Bangladesh and Pakistan Ship Recycling Markets Remain Steady

With the conclusion of week 11, the ongoing and seemingly endless dearth in the supply of viable candidates has been mercifully keeping the Bangladeshi and Pakistani ship recycling markets steady, reports cash buyer GMS.

“On the other hand, the Turkish and Indian markets continue to endure their respective shares of a notably trying time, given that the Turkish Lira continues to plummet even amidst a mercifully quieter week (on account of Ramadan).”

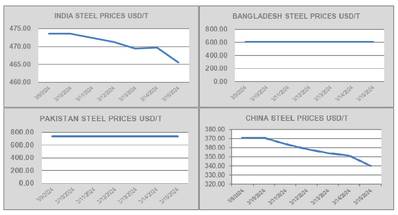

GMS says: “India continues to endure its share of nerve-racking volatility in local steel plate prices as well as the Indian Rupee, likely on the back of Alang Buyers anxiously anticipating the results of the upcoming general elections next month, with voting expected to last seven weeks and the results being announced on June 4. With any luck, further economic measures to stimulate this lackluster economy will hopefully be implemented by the Modi government, which is expected to win in another landslide election.”

The prospects for Alang’s ship recycling sector have not been quite this bad for many years, as most domestic recyclers continue to abstain from the buying even today, rather than conclude at what is only being perceived as loss-making levels in these present times. Moreover, cheap Chinese billets have also started to infiltrate the local market once again, and despite prohibitive anti-dumping measures being set in place, this most recent batch of imports is causing much consternation amongst Indian steel traders, as Alang Buyers are still preferring to wait-and-watch market developments even now.

The industry’s overall focus has therefore shifted towards a far-firmer Pakistan and Bangladesh of late, given that both markets have come back strongly since the start of the year. All major (sub-continent) recycling market currencies have been on an overall positive trend of late.

Overall, as dry bulk markets progressively reach new highs, the supply of tonnage from this sector seems likely to remain muted for, perhaps, the remainder of the year. Container ships are yet to see any meaningful movement this year either.

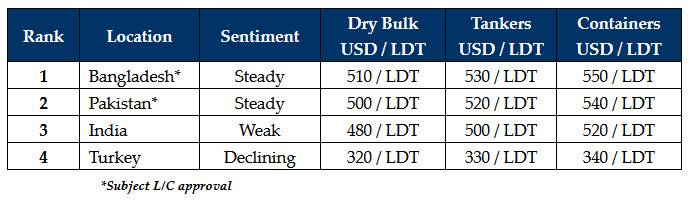

For week 11 of 2024, GMS demo rankings / pricing for the week are: