TEN Sells an Aframax Tanker

Greek shipowner Tsakos Energy Navigation (TEN), Ltd. announced it another vessel sale as part of its ongoing fleet renewal program.Sold was the aframax tanker Izumo Princess, the first in a series of eight pioneered-designed vessels the company built between 2007 and 2010.The sale will add approximately $37 million to the company’s cash balances, TEN said.“Following the sale of nine tankers over the last 12 months with an average age of 18.5 years, this subsequent 10th transaction…

China's Imports of Russian Oil Near Record High

Russia remained China's top oil supplier in March, data showed on Saturday, as refiners snapped up stranded Sokol shipments.China's imports from Russia, including supplies via pipelines and sea-borne shipments, jumped 12.5% on the year to 10.81 million metric tons, or 2.55 million barrels per day (bpd) last month, according to data from the General Administration of Customs.That was quite close to the previous monthly record of 2.56 million bpd in June 2023.Seven Russian tankers under sanctions offloaded Sokol cargoes in Chinese ports in March…

Wah Kwong Orders More LNG Carriers

Hong Kong-based shipping company Wah Kwong is finalizing a deal later this month to double the number of liquefied natural gas (LNG) carriers that it has ordered to four, as it eyes growing global trade in the superchilled fuel, its chairman said.The ships would be delivered from 2027 onwards, Wah Kwong's Executive Chairman Hing Chao told Reuters on the sidelines of the Singapore Maritime Week ShipZERO28 event late last week."We have always been very optimistic about the outlook of LNG as a global energy," said Chao, adding that a lot of supply will have to come from the U.S.

Corpus Christi Crude Oil Exports Up 6.9% in Q1

The port of Corpus Christi, Texas, the top U.S. oil export hub, said it exported 6.40 million barrels per day of crude oil in the first quarter, up 6.9% from the same period a year ago.The U.S. Gulf Coast port handles more than half the nation's oil exports, benefiting from its pipeline ties to South and West Texas shale fields. Its volumes have risen along with shale oil production.Overall, the port has moved nearly 48.9 million metric tons of goods through the Corpus Christi Ship Channel in the first quarter.

Stena Bulk Sells LNG Carrier Stena Blue Sky

Tanker shipping company Stena Bulk on Thursday announced the sale of the liquefied natural gas (LNG) carrier vessel Stena Blue Sky to an undisclosed Asian buyer.The sale of Stena Blue Sky follows the recent announcement that Stena Bulk had sold two LNG carriers to BW LNG.The successful transfer of Stena Blue Sky has already taken place. The vessel was delivered on April 18 in Singapore.Originally built in 2006 by Daewoo Shipbuilding & Marine Engineering (DSME) in South Korea, Stena Blue Sky has a carrying capacity 145…

US to Reimpose Oil Sanctions on Venezuela

The Biden administration said it would not renew a license set to expire early on Thursday that had broadly eased Venezuela oil sanctions, moving to reimpose punitive measures in response to President Nicolas Maduro’s failure to meet his election commitments.Just hours before the deadline, the U.S. Treasury Department announced on its website that it had issued a replacement license giving companies 45 days to “wind down” their business and transactions in the OPEC country's oil…

US Sanctions Impacting Sovcomflot's Ability to Trade, CEO of Russian Tanker Group Says

U.S. sanctions are limiting tanker activity for Russia's top shipping group, Sovcomflot, the company's head said on Tuesday, as Washington tightens the screws on Moscow.The U.S. imposed sanctions on Sovcomflot on Feb. 23 as Washington seeks to reduce Russia's revenues from oil sales that it can use to support its military actions in Ukraine.Sanctions have impacted the company's operations, "limiting our geography and commercial prospects", Sovcomflot CEO Igor Tonkovidov told reporters.He added that as sanctions are a relatively new instrument to the shipping market…

Russia's Seaborne Oil Product Exports Fell in March

Russia's seaborne oil product exports fell 4.2% in March from the previous month to 10.178 million metric tons due to unplanned maintenance at refineries and a uel export ban, data from industry sources and Reuters calculations showed.Russia's daily offline primary oil refining capacity has jumped by around a third in March to 4.079 million metric tons from February due to drone attacks, Reuters calculations based on data from industry sources showed.Last month, a fire broke out after a Ukrainian drone attack at the Norsi refinery…

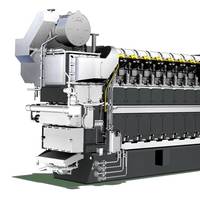

MAN Bags First Propulsion Order for Its Methanol-fueled MAN 21/31DF-M GenSet

MAN Energy Solutions reports it has received an order for three MAN 6L21/31DF-M (Dual Fuel-Methanol) GenSets capable of running on methanol in connection with the construction of a 7,990 dwt IMO Type II chemical bunker tanker.The dual-fuel engines will form part of a diesel-electric propulsion system on board the vessel with electrical motors driving twin fixed-pitch propellers via gearboxes; an onboard battery-storage system will optimize the use of the dual-fueled generators.

Greenpeace Targets Russia-linked Baltic Sea Fuel Tanker

Greenpeace activists painted slogans on an Estonian-owned tanker in the middle of the Baltic Sea on Friday, and said the ship supplied bunker fuel to vessels transporting Russian oil that posed a danger to the environment and would fuel conflict."Oil fuels war," the campaigners, who arrived in small boats, scrawled in large white letters on the side of the Zircone tanker, pictures provided by Greenpeace showed.The vessel, sitting in international waters off the Swedish island of Gotland, has supplied fuel to more than 50 oil tankers travelling to or from Russian ports in the last two months, S

Time Charter for Flex Endeavour Extended to 2032

Flex LNG on Friday announce that the charterer of its liquefied natural gas (LNG) carrier Flex Endeavour has exercised an option to extend the firm period of the time charter by 500 days, from the third quarter 2030 to the first quarter of 2032. As announced on November 23, 2022, in connection with the extension of three ships, the charterer has one further option to extend the time charter period by one additional year to 2033.Øystein Kalleklev, CEO of Flex LNG Management AS…

Japanese Partner Up on Anti-Roll Tank Research for Large Containerships

ClassNK has signed a joint R&D agreement with Nihon Shipyard and IMC to ensure the safety and performance evaluation of anti-roll tanks (ART) installed on large containerships.Under the R&D agreement, Nihon Shipyard, IMC, and ClassNK will work together to expand the application of ART to large containerships.Utilizing the obtained data and knowledge, each party will collaborate to ensure the safer application of ART on an actual ship and performance evaluation.AS part of the partnership…

Consulmar Executes ‘World's First’ Zero-Emissions Tanker Mooring

Maritime services company Consulmar has performed a zero-emissions mooring service for a tanker, said to be the world’s first such operation.This operation took place at an offshore multiple buoy mooring site near the BP refinery, situated 2 miles from the Port of Castellón in Spain.Utilizing its electric line handling tug, CASTALIA, Consulmar towed the steel mooring lines from the vessel to each of the five mooring buoys, marking a significant advancement in the maritime industry towards more sustainable practices.The tanker vessel ARCHANGEL…

ECOLOG Gains 'Industry-first' Approval from ABS

Classification society ABS announced it has awarded ECOLOG, a mid-stream Carbon Capture, Utilization and Sequestration (CCUS) service provider, with an industry first ISM Document of Compliance for the operation of liquified CO2 carriers on behalf of the Bermuda flag administration.ABS audited ECOLOG to verify compliance with the International Safety Management Code.ECOLOG plans to build and own CO2 terminals and a carrier fleet to service the emerging CCUS sector, connecting hard to abate emitters with cost competitive sequestration sites and carbon utilization facilities.“Carbon capture…

GTT Awarded AIPs for Cargo Transfers Between VLECs

GTT, the technological expert in membrane containment systems used to transport and store liquefied gases, has obtained two new approvals in principle (AIP) from the classification societies ABS and Lloyd's Register for cargo transfer operations between very large ethane carriers (VLEC) equipped with the Mark III technology developed by GTT.These approvals confirm the relevance of GTT's containment systems on board VLECs, with tanks of up to 105,000 m3, as a safe and cost-effective solution for the transfer of liquefied ethane…

