Hapag-Lloyd CEO: Transatlantic Shipping Trades Under Pressure

Transatlantic shipping freight rates have come under pressure from slack demand, meaning ship operators must watch costs, the chief executive of Germany's Hapag-Lloyd said on Monday."Rates have definitely collapsed, and that means we have to start looking at our costs, which have gone up," said Rolf Habben Jansen, CEO of Hapag-Lloyd, the world's fifth biggest container liner, in a call with journalists.He listed higher wage inflation, fuel prices, and terminal and timecharter costs, adding that the cost concerns could mean that certain voyages were cancelled.(Reuters - Reporting by Vera Eckert

EEX Launches Dry Freight Index Showing Cost of Carbon

German energy exchange EEX on Monday launched a zero carbon freight index (ZCFI) which combines the bourse's dry freight and emission permits prices to show operators how accounting for carbon emissions could affect freights.Decarbonization of the shipping value chain is already well underway and will continue to be front and center for ship owners, charterers and financiers in the decade ahead.The ZCFI comes as the European Union is due to unveil climate legislation this week which is likely to include the extension of the EU emissions trading system (ETS) to the maritime sector.As a conseque

Sovcomflot, Total Ink Timecharter Deal on LNG Transport

PAO Sovcomflot (SCF Group) and Total have concluded a time charter agreement for up to seven years for a newbuild 174,000-cubic-meter-capacity liquefied natural gas (LNG) carrier, scheduled to be delivered Q3 2023 and to be owned and operated by SCF, with options for up to two additional vessels.The new vessel will be the latest in a series of SCF’s new-generation conventional Atlanticmax LNG carriers, with three sister ships already in operation: SCF La Perouse, SCF Barents and SCF Timmerman.The vessel will be fitted with an X-DF propulsion system…

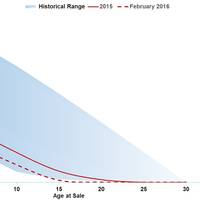

Baltic Exchange Launches New Service for Ship Investors

Publisher of maritime market benchmarks, the Baltic Exchange, has launched a new service for shipping investors which provides a snapshot five-year view of the financial prospects of dry bulk carriers.The Baltic Exchange Investor Indices are an easy to use online dashboard displaying data relevant to vessel investment decisions, residual value, health of earnings, spot and five-year timecharter earnings; purchase & recycling values; and running costs. It offers a high level of clarity and transparency for investors in capesize, panamax, supramax and handysize vessel types.

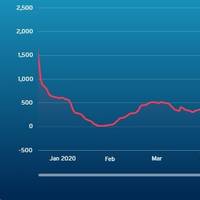

Containership Markets Plot Uncertain Course to Recovery -MSI

New HORIZON Monthly report shows freight rates remain high, blanked sailings have hit charter markets and coming quarters continue to hold riskContainership markets are exhibiting contradictory signals as the global economy continues its tentative emergence from lockdown. In the first of its new HORIZON Monthly reports, Maritime Strategies International (MSI) analyzes the forces at play in freight and charter markets as well as the impact of global policy on demand.On nearly all trade lanes…

Bulk Shanghai Joins 2020 Bulkers

Norway-based dry bulk shipping company 2020 Bulkers has taken delivery of Bulk Shanghai, the fourth of eight 208,000 dwt Newcastlemax newbuilds.The 300-meter-long bulker, which commenced a 13-year bareboat charter with 2020 Bulkers, is owned by Norwegian shipping company Ocean Yield.Two further vessels are expected to be delivered by January 2020, and the remaining two vessels are expected to be delivered by May 2020.The vessel will on November 9, 2019, commence a 11-13 month index-linked timecharter with ST Shipping, a 100% owned subsidiary of Glencore.Starting January 1, 2020, the vessel will also earn an additional premium related…

Shipping Companies: Is Bigger Better?

