Container Rates Fall on Declining Chinese Exports

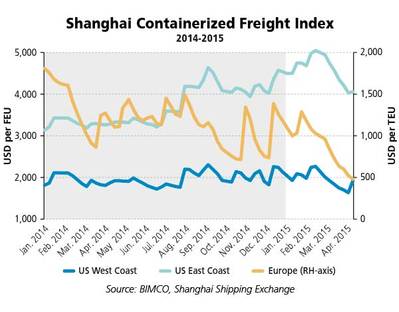

Since February, freight rates on the three key container shipping lanes has left the erratic up and down movements behind only to slide week after week.

On Friday April 10, 2015 the freight rate including ocean freight and surcharges, i.e. was quoted at USD 466 per TEU for the Shanghai to Europe trading lane. This is the lowest on record since the 2009.

The new all-time low point comes on the back of deteriorating exports from China for three months running in 2015. Export were down by 15% in March y-o-y. Moreover, Imports dropped too to the extent of 12.3%. The link between the global economics, external trade and the shipping industry is once again clearly felt in the freight market.

The challenges mount again on the Europe bound trade

Chief Shipping Analyst at BIMCO, Peter Sand, says: “striking the right level of supply to match the actual demand for transportation on this key container ship trade route has proven impossible recently. The re-activation of almost the entire idle fleet during the autumn, in a combination with the continued inflow of new Ultra-large container ships on the Far East to Europe trades has yet again, developed a situation where overcapacity sours the freight market.”

Mixed fortunes on US-bound trades

The other major destination for Chinese manufactured goods, the US saw a change in fortunes last week …

Chinese exports a mainstay in the container shipping market

Chinese exports are driven by foreign demand, and the US is currently in the strongest position with consumer demand growing firmly. In Europe, consumer demand in the southern part particularly, is more tepid. Nevertheless, the drop in exports from China seems to be quite steep and may not fully reflect the current state of demand but merely suggests that overall demand growth in 2014 was stronger that actual fundamental consumption.

“The Chinese manufacturing sector has been facing serious headwinds in 2015 with new orders declining three month in a row for the first time ever, according to Markit. New export work fell too in March. Still, it is likely that absolute export levels are lifted again in second quarter as purchasers gear up to the peak container season in the third quarter. If the supply side, by then, matches the demand side better, earnings should improve for owners and operators”, adds Peter Sand