Chevron Charters Its First Hybrid Electric Bunker Tanker

Chevron has chartered its first hybrid electric bunker tanker from V-Bunkers that will be used to provide fuel to maritime customers in Singapore region.The bunker tanker is expected to consume approximately 20% less fuel compared to a conventional tanker as it goes about its operations, which can reduce emissions and costs, according to Chevron.Instead of three auxiliary engines, as a conventional fueling barge this size would have, the barge has two auxiliary engines and an electric power distribution system.Current technology doesn’t allow barges to run completely on electricity…

Asia Crude Imports Surge as China, India Snap Up Russian Oil

Asia's imports of crude oil are expected to rise to the highest in 10 months as heavyweights China and India lifted arrivals from Russia, but impending maintenance schedules and rising prices mean such levels may not be sustained.The world's top importing region is forecast to see arrivals of 27.48 million barrels per day (bpd) in March, up from 26.70 million bpd in February and January's 27.18 million bpd, according to data compiled by LSEG Oil Research.The bulk of oil arriving in March was arranged before the current increase in prices…

Nine Dead After South Korean-Flagged Vessel Capsized Off Japan

At least nine people were killed when a South Korean-flagged vessel capsized off Japan, South Korea's foreign ministry said on Thursday.Two South Korean nationals were among the dead, it said, adding that the Japanese coastguard had rescued an Indonesian crew member and that another member of the crew of 11 was missing.The ministry did not provide the name of the vessel.Public broadcaster NHK, citing the coastguard, reported on Wednesday that a South Korean-flagged chemical tanker had capsized off the coast of Yamaguchi prefecture in western Japan…

Euronav to Exit Belgium's Blue-chip Index Two Days After Joining

Tanker company Euronav will exit Belgium's blue-chip Bel-20 index after just two days of trading, as it no longer meets the membership conditions after its takeover by Compagnie Maritime Belge (CMB), bourse operator Euronext said on Tuesday.CMB, owned by the Saverys family, and affiliates together hold 88.61% of the outstanding shares in Euronav, which exceeds the maximum allowed for the index."The Bel 20 rulebook prescribes that should the acquiring party own more than 85% of the shares, the company being acquired will exit the index," Euronext said.Belgium's Euronav announced in October that

Houthis Target Vessel in the Red Sea, Yemeni Military Source Says

Yemen's Houthis targeted a fuel tanker, Mado, in the Red Sea with naval missile and Israel's Eilat port and resort region with winged missiles, the group's military spokesperson Yahya Sarea said on Tuesday.Mado is a Marshall-Islands flagged liquefied petroleum gas (LPG) tanker heading to Singapore from Saudi Arabia, maritime shipping trackers showed. The Houthis described it as American, but Equasis's shipping database indicates that it is owned by Naftomar Shipping & Trading Co Ltd of Greece.

Chemical Tanker Capsizes Off Coast of Japan

A South Korean-flagged chemical tanker has capsized off the coast of Yamaguchi prefecture in western Japan, with operations to rescue the crew underway, public broadcaster NHK reported on Wednesday, citing the Coast Guard.The tanker, Keoyoung Sun, requested assistance after 0700 local time (2200 GMT), reporting the vessel was tilting over, and had 11 crew onboard with four people rescued so far, NHK reported.(Reuters - Reporting by Sam Nussey; Editing by Muralikumar Anantharaman)

Seven Deaths Confirmed as Tanker Capsizes Offshore Japan

A South Korean-flagged chemical tanker has capsized off the coast of Yamaguchi prefecture in western Japan, with seven deaths confirmed, public broadcaster NHK reported on Wednesday, citing the coastguard.The tanker, Keoyoung Sun, was anchored due to bad weather and requested assistance after 7:00 a.m. on Wednesday (2200 GMT on Tuesday), reporting the vessel was tilting over, NHK reported.The vessel had 11 crew aboard.

SFL Acquires LR2 Product Tanker Trio

Shipowner SFL Corporation on Wednesday announced it has agreed to acquire three new LR2 product tankers in combination with long term time charters to an energy and commodities company.The vessels are currently under construction in China, with the latest eco-design features, SFL said, noting the sellers are affiliates of the company’s largest shareholder Hemen Holding Ltd.SFL said it will acquire the three ships for an aggregate purchase price of approximately $230 million, in…