“If consolidation was the solution to all that ails shipping, then container liner companies would be super profitable. They are not. In ‘commoditized’ sectors of the shipping industry, which by now includes pretty much everything apart from very small niche markets, there is hardly any economies of scale at the company level. As long as bigger is not in fact much better, then meaningful consolidation will not happen.”Dr. Roar Adland, visiting scholar at MIT Center for Transportation and Logistics and Professor at the Norwegian School of Economics (NHH).Like any other business…

The Tanker Market: 2019 and Beyond

Late 2018 saw the tanker market bubble upwards through late November, with daily vessel hires moving in the direction of, though not yet reaching levels not seen since late 2014-2015, when oil prices were in freefall and inventories building to the brim. A few pundits have suggested that we are seeing a “mini 2014” where lowered oil prices are coaxing another inventory build which would drive tanker capacity utilization, and per diem freight inflows, higher. The oil market has changed over four years…

Scrubber-fitted Dry Bulk Vessels to Command Premiums -MSI

A two-tier market will reward early adopters with higher timecharter rates and asset values as cost of low sulphur fuel increases dramatically, says research and consultancy firm Maritime Strategies International (MSI).According to MSI, scrubber-fitted dry bulk vessels could be earning a significant premium over those burning more expensive low sulphur fuel and higher asset values will reward those owners that fitted the technology early.In an article ‘Scrubbing Up: the impact…

Peak Season Promises Better Box Freight Rates -MSI

After a pattern of divergence at the start of the year, July saw a modest realignment between charter and freight markets as liner operators react to cost pressures and the wider industry awaits the impact of the potential trade war between the U.S. and China, according to the latest Container Shipping Forecaster from MSI.Following an impressive run since the end of 2017, timecharter earnings have leveled off in recent weeks, a slowdown that began with smaller feeder vessels and has now spread to larger units.

Expedition Cruising: Full Speed Ahead in China

Talk of trade wars and politics aside, attention should be paid to a growing relationship between U.S.-based SunStone Ships, Inc. and Chinese shipyard China Merchants Heavy Industries in Haimen, China, as the pair is quietly growing a cruise shipbuilding business in China. Sunstone announced that on June 12, 2018, the keel was laid for the first Infinity Class vessel Greg Mortimer, the first in a series that could eventually total 10 high-spec expedition cruise vessels.Greg Mortimer…

Baltic Exchange Main Index to Drop Handysize T/C Average

The Baltic Exchange says from March 1, 2018, the Baltic Dry Index, its main sea freight index, which typically factors in rates for capesize, panamax, supramax and handysize shipping vessels, will no longer include the handysize time charter average. The Exchange furthmore said the index will be re-weighted to the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The contribution of the various dry bulk vessel types to the dry bulk market was 40 percent capesize, 25 percent panamax, 25 percent supramax and 10 percent handysize, as per external research. "The decision to not include Handysize contributions makes no statistical difference to the calculation of the BDI…

BW LPG Sees Better Market Sentiment for 2018 vs 2017

Natural gas shipper BW LPG expects a better freight market in 2018 than in 2017 and will not make any new long term contracts below $20,000 per day for its very large gas carriers (VLGC), CEO Martin Ackerman said on Thursday.

Jinhui Shipping Sees Bumpy Road to Recovery

Oslo-listed dry bulker Jinhui Shipping sees a bumpy road ahead despite signs of a recovery in the dry bulk market. The road to recovery will be challenging and the market will remain volatile, vice president Raymond Ching told the Q1 conference call on Monday. "To be honest it's very hard to pin down what will happen, this industry has been characterized by high volatility," Ching said. Q1 net loss $8 mln includes a non-cash impairment on disposed vessels of $6 million vs net loss of $18 mln in Q1 2016. Q1 average daily timecharter $5,925 per vessel vs $2,934 in Q1 2016. Jinhui Shipping owns two modern post-panamaxes of size of 93,000 dwt…

Dry Bulk: Less Pain, Not Much Gain

The dry bulk market’s strong end to 2016 is unlikely to last long into 2017, according to the latest research from Maritime Strategies International. In its latest quarterly dry bulk market report*, MSI predicts a depressed year for rates in 2017, a year marked by multiple risks to recovery. Stronger freight markets in Q4 2016 had been broadly expected by MSI, albeit for slightly different reasons. While iron ore trade undershot its expectations, coal trade overshot them with geographical imbalances playing a key role.

Vessel Earnings and Global Fleet Trends

Clarkson Research Services says market conditions across most sectors of the shipping industry have been highly challenging in 2016. The ClarkSea Index, which illustrates the fortunes of earnings for the major commercial ship types makes fairly clear the fate of the volume shipping sectors, but how is the wider global fleet covered by World Fleet Monitor faring now, in comparison to the post-downturn period as a whole? The ClarkSea Index, an average of earnings for tankers, bulkers, boxships and gas carriers, averaged $10,574/day in November 2016, down 11% on the average since the start of 2009, a handy marker for the onset of the downturn.

