbreak, causing aftershocks across the Far East.“A reversal of front-haul and back-haul spot freight rates is a rare event. Especially on a high-volume main trade route like the Far East to Europe…

CMA CGM: Virus Impact Limited as China Activity Resumes

French shipping group CMA CGM said its operations in China were returning to normal after the coronavirus outbreak crippled traffic last month, forecasting the health emergency would have a limited impact on its results this year.CMA CGM, the world's fourth-largest container shipping firm, expects to return to normal fleet capacity in China from mid-March after seeing signs of industrial production picking up as of late February, it said in a results statement on Friday.The new coronavirus…

Shipping Confidence at 18-month High

Confidence in the shipping industry rose in the last quarter to its highest level for 18 months, according to the latest Shipping Confidence Survey from leading shipping adviser and accountant BDO.The average confidence level expressed by respondents to the survey was 6.4 out of 10.0, compared to 5.8 Q3 2019. This is the highest rating since the same level of confidence was recorded in May 2018, and it is necessary to go back to February 2014 in order to see confidence at a higher…

Shipping Confidence Dips as Trade War Worries Weigh

Confidence in the shipping industry fell in the past three months to its lowest level for two and half years, according to the latest Shipping Confidence Survey from leading shipping adviser and accountant BDO. Yet owners, charterers and managers were more confident than they were at the time of the previous survey in May 2019.The average confidence level recorded by the survey in the three months to end-August 2019 was 5.8 out of a possible maximum of 10.0. This compares to the…

Xeneta: Trade War Impacting on Far East

Look beneath the surface of a relatively calm month for long-term contracted ocean freight rates and, says Oslo-headquartered Xeneta, industry observers will see a maelstrom of activity, adjustments and market uncertainty.According to the latest XSI Public Indices report from Xeneta, the leading ocean freight rate benchmarking and market analytics platform, July saw a marginal decline in rates of 0.4%, with a marked fall in the Far East export benchmark. Meanwhile US exports and European imports performed well.The global index has now fallen by 2.4% since its all time high in May this year…

Concern Over Trade Wars Impacts Shipping Confidence

Confidence in the shipping industry has fallen marginally over the past three months, largely as a result of ongoing concern over trade wars and increased regulation, according to the latest Shipping Confidence Survey from leading shipping adviser and accountant BDO.The average confidence level in the three months to May 2019 was 6.1 out of a possible maximum of 10.0. This is slightly down on the figure of 6.2 recorded in February 2019.Confidence was up in Asia, from 5.8 to 6.0, and in North America, from 5.6 to 6.4.

Ship Insurance Costs Soar After Tanker Attacks

Insurance costs for ships sailing through the Middle East have increased by at least 10% after attacks on two tankers in the Gulf of Oman on Thursday, with the potential for costs to rise further as regional tensions escalate, ship insurers said.The attacks have already stoked concerns about reduced flows of crude oil on one of the world's key shipping routes, pushing up oil prices by as much as 4.5%.Some tanker companies have already suspended new bookings to the Middle East…

BDO: Shipping Confidence Rises

Even in the face of a raft of geopolitical and trade disputes that have conspired to instill uncertainty in many industries, confidence in the shipping industry rose in the last three months says the latest Shipping Confidence Survey from BDO, a survey that was launched 11 years ago.The survey says …The average confidence level rose to 6.2 out of maximum score of 10 this quarter compared to 6.0 in Q4 2018, according to the BDO survey. Specifically confidence was up in Europe, from 6.1 to 6.3, and in North America, from 5.2 to 5.6.

Moore Stephens: Shipping Confidence Dips

Shipping confidence dipped slightly in the three months to end-November 2018, according to the latest Confidence Survey from international accountant and shipping adviser Moore Stephens.The average confidence level expressed by respondents fell to 6.0 out of a maximum score of 10.0, compared to the 6.3 recorded in August 2018.Confidence on the part of all main categories of respondent was down, with the exception of brokers, where the rating increased from 4.9 to 5.2. Owners’ confidence fell to 6.4 from 6.8, which was originally the second highest achieved by this category of respondent in the life of the survey. The confidence rating for managers, meanwhile, was down from 6.2 to 6.0 and that for charterers from 7.0 to 6.8.

SSY Pacific Capesize Index rise by 36 points

Shipbrokers Simpson, Spence and Young's Pacific Capesize Index rise by 36 points in the week ending Monday to 6,148.The SSY Pacific Capesize Index was almost unchanged week-on-week at 6,148 points as further robust rate increases on backhaul routes were cancelled out by lower earnings on South Africa-China iron ore and coal trades. The W.Australia-China iron ore spot rate edged up to $8.65/t, while there was a $300/day decline in the Pacific round-voyage rate (180k dwt) to $19,000/day.By Reuters

SSY Pacific Capesize Index Up 283 Points

Shipbrokers Simpson, Spence and Young's Pacific Capesize Index rise by 283 points in the week ending Monday to 6,112."Led by strong rate increases on backhaul trades, the SSY Pacific Capesize Index climbed 283 points week-on-week to the highest level since August at 6,112 points. The Pacific round-voyage rate retreated to $19,300/day, down $850/day, while the W.Australia-China iron ore spot rate edged lower to $8.60/t.".

Proposed Rate Hikes for Houston Ship Pilots Under Fire

No less than 15 shipping companies, many of them top 10 liner companies, have written to Port of Houston Chairman Janice Longoria to reject the latest call for substantial rate hikes on the Houston Ship Channel. Local pilots already earn salaries that approach $500,000 annually.Like any other major U.S. port, registered foreign flag vessels must use a local state pilot on the Houston Ship Channel. According to local shipping stakeholders, the rates for those mandated services have spiraled more than 50% in the past 14 years alone.The rate increase proposal, a seemingly regular event at most U.S. ports over time, has on this occasion, struck a raw nerve at precisely the wrong time for industry.

INSIGHTS: John Rynd / President , CEO and Director, Tidewater Inc.

Mr. John Rynd graduated from Texas A&M University with a Bachelor of Arts degree in Economics. He previously served as Chief Executive Officer and President, and as a director of Hercules Offshore from 2008 through 2016. Prior to his time with Hercules, Mr. Rynd spent 11 years with Noble Drilling Services, Inc., where he served in a variety of management roles. Earlier in his career, he served in various roles of increasing levels of responsibility with Chiles Offshore and Rowan Companies. Beyond this, Mr. Rynd served as Chairman of the National Ocean Industries Association (NOIA) from 2014-15 and currently holds an Ex-Officio position on the Executive Committee. He serves on the Board of Directors of Fieldwood Holdings LLC, and was on the Board of Directors of Hornbeck Offshore, Inc.