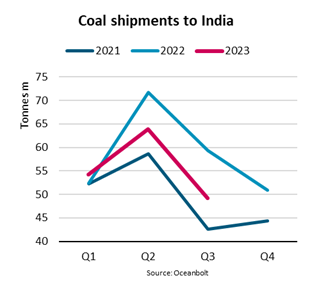

Coal Shipments to India fall 9% as Domestic Mining Increases

During the first nine months of 2023, coal shipments to the world’s second-largest importer of seaborne coal, India, fell 9% y/y. A 12% y/y rise in domestic coal mining replaced imports and electricity production continued to rise despite lower production from hydropower. This is according to Filipe Gouveia, Shipping Analyst at BIMCO.

To ensure energy supplies, India’s government has pushed for an increase in domestic coal mining. Indian coal imports peaked in 2019 and significantly fell during the Covid pandemic before partially recovering in 2022. So far this year, coal shipments accounted for 19.1% of India’s coal supply, 3.3 percentage points less than a year ago, BIMCO said.

From May to August 2022, India’s government requested power plants to blend at least 10% of imported coal to address low inventories at its power plants and combat power shortages. In 2023, the import request was lowered to 6% between January and September and again to 4% between September and March next year. By the end September 2023, the number of power plants with critically low inventories were 25% below the level a year earlier.

“In the first nine months of 2023, tonne mile demand fell 5% y/y, significantly less than the drop in cargo volumes. Average haul increased as India imported more coal from Russia, the US and South Africa and less from Australia and Indonesia, its two largest trading partners,” says Gouveia.

A surge in Chinese coal imports may have pushed India to seek new suppliers. Indonesia is China’s largest coal supplier and China’s ban on Australian coal was lifted in February, causing imports to increase. India is a cost-sensitive market and usually prefers cheaper thermal coal with low energy content, directly competing with other importers in Asia. Credit: BIMCO

Credit: BIMCO

Coal shipments to India are mainly carried by capesize and panamax ships, and to a lesser extent, supramax ships. This year, shipments to India on capesize ships fell by 30% y/y, and panamax ships now transport the majority of coal to India for the first time since 2020, according to BIMCO.

This shift may have occurred due to lower cargo volumes and higher freight rates for capesizes.

Despite the lower coal volumes to India, global coal shipments have increased by 3.4% year-to-date due to a significant increase in volumes to China. Coal therefore remains the second largest commodity, contributing nearly 25% of all dry bulk volumes.

“Future coal demand growth is expected in emerging economies, especially in Asia. However, decarbonization and increased domestic mining in China and India could still drive seaborne coal volumes lower within this decade and impact overall demand growth prospects for the dry bulk sector,” says Gouveia.