Dry Bulk’s Biggest Spenders

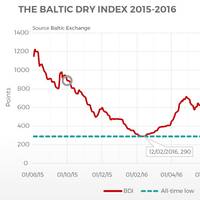

In the last month, we have seen the Baltic Dry Index (BDI) recover to the same level it was 12 months ago (see circles in fig.1). Vessel values have started to firm, but not at the same rate and are still at historically low levels. In the last 12 months, contrarian owners have taken advantage of the low values and have been buying cheap tonnage. With hindsight, this looks to have paid off with many values having increased above the purchase price. This article takes a look at which dry bulk owners have been buying the most in the last year.

Paragon Shipping to Counter Downturn

Paragon Shipping Inc is at cyclical lows, as the entire drybulk shipping sector has suffered and, along with the container and LNG sectors. Michael Bodouroglou, Founder, Chairman and Chief Executive Officer of Paragon Shipping Inc. has sent a letter to all its share holders about the measures that company has taken to counter cyclical downturn. "I have seen these times before. I have been in marine shipping, as a shipping company founder, executive and technical superintendent supervising vessels for other shipping companies, for more than 35 years. These highs and lows are a part of life and we understand the classically cyclical nature of the business. Times like these are not only financially difficult, they are humbling as well," Michael said.

Paragon Sells Ships, Defer Deliveries

The dry bulk operator Paragon Shipping has reached an agreement with its creditors to liquidate its remaining fleet in order to settle one of its debt obligations. The company agrees to sell its six mortgaged vessels to unaffiliated third parties in exchange for the full and final settlement of the outstanding amount of its syndicated loan facility. "The fleet, consisting of the handysize and panamax bulkers Coral Seas, Golden Seas, Prosperous Seas, Precious Seas, Priceless Seas and Proud Seas, is to be sold to unnamed, unaffiliated third parties," Paragon said. Paragon also says it is in talks with Jiangsu Yangzijiang to extend the deliveries of its three Kamsarmax newbuilding drybulk carriers towards the end of 2016 at no extra cost to the company.

Paragon Shipping Sells Panamax Bulker to Repay Loan

Paragon Shipping Inc. announced that it has entered into an agreement to sell M/V Kind Seas for a cash consideration of $3.5 million to an unaffiliated third party and the delivery of the vessel was concluded on January 8, 2016. The Company has also agreed with Bank of Ireland to apply the total net proceeds from the sale of M/V Kind Seas towards an immediate prepayment of the loan facility. The remaining principal amount of $4.4 million shall be treated as follows: a) $2.2 million shall be written-off subject to certain conditions and b) $2.2 million, plus any accrued interest, was converted into an unsecured paid-in-kind note (“PIK Note”). The PIK Note will be non-amortizing and will have a maturity date of December 31, 2020, at which time it will be repaid at par.

Paragon Shipping Gets US$120-Million Towards Ultramax Newbuildings

Greek drybulk cargo ship owner, Paragon Shipping, informs it has entered into a firm commitment with a European bank syndicate to partly finance up to 60 % of the market value of their two new Ultamax newbuilds due to be delivered in 2015. The new $120.0 million senior secured amortizing credit facility is with a syndicate of banks led by Nordea Bank Finland PLC. Paragon adds that the six-year facility is subject to the execution of definitive documentation and completes the financing for their Ultramax newbuilding program…

Paragon Takes New Vessel Delivery, Finances Two Other Builds

Paragon Shipping Inc. a global shipping transportation company specializing in drybulk cargoes, announced today that it has taken delivery of M/V Proud Seas, a 37,227 dwt Handysize vessel, from Zhejiang Ouhua Shipbuilding Co. in China. In addition, the company announced today that it has entered into an agreement with HSH Nordbank AG, subject to final documentation, to partially finance its first two Ultramax drybulk newbuildings, which are expected to be delivered to the company in the second and third quarters of 2014. For each of the two Ultramax vessels, HSH Nordbank AG has agreed to finance the lower of $17.2 million or 65% of the vessels' market value upon their delivery.

Paragon Shipping Easing From Red to Black in Q2 2013

Greece's drybuld cargo shipping specialistsm Paragon Shipping Inc. ,announce its results for the second quarter and six months ended June 30, 2013. Gross charter revenue for the second quarter of 2013 was $14.7 million, compared to $12.7 million for the second quarter of 2012. Excluding all non-cash items described below, the adjusted net loss for the second quarter of 2013 was $0.1 million, or $0.01 per basic and diluted share, compared to adjusted net income of $0.5 million, or $0.08 per basic and diluted share, for the second quarter of 2012. Commenting on the results, Michael Bodouroglou, Chairman and Chief Executive Officer of Paragon Shipping, stated, "We are pleased to announce our results for the quarter and six months ended June 30, 2013.

Greece's Box Ships Inc. Ride Crest of the Wave in Q2 2013

Box Ships Inc. announce financial results for the second quarter and six months ended June 30, 2013. Mr. "We are pleased to announce our ninth consecutive profitable quarter as a public company. Mr. Bodouroglou concluded, "Since the end of the quarter, we have streamlined and strengthened our balance sheet, by completing a preferred share offering, retiring all the remaining Series B-1 Preferred Shares, and repaying $5.0 million of our loan to Paragon Shipping, which improves our free cash flow per common share. Box Ships Inc. is an Athens, Greece-based international shipping company specializing in the transportation of containers.