Odfjell Returns to Profit

Odfjell SE today reported preliminary full year and Q4 2016 results, showing improvement in financial performance in 2016 in spite of challenging markets. Efficiency programs continue to increase competitiveness, and the balance sheet is substantially strengthened. For the full year, Odfjell reports net results of USD 100 million, compared with net results of USD -36 million in 2015, and improved full year EBITDA to USD 238 million, from USD 190 million in 2015. The Q4 results show stable underlying operational performance, but softer markets impacted the net result which ended at USD 43 million. including capital gains and impairments. “Our markets remained challenging, but Odfjell continues to build both financial and operational strength.

Navios Acquires Two Panamax Vessels

Navios Maritime Partners L.P. ("Navios Partners") (NYSE:NMM) an international owner and operator of drybulk and container vessels, announced today that it has agreed to acquire two panamax vessels, 2007 South Korean-built of about 75,000 dwt for a total of $27.0 million. The vessels are expected to be delivered to Navios Partners' owned fleet in June and July 2017. The two vessels are expected to generate approximately $4.6 million of annual EBITDA based on current rate environment (Clarkson’s 1-year timecharter rate for Panamaxes as of March 31, 2017), assuming operating expenses approximating current operating costs and 360 revenue days.

Dry Bulk Market in Historically Bad State -MSI

Dry bulk sector revisits 1980s lows and faces uncertain longer term outlook; with the market near bottom, attention is turning toward the length of the downturn, the effect on asset values and the impact of broader demand side changes. In terms of annual average fleet employment rates, the dry bulk market has now dropped to levels last seen over 20 years ago in 1992, according to the latest quarterly dry bulk market forecast from Maritime Strategies International (MSI). However, current time charter rates of $5,700/day for Panamax vessels are much worse now than the $9,500/day rates seen then.

Dry Bulk Shipping Remains Positive: Drewry

The outlook for dry bulk shipping remains positive given the shrinking supply-demand gap, according to the latest edition of the Dry Bulk Forecaster, published by global shipping consultancy Drewry. With high demolition activity and low deliveries the fleet is expected to grow at a slow annual rate of 1 percent over the next five years, while tonne mile demand will grow at a faster pace of around 3 percent per annum. As supply and demand becomes more balanced over the forecast years, charter rates are expected to improve gradually. Drewry has also researched and flagged the impact of renewables on the dry bulk trade, as this has the potential to reverse charter rates, and has built two scenarios based on current trade developments.

Phaethon Takes Diana Panamax on Timecharter

Phaethon International has chartered a panamax bulk carrier Which is owned by the Greek shipping Diana Shipping on for up to eight months with a daily rate of US $ 5,250, according to the Baltic Exchange data. Coronis (74,381 dwt, built 2006) will deliver to the charterer in Donguan in southern China between May 25-30 and may be redelivered up to a maximum of February 18, 2017. The daily rate is a 24% discount on what Coronis was earning during its previous employment with Sandgate Maritime. The charterer booked the vessel in July 2015 at a gross rate of $6,500 per day, which terminated when Sandgate redelivered the vessel slightly earlier than scheduled on March 19 this year, rather than April 3.

Nordic American Tankers Fixes Suezmax on Timecharter

Nordic American Tankers Ltd. (NYSE:NAT) entered into a 30 months charter contract with a subsidiary of ExxonMobil (EM) for one of the NAT suezmaxes. The firm period is 18 months with an option of further 12 months. The gross revenue from the contract of 30 months is about $25 million, reflecting a time charter rate between $25,000 and $30,000 per day. The charter is scheduled to commence in a few days. The cash breakeven level of NAT, including all G&A costs and financial items, is now about $11,000 per day per vessel, spread across 30 units. This type of a solid employment base strengthens NAT and is sustaining our dividend distribution policy. This new contract supplements the contract of affreightment we already have with a subsidiary of EM.

Q4 Bounce Forecast for Dry Bulk Market

The Q4 bounce – a seasonal staple of the dry bulk markets – looks likely for Capesize and Panamax segments, but the effects may be limited. Independent research and consultancy firm Maritime Strategies International (MSI) is forecasting a fourth quarter bounce in dry bulk market earnings, driven by improving iron ore, coal and grain trades. In its latest Dry Bulk Freight Forecaster, MSI sees positive signs beyond the traditional summer lull in chartering activity for both the Capesize and Panamax sectors.