Container Market Growth Modest in 2023

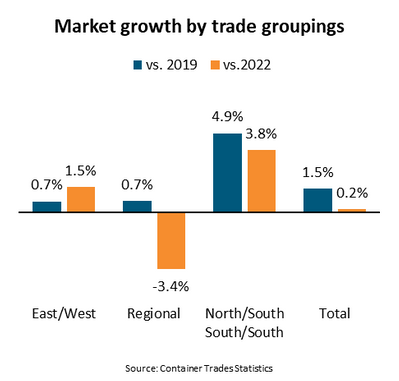

In 2023, the container market grew 0.2% year-on-year, ending at 173.8 million TEU. Compared to 2019, before the COVID pandemic hit, the market grew 1.5%.

“Container market growth has lagged behind overall economic development significantly, as the world economy has grown 10% since 2019,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Highlighting the challenge for liner operators, the container fleet capacity in 2023 grew 21% vs 2019 and 8% vs 2022. The order book of new ships will add nearly 25% to the capacity during the next four and a half years. Although recycling of older ships will moderate the future capacity, fleet growth will be significant.

“Initially, the container market saw a strong rebound from the COVID crisis. Container Trades Statistics (CTS) estimates that in 2021 the market was 3.9% larger than in 2023 but has since lost nearly 7 million TEU due to a contraction in both east/west and regional trades,” says Rasmussen.

Trades within regions, so-called regional trades, contribute about a third of global volumes and have long been key growth drivers for the market. However, CTS estimates that combined volumes in the trade lanes fell 3.7% in 2023 to end only 0.7% higher than in 2019.

The trade within the Europe/Mediterranean region has been the biggest disappointment. Volumes are estimated to have fallen 7.9% in 2023 to end 12.6% lower than in 2019. The reduction in trade between the EU and Russia since the war in Ukraine began has been a significant contributor.

North/south and south/south trades that encompass all trades to and from the South and Central America, Sub-Saharan Africa, and Oceania regions have seen the highest growth rates in the meantime. The trades into Sub-Saharan Africa and the South and Central America regions have stood out with growth rates of respectively 1.1% and 11.8% versus 2022 and 6.8% and 9.1% versus 2019. Exports from East and Southeast Asia have been the key driver.

Growth in the east/west trades between the Asia, Europe/Mediterranean, and North America regions has been hurt by a 12.0% contraction in back-haul trade lanes since 2019 whereas head-haul trades have grown 7.2% since then.

“Driven by the development in the Europe and Mediterranean and North America regions, the east/west head-haul trades account for nearly 60% of ship demand. The International Monetary Fund estimates that average annual growth into the two regions will be less than 2% during 2024-2025, adding to concerns about the future supply/demand balance,” says Rasmussen.