Chairman-Controlled Firm Buys $5-million of Box Ships Share Offering

Box Ships Inc. has closed its public offering of 558,333 shares of its newly designated 9.00% Series C Cumulative Redeemable Perpetual Preferred Stock at $24.00 per share. The gross proceeds from the offering before the underwriting discount and other offering expenses payable by the Company amounted to approximately $13.4 million. Neige International Inc., a company controlled by Mr. Michael Bodouroglou, the Company's Chairman, President and Chief Executive Officer, purchased $5.0 million of the Series C Preferred Shares, or 208,333 shares, sold in the offering at the public offering price. The Company has granted the underwriters a 45-day option to purchase up to an additional 52,500 Series C Preferred Shares on the same terms and conditions to cover over-allotments, if any.

China Development Bank Grants Paragon Credit Facility

Greece's Paragon Shipping Inc. obtains a $69-million credit facility with China Development Bank to partially finance its two 4,800 TEU containerships currently under construction. The two container ships on order are expected to be delivered in the second quarter of 2014, and the company has granted an option to its subsidiary, Box Ships Inc., until its initial public offering in 2011, to acquire the vessels at any time prior to their delivery to Paragon Shipping. The CDB Credit Facility, which is available for drawdown upon the delivery of the vessels subject to certain contingencies and conditions, will be used to finance the lower of 60% of the construction cost of the vessels, or 80% of the vessels' market value at delivery. The facility matures ten years after the drawdown date.

Marine Money Istanbul Ship Finance Forum

Registration is open for the 10th Annual Marine Money Istanbul Ship Forum on May 22, 2013 at the Swissotel - The Bosphorus. Meet with shipping professionals to hear about how to position your business in these challenging times. The latest issues in Turkish shipping and ship finance will be discussed by industry experts in Istanbul. Confirmed to-date speakers and sponsors include, among others, AlixPartners UK LLP, AKT Law Firm, Besiktas Shipyard, Geden Line, Desan Shipyard-Kaptanoglu Holding…

Paragon Shipping Raises Working Capital

Paragon Shipping Inc. raises US$ 10-million working capital in sale of newly-issued shares to an entity affiliated to its own chairman. The Paragon Board agreed to sell 4,901,961 newly-issued shares of the Company's common stock to an entity affiliated with Mr. Michael Bodouroglou , the Company's Chairman and Chief Executive Officer, for total consideration of $10 million. The proceeds will be used by the Company for working capital purposes. In addition, the Company will have the right, but not the obligation, to repurchase these newly-issued shares, at the same price per share at which they were sold in this private placement. Commenting on the private placement…

Box Ships Declares Another Profitable Quarter

Greece-based container ship owners report third quarter & nine months financial results ending 30, September 2012. Mr. Michael Bodouroglou, Chairman, President and Chief Executive Officer of Box Ships Inc., commented: “The third quarter of 2012 was marked with uncertainty in the mid-size segment that we operate in, with lower charter rates and increased number of ships that were without employment in the market. Despite this weakness and uncertainty, we were able to report our sixth consecutive profitable quarter. We also were able to secure employment for Box Trader and Box Voyager, and today we are pleased to note that both vessels are employed under short term time charters, bringing our fixed revenue coverage to 94% for the remainder of 2012 and 81% for 2013. Mr.

Paragon Shipping Charters Out Two Bulk Carriers

Paragon Shipping Inc. The M/V Diamond Seas, a 2001 built 74,274 dwt Panamax bulkcarrier, has been fixed to HYundai Glovis Co. Ltd for a period of 3 to 6 months at a gross daily rate of $9,150. As a result, the Company's fixed revenue days now stand at 97% in 2012, at 69% in 2013 and at 35% in 2014 based on latest redelivery dates. The new time charter contracts are anticipated to contribute a minimum of about $2.6 million of gross revenues to the Company. Paragon Shipping is a Marshall Islands-based international shipping company with executive offices in Athens, Greece, specializing in the transportation of drybulk cargoes. The Company's current fleet consists of twelve drybulk vessels with a total carrying capacity of 779,270 dwt.

Box Ships Recieves First Two Containerships

Box Ships Inc., (NYSE: TEU), a global shipping company specializing in the transportation of containers, announced that it has taken delivery from Paragon Shipping Inc., of the Box Trader and the Box Voyager, two 3,426 TEU high specification vessels built in 2010. Both vessels have a remaining fixed rate period time charter term of 16 months (with charter option of plus / minus 45 days) with CSAV Valparaiso Chile at a gross daily charter rate of $20,000. The Box Voyager and Box Trader are the first two of the six vessels comprising the Company’s initial fleet to be delivered. The remaining four vessels include two 5,095 TEU 2007 built containerships…

