While the Y2K bug proved to be an overblown concern, world-leading Carnival Corp. surely must feel that there's something about the turn of the new decade that's making it feeling sickly. With its stock price flying high at the $50/share level at the beginning of the year, the worlds' largest cruise company has literally been beaten down at the start of 2000, as its price per share has plummeted to the upper $20s. A myriad of unrelated circumstance, including historically high fuel costs and a series of mishaps onboard its ships, have conspired to leave the investment community leery of the stock.

In an effort to rouse its stock price, CCL has scuttled a merger with a time-share specialist and announced a $1 billion buyback of its own stock. The Miami-based company's shares, closed on Monday at 29-5/16, up 1 ¾ but still near a 52-week low, were "a very attractive investment," Carnival Chairman Micky Arison said in a news release.

With an average 616 million shares outstanding during the 12 months ended Nov. 30, Carnival gave no details in the release, other than to say buyback transactions depended on market conditions and may include private purchases.

Only the second since Carnival, now operator of 45 cruise ships under the Cunard, Holland America and other names, became a public company in 1987, the buyback was open ended and could continue indefinitely, Frank said.

Big cruises lines are on a shipbuilding spree. Carnival alone added 12.4 percent to its capacity in 1999 and was scheduled to take on 13 new ships at a cost of $5.075 billion through 2004, including four this year, according to Carnival spokeswoman Jennifer de la Cruz.

Featured videos

Send in the Drones (to deep, dark, confined maritime spaces)

Taking the First Step Toward Autonomy

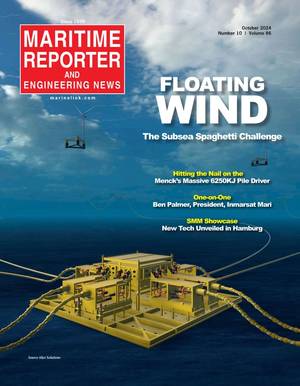

October 2024

Read the Magazine

Read the Magazine

Read the Magazine

Read the Magazine

This issue sponsored by:

Training for Maritime Compliance: Navigating SOLAS, MARPOL, STCW, and MLC

Subscribe for

Maritime Reporter E-News

Maritime Reporter E-News is the maritime industry's largest circulation and most authoritative ENews Service, delivered to your Email five times per week