Box Ships Takes Delivery of Containership

ATHENS, Greece, May 19, 2011 – Box Ships Inc., (NYSE: TEU), or the Company, a global shipping company specializing in the transportation of containers, announced today that it has taken delivery of the MSC Siena, a 4,546 TEU container vessel built in 2006, from an unaffiliated third party and the CMA CGM Kingfish, a 5,095 TEU container vessel built in 2007 from Paragon Shipping. The MSC Siena has a fixed rate period time charter term expiring in January 2014 with Maersk at a gross daily charter rate of $28…

Paragon Shipping Announces Date For Q1

Paragon Shipping Inc. (NYSE: PRGN), a global shipping transportation company specializing in drybulk cargoes, announced today that it will release its results for the first quarter ended March 31, 2011, after the market closes in New York on Thursday, May 26, 2011. Paragon’s management team will host a conference call to discuss the Company's financial results on Friday, May 27, 2011, at 10:00am EDT. Participants should dial into the call 10 minutes before the scheduled time using the following numbers: 1(866) 819-7111 (from the USA)…

Paragon Shipping Enters New Time Charters

Paragon Shipping Inc., a shipping transportation company specializing in drybulk cargoes, announced that it has entered into fixed rate time charter agreements for two of its 37,200 dwt, Handysize newbuildings with Cargill International S.A. Both vessels have been fixed for a period of two years at a gross daily rate of $12,125 commencing upon their delivery to the company, which is expected to take place in the first quarter of 2012. In addition, the charterers have an option to extend the charter period for an additional year at a gross daily rate of $15,500. Paragon also announced that it has entered into a three year time charter agreement for the M/V Deep Seas, a 1999 build, 72,891 dwt Panamax bulkcarrier, with Morgan Stanley Capital Group Inc.

Paragon Reports 2Q and 6-Month Financial Results

Paragon Shipping Inc., a shipping transportation company specializing in drybulk cargoes and containers, announced its results for the second quarter and six months ended June 30, 2011. Bodouroglou continued, “Since the beginning of the year, the drybulk charter market has continued to decline and the orderbook is still at a high level. Subsequent to the second quarter, we have taken certain steps that we believe will position us well to take advantage of the opportunities that we expect to arise during these weak markets. Specifically, we no longer have exposure in the Kamsarmax segment of the market, we have agreed to extend one of our credit facilities that was maturing in 2012 by five years…

Bulk Carrier Charter Agreement With Morgan Stanley Capital Group

Paragon Shipping Inc. (NYSE: PRGN) entered into a fixed rate time charter agreement for its Panamax Vessel, M/V Coral Seas, with Morgan Stanley Capital Group Inc. The M/V Coral Seas, a 2006 build, 74,477 dwt Panamax bulkcarrier, has been fixed to Morgan Stanley Capital Group Inc. for a period of 23 to 25 months at a gross daily rate of $12,000. In addition, the Charterers have an option to extend the charter period for an additional 11 to 13 months at a gross daily rate of $14,500. As a result, the Company’s fixed revenue days have now increased to 89% from 84% in 2012, to 66% from 59% in 2013 and to 37% from 30% in 2014 based on latest redelivery dates.

Paragon Announces Early Charter Termination

Paragon Shipping Inc. announced that Deiulemar Compagnia di Navigazione SpA, the charterer of the M/V Friendly Seas (the "Vessel"), a 2008-built 58,779 dwt Supramax bulkcarrier (the "Charterer"), has continued to fail to provide payment due since January 5 and has failed to provide the Vessel with voyage instructions. Accordingly, Paragon Shipping has provided written notice to the Charterer of the termination of the charter, but has received no response. Paragon Shipping is currently seeking alternative employment for the Vessel and will seek damages for the Charterer's breach. There can be no assurance that Paragon Shipping will be…

Chinese Shipyard Delivers Handysize Bulk Carrier to Greek Owners

Paragon Shipping has taken delivery of 37,293 dwt handysize bulker 'MV Prosperous Seas' from Zhejiang Ouhua Shipbuilding Co. China. The newly constructed vessel has been chartered out to Cargill International S.A. (the "Charterers") for a period of 23 to 26 months at a gross daily rate of $12,125. In addition, the Charterers have the option to extend the charter period for an additional 11 to 14 months at a gross daily rate of $15,500. As a result, the Company's contracted revenue days now stand at 92% in 2012, at 68% in 2013 and at 35% in 2014 based on the latest redelivery dates. The new time charter contract is anticipated to contribute a minimum of about $8.5 million of gross revenues to the Company.

Chinese Shipyard Delivers Bulker to Paragon Shipping

Paragon Shipping Inc. announce that it has taken delivery of the M/V Precious Seas, a 37,205 dwt Handysize vessel, from the Zhejiang Ouhua Shipbuilding Co. in China. The vessel has been chartered out to Cargill International S.A. for a period of 23 to 26 months at a gross daily rate of $12,125. In addition, the Charterers have the option to extend the charter period for an additional 11 to 14 months at a gross daily rate of $15,500. The new time charter contract is anticipated to contribute a minimum of about $8.5 million of gross revenues to the Company. Based on the latest redelivery dates, the Company's contracted revenue days currently stand at 94% in 2012, at 68% in 2013 and at 35% in 2014.